Global Continuous Glucose Monitoring Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowContinuous Glucose Monitoring Market Trends & Summary

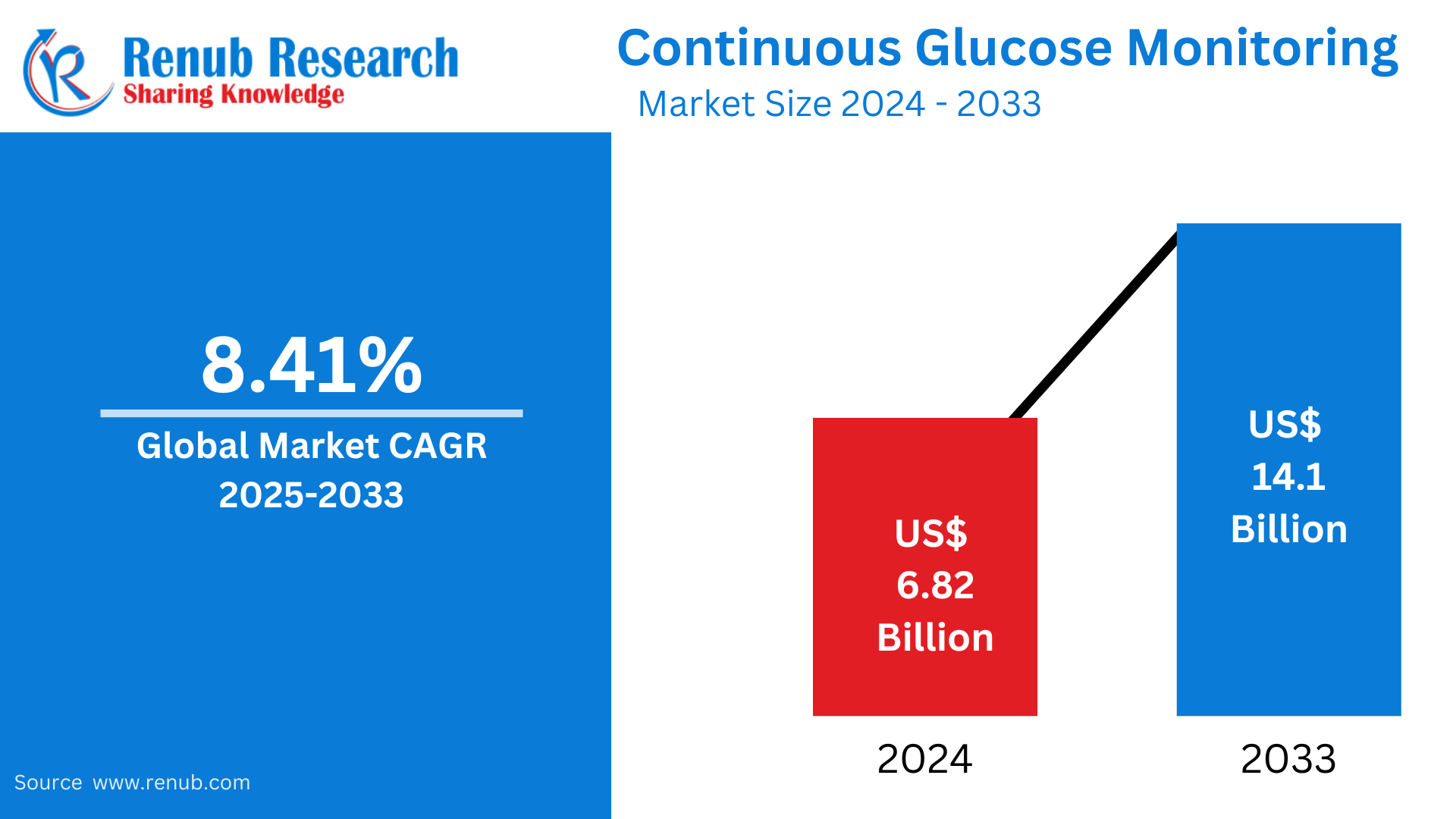

The global Continuous Glucose Monitoring (CGM) Market is anticipated to expand considerably. Valued at around US$ 6.82 billion in 2024, it is anticipated to reach US$ 14.1 billion in 2033. This development, fueled by a strong CAGR of 8.41% between 2024 and 2033, is attributed to growing uptake owing to the rise in diabetes cases, advancements in glucose monitoring systems, and a heightened emphasis on effective diabetes control globally.

Global Continuous Glucose Monitoring Market Report by Component (Sensors, Transmitters, Receivers), End-User (Hospitals, Homecare Settings, Others), Regions and Company Analysis 2025-2033

Continuous Glucose Monitoring Market Outlooks

Continuous Glucose Monitoring (CGM) is a healthcare technology that monitors blood glucose levels continuously during the day and night. In contrast to conventional finger-stick testing, CGM monitors employ a small sensor implanted just beneath the skin to measure the level of glucose in interstitial fluid. This data is transferred to a monitor or smartphone, giving users continuous feedback on their blood sugar trends.

CGM is widely used for managing diabetes, offering significant advantages over traditional methods. It helps individuals understand how lifestyle factors like food, exercise, and medications affect their glucose levels. CGM devices alert users to high or low glucose levels, enabling timely interventions to avoid complications. This technology is most useful for patients with Type 1 or insulin-dependent Type 2 diabetes since it improves glucose control and lowers the risk of hypoglycemia. CGM systems are also widely employed in clinics and hospitals to track glucose levels in critically ill patients to ensure accurate and efficient care.

Growth Drivers in the Continuous Glucose Monitoring Market

Increasing Incidence of Diabetes

The increasing incidence of diabetes, both Type 1 and Type 2, is a primary growth driver for the Continuous Glucose Monitoring (CGM) market. Globally, diabetes affects millions, with a significant portion requiring consistent glucose monitoring to manage the condition effectively. CGM systems provide real-time data, which improves disease management and reduces complications. Demand for CGM devices has increased with healthcare systems shifting towards early diagnosis and preventive medicine, addressing the needs of an aging population and an increase in obesity-related diabetes. There are currently 537 million adults aged 20 to 79 with diabetes, or about 1 in 10 people. This number is projected to increase to 643 million in 2030 and to 783 million in 2045. In 2022, 14% of adults aged 18 years and older had diabetes, compared with 7% in 1990. Particularly, over half (59%) of adults aged 30 and above with diabetes did not take medication for diabetes in 2022. Innovations in CGM Technology Advances in CGM technology, such as improved sensor accuracy, extended sensor life, and compatibility with smartphones and insulin pumps, have all played a substantial role in fueling market expansion.

Wearable CGM systems are increasingly less invasive and easier to use. Predictive notifications and ongoing data analysis have transformed these devices into essential tools for diabetes management, driving their uptake among patients and healthcare professionals. Aug 2024, Abbott partnered with Medtronic to create an integrated continuous glucose monitoring (CGM) system based on Abbott's cutting-edge FreeStyle Libre technology that will pair with Medtronic's automated insulin systems. Growing Use of Homecare Solutions The shift towards home care has fueled the need for CGM devices. They allow patients to track their glucose levels without recurrent hospital visits, providing convenience and cost-effectiveness. With enhanced connectivity, patients can remotely send data to healthcare providers, improving the quality of care. The increasing demand for personalized healthcare solutions at home has increased the market for CGM, especially among pediatric and geriatric patients.

Challenges of the Continuous Glucose Monitoring Market

Excessive Device Costs

The excessive up-front costs of CGM devices and regular expenditures on sensors and accessories are a major adoption obstacle, especially for low- and middle-income economies. Most people without full health insurance find the systems unaffordable, making them less accessible and penetrating less deeply into markets despite their value.

Accuracy and Calibration Problems

While CGM systems have become much better, there are still issues with occasional inaccuracy and the requirement for regular calibrations. Discrepancies between blood glucose values and sensor readings can create mistrust or underutilization of the technology by users. Resolving these technical issues is important to achieving wider adoption and sustained market expansion.

Continuous Glucose Monitoring Sensors Market

Sensors are the central components of CGM systems, tracking glucose levels in the interstitial fluid at all times. Advances in sensor technology have improved accuracy, longevity, and user-friendliness. Growth in the sector is driven by demand for sensors that last long with low calibration. Businesses invest in research to develop affordable, comfortable, and durable sensors for various patients.

Continuous Glucose Monitoring Receivers Market

Receivers gather and present data from CGM sensors, offering real-time glucose levels and trends. Advanced receivers have increased connectivity with smartphones and cloud platforms for data analysis and sharing. Receivers enhance patient engagement and treatment plan compliance. With increased integration with other diabetes management systems, the market for receivers is expected to grow steadily, particularly in developed areas.

Continuous Glucose Monitoring Hospitals Market

Hospitals are a strong segment for adoption of CGM devices, especially for the control of critically ill or diabetic inpatients. Monitoring glucose in real-time enables clinicians to make good decisions, which enhances patient care. CGM systems are gaining traction in intensive care units and among surgical patients to prevent fluctuations in glucose. The hospital segment is expected to expand as centers focus on cutting-edge monitoring technologies.

Continuous Glucose Monitoring Homecare Settings Market

Homecare is a major growth segment for CGM devices, fueled by the convenience and cost savings of home monitoring. Patients enjoy individualized care, fewer hospital visits, and remote sharing of data with healthcare professionals. The aging population and a growing preference for home care are likely to drive the growth of CGM devices in homecare settings.

United States Continuous Glucose Monitoring Market

The United States dominates the CGM market, fueled by widespread diabetes prevalence, sophisticated healthcare infrastructure, and comprehensive insurance coverage. Increased awareness of diabetes care and significant research investments have fueled growth. Government campaigns for digital health technologies also accelerated the use of CGM devices. The Centers for Disease Control and Prevention puts the number of 98 million (37.0%) adults in United States with prediabetes, yet most are unaware. If left unchecked, most individuals with prediabetes will have type 2 diabetes within five years and are also at heightened risk of getting cardiovascular disease and stroke.

Germany Continuous Glucose Monitoring Market

The CGM market of Germany is thriving owing to increasing diabetes cases coupled with the uptake of innovative healthcare solutions. Public and private insurance policies for CGM devices improve access. High government support for innovation and education initiatives among patients further boost the growth of the market. Germany is still an important European market for CGM technologies. January 2023: LifeScan revealed that peer-reviewed Journal of Diabetes Science and Technology released Improved Glycemic Control Using a Bluetooth Connected Blood Glucose Meter and a Mobile Diabetes App: Real-World Evidence From Over 144,000 People With Diabetes, reporting outcomes from a real-world data retrospective analysis in more than 144,000 people with diabetes - one of the largest aggregate blood glucose meter and mobile diabetes app datasets ever released.

India Continuous Glucose Monitoring Market

India is witnessing high growth in the CGM market with its large diabetic population and growing healthcare awareness. Although affordability is a challenge, progress in low-cost CGM systems is filling the gap. The increasing popularity of homecare devices and telemedicine services also aids regional market growth. February 2023: Dario Health Corp. said it had a deal with Dexcom to embed its CGM, into Dario's multi-chronic condition platform. Dexcom CGM involves the use of a small, wearable sensor to continually measure and transmit glucose levels to a receiver or smart phone, allowing individuals with diabetes to make real-time adjustments to their health. This partnership allows for the seamless integration of Dexcom CGM data into Dario's metabolic solution, and it becomes simple for users of the wearable device to enjoy Dario's highly individualized care.

Brazil Continuous Glucose Monitoring Market

The market for CGMs in Brazil is expanding with an increase in diabetes cases and the encouragement of sophisticated medical devices by the government. Though high costs of devices continue to be a problem, greater public and private sector investments in healthcare facilities are enhancing accessibility. Global CGM manufacturer partnerships are anticipated to accelerate the growth of the market further. October 2023: Phillips-Medisize company Molex and Finland-based medtech firm GlucoModicum have collaborated on an innovative non-invasive, needle-free continuous glucose monitor (CGM).

UAE Continuous Glucose Monitoring Market

The CGM market of UAE is growing on the back of increasing prevalence of diabetes and rising emphasis on preventive healthcare. Government programs encouraging high-end medical devices and digital health technologies have fostered adoption. The market is aided by a robust healthcare infrastructure and growing awareness of the advantages of continuous glucose monitoring for optimal diabetes control. October 2023, PureHealth has announced a massive rise in users of Pura, the company's AI-powered app. With over 140,000 downloads so far, Pura is focused on enhancing quality of life and lifespans by giving individuals personalized information, enabling them to enhance their health using easy-to-use tools and customized insights.

Continuous Glucose Monitoring Market Segments

Component

- Sensors

- Transmitters

- Receivers

End User

- Hospitals

- Homecare Settings

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Key Players Analysis

- Abbott Laboratories

- Roche

- Tandem Diabetes Care

- DexCom Inc.

- Senseonics Holdings Inc.

- Ypsomed Holding AG

- Medtronic Plc.

- i-Sens Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Component, By End User and Cauntries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the CGM industry by 2033?

-

What is the expected CAGR of the CGM market from 2025 to 2033?

-

Which factors are driving the growth of the CGM market globally?

-

What are the key challenges hindering the adoption of CGM devices?

-

Which region dominates the CGM market, and why?

-

How are technological advancements influencing CGM market growth?

-

What role does homecare play in the expansion of the CGM market?

-

Which companies are the major players in the CGM market?

-

How does diabetes prevalence impact the demand for CGM devices?

-

What are the key components of CGM systems, and how do they function?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Continuous Glucose Monitoring Market

6. Market Share Analysis

6.1 By Component

6.2 By End User

6.3 By Country

7. Component

7.1 Sensors

7.2 Transmitters

7.3 Receivers

8. End User

8.1 Hospitals

8.2 Homecare Settings

8.3 Others

9. Countries

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia

9.3.5 South Korea

9.3.6 Thailand

9.3.7 Malaysia

9.3.8 Indonesia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Saudi Arabia

9.5.3 United Arab Emirates

9.6 Rest of World

10. Porters Five Forces

10.1 Bargaining Power of Buyer

10.2 Bargaining Power of Supplier

10.3 Threat of New Entrants

10.4 Rivalry among Existing Competitors

10.5 Threat of Substitute Products

11. SWOT Analysis

11.1 Strengths

11.2 Weaknesses

11.3 Opportunities

11.4 Threats

12. Key Players Analysis

12.1 Abbott Laboratories

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Roche

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Tandem Diabetes Care

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 DexCom Inc.

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 Senseonics Holdings, Inc.

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Ypsomed Holding AG

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Medtronic Plc.

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 i-Sens, Inc.

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com