Global Flour Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowGlobal Flour Market Trends & Summary

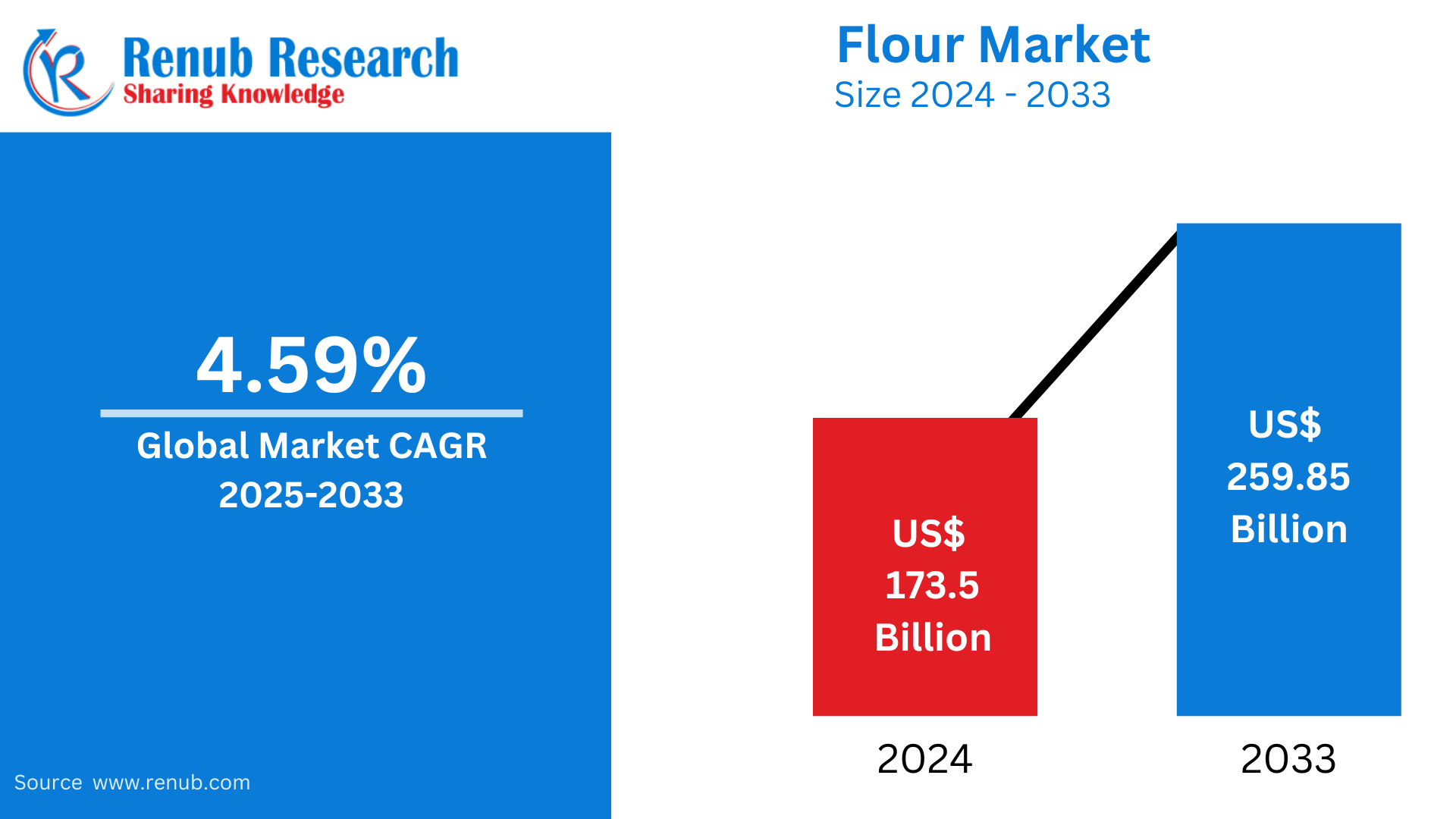

Global Flour market is expected to reach US$ 259.85 billion by 2033 from US$ 173.5 billion in 2024, with a CAGR of 4.59% from 2025 to 2033. The rising demand for convenience foods, baked goods, and processed foods is propelling the worldwide flour market's steady growth. The industry is growing as a result of factors like urbanization, population growth, and shifting dietary choices.

The report Global Flour Market & Forecast covers by Raw Material (Wheat, Maize, Rice), Application (Pasta, Bread and Bakery Products, Wafers, Crackers and Biscuits, Animal Feed, Non-Food Application), Sales Channel (Supermarkets, Hypermarkets, Online Stores, Others), Countries and Company Analysis 2025-2033.

Flour Industry Overview

Due to rising demand for convenience foods, baking, and food processing, the worldwide flour industry is expanding steadily. The most common form of flour is still wheat, which is used in bread, pastries, and packaged foods. Demand is being driven by factors such as population growth, urbanization, and shifting consumer preferences, especially for processed and ready-to-eat foods. Due to dietary limitations and health-conscious consumers, the use of gluten-free, organic, and alternative flours—like rice and almond flour—is also growing in popularity. Furthermore, advancements in flour manufacturing, like better milling methods and vitamin fortification, are fueling market expansion. The market is impacted by variables such as supply chain dynamics, climate, and the availability of raw materials, but it is resilient due to the rising demand for flour-based goods worldwide.

Geographically, the United States and Germany are major producers of flour, and North America and Europe are the top two regions. According to the United States Department of Agriculture (USDA), the United States alone produced over 50 million metric tons of wheat flour in 2021. Urbanization, increased disposable incomes, and shifting eating habits are all contributing to the significant expansion of emerging markets in Latin America and Asia-Pacific. These areas provide market participants profitable chances to increase their presence as they develop further.

Although flour is widely used in many different industries, it is mostly used in the food and beverage sector as a basic ingredient in bread, pastries, and noodles. Due to the rising demand for artisanal bread and baked items, the bakery industry alone is expected to exceed $300 billion by 2025. Furthermore, flour's adaptability is increased by the snack and confectionery businesses, which use it to make cakes, cookies, and crackers. In addition to food, flour is used in non-food industries like biofuels and cosmetics, demonstrating its versatility.

Growth Drivers for the Flour Market

Rising Population and Urbanization

Urbanization and population increase are major factors propelling the flour market, particularly in developing nations. Convenient, ready-to-eat, and packaged food items are in greater demand as more people relocate to urban areas. Urban dwellers, who frequently lead hectic lives, favor quick meals, many of which are made with flour, such bread, pastries, noodles, and snacks. Additionally, supermarkets and convenience stores are more accessible to urban consumers, which raises the availability and consumption of flour goods. The demand for processed meals that mainly rely on flour is further fueled by changing dietary preferences and the growing population in emerging markets. The market's expansion will be aided by the rising need for flour as cities and populations continue to grow.

Growing Demand for Processed and Packaged Foods

One of the main factors propelling the flour industry is the rising demand for packaged and processed goods. Convenient, ready-to-eat meals, baked goods, snacks, and convenience foods have become more and more popular as people lead busier lives. The demand for flour, a basic component of many of these products, rises in tandem. Flour is a key ingredient in many dishes, including bread, cakes, pastries, biscuits, and snack foods. This tendency is also fueled by rising consumption of packaged baked goods, frozen meals, and fast food, especially in cities. Flour continues to play a key role in product formulations as producers concentrate on providing quick and simple food options, guaranteeing that its consumption will continue to rise.

Rising Popularity of Bakery Products

The demand for flour is significantly influenced by the growing popularity of bread goods, especially in areas with a strong baking culture. More individuals are choosing bread, cakes, pastries, and other baked goods as part of their daily meals as a result of growing consumer indulgence and increased disposable incomes. Particularly in Western and European nations where bread consumption is a significant aspect of the cultural food landscape, bakery goods are viewed as both comfort foods and necessary meal components. Additionally, people are willing to spend more on artisanal or high-end baked goods when their disposable incomes increase. Since flour is still a necessary component of almost all baked goods, its demand is directly fueled by the expanding demand for bakery goods worldwide.

Challenges in the Flour Market

Volatile Raw Material Prices

The price of wheat, the primary ingredient used to make flour, fluctuates a lot, which makes volatile raw material pricing a major problem for the flour market. A number of variables, such as erratic weather patterns that affect crop production, including droughts or floods, can have an impact on wheat prices. Wheat prices can also be further destabilized by geopolitical tensions, trade policies, and supply chain interruptions, such as those brought on by the COVID-19 epidemic or conflicts in important wheat-producing countries. Price volatility in the flour market results from these price swings since they raise production costs for flour producers, who may then pass these increased costs on to consumers. Particularly in areas where flour is a staple item, this volatility makes it difficult for consumers to control their purchase decisions and for producers to maintain profit margins. As a result, the volatility of wheat prices has a knock-on effect that affects the whole flour market value chain.

Competition from Alternative Flours

The market for traditional wheat flour is being more and more challenged by competition from substitute flours. Consumers are increasingly using rice, almond, gluten-free, and other plant-based flours to satisfy particular dietary requirements, such as low-carb or gluten sensitivity, as a result of growing health consciousness. Because they are seen as healthier, more environmentally friendly, and compatible with plant-based and clean eating diets, these substitute flours are becoming more and more well-liked. Among people with celiac disease or trying to cut back on gluten, there is a noticeable trend toward specialist and gluten-free items. In order to stay competitive in this changing market, traditional wheat flour producers need to develop and diversify their products as the demand for alternative flours rises. The dominance of wheat flour in international markets is being challenged by this development.

Wheat accounts for a sizeable amount of the world market for flour

Wheat commands one of the highest shares in the global flour market due to its versatile applications and widespread consumption. It is essential in many food products like bread, pasta, pastries, and noodles. The enduring reputation of wheat-based ingredients throughout various cuisines and cultures guarantees a constant demand for wheat flour globally. Besides, its nutritional value, gluten content, and simplicity of processing contribute to its enormous dominance in the flour market.

The worldwide flour market may see bread and bakery goods as a major application

Bread and bakery products could stand out as a leading application in the global flour market. This is owed to their prevalent recognition and giant consumption. Flour, a fundamental component in baking, is vital for producing numerous bread and bakery items. Consistent demand for staple merchandise and evolving consumer preferences for distinct varieties ensure a non-stop and significant flour market share. The versatility of flour in developing a wide variety of baked items also solidifies the pivotal function of bread and bakery applications in driving the global flour market.

Supermarkets have the ability to rise to the top of the global flour market

Supermarkets may emerge as a leading segment in the global flour market. This is because of their central accessibility and various product offerings. These retail giants offer a convenient one-stop shopping experience, providing multiple flour types for different client choices. With a considerable distribution network and competitive pricing, supermarkets entice a large client base. Their strategic placement in city and suburban regions further contributes to their prominence in the flour market, as consumers increasingly seek comfort and variety in their purchases.

Flour Market Overview by Regions

By countries, the global flour market is divided into United States, Canada, France, Germany, Italy, Spain, United Kingdom, Belgium, Netherlands, Turkey, China, Japan, India, South Korea, Thailand, Malaysia, Indonesia, Australia, New Zealand, Brazil, Mexico, Argentina, Saudi Arabia, United Arab Emirates, and South Africa.

United States Flour Market

Due to the high demand for processed foods, convenience meals, and bakery goods, the US flour market is a significant part of the worldwide food sector. The market is dominated by wheat flour, and bread, cakes, pastries, and other bakery products are among the top buyers. A move towards healthier, more natural products is reflected in the growing demand for alternative flours, such as whole wheat, almond, and gluten-free flour, as health-conscious consumers become more prevalent. Additionally, customer preferences are being influenced by trends in non-GMO and organic products. With advancements in milling methods and fortified flour options, the industry is also witnessing increase in specialized and artisanal flour products. Supply chain interruptions and fluctuating wheat prices, however, continue to be problems for the sector.

Germany Flour Market

The robust demand for premium wheat and specialized flours makes Germany's flour market one of the biggest in Europe. Due in major part to Germany's rich baking culture, where bread, pastries, and other baked goods are staple foods, wheat flour is the most common variety. Due to the nation's reputation for producing a wide variety of bread products, such as rye, sourdough, and whole-grain bread, there is a considerable need for different kinds of flour.

Growing knowledge of dietary preferences and food allergies has led health-conscious German consumers to favor alternatives like whole wheat, organic, and gluten-free flours in recent years. Additionally, flour producers are concentrating on clean-label products and environmentally friendly packaging in response to the growing demand for eco-friendly and sustainable manufacturing methods.

The manufacture of convenience foods and snacks is part of Germany's thriving food processing industry, which also supports the market's ongoing expansion. However, producers continue to have serious worries about issues like shifting agricultural conditions, notably the effects of climate change on wheat yields, and fluctuating raw material prices. The market for premium, specialty flours is nevertheless thriving in spite of these obstacles thanks to innovation and Germany's dominant export position in the European flour market.

China Flour Market

Due to the country's enormous population and changing eating patterns, the flour market in China is among the biggest and fastest-growing in the world. The most popular flour is wheat flour, which is used in many traditional Chinese cuisines and staple foods like noodles, dumplings, and baozi (steamed buns). The demand for convenience and processed foods, particularly baked goods, has increased along with China's urban population, which has fueled the market's growth.

Whole wheat, organic, and gluten-free flours are among the healthier and specialist types that have become more popular in recent years, particularly in cities where consumers are becoming more health-conscious. Further driving flour consumption is the increased demand for bakery goods brought about by the growing influence of Western diets.

Production efficiency has increased thanks to technological developments in milling operations and government assistance for the agriculture industry. But issues like shifting wheat prices, crop yields being impacted by climate change, and supply chain interruptions still present market concerns. Notwithstanding these obstacles, it is anticipated that the Chinese flour industry would keep growing due to a mix of industrialization, traditional consumption patterns, and a move toward better eating.

Saudi Arabia Flour Market

The robust domestic demand for staple goods like bread, flatbreads (like khubz), and pastries is the main driver of the Saudi Arabian flour market, a significant sector of the nation's food industry. Since bread is a mainstay in Saudi homes and an essential component of traditional meals, wheat flour is the most commonly utilized form of flour. The consumption of flour-based products is rising in Saudi Arabia due to the country's urbanization and population growth, especially in the form of convenience foods and baked goods that are ready to eat. Whole wheat, organic, and gluten-free flours are in greater demand as a result of the current surge in health-conscious tendencies. This change is a result of people looking for refined flour substitutes as they become more conscious of their diet and health.

Due to a lack of domestic wheat production, Saudi Arabia also imports a large amount of its wheat, making the market vulnerable to changes in the price of wheat globally. Although the nation still depends largely on imports, the government has also been working to increase food security and encourage domestic wheat production.

With rising demand from the foodservice industry (including bakeries and restaurants) as well as retail customers, the Saudi flour market is nevertheless robust despite obstacles including price instability and shifting wheat supply. Additionally, the flour industry is expected to increase further due to the rising popularity of convenience foods and the burgeoning supermarket and e-commerce retail sectors.

Raw Material – Market breakup in 4 viewpoints:

1. Wheat

2. Maize

3. Rice

4. Others

Application – Market breakup in 6 viewpoints:

1. Pasta

2. Bread and Bakery Products

3. Wafers, Crackers and Biscuits

4. Animal Feed

5. Non-Food Application

6. Others

Sales Channel – Market breakup in 5 viewpoints:

1. Supermarkets

2. Hypermarkets

3. Online Stores

4. Others

Country – Market of 25 Countries Covered in the Report:

1. North America

1.1 United States

1.2 Canada

2. Europe

2.1 France

2.2 Germany

2.3 Italy

2.4 Spain

2.5 United Kingdom

2.6 Belgium

2.7 Netherlands

2.8 Turkey

3. Asia Pacific

3.1 China

3.2 Japan

3.3 India

3.4 South Korea

3.5 Thailand

3.6 Malaysia

3.7 Indonesia

3.8 Australia

3.9 New Zealand

4. Latin America

4.1 Brazil

4.2 Mexico

4.3 Argentina

5. Middle East & Africa

5.1 Saudi Arabia

5.2 United Arab Emirates

5.3 South Africa

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. King Arthur Flour Company

2. Associated British Foods Plc.

3. Hindustan Unilever Ltd

4. Archer Daniels Midland Company

5. Conagra Foods Inc.

6. Cargill, Incorporated

7. ITC Ltd

8. General Mills, Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Raw Material, Application, Sales Channel, and Countries |

| Countries Covered |

|

| Companies Covered | 1. King Arthur Flour Company 2. Associated British Foods Plc. 3. Hindustan Unilever Ltd 4. Archer Daniels Midland Company 5. Conagra Foods Inc. 6. Cargill, Incorporated 7. ITC Ltd 8. General Mills, Inc. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in Report:

-

What is the projected market size and growth rate of the global flour market from 2025 to 2033?

-

Which raw materials (wheat, maize, rice, etc.) dominate the global flour market, and why?

-

What are the major applications driving flour demand (e.g., bread, bakery, pasta, animal feed)?

-

How are changing consumer preferences (e.g., gluten-free, organic, plant-based) impacting flour market trends?

-

What are the key regional markets for flour, and which countries are expected to show the highest growth?

-

What are the main distribution channels for flour (e.g., supermarkets, hypermarkets, online)?

-

How are urbanization and population growth contributing to rising flour consumption globally?

-

What challenges does the industry face, such as raw material price volatility and climate impacts?

-

How are technological advancements in milling and fortification shaping the market?

-

Who are the major players in the global flour market, and what strategies are they adopting for growth?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Flour Market

6. Market Share

6.1 By Raw Material

6.2 By Application

6.3 By Sales Channels

6.4 By Countries

7. Raw Material

7.1 Wheat

7.2 Maize

7.3 Rice

7.4 Others

8. Application

8.1 Noodles and Pasta

8.2 Bread and Bakery Products

8.3 Wafers, Crackers and Biscuits

8.4 Animal Feed

8.5 Nin-Food Application

8.6 Others

9. Sales Channels

9.1 Supermarkets

9.2 Hypermarkets

9.3 Online Stores

9.4 Others

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 South Korea

10.3.5 Thailand

10.3.6 Malaysia

10.3.7 Indonesia

10.3.8 Australia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 Saudi Arabia

10.5.2 United Arab Emirates

10.5.3 South Africa

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 King Arthur Flour Company

13.1.1 Overview

13.1.2 Recent Development

13.1.3 Revenue

13.2 Associated British Foods Plc

13.2.1 Overview

13.2.2 Recent Development

13.2.3 Revenue

13.3 Hindustan Unilever Ltd

13.3.1 Overview

13.3.2 Recent Development

13.3.3 Revenue

13.4 Archer Daniels Midland Company

13.4.1 Overview

13.4.2 Recent Development

13.4.3 Revenue

13.5 Conagra Foods Inc.

13.5.1 Overview

13.5.2 Recent Development

13.5.3 Revenue

13.6 Cargill, Incorporated

13.6.1 Overview

13.6.2 Recent Development

13.6.3 Revenue

13.7 ITC Ltd

13.7.1 Overview

13.7.2 Recent Development

13.7.3 Revenue

13.8 General Mills, Inc.

13.8.1 Overview

13.8.2 Recent Development

13.8.3 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com