Artificial Sweetener Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowArtificial Sweetener Market Trends & Summary

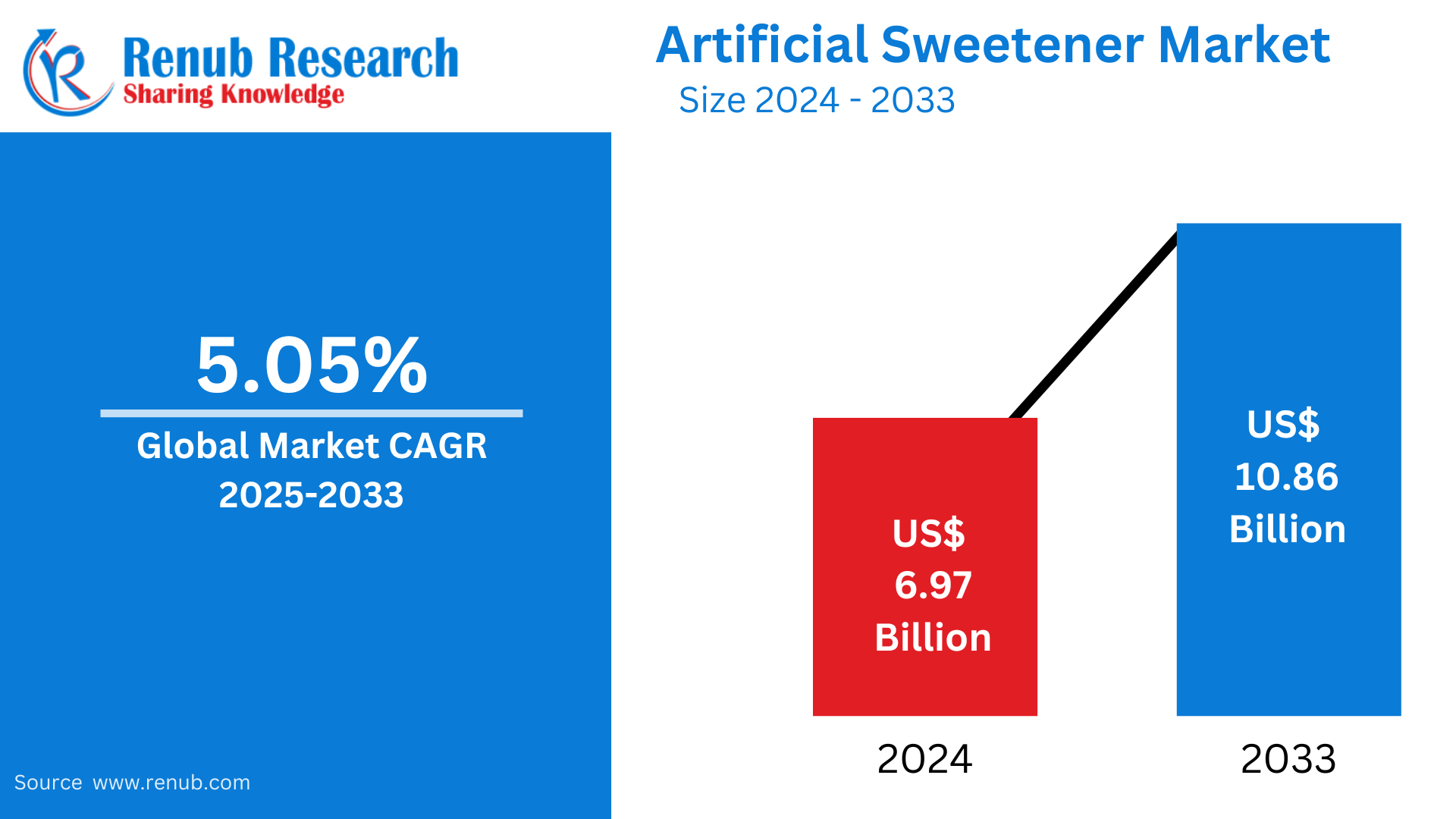

Artificial Sweetener Market is expected to reach US$ 10.86 billion by 2033 from US$ 6.97 billion in 2024, with a CAGR of 5.05% from 2025 to 2033. The growing prevalence of lifestyle diseases like obesity and diabetes, the growing demand for low-calorie or zero-calorie sugar alternatives due to health consciousness, and the trend toward healthier food choices among consumers looking to control their calorie intake and enhance their general health are all factors contributing to the growth in the market share of artificial sweeteners during the forecast period.

Artificial Sweetener Global Market Report by Product Type (Aspartame, Neotame, Sucralose, Acesulfame k, Saccharin, Others) Application (Bakery Products, Dairy Products, Confectionery, Beverages, Others) Countries and Company Analysis, 2025-2033

Global Artificial Sweetener Industry Overview

The growing consumer desire for sugar-free, low-calorie substitutes for conventional sugar has led to a notable expansion in the global artificial sweetener market. Soft drinks, baked goods, dairy products, and confections are just a few of the food and beverage items that include artificial sweeteners. Consumers are looking for sugar alternatives as a result of growing worries about the increased prevalence of diabetes, obesity, and other health problems linked to excessive sugar consumption worldwide. The market is expanding as a result of this change in consumer behavior and continuous advancements in sweetener formulas. The expanding availability of artificial sweeteners in both established and emerging nations, where people are becoming more conscious of health issues, is another factor supporting the market.

Major international producers like Cargill, Nestlé, and PepsiCo are important participants in the artificial sweetener market. These companies are investing in the creation of new products and diversifying their product lines. Because they are low in calories and can be used for a variety of purposes, artificial sweeteners like aspartame, sucralose, stevia, and saccharin are frequently employed. However, the market's expansion is hampered by worries about the long-term safety of some artificial sweeteners as well as strict laws in different places. Despite these obstacles, the market for artificial sweeteners is still growing as more people prioritize leading better lives and look for products free of added sugar.

The need for low-calorie, sugar-free substitutes is being driven by the increased incidence of diabetes and obesity worldwide. The World Health Organization (WHO) reports that by 2014, there were 422 million diabetes worldwide, up from 108 million in 1980. According to the International Diabetes Federation (IDF), 700 million people worldwide will have diabetes by 2045. The market for artificial sweeteners is being driven mostly by the growing number of people with diabetes who are looking for sugar alternatives to treat their illness.

The market for artificial sweeteners is rising as people become more conscious of the health risks associated with consuming large amounts of sugar. Between 2011 and 2014, 63% of American adults made an effort to reduce or cut out sugar from their diets, according to the Centers for Disease Control and Prevention (CDC). Additionally, research in the Journal of the Academy of Nutrition and Dietetics found that the proportion of adults consuming low-calorie sweeteners increased from 21% to 24% between 1999 and 2008. The market for artificial sweeteners is expanding as a result of people adopting healthier eating habits.

Growth Drivers for the Artificial Sweetener Market

Rising Health Consciousness

The market for artificial sweeteners is significantly influenced by growing health consciousness. More customers are actively looking for better options as they become more aware of the detrimental health implications of consuming large amounts of sugar, such as obesity, diabetes, and heart disease. People who want to control their blood sugar levels or cut back on calories will find artificial sweeteners intriguing because they offer low-calorie or even zero-calorie alternatives to sugar. With the help of these sweeteners, people can enjoy sweet-tasting foods and drinks without running the risk of health problems that come with consuming too much sugar. The market for artificial sweeteners is being driven by this movement in consumer behavior toward better options, especially among health-conscious people who are placing a higher priority on wellness in their meals.

Increasing Prevalence of Diabetes and Obesity

The need for sugar substitutes like artificial sweeteners is being greatly fueled by the rising incidence of diabetes and obesity worldwide. Due to the connection between these problems and excessive sugar consumption, many people are looking for better ways to manage their health. Artificial sweeteners are perfect for diabetics to regulate their blood sugar levels because they offer a low-calorie or calorie-free alternative. Similarly, artificial sweeteners provide a means to experience sweet sensations without the harmful health effects of sugar for people trying to control their weight or cut back on calories. The demand for healthier, sugar-free substitutes is still a major driver of the artificial sweetener market's expansion as the prevalence of diabetes and obesity rises worldwide.

Demand for Low-Calorie and Sugar-Free Products

One of the main factors propelling the artificial sweetener market's expansion is the rising demand for diet-friendly, sugar-free, and low-calorie food and beverage items. Customers are looking for options that let them enjoy sweet flavors without the extra calories as they grow more health conscious and try to limit their sugar intake. Since artificial sweeteners provide the sweetness of sugar without the calorie content, they are essential in satisfying this demand. The increasing availability of low-sugar and sugar-free items in a variety of categories, such as snacks, beverages, and dairy products, reflects this trend toward healthy eating patterns. Artificial sweeteners are becoming more and more essential to the food and beverage sector as the drive toward healthy lifestyles continues.

Challenges in the Artificial Sweetener Market

Taste and Consumer Acceptance

In the market for artificial sweeteners, taste and consumer acceptance continue to be major obstacles. A bitter or metallic aftertaste is frequently the result of the unique flavor profiles of many artificial sweeteners, which diverge from those of natural sugar. This may affect the whole flavor experience, especially in commodities where taste is important, such as baked goods, beverages, and confections. The broad use of artificial sweeteners may be constrained by consumers who are used to the taste of sugar and may find these substitutes difficult to accept. In order to overcome customer hesitation and broaden their market reach, manufacturers are constantly striving to enhance the taste and blend various sweeteners to more precisely mimic the flavor of sugar.

Regulatory Hurdles

One major obstacle facing the market for artificial sweeteners is regulatory barriers. Because every country has its own strict safety and regulatory requirements, the licensing procedure for novel sweeteners is frequently drawn out, complicated, and distinct. It can take years for manufacturers to finish the thorough testing necessary to guarantee that the sweeteners are safe for human use. Innovation and market expansion may be halted by this drawn-out and expensive procedure, which can postpone the release of new goods. Furthermore, regional variations in rules might make international marketing plans more difficult to implement and result in uneven product availability. The market for artificial sweeteners is growing and developing more slowly overall as a result of these regulatory obstacles.

United States Artificial Sweetener Market

The demand for sugar substitutes and growing health consciousness have made the US artificial sweetener market one of the biggest in the world. Consumers are increasingly looking for low-calorie, sugar-free items, especially in food and beverages, as concerns about obesity, diabetes, and heart disease grow. Soft beverages, snacks, and baked products frequently contain artificial sweeteners including stevia, sucralose, and aspartame. A well-established regulatory structure that ensures product safety through approvals from organizations like the FDA benefits the U.S. market. However, issues could arise due to consumer preference for more natural choices, like stevia, and worries about the possible long-term health implications of artificial sweeteners. Notwithstanding these problems, the industry is nevertheless robust and is growing steadily due to trends that are health-conscious.

Germany Artificial Sweetener Market

The market for artificial sweeteners in Germany is expanding steadily due to rising consumer demand for sugar-free and low-calorie substitutes. An increasing number of consumers are choosing products with artificial sweeteners due to growing health concerns about obesity, diabetes, and other lifestyle-related illnesses. Aspartame, sucralose, and stevia are popular sweeteners in Germany and are frequently found in dairy products, beverages, and confections. Strict regulatory requirements also support the market, with the European Food Safety Authority (EFSA) guaranteeing the products' safety. Traditional artificial sweeteners are facing competition from consumers who are favoring more natural and plant-based sweeteners like stevia. Despite these obstacles, the market is nevertheless robust since customer decisions are still influenced by health-conscious trends.

India Artificial Sweetener Market

The market for artificial sweeteners in India is growing as a result of growing health consciousness and the rising incidence of obesity and diabetes. The need for sugar alternatives is rising due to the high number of people with diabetes, especially in processed meals, beverages, and snacks. Since they provide low-calorie substitutes for sugar, artificial sweeteners like aspartame, sucralose, and stevia are becoming more and more popular. Government efforts to encourage healthy living and address growing healthcare problems are also helping the Indian market. Adoption may be slowed by issues including a lack of knowledge about the safety and flavor preferences of artificial sweeteners. Nevertheless, as more people choose sugar-free options and as these goods become more readily available in cities, the industry is expected to expand.

United Arab Emirates Artificial Sweetener Market

The market for artificial sweeteners in the United Arab Emirates (UAE) is expanding due to growing health consciousness and a growing need for sugar-free, low-calorie substitutes. Due to rising rates of obesity and diabetes, especially in metropolitan areas, customers are choosing artificial sweeteners like stevia, sucralose, and aspartame since they are healthier. The market is being driven further by the UAE's thriving food and beverage sector as well as growing awareness of the dangers of consuming sugar. The usage of sugar alternatives is also being promoted by government programs aimed at lowering sugar consumption. However, issues including personal taste preferences and a lack of knowledge about artificial sweeteners' safety could prevent their widespread use. Despite this, the market is still expanding as people adopt healthier eating habits.

Artificial Sweetener Market Segments

Product Type – Market breakup in 6 viewpoints:

- Aspartame

- Neotame

- Sucralose

- Acesulfame k

- Saccharin

- Others

Application – Market breakup in 5 viewpoints:

- Bakery Products

- Dairy Products

- Confectionery

- Beverages

- Others

Country – Market breakup in 25 viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- the Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Financial Insights

Company Analysis:

- Tate & Lyle PLC

- Cargill Incorporated

- Archer Daniels Midland Company

- DuPont de Nemours Inc.

- Ajinomoto Co. Inc.

- Ingredion Incorporated

- GLG Life Tech Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Application and Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size and growth rate of the artificial sweetener market from 2025 to 2033?

-

What are the key drivers influencing the growth of the global artificial sweetener market?

-

How is rising health consciousness impacting the demand for artificial sweeteners?

-

Which artificial sweetener product types (e.g., Aspartame, Sucralose, Stevia) are expected to dominate the market during the forecast period?

-

What are the major application areas (e.g., Beverages, Bakery, Confectionery) for artificial sweeteners, and how are they evolving?

-

Which regions and countries are leading in artificial sweetener consumption and why?

-

What regulatory challenges are affecting the global artificial sweetener industry?

-

How are changing consumer preferences toward natural ingredients shaping the competitive landscape?

-

What are the key strategies and recent developments by leading companies like Cargill, Tate & Lyle, and DuPont in this market?

-

How is the artificial sweetener market expected to evolve in emerging markets such as India, UAE, and Brazil?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Artificial Sweetener Market

6. Market Share

6.1 Product Type

6.2 Application

6.3 Country

7. Product Type

7.1 Aspartame

7.2 Neotame

7.3 Sucralose

7.4 Acesulfame k

7.5 Saccharin

7.6 Others

8. Application

8.1 Bakery Products

8.2 Dairy Products

8.3 Confectionery

8.4 Beverages

8.5 Others

9. Country

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia

9.3.5 South Korea

9.3.6 Thailand

9.3.7 Malaysia

9.3.8 Indonesia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Saudi Arabia

9.5.3 UAE

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Tate & Lyle PLC

12.1.1 Overview

12.1.2 Recent Development & Strategies

12.1.3 Product Portfolio

12.1.4 Financial Insight

12.2 Cargill Incorporated

12.2.1 Overview

12.2.2 Recent Development & Strategies

12.2.3 Product Portfolio

12.2.4 Financial Insight

12.3 Archer Daniels Midland Company

12.3.1 Overview

12.3.2 Recent Development & Strategies

12.3.3 Product Portfolio

12.3.4 Financial Insight

12.4 DuPont de Nemours Inc.

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development & Strategies

12.4.4 Product Portfolio

12.4.5 Financial Insight

12.5 Ajinomoto Co. Inc.

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development & Strategies

12.5.4 Product Portfolio

12.5.5 Financial Insight

12.6 Ingredion Incorporated

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development & Strategies

12.6.4 Product Portfolio

12.6.5 Financial Insight

12.7 GLG Life Tech Corporation

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development & Strategies

12.7.4 Product Portfolio

12.7.5 Financial Insight

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com