Global Beef Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowGlobal Beef Market Trends & Summary

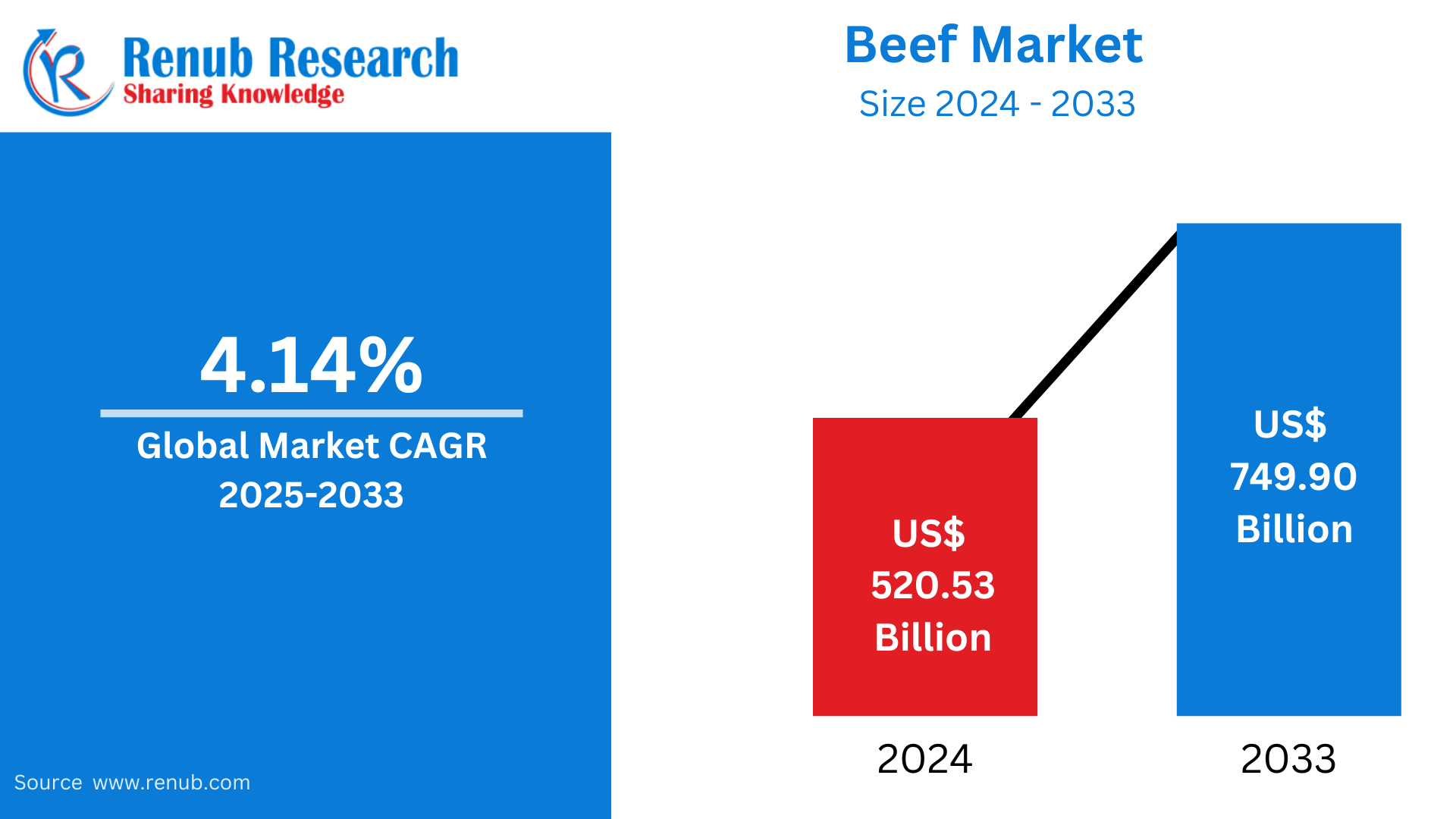

Beef Market is expected to reach US$ 749.90 billion in 2033 from US$ 520.53 billion in 2024, with a CAGR of 4.14% from 2025 to 2033. Rising global demand, growing consumer desire for diets high in protein, technological developments in beef production, and growing markets in emerging nations and the foodservice industry are some of the major factors propelling the beef market's expansion.

Beef Market Global Report by Cut (Brisket, Shank, Loin, Others), Slaughter Method (Halal, Kosher, Others), Distribution Channel (Supermarket and hypermarket, Retail Store, Wholesaler, E-Commerce, Others), Countries and Company Analysis 2025-2033.

Beef Industry Overview

Meat from cattle is referred to as beef and is valued for its high protein content, flavor, and texture. It is a mainstay in many diets around the world and is eaten in a variety of ways, including roasts, ground beef, and steaks. Iron, zinc, and B vitamins are among the vital minerals that are abundant in beef. Cattle production, processing, and distribution are all included in the beef business, which is important to the world's food and agricultural systems.

The growing need for diets high in protein worldwide, especially in developing nations with growing middle classes, is fueling the expansion of the beef market. Market expansion is further aided by shifting consumer preferences, which include a move toward premium goods and higher-quality beef cuts. Growth in supply is facilitated by technological developments in beef production, such as improved genetics and productive farming methods. The rising demand for beef in the foodservice industries, such as restaurants and fast food chains, also contributes significantly to market expansion.

Growth Drivers for the Beef Market

Growing consumer desire for natural and antibiotic-free products will fuel market expansion.

The market for branded goods has grown dramatically in recent years. Demand for premium and high-quality beef with labels like USDA Choice, USDA Natural, USDA Prime, and Certified Angus Beef (CAB) has significantly increased due to rising disposable income and the premiumization trend in nations like the U.S. By upholding a number of quality requirements, these labels can be obtained. The demand for premium beef meat is being further stimulated by rising consumer awareness and the quick expansion of businesses supplying certified Angus beef in the food service sector.

For instance, the food service sales of certified angus beef products increased by about 2.4% in 2022, according to the most recent report released by the Certified Angus Beef Brand. Customers are become more aware of the detrimental effects eating animal products containing antibiotics and growth-promoting hormones can have on their health. As a result, customers' desire for natural beef products is rising quickly. For example, the US-based company Raise American introduced organic goods that are 100% grass-fed to satisfy flexitarian customers.

Boosting Sales via Distribution Channels to Drive Market Development

The growth of the beef market is anticipated to be supported in the coming years by the constantly growing global meat distribution network. The foodservice industry is seeing a rise in demand for meat preparations as a result of the growing habit of eating out at cafes, hotels, and restaurants.

Sales of fresh and chilled products are predicted to rise even more as online channels gain popularity because of their extensive product selection and promotional offers. Additionally, meat sales through a variety of retail distribution channels, including supermarkets, hypermarkets, specialty shops, and internet retailers, have been largely supported by the increased awareness of the healthfulness of fresh food.

The availability of a large variety of meat cuts and the guarantee of the product's authenticity make supermarkets and hypermarkets popular places to buy fresh products. Online retail stores have seen a significant increase in sales due to the expanding trend of e-commerce. These retailers provide the ease of placing several orders and having them delivered hassle-free to your home. Buying fresh cuts online guarantees their quality and safety because the vendor is only required to present the product once it has received certification from specific food safety agencies.

Rising global demand for protein-rich diets, especially in emerging economies

The market for beef is significantly influenced by the growing demand for diets high in protein worldwide, especially in emerging economies. Western-style diets that emphasize animal protein, particularly beef, are becoming more and more popular among the populations of nations like China, India, and Brazil as their economies expand. Urbanization, rising middle-class earnings, and a demand for better cuisine are the main drivers of this change. Customers can now afford to eat more beef as their disposable incomes increase, which increases demand and speeds up market growth internationally.

Challenges in the Beef Market

Animal welfare concerns

Concerns about animal welfare pose a significant obstacle to the beef industry as consumers and advocacy organizations call for more humane treatment of cattle. Ethical discussions have been sparked by practices including overpopulation, cruel killing techniques, and subpar living conditions. Stricter laws and a rise in the market for certified humane or grass-fed beef are the results of this, which may raise production costs and affect producers' profit margins.

Supply chain disruptions

A major problem in the beef market is supply chain disruptions, which are frequently brought on by illness outbreaks, a lack of workers, and traffic jams. Events such as the COVID-19 pandemic brought weaknesses to light, resulting in distribution delays and the shutdown of processing plants. Both producers and consumers may be impacted by these interruptions, which may result in lower availability, increased costs, and shortages of beef products. Reducing these risks requires effective supply chain management.

Beef Market Overview by Regions

Regional variations exist in the cattle industry. It is characterized by high production and consumption in North America, especially the United States, with a considerable demand in restaurants and fast food. South America is a significant exporter, particularly Argentina and Brazil. Growing middle classes in Asia's emerging economies, such as China and India, are driving more beef consumption. Strong demand exists in Europe, but it is constrained by stringent laws and increased production costs.

United States Beef Market

Regional variations exist in the cattle industry. It is characterized by high production and consumption in North America, especially the United States, with a considerable demand in restaurants and fast food. South America is a significant exporter, particularly Argentina and Brazil. Growing middle classes in Asia's emerging economies, such as China and India, are driving more beef consumption. Strong demand exists in Europe, but it is constrained by stringent laws and increased production costs.

Germany Beef Market

Consumer preference for premium beef products is the main factor driving Germany's beef market's consistent demand. The demand for premium cuts and processed beef products is still high, notwithstanding a minor slowdown in beef consumption in Germany as a result of health and environmental concerns. A large amount of the nation's beef is imported, particularly from other EU nations. Concerns about animal welfare and sustainability have raised demand for certified humane beef. Increasing production costs and regulatory standards also have an effect on the market.

China Beef Market

Due to factors including urbanization, rising affluence, and shifting dietary preferences for foods high in protein, such as beef, the Chinese beef market has grown quickly. China, which has the largest population in the world, is a big consumer of beef, and its consumption has increased dramatically in recent years. Imports, mostly from Brazil, Argentina, and Australia, have surged as a result of domestic production's inability to keep up with demand. Health-conscious consumers choosing better, leaner cuts also has an impact on the market. China's beef industry is anticipated to keep rising as a result of the country's burgeoning middle class, despite obstacles like shifting supply chains and worries about food safety.

Global Beef Market Segments

Cut

- Brisket

- Shank

- Loin

- Others

- Gender

Slaughter Method

- Halal

- Kosher

- Others

Distribution Channel

- Supermarket and hypermarket

- Retail Store

- Wholesaler

- E-Commerce

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Financial Insight

Key Players Analysis

- JBS S.A

- Tyson Foods

- Pilgrim's pride corporation

- Danish crown group

- Vion Food Group

- WH Group

- Hormel Foods Corporation

- Muyuan Foods

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Cut, By Slaughter Method, By Distribution Channel and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size and CAGR of the global beef industry from 2025 to 2033?

-

Which factors are driving the demand for beef in emerging markets?

-

How is the shift towards premium and antibiotic-free beef influencing market growth?

-

What role do distribution channels like supermarkets and e-commerce play in the beef market expansion?

-

How are technological advancements contributing to increased beef production and efficiency?

-

What are the major challenges facing the beef market, such as animal welfare concerns and supply chain disruptions?

-

How do regional dynamics differ in beef consumption and production across North America, South America, Asia, and Europe?

-

What are the trends and demand patterns in key markets such as the United States, China, and Germany?

-

Which beef cuts (brisket, shank, loin, etc.) and slaughter methods (halal, kosher) are dominating global consumption trends?

-

Who are the major players in the global beef market and what strategies are they adopting for growth?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Beef Market

6. Market Share Analysis

6.1 By Cut

6.2 By Slaughter Method

6.3 By Distribution Channel

6.4 By Countries

7. Cut

7.1 Brisket

7.2 Shank

7.3 Loin

7.4 Others

8. Slaughter Method

8.1 Halal

8.2 Kosher

8.3 Others

9. Distribution Channel

9.1 Supermarket and hypermarket

9.2 Retail Store

9.3 Wholesaler

9.4 E-Commerce

9.5 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.5 Brazil

10.6 Mexico

10.7 Argentina

10.8 Middle East & Africa

10.9 South Africa

10.10 Saudi Arabia

10.11 UAE

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1.1 Strength

12.1.2 Weakness

12.1.3 Opportunity

12.1.4 Threat

13. Key Players Analysis

13.1 JBS S.A

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Financial Insight

13.2 Tyson Foods

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Financial Insight

13.3 Pilgrim's pride corporation

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Financial Insight

13.4 Danish crown group

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Financial Insight

13.5 Vion Food Group

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Financial Insight

13.6 WH Group

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Financial Insight

13.7 Hormel Foods Corporation

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Financial Insight

13.8 Muyuan Foods

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Financial Insight

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com