Germany E-Commerce Payment Market Forecast Report by Type (Digital Wallet, Credit Card, Debit Card, Account-to-Account (A2A), Buy now pay later (BNPL), Cash on Delivery (CoD), PrePay, Others), Application (Electronics & Media, Food & Personal Care, Fashion Accessories, Furniture & Appliances, Others) and Company Analysis 2024-2032

Buy NowGermany E-Commerce Payment Market Size

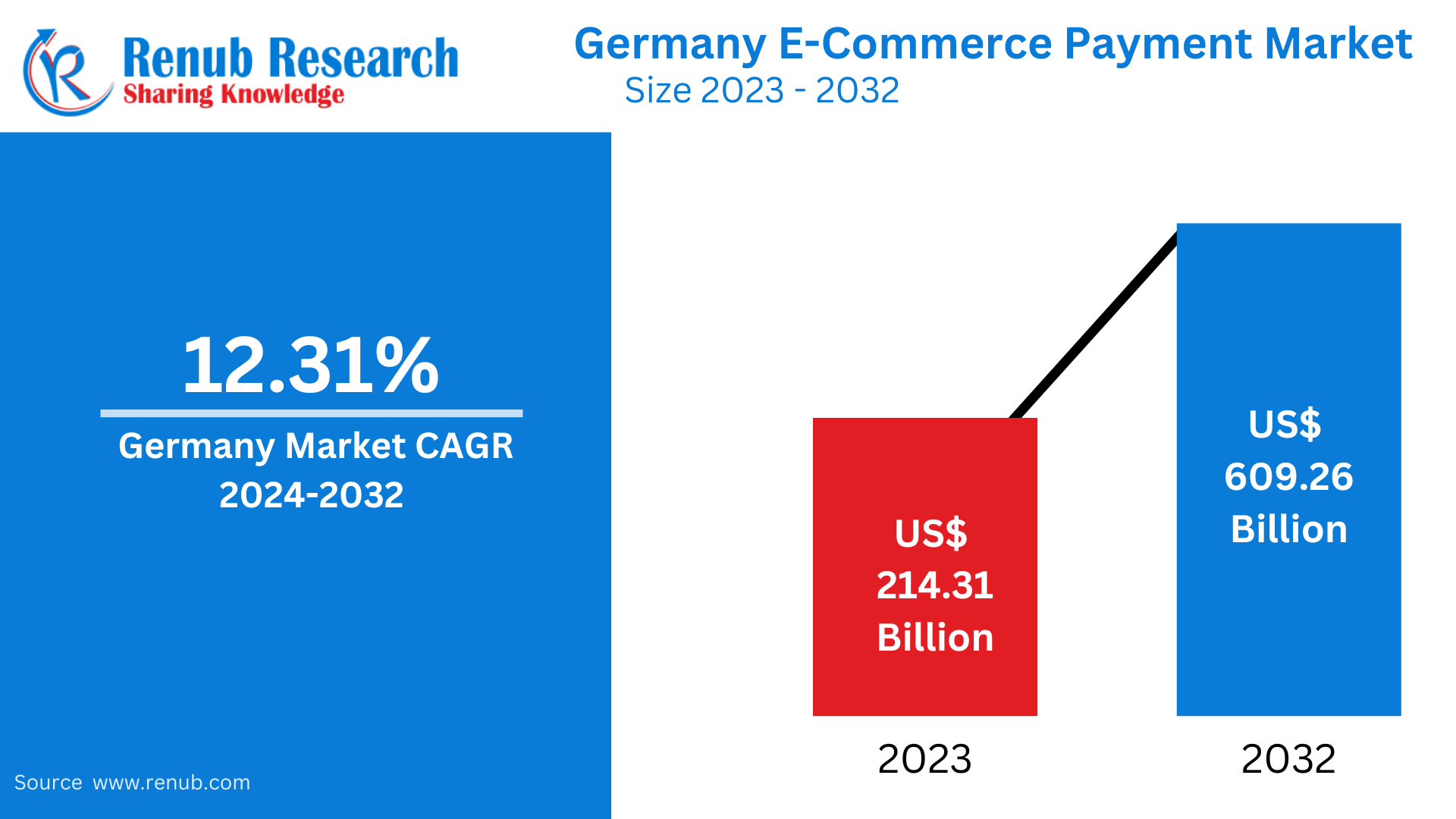

Germany E-Commerce Payment market is expected to reach US$ 214.31 Billion in 2023 to US$ 609.26 Billion by 2032, with a CAGR of 12.31 % from 2024 to 2032. The region's market is experiencing strong growth due to several factors, including rising internet penetration, the quick uptake of mobile payments, and substantial growth in e-commerce.

Germany E-Commerce Payment Market Overview

The powerful and broad e-commerce payment business in Germany is indicative of the nation's thriving digital economy. Direct debit and credit card payments account for a sizable amount of online transactions, but other payment options such as PayPal, Sofort, and mobile wallets are also becoming more and more common. The proliferation of mobile commerce and the rise in online shopping are driving the acceptance of digital payment systems.

Germany places a high value on consumer trust, which explains why people there favor safe and dependable payment methods. For payment providers, regulatory compliance is essential, particularly with regard to data protection. Furthermore, the rise of buy-now-pay-later (BNPL) services is altering consumer behavior, especially with younger customers. Businesses are positioned themselves for ongoing success in a competitive context by concentrating on improving the payment experience with seamless interfaces and localized alternatives as the industry continues to expand.

Growth Drivers for the Germany E-Commerce Payment Market

The payments market is predicted to be driven by the high proliferation of e-commerce

Because more people are shopping online than ever in the last several years, e-commerce is growing rapidly in the area. For example, according to EUROSTAT, 51% of European Union citizens between the ages of 16 and 74 placed online orders or purchased products and services in 2016, and that number increased to 66% in 2021.

PayPal and credit cards are accepted as payment methods by a large number of online retailers and e-commerce sites in Germany. A lot of e-commerce companies also allow customers to purchase now and pay later using invoices. E-commerce companies provide simple payment checkout solutions with a plethora of benefits. Over the course of the projection period, more growth in the e-commerce market is anticipated.

Additionally, the region's payment options are often changing. According to a PostNord research, 50% of Germans used PayPal or comparable services to pay for their online purchases; invoicing and debit or credit cards came in second and third, with 21% and 17% of respondents, respectively.

Customer Preferences

Due to a shift in their purchasing patterns toward greater flexibility and convenience, German customers are increasingly using digital payment methods. Apple Pay and Google Pay are two examples of mobile wallets that are becoming more popular because of how simple and fast they can process transactions. This tendency is especially noticeable among younger consumers who place a high importance on easy payment processes.

Additionally gaining popularity are buy-now-pay-later (BNPL) alternatives, which let customers make purchases without having to pay for them right away. This adaptability improves overall buying enjoyment and makes better budget management possible. Businesses are adjusting as these tastes change by incorporating a variety of payment options to satisfy the needs of contemporary customers.

Germany E-Commerce Payment Company Analysis

The major participants in the Germany E-Commerce Payment market includes Amazon.com Inc., American Express Company, Apple Inc., Fiserv Inc., Mastercard Incorporated, PayPal Holdings Inc., Visa Inc.

Germany E-Commerce Payment Company News

In April 2022, SaveStrike, a German fintech startup, intends to release a new mobile banking software to assist millennials with capital market investing. To make saving, investing, and spending easy and integrated, the app will be divided into four sections. Fundamentally, SaveStrike will offer distinct savings accounts in addition to constant access to a custodial account and current account within a single app. All of the standard current account features, such as transfers, standing orders, payments using QR codes, ATM searches, and card settings, will be available with SaveStrike Pay.

In March 2022, The US venture capital firm Valar Ventures led a USD 43 million Series A round for Berlin-based B2B BNPL platform Mondu. The company plans to use the money to grow into other European nations later this year.

Type- Industry is divided into 8 viewpoints:

- Digital Wallet

- Credit Card

- Debit Card

- Account-to-Account (A2A)

- Buy now pay later (BNPL)

- Cash on Delivery (CoD)

- PrePay

- Others

Application- Industry is divided into 5 viewpoints:

- Electronics & Media

- Food & Personal Care

- Fashion Accessories

- Furniture & Appliances

- Others

All companies have been covered with 5 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Financial Insight

Company Analysis

- Amazon.com Inc.

- American Express Company

- Apple Inc.

- Fiserv Inc.

- Mastercard Incorporated

- Paypal Holdings Inc.

- Visa Inc.

Report Details:

| Report Features | Details |

| Base Year |

2023 |

| Historical Period |

2019 - 2023 |

| Forecast Period |

2024 - 2032 |

| Market |

US$ Billion |

| Segment Covered | Type and Application |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Germany E-Commerce Payment Market

6. Market Share

6.1 Type

6.2 Application

7. Type

7.1 Digital Wallet

7.2 Credit Card

7.3 Debit Card

7.4 Account-to-Account (A2A)

7.5 Buy now pay later (BNPL)

7.6 Cash on Delivery (CoD)

7.7 PrePay

7.8 Others

8. Application

8.1 Electronics & Media

8.2 Food & Personal Care

8.3 Fashion Accessories

8.4 Furniture & Appliances

8.5 Others

9. Porter’s Five Analysis

9.1 Bargaining Power of Buyers

9.2 Bargaining Power of Suppliers

9.3 Degree of Rivalry

9.4 Threat of New Entrants

9.5 Threat of Substitutes

10. SWOT Analysis

10.1 Strength

10.2 Weakness

10.3 Opportunity

10.4 Threat

11. Key Players Analysis

11.1 Amazon.com Inc.

11.1.1 Overview

11.1.2 Key Persons

11.1.3 Recent Development & Strategies

11.1.4 Product Portfolio

11.1.5 Financial Insight

11.2 American Express Company

11.2.1 Overview

11.2.2 Key Persons

11.2.3 Recent Development & Strategies

11.2.4 Product Portfolio

11.2.5 Financial Insight

11.3 Apple Inc.

11.3.1 Overview

11.3.2 Key Persons

11.3.3 Recent Development & Strategies

11.3.4 Product Portfolio

11.3.5 Financial Insight

11.4 Fiserv Inc.

11.4.1 Overview

11.4.2 Key Persons

11.4.3 Recent Development & Strategies

11.4.4 Product Portfolio

11.4.5 Financial Insight

11.5 Mastercard Incorporated

11.5.1 Overview

11.5.2 Key Persons

11.5.3 Recent Development & Strategies

11.5.4 Product Portfolio

11.5.5 Financial Insight

11.6 Paypal Holdings Inc.

11.6.1 Overview

11.6.2 Key Persons

11.6.3 Recent Development & Strategies

11.6.4 Product Portfolio

11.6.5 Financial Insight

11.7 Visa Inc.

11.7.1 Overview

11.7.2 Key Persons

11.7.3 Recent Development & Strategies

11.7.4 Product Portfolio

11.7.5 Financial Insight

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com