Germany In-Vitro Diagnostics Market, Size, Forecast 2023-2028, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

Buy NowGermany In-Vitro Diagnostics Market Outlook

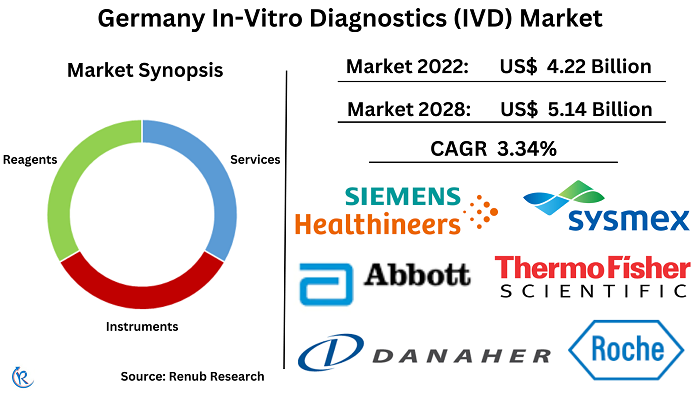

Germany In-Vitro Diagnostics Market will reach US$ 5.14 Billion in 2028, according to Renub Research. IVD tests have several uses, including diagnosis for infectious diseases, cancer, autoimmune diseases, and genetic disorders. They also play a crucial role in screening and early disease detection, disease monitoring and management, risk assessment and personalized medicine, and transplantation compatibility. In addition, IVD tests are also widely used in pregnancy, prenatal care, and forensic and drug testing.

The in-vitro diagnostics market in Germany is growing because of the rising number of chronic illnesses, a growing aging population, rising demand for accurate diagnosis, and favorable government initiatives. For instance, Germany witnessed approximately 628,519 new cancer cases, as GLOBOCAN reported. Among females, breast and colorectal cancer were more prevalent, while among males, prostate and lung cancer were more common in the country.

Germany In-Vitro Diagnostics Market shall expand at a CAGR of 3.34% from 2022 to 2028

Germany IVD market is one of the Europe's largest, driven by its robust healthcare system and population of over 83 million people. With advanced healthcare infrastructure, including hospitals, labs, and research institutions, Germany fosters technological innovation and leads in developing cutting-edge diagnostics technologies. The market spans various applications, such as infectious diseases, cancer diagnostics, and genetic testing, reflecting Germany's focus on preventive medicine and personalized healthcare.

Adhering to EU regulations, Germany ensures safety and performance standards for IVD products. In addition, the country's comprehensive healthcare system, with a reimbursement mechanism, promotes accessibility and financial viability for patients. Multinational corporations and local manufacturers enhance the market's competitiveness with innovative products and solutions. Hence, the market value for Germany's in-vitro Diagnostics Market was US$ 4.22 Billion in 2022.

Services in the Germany In-vitro Diagnostics Market shall experience thriving growth

The product segments in Germany in-vitro diagnostics market include Services, Instruments, and Reagents. Increasing demand for outsourced services allows healthcare facilities to optimize operations and focus on core competencies, enhancing efficiency and cost reduction. Technological advancements like automation and data analytics enable service providers to offer more efficient and accurate diagnostic services. The complexity of diagnostic testing, including molecular diagnostics and genetic testing, has led to a greater reliance on specialized service providers.

Outsourcing diagnostic services also brings cost-effectiveness and resource optimization, avoiding heavy upfront investments and allowing the allocation of resources to critical patient care areas. Specialized service providers excel in quality assurance and compliance with regulatory requirements, ensuring accurate and reliable results. Collaboration and integration with healthcare systems enable seamless coordination of diagnostic services, facilitating effective patient care.

Rapid tests are gaining fame in Germany In-vitro Diagnostics Market

Germany in-vitro diagnostics market offers a variety of test types, such as ELISA & CLIA, PCR, Rapid Test, Fluorescence Immunoassays (FIA), In Situ Hybridization, Transcription Mediated Amplification, Sequencing, Colorimetric Immunoassay, Radioimmunoassay (RIA), Isothermal Nucleic Acid Amplification Technology, and others. Rapid tests have become increasingly popular due to their quick and efficient results, eliminating the need for lengthy laboratory processing times. They enable healthcare professionals to perform diagnostics tests at the point of care and play a crucial role in various screening programs.

Rapid tests have gained prominence with the growing emphasis on early detection and prevention, especially in outpatient settings. Technology advancements have enhanced their performance and accuracy, expanding the range of conditions and pathogens detected. Rapid tests are also crucial tools in public health emergency preparedness and are often designed for ease of use, requiring minimal training. The COVID-19 pandemic has significantly boosted their demand worldwide, helping to control the spread of the virus.

Cardiology application is the fastest growing in Germany In-vitro Diagnostics Market

In the German in-vitro Diagnostics Market, several applications hold great importance, encompassing Infectious Diseases, Diabetes, Cardiology, Oncology, Nephrology, Autoimmune Diseases, Drug Testing, and various other applications. Cardiovascular diseases drive demand for advanced cardiology diagnostics in Germany. In-vitro diagnostics play a crucial role in early detection and management. Technological advancements improve accuracy, efficiency, and risk assessment.

In addition, the aging population increases the demand for cardiac diagnostics. In-vitro tests provide valuable information on biomarkers and genetic markers. Preventive healthcare emphasizes early detection and intervention, with non-invasive diagnostics helping prevent cardiac diseases. Point-of-care testing expands access to immediate diagnostics. Favorable reimbursement policies drive adoption and market growth.

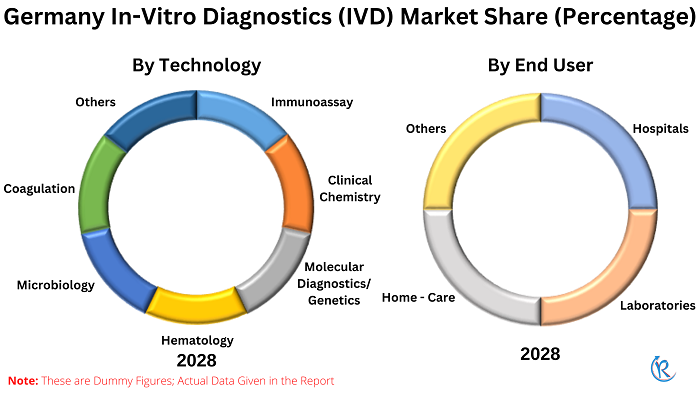

Immunoassay dominates Germany In-vitro Diagnostics Market due to its versatile applications, automation capabilities, and extensive assay catalog

In Germany In-vitro diagnostics market, the technologies employed include Immunoassay, Clinical Chemistry, Molecular Diagnostics/Genetics, Hematology, Microbiology, Coagulation, and other related technologies. Immunoassay techniques have many applications across medical disciplines like infectious diseases, oncology, endocrinology, autoimmune diseases, and allergy testing. They are famous for their high sensitivity and specificity, enabling accurate detection and quantification of target analytes.

Immunoassay platforms offer automation and increased throughput capabilities, making them efficient for analyzing large samples. The extensive catalog of validated assays, regulatory approval, and ongoing research contributes to their reliability and performance. In addition, immunoassays are cost-effective and benefit from Germany's well-developed healthcare infrastructure and skilled workforce in laboratory medicine, further drive their dominance in the market.

Hospitals maintain their dominant position in the Germany in-vitro diagnostics market

Germany's in-vitro diagnostics market classifies end-users into four categories: Hospitals, Laboratories, Home-Care, and Others. Hospitals dominate Germany's in-vitro diagnostics market due to their comprehensive healthcare services, advanced facilities and equipment, availability of specialized departments, collaboration with healthcare professionals, accessibility and convenience, referral system, quality assurance and accreditation, and affiliation with research and academic institutions. These factors collectively establish hospitals as the primary location for conducting a wide range of in-vitro diagnostic tests, attracting patients and healthcare providers.

Key Players

Germany's in-vitro diagnostics market features prominent companies such as Roche Diagnostics, Abbott Diagnostics, Siemens Healthineers, Danaher Corporation, Thermo Fisher Scientific, and Sysmex Corporation.

- In May 2022- Spindiag GmbH obtained CE-IVD conformity for two additional tests on its Rhonda PCR rapid testing system. The recently introduced Rhonda Respi disk can detect SARS-CoV-2, Influenza A, Influenza B, and the Respiratory Syncytial Virus (RSV) using one swab sample, with results available in less than an hour.

Renub Research report titled “Germany in-vitro diagnostics Market Global Forecast by Products (Services, Instruments, and Reagents), Test Types (ELISA & CLIA, PCR, Rapid Test, Fluorescence Immunoassays (FIA), In Situ Hybridization, Transcription Mediated Amplification, Sequencing, Colorimetric Immunoassay, Radioimmunoassay (RIA), Isothermal Nucleic Acid Amplification Technology, and Others), Application (Infectious Diseases, Diabetes, Cardiology, Oncology, Nephrology, Autoimmune Diseases, Drug Testing, and Others), Technology (Immunoassay, Clinical Chemistry, Molecular Diagnostics/Genetics, Hematology, Microbiology, Coagulation, and Others), End-Users (Hospitals, Laboratories, Home - Care, and Others), Company Analysis (Roche Diagnostics, Abbott Diagnostics, Siemens Healthineers, Danaher Corporation, Thermo Fisher Scientific, and Sysmex Corporation)" provides a detailed analysis of Germany in-vitro Diagnostics Market.

Products - Market breakup from 3 Viewpoints:

1. Services

2. Instruments

3. Reagents

Test Types - Market breakup from 11 Viewpoints:

1. ELISA & CLIA

2. PCR

3. Rapid Test

4. Fluorescence Immunoassays (FIA)

5. In Situ Hybridization

6. Transcription Mediated Amplification

7. Sequencing

8. Colorimetric Immunoassay

9. Radioimmunoassay (RIA)

10. Isothermal Nucleic Acid Amplification Technology

11. Others

Application - Market breakup from 8 Viewpoints:

1. Infectious Diseases

2. Diabetes

3. Cardiology

4. Oncology

5. Nephrology

6. Autoimmune Diseases

7. Drug Testing

8. Others

Technology - Market breakup from 7 Viewpoints:

1. Immunoassay

2. Clinical Chemistry

3. Molecular Diagnostics/Genetics

4. Hematology

5. Microbiology

6. Coagulation

7. Others

End-Users - Market breakup from 4 Viewpoints:

1. Hospitals

2. Laboratories

3. Home – Care

4. Others

Company has been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue

Company Analysis:

1. Roche Diagnostics

2. Abbott Diagnostics

3. Siemens Healthineers

4. Danaher Corporation

5. Thermo Fisher Scientific

6. Sysmex Corporation

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2018 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | Products, Test Types, Application, Technology, and End User |

| Companies Covered | Roche Diagnostics, Abbott Diagnostics, Siemens Healthineers, Danaher Corporation, Thermo Fisher Scientific, and Sysmex Corporation |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Porter’s Five Forces

5.1 Bargaining Power of Buyer

5.2 Bargaining Power of Supplier

5.3 Threat of New Entrants

5.4 Rivalry among Existing Competitors

5.5 Threat of Substitute Products

6. SWOT Analysis

6.1 Strengths

6.2 Weaknesses

6.3 Opportunities

6.4 Threats

7. Germany In-Vitro Diagnostics (IVD) Market

8. Market Share – Germany In-Vitro Diagnostics (IVD)

8.1 By Test Types

8.2 By Products

8.3 By Technology

8.4 By Application

8.5 By End User

9. Test Types – Germany In-Vitro Diagnostics (IVD) Market

9.1 ELISA & CLIA

9.2 PCR

9.3 Rapid Test

9.4 Fluorescence Immunoassays (FIA)

9.5 In Situ Hybridization

9.6 Transcription Mediated Amplification

9.7 Sequencing

9.8 Colorimetric Immunoassay

9.9 Radioimmunoassay (RIA)

9.10 Isothermal Nucleic Acid Amplification Technology

9.11 Others

10. Product Types – Germany In-Vitro Diagnostics (IVD) Market

10.1 Services

10.2 Instruments

10.3 Reagents

11. Technology – Germany In-Vitro Diagnostics (IVD) Market

11.1 Immunoassay

11.2 Clinical Chemistry

11.3 Molecular Diagnostics/Genetics

11.4 Hematology

11.5 Microbiology

11.6 Coagulation

11.7 Others

12. Application – Germany In-Vitro Diagnostics (IVD) Market

12.1 Infectious Disease

12.2 Diabetes

12.3 Cardiology

12.4 Oncology

12.5 Nephrology

12.6 Autoimmune Diseases

12.7 Drug Testing

12.8 Other Applications

13. End User – Germany In-Vitro Diagnostics (IVD) Market

13.1 Hospitals

13.2 Laboratories

13.3 Home - Care

13.4 Others

14. Government Rules & Regulation

15. Reimbursement

15.1 Public

15.2 Private& Insurance

16. Company Analysis

16.1 Roche Diagnostics

16.1.1 Overview

16.1.2 Recent Development

16.1.3 Revenue

16.2 Abbott Diagnostics

16.2.1 Overview

16.2.2 Recent Development

16.2.3 Revenue

16.3 Siemens Healthineers

16.3.1 Overview

16.3.2 Recent Development

16.3.3 Revenue

16.4 Danaher Corporation

16.4.1 Overview

16.4.2 Recent Development

16.4.3 Revenue

16.5 Thermo Fisher Scientific

16.5.1 Overview

16.5.2 Recent Development

16.5.3 Revenue

16.6 Sysmex Corporation

16.6.1 Overview

16.6.2 Recent Development

16.6.3 Revenue

List of Figures:

Figure-01: Germany – In-Vitro Diagnostics Market (Billion US$), 2018 – 2022

Figure-02: Germany – Forecast for In-Vitro Diagnostics Market (Billion US$), 2023 – 2028

Figure-03: Test Types – ELISA & CLIA Market (Million US$), 2018 – 2022

Figure-04: Test Types – Forecast for ELISA & CLIA Market (Million US$), 2023 – 2028

Figure-05: Test Types – PCR Market (Million US$), 2018 – 2022

Figure-06: Test Types – Forecast for PCR Market (Million US$), 2023 – 2028

Figure-07: Test Types – Rapid Test Market (Million US$), 2018 – 2022

Figure-08: Test Types – Forecast for Rapid Test Market (Million US$), 2023 – 2028

Figure-09: Test Types – Fluorescence Immunoassays (FIA) Market (Million US$), 2018 – 2022

Figure-10: Test Types – Forecast for Fluorescence Immunoassays (FIA) Market (Million US$), 2023 – 2028

Figure-11: Test Types – In Situ Hybridization Market (Million US$), 2018 – 2022

Figure-12: Test Types – Forecast for In Situ Hybridization Market (Million US$), 2023 – 2028

Figure-13: Test Types – Transcription Mediated Amplification Market (Million US$), 2018 – 2022

Figure-14: Test Types – Forecast for Transcription Mediated Amplification Market (Million US$), 2023 – 2028

Figure-15: Test Types – Sequencing Market (Million US$), 2018 – 2022

Figure-16: Test Types – Forecast for Sequencing Market (Million US$), 2023 – 2028

Figure-17: Test Types – Colorimetric Immunoassay Market (Million US$), 2018 – 2022

Figure-18: Test Types – Forecast for Colorimetric Immunoassay Market (Million US$), 2023 – 2028

Figure-19: Test Types – Radioimmunoassay (RIA) Market (Million US$), 2018 – 2022

Figure-20: Test Types – Forecast for Radioimmunoassay (RIA) Market (Million US$), 2023 – 2028

Figure-21: Test Types – Isothermal Nucleic Acid Amplification Technology Market (Million US$), 2018 – 2022

Figure-22: Test Types – Forecast for Isothermal Nucleic Acid Amplification Technology Market (Million US$), 2023 – 2028

Figure-23: Test Types – Others Market (Million US$), 2018 – 2022

Figure-24: Test Types – Forecast for Others Market (Million US$), 2023 – 2028

Figure-25: Product Types – Services Market (Million US$), 2018 – 2022

Figure-26: Product Types – Forecast for Services Market (Million US$), 2023 – 2028

Figure-27: Product Types – Instruments Market (Million US$), 2018 – 2022

Figure-28: Product Types – Forecast for Instruments Market (Million US$), 2023 – 2028

Figure-29: Product Types – Reagents Market (Million US$), 2018 – 2022

Figure-30: Product Types – Forecast for Reagents Market (Million US$), 2023 – 2028

Figure-31: Technology – Immunoassay Market (Million US$), 2018 – 2022

Figure-32: Technology – Forecast for Immunoassay Market (Million US$), 2023 – 2028

Figure-33: Technology – Clinical Chemistry Market (Million US$), 2018 – 2022

Figure-34: Technology – Forecast for Clinical Chemistry Market (Million US$), 2023 – 2028

Figure-35: Technology – Molecular Diagnostics/Genetics Market (Million US$), 2018 – 2022

Figure-36: Technology – Forecast for Molecular Diagnostics/Genetics Market (Million US$), 2023 – 2028

Figure-37: Technology – Hematology Market (Million US$), 2018 – 2022

Figure-38: Technology – Forecast for Hematology Market (Million US$), 2023 – 2028

Figure-39: Technology – Microbiology Market (Million US$), 2018 – 2022

Figure-40: Technology – Forecast for Microbiology Market (Million US$), 2023 – 2028

Figure-41: Technology – Coagulation Market (Million US$), 2018 – 2022

Figure-42: Technology – Forecast for Coagulation Market (Million US$), 2023 – 2028

Figure-43: Technology – Others Market (Million US$), 2018 – 2022

Figure-44: Technology – Forecast for Others Market (Million US$), 2023 – 2028

Figure-45: Application – Infectious Disease Market (Million US$), 2018 – 2022

Figure-46: Application – Forecast for Infectious Disease Market (Million US$), 2023 – 2028

Figure-47: Application – Diabetes Market (Million US$), 2018 – 2022

Figure-48: Application – Forecast for Diabetes Market (Million US$), 2023 – 2028

Figure-49: Application – Cardiology Market (Million US$), 2018 – 2022

Figure-50: Application – Forecast for Cardiology Market (Million US$), 2023 – 2028

Figure-51: Application – Oncology Market (Million US$), 2018 – 2022

Figure-52: Application – Forecast for Oncology Market (Million US$), 2023 – 2028

Figure-53: Application – Nephrology Market (Million US$), 2018 – 2022

Figure-54: Application – Forecast for Nephrology Market (Million US$), 2023 – 2028

Figure-55: Application – Autoimmune Diseases Market (Million US$), 2018 – 2022

Figure-56: Application – Forecast for Autoimmune Diseases Market (Million US$), 2023 – 2028

Figure-57: Application – Drug Testing Market (Million US$), 2018 – 2022

Figure-58: Application – Forecast for Drug Testing Market (Million US$), 2023 – 2028

Figure-59: Application – Other Applications Market (Million US$), 2018 – 2022

Figure-60: Application – Forecast for Other Applications Market (Million US$), 2023 – 2028

Figure-61: End User – Hospitals Market (Million US$), 2018 – 2022

Figure-62: End User – Forecast for Hospitals Market (Million US$), 2023 – 2028

Figure-63: End User – Laboratories Market (Million US$), 2018 – 2022

Figure-64: End User – Forecast for Laboratories Market (Million US$), 2023 – 2028

Figure-65: End User – Home - Care Market (Million US$), 2018 – 2022

Figure-66: End User – Forecast for Home - Care Market (Million US$), 2023 – 2028

Figure-67: End User – Others Market (Million US$), 2018 – 2022

Figure-68: End User – Forecast for Others Market (Million US$), 2023 – 2028

Figure-69: Roche Diagnostics – Global Revenue (Billion US$), 2018 – 2022

Figure-70: Roche Diagnostics – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-71: Abbott Diagnostics – Global Revenue (Billion US$), 2018 – 2022

Figure-72: Abbott Diagnostics – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-73: Siemens Healthineers – Global Revenue (Billion US$), 2018 – 2022

Figure-74: Siemens Healthineers – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-75: Danaher Corporation – Global Revenue (Billion US$), 2018 – 2022

Figure-76: Danaher Corporation – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-77: Thermo Fisher Scientific – Global Revenue (Billion US$), 2018 – 2022

Figure-78: Thermo Fisher Scientific – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-79: Sysmex Corporation – Global Revenue (Billion US$), 2018 – 2022

Figure-80: Sysmex Corporation – Forecast for Global Revenue (Billion US$), 2023 – 2028

Figure-81: QIAGEN N.V.– Global Revenue (Billion US$), 2018 – 2022

Figure-82: QIAGEN N.V.– Forecast for Global Revenue (Billion US$), 2023 – 2028

List of Tables:

Table-01: Germany – In-Vitro Diagnostics Market Share by Test Types (Percent), 2018 – 2022

Table-02: Germany – Forecast for In-Vitro Diagnostics Market Share by Test Types (Percent), 2023 – 2028

Table-03: Germany – In-Vitro Diagnostics Market Share by Technology (Percent), 2018 – 2022

Table-04: Germany – Forecast for In-Vitro Diagnostics Market Share by Technology (Percent), 2023 – 2028

Table-05: Germany – In-Vitro Diagnostics Market Share by Products (Percent), 2018 – 2022

Table-06: Germany – Forecast for In-Vitro Diagnostics Market Share by Products (Percent), 2023 – 2028

Table-07: Germany – In-Vitro Diagnostics Market Share by Application (Percent), 2018 – 2022

Table-08: Germany – Forecast for In-Vitro Diagnostics Market Share by Application (Percent), 2023 – 2028

Table-09: Germany – In-Vitro Diagnostics Market Share by End User (Percent), 2018 – 2022

Table-10: Germany – Forecast for In-Vitro Diagnostics Market Share by End User (Percent), 2023 – 2028

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com