Geographic Information Systems Market Global Forecast Report by Component (Hardware, Software, Services), Function (Mapping, Surveying, Telematics and Navigation, Location-Based Services), Device Type (Desktop, Mobile), Vertical (Transportation & Logistics, Agriculture, Construction, Mining & Geology, Oil & Gas, Aerospace & Defense, Utilities, Government, Others), Countries and Company Analysis 2025-2033

Buy NowGeographic Information Systems Market Analysis

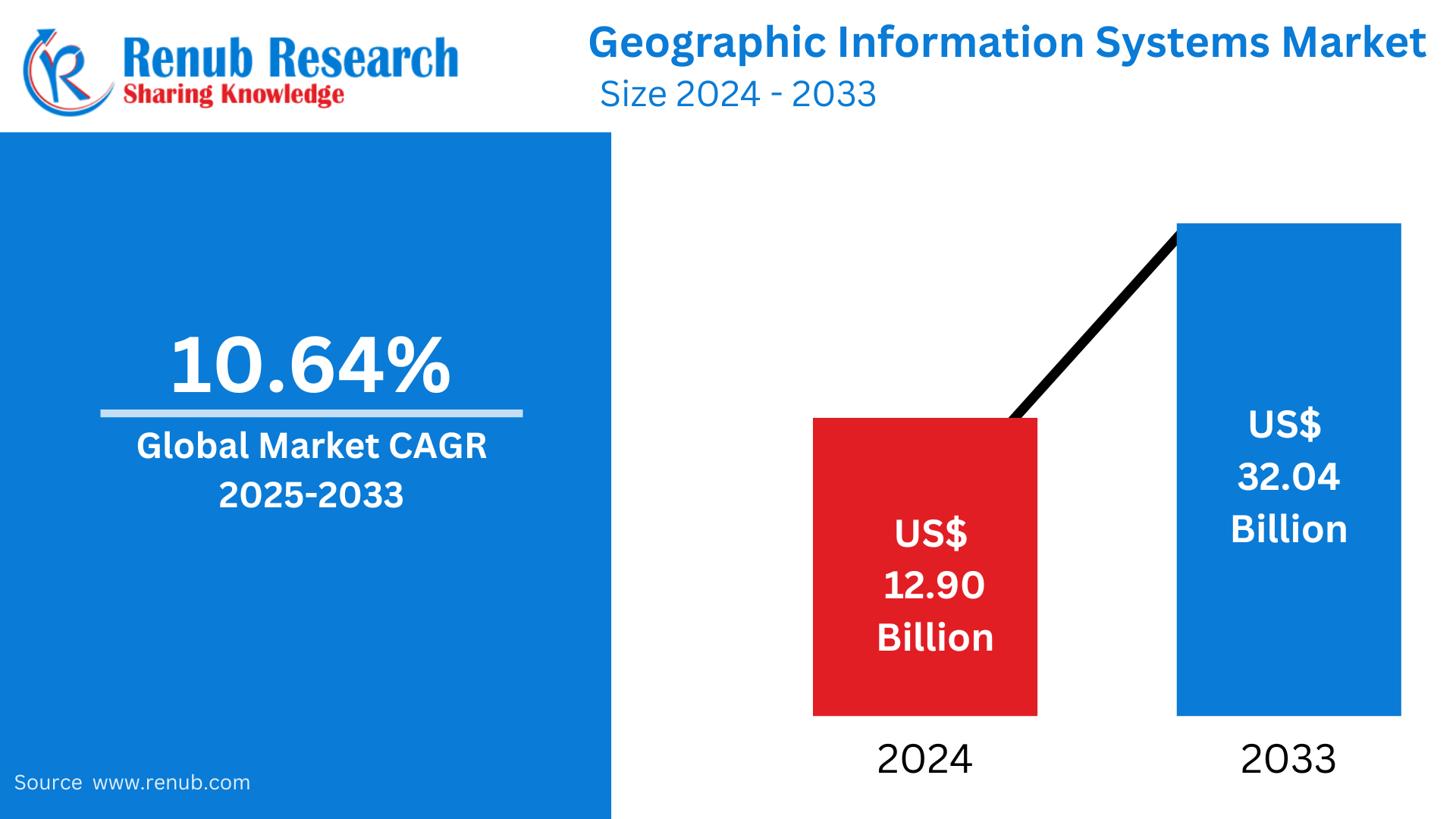

The Global Geographic Information Systems Market will reach US$ 32.04 billion by 2033, up from US$ 12.90 billion in 2024, with a CAGR of 10.64% between 2025 and 2033. Advances in data analytics, growing demand for location-based services, growing use in sectors like urban planning, agriculture, and military, and the expansion of smart city initiatives are the main factors propelling the Geographic Information Systems (GIS) market.

Global Geographic Information Systems Industry Overview

Tools for gathering, storing, managing, analyzing, and visualizing spatial or geographic data are called geographic information systems, or GIS. In order to study patterns, trends, and correlations in the actual world, GIS combines a variety of data types, including maps, satellite photos, and sensor data. It facilitates decision-making in a variety of domains, including urban planning, environmental management, transportation, agriculture, and disaster response, by helping users comprehend geographic locations and spatial phenomena. GIS applications help enterprises optimize operations, increase productivity, and resolve location-based problems through data-driven insights. These applications range from mapping and tracking assets to modeling complicated systems.

The industry is being driven by government agencies' growing investments in smart cities in an effort to better understand geospatial trends. Furthermore, the growing use of GIS in the healthcare industry is also playing a major role in driving growth.

Driving Forces of Geographic Information Systems Market

Technological Advancements

The possibilities and applications of geographic information systems have been greatly increased by the development of several technologies. The combination of machine learning (ML) with artificial intelligence (AI) is among the most noteworthy developments. Furthermore, a number of businesses worldwide are using location intelligence with AI to automate processes, generate insights from vast volumes of data, and make precise business predictions. For example, FedEx's worldwide logistics business heavily depends on pinpoint accuracy. FedEx uses the new enterprise GIS to monitor its fleet and ensure on-time delivery.

Additionally, AI's predictive powers help determine when an aircraft will require maintenance or parts, which helps keep a complicated supply chain efficient and on schedule. The demand for geospatial information systems is subsequently being driven by this. In addition, the market is being further strengthened by the growing trend of cloud computing, which is being used by major players to offer flexible, scalable, and affordable GIS solutions. For instance, the Marshall Space Flight Center in Huntsville, which is part of the National Aeronautics and Space Administration (NASA), requested capability statements from interested partners in April 2024 for its Innovative Visualization, Exploration and Data Analysis (IVEDA) purchase. Accordingly, its primary goal is to support NASA's Earth Science Data System (ESDS) Program by launching new dashboard instances of the Visualization, Exploration, and Data Analysis (VEDA) Platform.

Additionally, in July 2023, Schneider Electric, a world leader in the digital transformation of energy management and automation, and ROK Technologies, a reputable provider of GIS-managed cloud services, announced a partnership to provide utilities with a comprehensive managed services offering to migrate ArcGIS and ArcFM systems to the cloud.

Growing Use of Mobile GIS

The widespread use of mobile-based geospatial information systems is growing as a result of ongoing developments in mobile technology and the accessibility of smartphones and tablets. They are widely used in many domains where the capacity to make quick, well-informed judgments might be crucial, including emergency services, urban planning, and environmental protection. The market opportunities for geographic information systems are thus represented by this. One example is the July 2023 launch of a new mobile application made especially for updating geographical information systems by TP Southern Odisha Distribution Limited (TPSODL), a division of Tata Power Company Limited that distributes electricity in the southern part of Odisha, India. Additionally, the GIS mobile app makes it simple for users to search for assets by asset code, address, work ID, or location.

Additionally, because data can be shared and viewed by anyone, anywhere, at any time, mobile GIS's flexibility and simplicity encourage better team participation and enable more responsive and dynamic project management. For instance, Leica Geosystems, a division of Hexagon, announced in May 2023 the launch of the Leica Pegasus TRK100, a mobile mapping solution. This innovative mobile mapping technology, created especially for GIS experts, is a user-friendly geospatial solution made for measuring massive infrastructure and creating digital twins.

The necessity of emergency management

The use of geographic information systems is increasing as a result of regulatory authorities' growing worries about public safety. This is because these systems help officials make well-informed judgments during emergencies by delivering accurate spatial data. In October 2023, for instance, CentralSquare Technologies, a prominent player in the public sector IT sector, announced a collaboration with Michael Baker International's public safety geographic information systems (GIS) team, DATAMARK. Public safety organizations were able to effectively plan, prepare, and respond to emergency occurrences by utilizing the most precise location-based information available thanks to CentralSquare's collaboration with DATAMARK.

Additionally, the growing requirement for mapping events like natural catastrophes and increased situational awareness are supporting the growth of the geographic information system industry. For example, the Louisiana Governor's Office of Homeland Security and Emergency Preparedness (GOHSEP) used geographic information system (GIS) technology to rebuild Virtual Louisiana, which includes extensive disaster data. The website offers real-time weather forecasts, shelter places and evacuation routes, and a mechanism for locals to report home damage.

In addition, the global industry is being further stimulated by the growing emphasis on evacuation planning in order to assess routes and pinpoint safe areas. For instance, Ryan Kinsella, a graduate student in the Geography Department at Binghamton University and an intern with the Office of Emergency Management, introduced a set of interactive public safety maps in February 2024 to offer conveniently available information and reduce misunderstanding during emergencies.

Geographic Information Systems Market Overview by Regions

Globally, the GIS industry is expanding, with North America leading the way because of its sophisticated technology usage. Europe comes next with robust government programs, and Asia-Pacific is growing quickly due to infrastructural development and urbanization. Africa and Latin America exhibit growing demand. The following provides a market overview by region:

United States Geographic Information Systems Market

The widespread use of Geographic Information Systems (GIS) in a variety of industries, such as government, defense, agriculture, healthcare, and urban planning, has made the US market a global leader. GIS expansion is fueled by advanced technological infrastructure, including cloud computing, high-speed internet, and IoT integration. For instance, with the goal of strengthening cooperation in geographic information system (GIS) software, location intelligence, and mapping, Trimble and Esri have extended their long-standing strategic alliance. In an effort to provide their common customers with greener infrastructure planning, construction, and operations, this ongoing partnership aims to improve procedures, support decision-making, and automate workflows.

Additionally, a major factor in the growth of the industry is the U.S. government's investment in infrastructure projects, smart city initiatives, and disaster management plans. Furthermore, GIS is used by commercial industries like logistics and retail to provide location-based services that improve operational efficiency. GIS innovation and acceptance in the US market are further accelerated by the growing need for real-time mapping and spatial data processing.

India Geographic Information Systems Market

India's market for Geographic Information Systems (GIS) is increasing quickly due to rising urbanization, infrastructural development, and government programs like Digital India and the Smart Cities Mission. In order to enhance decision-making and operational efficiency, GIS technology is being used more and more in industries such as agriculture, urban planning, transportation, defense, and disaster management. The uses of GIS are being further enhanced by its integration with cutting-edge technologies like cloud computing, big data analytics, and the Internet of Things.

For instance, In Lucknow, India, Agribazaar, an agritech platform and part of the StarAgri group, unveiled a command center powered by artificial intelligence (AI) and based on a geographic information system (GIS) in March 2024. This program is a component of the Uttar Pradesh Diversified Agriculture Support Project's (UPDASP) crop survey project. Furthermore, The Master Mentors Geo-enabling Indian Scholars (MMGEIS) program was launched by Esri India and the Centre for Knowledge Sovereignty (CKS) to help more Indian patents become a global center for geospatial innovation.

Furthermore, sustainable growth is supported by the growing application of GIS in resource management and environmental monitoring. The GIS industry is expanding due to India's growing need for location-based services and mapping solutions.

United Kingdom Geographic Information Systems Market

In the UK, the market for Geographic Information Systems (GIS) is expanding steadily due to its use in sectors like government, urban planning, transportation, agriculture, and environmental management. The UK government's investments in smart cities, infrastructure initiatives, and efforts to mitigate climate change are major drivers of the need for GIS. Furthermore, the incorporation of GIS with technologies such as cloud computing, artificial intelligence, and data analytics improves its capacity for geographical analysis, real-time mapping, and decision-making. The UK's emphasis on sustainability and the rising need for location-based services are two factors that are driving the growth of the GIS market in the area.

For instance, in order to provide cutting-edge GIS solutions to their global clientele, VertiGIS, a leader in spatial asset management, has teamed up with Esri, a leader in location intelligence in July 2024. Reselling, co-selling, co-marketing, and coordinating technical and business strategies are all part of this collaboration. It makes use of collective experience to provide creative solutions that address particular client requirements.

Saudi Arabia Geographic Information Systems Market

The ambitious Vision 2030 plan of Saudi Arabia, which places a strong emphasis on infrastructure development, urban planning, and smart city initiatives, is propelling the country's Geographic Information Systems (GIS) market's rapid growth. In order to maximize resources, boost productivity, and aid in decision-making, GIS technology is being used more and more in industries like transportation, utilities, oil and gas, agriculture, and environmental management. GIS usage is further boosted by Saudi Arabia's investments in major infrastructure projects like NEOM and Red Sea developments. Furthermore, GIS's capabilities and market presence in the area are growing as a result of its integration with cutting-edge technologies like cloud computing, big data, and the Internet of Things.

Component- Industry is divided into 3 viewpoints:

- Hardware

- Software

- Services

Function- Industry is divided into 4 viewpoints:

- Mapping

- Surveying

- Telematics and Navigation

- Location-Based Services

Device Type- Industry is divided into 2 viewpoints:

- Desktop

- Mobile

Vertical- Industry is divided into 9 viewpoints:

- Transportation & Logistics

- Agriculture

- Construction

- Mining & Geology

- Oil & Gas

- Aerospace & Defense

- Utilities

- Government

- Others

Countries- Industry is divided into 25 viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insights

Company Analysis

- Trimble Inc.

- Autodesk Inc.

- Bentley Systems Inc

- Hexagon AB

- Pitney Bowes Inc.

- Beijing SuperMap Software Co Ltd

- L3Harris Technologies Inc

- GE Vernova Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Component, Function, Device Type, Vertical and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in the Report

-

What is the current and projected market size of the global Geographic Information Systems (GIS) market from 2024 to 2033?

-

Which key factors are driving the growth of the GIS market globally?

-

How is the GIS market segmented by component, and which segment (hardware, software, or services) dominates the industry?

-

What are the primary functions supported by GIS (Mapping, Surveying, Telematics & Navigation, Location-Based Services), and which function contributes the most to the market share?

-

How is the market categorized by device type (Desktop vs. Mobile), and what is the forecasted adoption trend for mobile GIS solutions?

-

Which verticals (Transportation & Logistics, Agriculture, Construction, etc.) are the largest consumers of GIS technologies and solutions?

-

What is the regional market analysis of GIS across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa?

-

How are emerging technologies like AI, IoT, and cloud computing shaping the future of GIS applications globally?

-

Who are the leading companies operating in the GIS market, and what are their latest strategies and developments (e.g., Trimble, Autodesk, Hexagon)?

-

What are the key challenges and opportunities for new entrants in the GIS market across developing regions like Asia-Pacific and the Middle East?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Geographic Information Systems Market

6. Market Share Analysis

6.1 By Component

6.2 By Function

6.3 By Device Type

6.4 By Vertical

6.5 By Countries

7. Component

7.1 Hardware

7.2 Software

7.3 Services

8. Function

8.1 Mapping

8.2 Surveying

8.3 Telematics and Navigation

8.4 Location-Based Services

9. Device Type

9.1 Desktop

9.2 Mobile

10. Vertical

10.1 Transportation & Logistics

10.2 Agriculture

10.3 Construction

10.4 Mining & Geology

10.5 Oil & Gas

10.6 Aerospace & Defense

10.7 Utilities

10.8 Government

10.9 Others

11. Countries

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherlands

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 South Korea

11.3.5 Thailand

11.3.6 Malaysia

11.3.7 Indonesia

11.3.8 Australia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.2 UAE

11.5.3 South Africa

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players Analysis

14.1 Trimble Inc.

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development & Strategies

14.1.4 Revenue Analysis

14.2 Autodesk Inc.

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development & Strategies

14.2.4 Revenue Analysis

14.3 Bentley Systems Inc

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development & Strategies

14.3.4 Revenue Analysis

14.4 Hexagon AB

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development & Strategies

14.4.4 Revenue Analysis

14.5 Pitney Bowes Inc.

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development & Strategies

14.5.4 Revenue Analysis

14.6 Beijing SuperMap Software Co Ltd

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development & Strategies

14.6.4 Revenue Analysis

14.7 L3Harris Technologies Inc

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development & Strategies

14.7.4 Revenue Analysis

14.8 GE Vernova Inc.

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development & Strategies

14.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com