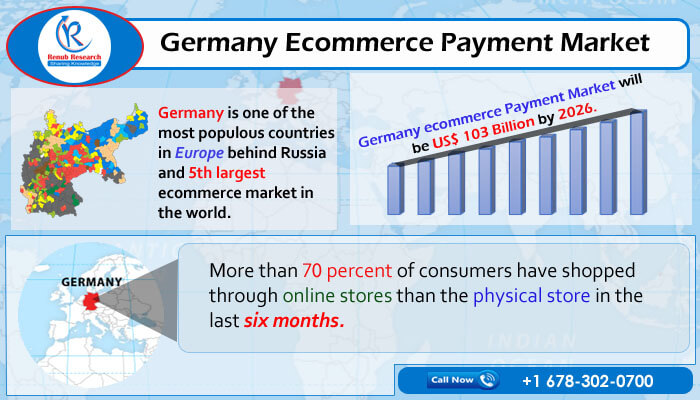

Germany E-commerce Payment Market is Forecasted to be more than US$ 103 Billion by the end of year 2026

01 Apr, 2021

According to the latest report by Renub Research, titled "Germany E-commerce Payment Market by Category (Food, Clothes, Travel, etc.) Payment Types (Bank Transfer, Card, Digital Wallets, Cash, Direct Debit, Open Invoice, Others), Company Analysis" Germany is Europe's second-most populous country after Russia and the world's fifth-largest eCommerce market. It is one of Europe's largest eCommerce markets after the UK and France. Consumers in Germany embrace digital payment strategies such as digital wallets, bank transfers, and credit card transactions. Last year, more than 70% of customers had shopped online rather than in a physical store. During this time, the e-commerce payment markets for hygiene products, pharmaceuticals, and groceries have expanded. Germany eCommerce Payment Market is expected to grow more than US$ 103 Billion by 2026 since there is a rise in the number of online shopper’s year on year.

COVID-19's Effect on the German eCommerce Payment Market

Germany is primarily a cash-based economy in Europe. Still, the coronavirus has changed German users' shopping habits, serving as a trigger for the digital payment industry. Most people have started to use digital payment and cash to prevent the spread of the virus. The country's tech-savvy citizens are switching from cash to digital wallet payment methods.

In Germany, smartphone use is increasingly growing, which may be another factor behind the increased use of e-wallet payment methods. Mobile shopping is becoming more popular, and instant payments are more convenient for today's consumers. When shopping online, most Germans choose to pay with Digital Wallets, Open Invoices, and Cards. Increased confidence among German users, due to advanced security measures and assurances from digital wallets, card issuers, and merchants, encourages German citizens to turn to digital payment instead of cash. Other growth drivers for the Germany eCommerce Payment Market include PayDirekt, AmazonPay, Giropay, and Paypal programs such as buy now pay later and 0% finance by these companies.

Open invoices have dominated the German online payment industry for the past ten years, accounting for 63% of all transactions. Furthermore, four out of ten Germans favour this method, making it difficult for more contemporary approaches to gain traction.

The merchant must supply the goods with an invoice for open invoices to be accurate. Consumers may try the goods for a certain amount of time and then either return them or pay for them within that period, usually 14 or 28 days. For German companies, incorporating eCommerce payments is now simpler than ever. For example, the German gaming site Solitaired uses Stripe as an off-the-shelf solution to integrate online payments for its premium solitaire games.

Market Summary:

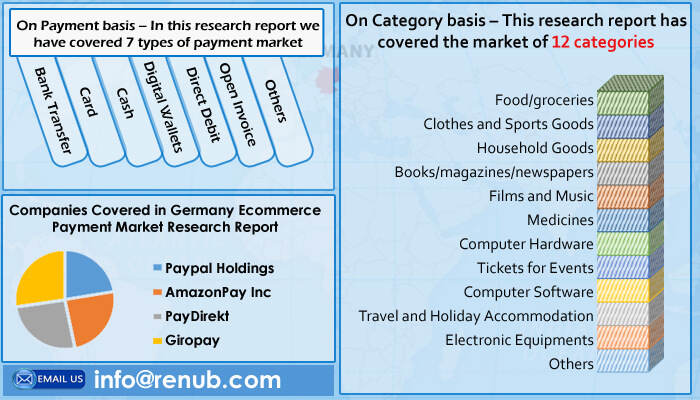

By Category: Films and Music, Computer Hardware, Travel and Holiday Accommodation, Household Goods, Medicines, Food/groceries, Computer Software, Clothes & Sports Goods, Electronic Equipments, Books/magazines/newspapers, Tickets for Events, and Others.

By Payment Method: Cash, Bank Transfer, Direct Debit, Open Invoice, Digital Wallets, Card, and Others.

By Company Analysis: Following companies are covered in this research report: PayDirekt, Paypal Holdings, Giropay, and AmazonPay Inc.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com