Fuel Cell Vehicle Market Global Forecast Forecast 2024-2030, Industry Trends, Share, Insight, Growth, Opportunity Companies Analysis

Buy NowFuel Cell Vehicle Market Outlook

A fuel cell is an electrochemical reactor that converts the chemical energy and an oxidant directly to electricity. In recent years, the word fuel cell has been used almost solely to describe a reactor using hydrogen as the chief energy source. Hydrogen has a protracted history of being employed as fuel for versatility. More than 200 years ago, hydrogen was adopted in the first internal combustion engines by igniting the hydrogen itself, like burning gasoline today. Though, this did not prove to be quite successful due to safety affairs and low energy density. Preferably, hydrogen is an energy carrier in a modern fuel cell by reacting with oxygen to form electricity.

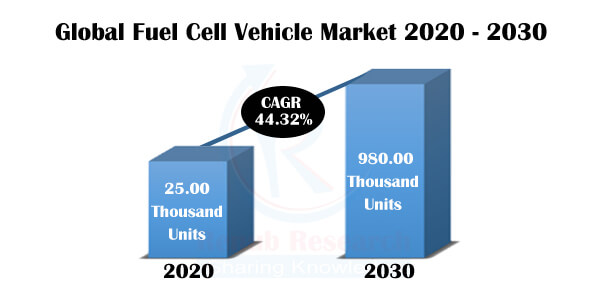

Moreover, fuel cell vehicles have become more lucrative in recent years due to higher performance, reduced refuelling time, and long-range offered by the systems. Also, the exhaust in terms of water, a deterioration in emissions dimension, and superior power and torque output play a significant role in adopting fuel cell technologies for automobiles. In addition, the rising environmental issues, such as climate change and low air quality, are due to substantial growth in the regional transportation sector. High fossil fuel consumption has generated the need for clean energy sources, thereby boosting the market's growth over the forecast period. According to Renub Research, the Global Fuel Cell Vehicle Market awaits to reach 980.00 Thousand Units by 2030.

Impact of COVID-19 on Global Fuel Cell Vehicle Market:

The production & sales of innovative vehicles had come to a standstill across the globe as the entire ecosystem had been obstructed in the initial outbreak of COVID 19. Fuel Cell Vehicles had to pause until lockdowns were lifted to continue blooming, which influenced their businesses. Consequently, vehicle manufacturers had to modify the production volume. Moreover, the automotive industry is highly capital-intensive and relies on frequent financing to continue operations. Thus, during the initial months of the outbreak, the production suspension and lower demand had an unprecedented impact on Fuel Cell Vehicles manufacturers and automotive fuel cell producers.

For example, according to the Times of India, Honda Motor Company's sales declined by more than 15% throughout the third quarter of 2020, while operating profit plunged by around 13% overall during the whole year. Toyota Motor Corporation's sales went down by 50% in the first quarter of 2020. However, demand for Fuel Cell Vehicles recovered at a fast rate after the initial months of 2020. Hence, the sales also increased along with the demand for zero-emission vehicles during the latter months of 2020. Our research suggests that the Worldwide Hydrogen Fuel Cell Vehicle Market was 25.00 Thousand Units in 2020.

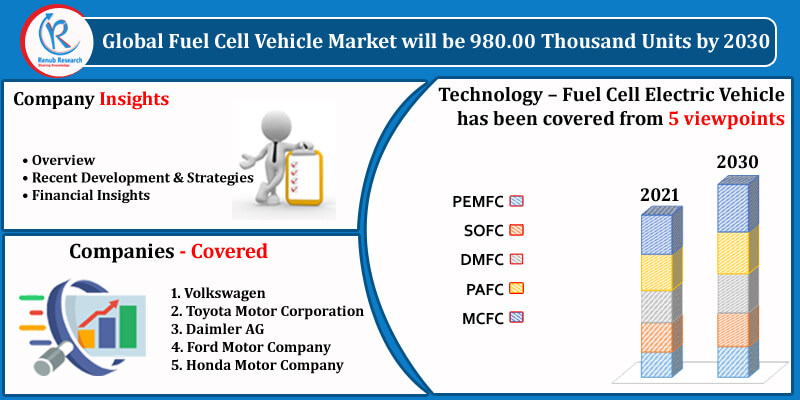

The technology used for Global Fuel Cells Vehicles

Globally, fuel cell vehicles are typically categorized by the technology used. Prominent technologies of fuel cells include Polymer Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Direct Methanol Fuel Cells (DMFC), Phosphoric Acid Fuel Cells (PAFC) and Molten Carbonate Fuel Cells (MCFC). Of these, PEMFC is the common commercialized type today due to its low operating temperature (50-100°C), compact start time, and its oxidant (atmospheric air) ease of use. These characteristics make PEMFC ideal for mobility solutions. They are part of the reason for the rapid development of FCEVs starting from the 1990s. As per our analysis, the Global Fuel Cell Vehicle Industry is expected to grow with a massive CAGR of 44.32% from 2020 – 2030.

Regional Analysis of Fuel Cell Vehicle Industry

The global fuel cell vehicle market report revolves around crucial regions, including Europe, North America, Asia Pacific, Middle East and Africa and Latin America. In North America, the United States has a massive number of hydrogen fuel stations provisioning to the market. Both US and Canada have been supporting the market for low emission vehicles. Fuel cell vehicles are in tremendous demand in some states like California in the US and British Columbia in Canada. Also, Asia-Pacific is a fast-growing market for hydrogen fuel stations. China, South Korea and Japan are currently leading the fuel cell vehicle market in Asia-Pacific. China is converging more on buses and trucks for FCEV's.

In the upcoming years, nations such as China, Japan, and South Korea are expected to pivot in advancing fuel cell electric vehicle technology. Large corporations such as Toyota are trying to become the leader in fuel cell technology. As with most technologies, fuel cell technology's initial development and deployment phases heavily depend on government policies and incentives. To various extents and for multiple reasons, governments of China, the United States, European nations and Japan have encouraged the development of the fuel cell industry. The countries invest heavily in core technology research and establish subsidy policies and medium/long-term strategic plans.

Policy Overview across Major Markets:

- In Europe Hydrogen Roadmap Europe: a transition to one-third ultra-low carbon hydrogen production by 2030 has been devised.

- Similarly, in Japan policy for the full-fledged manufacturing operation, transportation and storage of zero-carbon emission hydrogen by 2040 have been planned.

- In addition, in the United States, the California Fuel Cell Partnership has also outlined targets for 1,000,000 FCEVs by 2030.

The Global Fuel Cell Market is dominated by established players such as Toyota Motor Corporation, Volkswagen, Daimler AG, Honda Motor Company, and Ford Motor Company. These companies contribute extensive products and solutions for the fuel cell vehicle industry, have strong global distribution networks, and invest heavily in R&D to develop new products.

Recent Developments in Fuel Cell Car Companies:

- In March 2021, Toyota Corporation revealed a new hydrogen production facility and refuelling station at its decommissioned car factory in Melbourne, Australia, before its second-generation fuel-cell car, the Mirai FCEV. The facility includes a 200-kilowatt electrolyzer powered by an on-site 84-kilowatt solar array and a 100-kilowatt battery.

- In March 2021, Toyota Motor Corporation and Beijing SinoHytec proclaimed a joint venture to produce hydrogen fuel cell vehicles concerning the Chinese market. As per the joint statement, the two companies are foreseen to invest USD 72 million into Huafeng Fuel Cell Co. Ltd. The company's first car will be modelled after Toyota's hydrogen fuel cell vehicle MIRAI and is slated to begin production in 2023.

Renub Research latest report “Global Fuel Cell Vehicle Market, Global Forecast By Technology (Polymer Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Direct Methanol Fuel Cells (DMFC), Phosphoric Acid Fuel Cells (PAFC) and Molten Carbonate Fuel Cells (MCFC), Region (North America, Europe, Asia Pacific, Middle East and Africa and Latin America), Companies (Volkswagen, Daimler AG, Toyota Motor Corporation, Honda Motor Company, and Ford Motor Company)” provides a detailed analysis of Global Fuel Cell Vehicle Industry.

Technology – Fuel Cell Electric Vehicle has been covered from 5 viewpoints:

1. Polymer Exchange Membrane Fuel Cells (PEMFC)

2. Solid Oxide Fuel Cells (SOFC)

3. Direct Methanol Fuel Cells (DMFC)

4. Phosphoric Acid Fuel Cells (PAFC)

5. Molten Carbonate Fuel Cells (MCFC)

Region – Fuel Cell Electric Vehicle has been covered from 5 viewpoints:

1. North America

2. Europe

3. Asia Pacific

4. Middle East and Africa

5. Latin America

Company Insights:

• Overview

• Recent Development & Strategies

• Financial Insights

Company Analysis

1. Volkswagen

2. Toyota Motor Corporation

3. Daimler AG

4. Ford Motor Company

5. Honda Motor Company

Report Details:

| Report Features | Details |

| Base Year | 2020 |

| Historical Period | 2017 - 2020 |

| Forecast Period | 2021-2030 |

| Volume | Thousand Units |

| Segment Covered | Technology, Region |

| Region Covered | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

| Companies Covered | Volkswagen, Toyota Motor Corporation, Daimler AG, Ford Motor Company, Honda Motor Company |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Fuel Cell Electric Vehicle Market

6. Volume Share – Fuel Cell Electric Vehicle

6.1 By Technology

6.2 By Region

7. Technology – Fuel Cell Electric Vehicle

7.1 Polymer Exchange Membrane Fuel Cells (PEMFC)

7.2 Solid Oxide Fuel Cells (SOFC)

7.3 Direct Methanol Fuel Cells (DMFC)

7.4 Phosphoric Acid Fuel Cells (PAFC)

7.5 Molten Carbonate Fuel Cells (MCFC)

8. Region – Fuel Cell Electric Vehicle

8.1 North America

8.2 Europe

8.3 Asia Pacific

8.4 Middle East and Africa

8.5 Latin America

9. Company Analysis

9.1 Volkswagen

9.1.1 Overview

9.1.2 Recent Development

9.1.3 Financial Insights

9.2 Toyota Motor Corporation

9.2.1 Overview

9.2.2 Recent Development

9.2.3 Financial Insights

9.3 Daimler AG

9.3.1 Overview

9.3.2 Recent Development

9.3.3 Financial Insights

9.4 Ford Motor Company

9.4.1 Overview

9.4.2 Recent Development

9.4.3 Financial Insights

9.5 Honda Motor Company

9.5.1 Overview

9.5.2 Recent Development

9.5.3 Financial Insights

List Of Figures:

Figure 1: Global Fuel Cell Electric Vehicle Volume (Thousand Units), 2017 – 2020

Figure 2: Forecast for – Global Fuel Cell Electric Vehicle Volume (Thousand Units), 2021 – 2030

Figure 3: Technology – Polymer Exchange Membrane Fuel Cells (PEMFC) Volume (Thousand Units), 2017 – 2020

Figure 4: Technology – Forecast for Polymer Exchange Membrane Fuel Cells (PEMFC) Volume (Thousand Units), 2021 – 2030

Figure 5: Technology – Solid Oxide Fuel Cells (SOFC) Volume (Thousand Units), 2017 – 2020

Figure 6: Technology – Forecast for Solid Oxide Fuel Cells (SOFC) Volume (Thousand Units), 2021 – 2030

Figure 7: Technology – Direct Methanol Fuel Cells (DMFC) Volume (Units), 2017 – 2020

Figure 8: Technology – Forecast for Direct Methanol Fuel Cells (DMFC) Volume (Units), 2021 – 2030

Figure 9: Technology – Phosphoric Acid Fuel Cells (PAFC) Volume (Units), 2017 – 2020

Figure 10: Technology – Forecast for Phosphoric Acid Fuel Cells (PAFC) Volume (Units), 2021 – 2030

Figure 11: Technology – Molten Carbonate Fuel Cells (MCFC) Volume (Units), 2017 – 2020

Figure 12: Technology – Forecast for Molten Carbonate Fuel Cells (MCFC) Volume (Units), 2021 – 2030

Figure 13: North America – Fuel Cell Electric Vehicle Volume (Thousand Units), 2017 – 2020

Figure 14: North America – Forecast for Fuel Cell Electric Vehicle Volume (Thousand Units), 2021 – 2030

Figure 15: Europe – Fuel Cell Electric Vehicle Volume (Units), 2017 – 2020

Figure 16: Europe – Forecast for Fuel Cell Electric Vehicle Volume (Units), 2021 – 2030

Figure 17: Asia Pacific – Fuel Cell Electric Vehicle Volume (Thousand Units), 2017 – 2020

Figure 18: Asia Pacific – Forecast for Fuel Cell Electric Vehicle Volume (Thousand Units), 2021 – 2030

Figure 19: Middle East and Africa – Fuel Cell Electric Vehicle Volume (Thousand Units), 2017 – 2020

Figure 20: Middle East and Africa – Forecast for Fuel Cell Electric Vehicle Volume (Thousand Units), 2021 – 2030

Figure 21: Latin America – Fuel Cell Electric Vehicle Volume (Units), 2017 – 2020

Figure 22: Latin America – Forecast for Fuel Cell Electric Vehicle Volume (Units), 2021 – 2030

Figure 23: Volkswagen – Global Revenue (Billion US$), 2017 – 2020

Figure 24: Volkswagen – Forecast for Global Revenue (Billion US$), 2021 – 2030

Figure 25: Toyota Motor Corporation – Global Revenue (Billion US$), 2017 – 2020

Figure 26: Toyota Motor Corporation – Forecast for Global Revenue (Billion US$), 2021 – 2030

Figure 27: Daimler AG – Global Revenue (Billion US$), 2017 – 2020

Figure 28: Daimler AG – Forecast for Global Revenue (Billion US$), 2021 – 2030

Figure 29: Ford Motor Company – Global Revenue (Billion US$), 2017 – 2020

Figure 30: Ford Motor Company – Forecast for Global Revenue (Billion US$), 2021 – 2030

Figure 31: Honda Motor Company – Global Revenue (Billion US$), 2017 – 2020

Figure 32: Honda Motor Company – Forecast for Global Revenue (Billion US$), 2021 – 2030

List Of Tables:

Table-01: Global – Fuel Cell Electric Vehicle Volume Share by Technology (Percent), 2017 – 2020

Table-02: Global – Forecast for Fuel Cell Electric Vehicle Volume Share by Technology (Percent), 2021 – 2030

Table-03: Global – Fuel Cell Electric Vehicle Volume Share by Region (Percent), 2017 – 2020

Table-04: Global – Forecast for Fuel Cell Electric Vehicle Volume Share by Region (Percent), 2021 – 2030

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com