Germany Toy Market is expected to be US$ 6.76 Billion by the year 2028, as Toys are Beneficial for Cognitive Ability and Emotional Growth of Kids

20 Jan, 2023

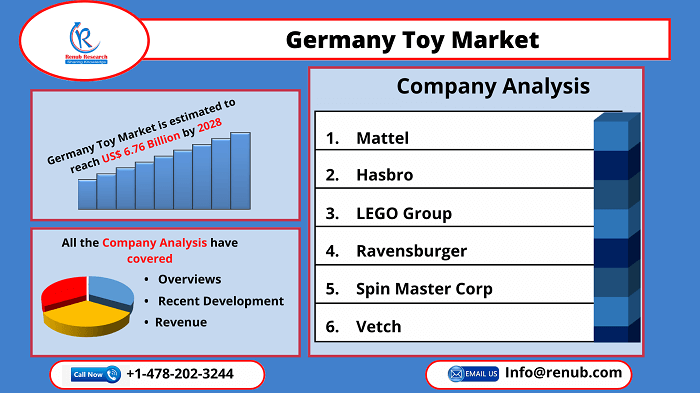

According to Renub Research's latest report, "Germany Toy Market, Size, Forecast 2023-2028 Industry Trends, Share, Growth," the Germany Toy Market is estimated to reach US$ 6.76 billion by 2028. German is the fourth largest economy and a primary significant toy market. Toys are essential in most social interactions; families with children do not visit without bringing a toy. The German toy industry is increasing yearly high percentage of e-Commerce sales. This increase came mainly due to partial lockdowns in the spring and fall. Consequently, the German e-commerce market is expanding, growing all German toy sales. Online solid players include Amazon.de, Mytoys.de, Jako-O.de, and Limango.de.

Over the years, many German towns and states were well-known for centuries for creating handcrafted wooden toys. Their products were regarded worldwide. Moreover, in Germany, most of its toys are made by small specialty stores, which makes it unique in toy sales and services by Vedas, idee+spiel, duo, duo schreib+ spiel, and others, performing essentially in the wholesale role.

Therefore, toys" "R" Us plays a significantly minor role in the German toy Market. Amazon.de is leading the Toys & Baby e-commerce market in Germany. In addition, an E-Commerce retailer, Family-oriented, my Toys Germany is a leader in toys and child-related products such as educational toys, sports, equipment, electronics, games, and puzzles, all at affordable prices. These toys are high quality and big brand and a one-stop shopping site for families.

The factors propelling the German toy market are increased disposable income and the launch of eco-friendly toys. The most successful toy manufacturers based on sales revenue in Germany were LEGO and Ravensburger, which focus on the demand for eco-friendly and high-quality toys. As per this research report German Toy Industry was US$ 5.50 Billion in 2022.

Infant/Preschool dominates the largest market share during the forecast period:-

Infant/Preschool dominates the largest market share during the forecast period. Increasing science, art-based gadgets, and maths technology have driven its demand significantly in Germany's toy Market. Moreover, in neurological diseases, doctors also treat patients with the help of plush toys, which provide a sense of happiness and peace to the patients.

Specialty captured the largest market share;-

They maintain different categories of soft toys in their shops.Germany was a world-leading toy manufacturer with considerable exports to the United States. In addition, growing infrastructure facilities related to specialty and brand stores drive market growth. In addition, E-commerce retailers are adding new toy products as their primary category in Germany. E-commerce allows customers to compare different brands and then buy the products and compels the manufacturers to focus on online selling of toys and games according to the age group. As in many other industries, e-commerce and online shopping have rapidly influenced consumers to buy toys.

Competitive landscape

Renub Research has studied six German toy Companies, including Mattel, Hasbro, LEGO Group, Ravensburger, Spin Master Corp, and VTech.

- In May 2022, VTech Announces New Bluey Toys in the Latest Expansion of Its Preschool Line.

- In June 2022, The LEGO Group brings 2-player action to the LEGO Super Mario universe with LEGO Mario and LEGO Luigi.

Market Summary:-

- By Segmentation:- The Report covers the Germany Toy Market by type in 10 viewpoints (Infant/Preschool, Construction, Doll, Game Puzzles, Vehicles, Action Figures, Outdoor Sports, Plush, Arts& Crafts, Youth Electronics, and Other Toys).

- By Sales Channels: - The Report covers the Germany Toy Market by sales channels in 5 viewpoints (Specialty, Department Stores, Discounters, E-commerce, and Others.)

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com