Global Lung Cancer Screening Market to Reach US$ 16.7 Billion by 2027, Bolstered by Growth in Smoking Population and Huge Government Support for Early Detection

21 Feb, 2022

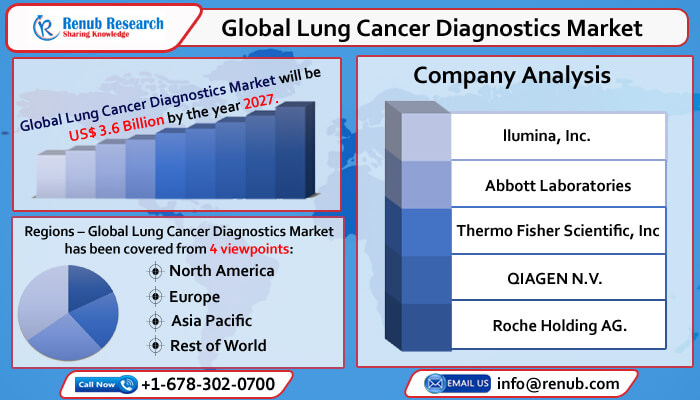

According to the latest report by Renub Research titled, “Lung Cancer Screening Market, Size, Global Forecast 2022-2027, Industry Trends, Share, Growth, Impact of COVID-19, Opportunity Company Analysis” the Global Lung Cancer Screening Market Size was US$ 15.4 Billion in 2021. Lung cancer is the ultimate cause of cancer death among both women and men globally. Thus, lung cancer screening aims to detect lung cancer before it has spread; this can help find cancer early. However, the only recommended screening test for lung cancer is low-dose computed tomography (also called a low-dose C.T. scan, or LDCT), Chest x-ray, and Sputum cytology. Screening with LDCT scans has been conferred to decrease the risk of dying from lung cancer in heavy smokers. Screening by chest x-rays and sputum cytology does not reduce the risk of dying of lung cancer. Furthermore, lung cancer screening is a method used to detect lung cancer in otherwise healthy people with a high risk of lung cancer.

Worldwide Lung Cancer Screening Industry to Grow with a CAGR of 1.4% from 2021 to 2027

According to Statista the increasing incidence of lung cancer death is one of the significant factors driving the lung cancer screening industry. For instance, in 2020, around 1.79 Million cancer deaths, or 18% of all cancer deaths worldwide, were attributed to lung cancer. Further, the increasing number of screening test approvals from regulatory bodies is to drive the growth of the lung cancer screening market. For instance, in 2021, the U.S. Food and Drug Administration (FDA) announced approval for Amgen’s Sotorasib to treat patients with metastatic non-small cell lung cancer (NSCLC) or locally advanced with KRAS G12C mutation.

Non-small Cell Lung Cancer (NSCLC) Segment Holds the Lion’s Share

Based on cancer type, the global lung cancer screening market is segmented into non-small cell lung cancer (NSCLC) and small cell lung cancer. For instance, according to the (ACS) American Cancer Society, about 84% of all lung cancers are non-small cell, and 13% are SCLC. The growing awareness about screening in developed and developing countries combined with the ever-increasing cases of NSCLC across the globe demand for screening lung cancer type is done with a test called a spiral computed tomography or low-dose helical (C.T. or CAT) scan.

Healthcare like Hospitals & Clinics, Research institutes, and Diagnostic Centers play an active role in making people aware and educated about lung cancer screening. Doctors used conventional chest X-rays to check for signs of lung cancer, such as a suspicious spot. While traditional X-rays help detect lung cancer, they offer less detailed pictures from one angle than more advanced imaging technology, like C.T. scans, that use X-rays from multiple angles to make clear images of the lungs. Moreover, because of the National Lung Screening Trial and support from leaders in lung cancer treatment and prevention, low-dose C.T. scans of the chest are a standard of care in hospitals across the world.

Lung Cancer Incidence and Mortality in China have been Increasing Rapidly

Geographically, United States holds the most crucial requirement for lung cancer screening due to the rising lung cancer cases, progressing implementation of technologically advanced solutions and robust application of cancer screening courses, which are few of the aspects accountable for the domination of United States. For instance, as per the American Society of Clinical Oncology (2020), lung cancer is the second greatest basic cancer occurring in men and women and was assessed to affect more than 235,000 adults in the U.S.

In Germany, the lung cancer screening industry has grown due to increasing cancer awareness and introducing new medical diagnostic equipment and advanced therapies. The expanding elderly population, changing lifestyles, and rising tobacco smoking, including passive smoking, are likely drivers for the German lung cancer screening market. Likewise, as per the Global Cancer Observatory (Globocan), around 64,804 new cases of lungs cancer were identified in Germany in the year 2020.

COVID-19 Outbreak:

The outbreak of COVID-19 has hindered the lung cancer screening market since its arrival. This pandemic has created a commotion in the supply chain of clinical material. Consequently, there has been a rise in demand for global imaging solutions. Nevertheless, disruption in production and the industrial procedure has led to a disadvantageous impact on the market globally.

Robust Portfolio, Strong Distribution Network, and New Product Launch to help Key Players Lead

The global lung cancer screening market is consolidated with key players, including llumina, Inc, Abbott Laboratories, Thermo Fisher Scientific, Inc, QIAGEN N.V. and Roche Holding AG. The dominance of these major companies is attributed to the strong product portfolio of screening devices, robust distribution network, mergers and acquisitions, and introduction of new products in the market.

Market Summary:

- Cancer Type - We have covered Global Lung Cancer Screening Market breakup by 2 viewpoints by Cancer Type (Non-small cell lung cancer (NSCLC) and Small cell lung cancer)

- End User - Renub Research Report has covered by End User in the 4 viewpoints (Hospitals & Clinics, Research institutes and Diagnostic Centers and Others)

- Country – Our Report has covered Lung Cancer Screening Market breakup by 3 countries (United States, Canada, Norway, Italy, France, Germany, United Kingdom, Russia, Spain, China, India, Japan and South Korea)

- All the key players have been covered from 3 Viewpoints (Overview, Recent Development, and Revenue Analysis) llumina Inc, Abbott Laboratories, Thermo Fisher Scientific Inc, QIAGEN N.V. and Roche Holding AG.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com