France Toys Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowFrance Toys Market Trends & Summary

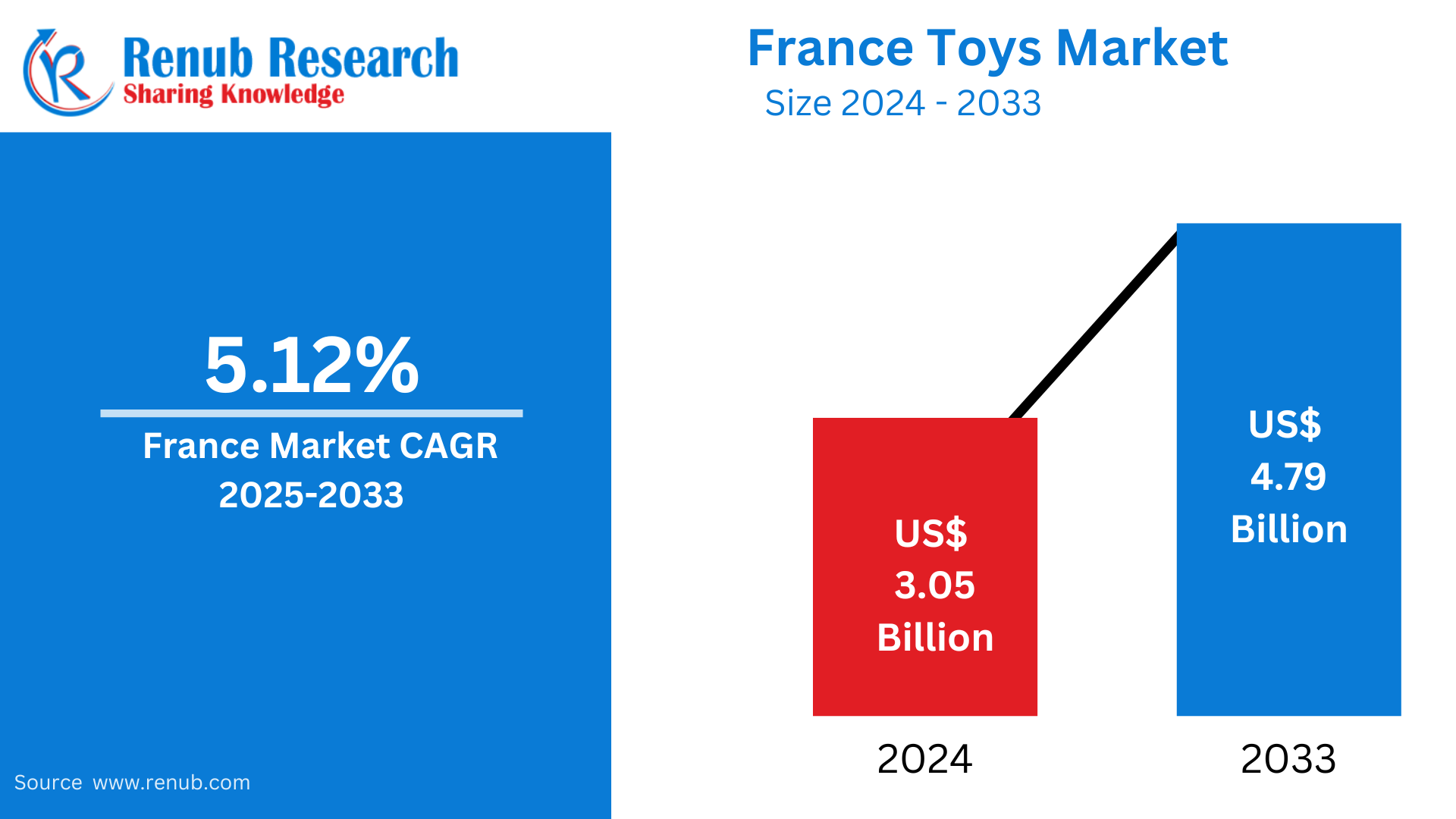

France Toys Market is expected to reach US$ 4.79 billion by 2033 from US$ 3.05 billion in 2024, with a CAGR of 5.12% from 2025 to 2033. Rising disposable income, an increased demand for interactive and educational toys, an increase in online sales, and a focus on sustainable and eco-friendly products are some of the factors driving the expansion of the toy business in France. Consumer expenditure on toys is increased by these developments.

France Toys Market Report by Toys Segmentation (Action Figures, Board Games, Card Games, Construction Sets & Models, Dolls & Stuffed Toys, Plastic & Other Toys, Puzzles, Toys for Toddlers & Kids), Sales Channel (Hypermarkets, Supermarkets, Toy Specialists, Multi-Specialists, Others) and Company Analysis, 2025-2033

France Toys Industry Overview

The toys market in France has been steadily expanding due to changing customer tastes and the increasing power of internet buying. A vast range of items, from high-tech interactive and instructional toys to more conventional toys like dolls and action figures, define the market. The growing need for educational toys that support kids' cognitive, motor, and emotional development is a major motivator. Furthermore, more people are choosing toys that are sustainable and made of natural materials, as well as those that adhere to ethical production standards, reflecting the growing demand for eco-friendly toys. The popularity of licensing is also helping the French toy sector, as toys based on well-known movie and television franchises, like Disney and Marvel, continue to draw interest from both kids and collectors.

Changing consumer behavior, especially the rise of e-commerce, is another factor driving the French toy business. Online shopping is becoming more and more popular among consumers since it offers a wider selection of goods and frequently offers convenience and discounts. Sales of toys are greatly increased by seasonal occasions like Christmas and back-to-school times. Another contributing aspect is the growing emphasis on interactive and digital toys, like those with app-based or augmented reality elements. Additionally, specialty markets like STEM toys—which promote learning in science, technology, engineering, and mathematics—are expanding. The toy market in France is expected to continue expanding as customer preferences change toward sustainability and innovation.

Since the country's long history in the toy industry, France is home to some of the most well-known toy firms in the world. Toys are essential to a child's growth because they help them develop their cognitive, logical, social, and spatial skills. One of the main factors propelling the market's expansion is the rising demand for approach-based and educational toys. In 2022, there were over 723,000 births in France, and 17.2% of the population was made up of children ages 0 to 14. The future course of the toy industry will be greatly impacted by this demographic makeup.

Growth Drivers for the France Toys Market

Increasing Demand for Educational Toys

One of the main factors propelling the French toy market's expansion is the rising demand for educational toys. More and more parents are looking to buy toys that help their kids' social, emotional, and cognitive development in addition to providing entertainment. Educational toys are becoming more and more popular, especially those that encourage STEM (science, technology, engineering, and mathematics) education. These toys promote creativity, critical thinking, and problem-solving skills—all of which are in line with the increased focus on early education and skill development. As a result, parents who want to give their kids a strong foundation for future learning are increasingly choosing STEM toys. As parents look for items that are both entertaining and informative, this trend reflects broader shifts in consumer behavior.

Rising Popularity of Eco-friendly and Sustainable Products

One of the main factors propelling the French toy market is the growing demand for sustainable and eco-friendly products. Customers are looking for toys that reflect their principles of sustainability and responsible purchasing as they become more ecologically concerned. The market for eco-friendly toys manufactured from natural materials like wood, organic textiles, or recycled plastics is rising as a result of this change. Furthermore, toys made with sustainable manufacturing techniques are becoming more popular as customers and parents value goods with the least possible negative effects on the environment. The market for eco-friendly toys in France has grown overall as a result of businesses responding to this trend by developing greener alternatives, which mirrors a larger social shift toward sustainability.

Seasonal and Event-Based Demand

Demand that is influenced by events and seasons is a major factor in the expansion of the French toy business. The back-to-school season and holiday seasons like Christmas and Easter cause notable increases in toy sales. During these times, shoppers are more likely to purchase gifts, and toys are a common choice, especially for youngsters. Special discounts and promotions are frequently offered by retailers, which encourages more spending by customers. These seasonal occurrences increase demand, which contributes to higher sales volumes and total market growth. These events are also crucial times for the French toy sector since they are perfect for launching new toy trends and leveraging the joyous purchasing mood.

Challenges in the France Toys Market

Increasing Competition

With so many domestic and foreign businesses fighting for consumers' attention, the French toy market is becoming more and more competitive. Price wars have resulted from this competitive environment, when businesses cut prices to draw clients, eventually lowering profit margins for producers and merchants. It is difficult for firms to differentiate themselves from the vast array of toys available, which range from conventional alternatives to cutting-edge tech-based ones. To preserve market share, toy producers must thus consistently engage in marketing, innovation, and product differentiation. The market may become even more competitive as smaller firms find it difficult to compete with bigger, more well-known companies. Because of this dynamic, toy producers must figure out how to innovate and draw in devoted customers at a reasonable cost.

Shifting Consumer Preferences

The French conventional toy business is under challenges due to changing consumer tastes. Digital games, smartphone apps, and interactive gadgets are fiercely competing with traditional toys as kids spend more time with digital material. Because they provide immersive experiences, these digital platforms frequently draw older kids who are more interested in entertainment centered around technology. Since traditional toys like dolls, action figures, and board games find it difficult to compete with the interactive and captivating qualities of digital equivalents, this trend may have an effect on the demand for these items. To meet the changing tastes of today's tech-savvy generation, toy producers are responding by integrating technology into their products, such as augmented reality (AR) or app-integrated toys.

France Toys Market Segments

Toys Segmentation–Market breakup in 8 viewpoints:

- Action Figures

- Board Games

- Card Games

- Construction Sets & Models

- Dolls & Stuffed Toys

- Plastic & Other Toys

- Puzzles

- Toys for Toddlers & Kids

Sales Channel –Market breakup in 5 viewpoints:

- Hypermarkets

- Supermarkets

- Toy Specialists

- Multi-Specialists

- Others

Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Financial Insights

Company Analysis:

- Mattel Inc.

- Hasbro, Inc

- LEGO

- Ravensburger

- Spin Master Corp.

- VTech

- Clementoni

- Thames & Kosmos

- Simba Dickie Group (Corp)

- HABA Sales GmbH and Co. KG

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Toys Segmentation and Sales Channel |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. France Toys Market

6. France Toys Market Share Analysis

6.1 By Toys Segmentation

6.2 By Sales Channel

7. France Toys Market by Toys Segmentation

7.1 Action Figures

7.2 Board Games

7.3 Card Games

7.4 Construction Sets & Models

7.5 Dolls & Stuffed Toys

7.6 Plastic & Other Toys

7.7 Puzzles

7.8 Toys for Toddlers & Kids

8. France -Toys Market by Sales Channel

8.1 Hypermarkets

8.2 Supermarkets

8.3 Toy Specialists

8.4 Multi-Specialists

8.5 Others

9. Porter’s Five Analysis

9.1 Bargaining Power of Buyers

9.2 Bargaining Power of Suppliers

9.3 Degree of Rivalry

9.4 Threat of New Entrants

9.5 Threat of Substitutes

10. SWOT Analysis

10.1 Strength

10.2 Weakness

10.3 Opportunity

10.4 Threat

11. Company Analysis

11.1 Mattel Inc.

11.1.1 Overviews

11.1.2 Key Persons

11.1.3 Recent Developments

11.1.4 Revenues

11.2 Hasbro Inc.

11.2.1 Overviews

11.2.2 Key Persons

11.2.3 Recent Developments

11.2.4 Revenues

11.3 LEGO.

11.3.1 Overviews

11.3.2 Key Persons

11.3.3 Recent Developments

11.3.4 Revenues

11.4 Ravensburger

11.4.1 Overviews

11.4.2 Key Persons

11.4.3 Recent Developments

11.4.4 Revenues

11.5 Spin Master Corp.

11.5.1 Overviews

11.5.2 Key Persons

11.5.3 Recent Developments

11.5.4 Revenues

11.6 Vtech

11.6.1 Overviews

11.6.2 Key Persons

11.6.3 Recent Developments

11.6.4 Revenues

11.7 Clementoni

11.7.1 Overviews

11.7.2 Key Persons

11.7.3 Recent Developments

11.8 Thames & Kosmos

11.8.1 Overviews

11.8.2 Key Persons

11.8.3 Recent Developments

11.9 Simba Dickie Group (Corp)

11.9.1 Overviews

11.9.2 Key Persons

11.9.3 Recent Developments

11.10 HABA Sales GmbH and Co. KG

11.10.1 Overviews

11.10.2 Key Persons

11.10.3 Recent Developments

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com