Native Starch Market, Size, Share, Global Forecast 2024-2030, Industry Trends, Growth, Insight, Raw Materials, Top Companies Analysis

Buy NowNative Starch Market Outlook

Worldwide consumption of foods and products with a long shelf life is growing. Therefore, manufacturers have an incentive to expand the product line, for which they will need native starches with high functionality. Starch is a polysaccharide which is made up of glucose and is cache carbohydrate of the plant kingdom. The starch granules are laid into made the roots, seeds, stem pits and tubers of plants as a cache food supply for periods of growth, germination and dormancy. Native starches still perform prominent thickening and texturizing functions in fresh foods, restaurant production, and food processing. According to Renub Research, Native Starch Market is expected to be US$ 7.60 Billion globally by the end of the year 2026.

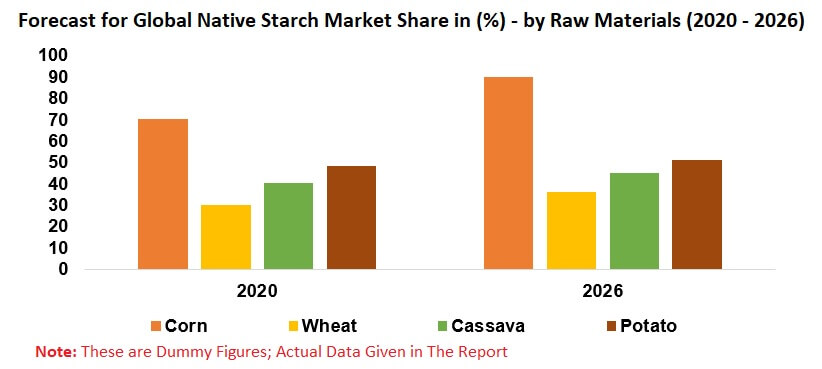

Native starch has a long history of being used as a food source, but because of its abundance, nonfood applications have been developed. Available carbohydrates are mostly isolated from corn, wheat, potato, or cassava. The most commonly used native starches in global food processing are corn (dent, waxy maize, high amylose). By Industry Consumption, Confectionery, Corrugating and Paper Making and Drinks and Processed Food will be gardened in the forecast period.

In 2018, Cargill invested in potato starch production in Denmark. This investment demonstrated Cargill’s to provide food manufacturing customers with the functional native starches they need to meet the demand of label-conscious consumers. During the coronavirus pandemic, some food and beverage manufacturers faced a lack of ingredients. To prevent a similar situation in the future, they are likely to diversify supplies by expanding the list of suppliers. Another possibility in the case of a shortage of raw materials may be the use of flexible rules for labelling ingredients for their substitution.

Renub Research report titled “Native Starch Market, Production & Global Forecast, By (Corn, Wheat, Cassava, Potato), By (Americas, Europe, Asia Pacific, ROW), By (Confectionery & Drinks, Processed Food, Corrugating & Paper Making, Feed, Pharmaceuticals & Chemicals, Non-food), Company (Cargill, Ingredion, Tate & Lyle, Archer Daniels Midland Company, Riddhi Siddhi Gluco Biols Ltd. and Gulshan Polyols Ltd.)” studies the global starch market and production.

Global Native Starch Market & Production

• Raw Materials

• Regions

Market Segmentation based on Raw Materials

Native starch is used in soups dessert puddings, sauces, and other food applications to add to the taste and flavour of the food recipes. Based on raw materials, the native starch market is segmented as

• Corn

• Wheat

• Cassava

• Potato

Segmentation based on Industry

The native starch market is also segmented based on its application in various companies like

• Confectionery and Drinks

• Processed Food

• Corrugating and Paper Making

• Feed

• Pharmaceuticals and Chemicals

• Other non-food

Geographical Aspect - Based on geography, the native starch market has been segmented into

• Americas

• Europe

• Asia Pacific

• Rest of the World

All the companies have been studied from three points

• Overview

• Recent Developments & Strategy

• Sales Analysis

Company

• Cargill, Ingredion.

• Tate & Lyle.

• Archer Daniels Midland Company.

• Riddhi Siddhi Gluco Biols Ltd.

• Gulshan Polyols Ltd.

If the information you seek is not included in the current scope of the study kindly share your specific requirements with our custom research team at info@renub.com

1 Introduction

2 Research & Methodology

3 Executive Summary

4 Global Native Starch Market

5 Market Share Analysis – Global Native Starch

5.1 By Raw Material

5.2 By Region

6 Production Share Analysis – Global Native Starch

6.1 By Raw Materials

6.2 By Region

7 Industry Consumption Share Analysis – Global Native Starch

8 By Raw Materials – Global Native Starch Market

8.1 Corn

8.2 Wheat

8.3 Cassava

8.4 Potato

9 America - Native Starch Market

9.1 Raw Materials Market Share Analysis

9.2 By Raw Materials

9.2.1 Corn

9.2.2 Wheat

9.2.3 Cassava

9.2.4 Potato

10 Europe - Native Starch Market

10.1 By Raw Materials – Market Share Analysis

10.2 By Raw Materials

10.2.1 Corn

10.2.2 Wheat

10.2.3 Potato

11 Asia-Pacific - Native Starch Market

11.1 By Raw Materials – Market Share Analysis

11.2 By Raw Materials

11.2.1 Corn

11.2.2 Wheat

11.2.3 Cassava

11.2.4 Potato

12 Rest of the World - Native Starch Market

12.1 By Raw Materials – Market Share Analysis

12.2 By Raw Materials

12.2.1 Corn

12.2.2 Wheat

12.2.3 Cassava

12.2.4 Potato

13 By Industry Consumption – Global Native Starch

13.1 Confectionery and Drinks

13.2 Processed food

13.3 Corrugating and Paper Making

13.4 Feed

13.5 Pharma and Chemicals

13.6 Other non-food

14 Global Native Starch Production

15 By Raw materials – Global Native Starch Production

15.1 Corn

15.2 Wheat

15.3 Cassava

15.4 Potato

16 Americas - Native Starch Production

16.1 By Raw Materials – Production Share Analysis

16.2 By Raw Materials

16.2.1 Corn

16.2.2 Wheat

16.2.3 Cassava

16.2.4 Potato

17 Europe - Native Starch Production

17.1 By Raw Materials – Production Share Analysis

17.2 By Raw Materials

17.2.1 Corn

17.2.2 Wheat

17.2.3 Potato

18 Asia-Pacific - Native Starch Production

18.1 By Raw Materials – Production Share Analysis

18.2 By Raw Materials

18.2.1 Corn

18.2.2 Wheat

18.2.3 Cassava

18.2.4 Potato

19 Rest of World - Native Starch Production

19.1 By Raw Materials – Production Share Analysis

19.2 By Raw Materials

19.2.1 Corn

19.2.2 Wheat

19.2.3 Cassava

19.2.4 Potato

20 Processing Process

20.1 Starch Value Chain

20.2 Corn Starch Production Process

20.3 Wheat Starch Production Process

20.4 Cassava Starch Production Process

20.5 Potato Starch Production Process

21 Key Players – Financial Insights

21.1 Cargill

21.1.1 Overview

21.1.2 Recent Development

21.1.3 Revenue

21.2 Ingredion

21.2.1 Overview

21.2.2 Recent Development

21.2.3 Revenue

21.3 Archer Daniels Midland Company

21.3.1 Overview

21.3.2 Recent Development

21.3.3 Revenue

21.4 Tate & Lyle

21.4.1 Overview

21.4.2 Recent Development

21.4.3 Revenue

22 Growth Drivers

22.1 Point no. 1

22.2 Point no. 2

22.3 Point no. 3

23 Restraints

23.1 Point no. 1

24 Appendix

List of Figures:

Figure 4‑1: Global Native Starch Market (Million US$), 2014 - 2019

Figure 4‑2: Forecast for Global Native Starch Market (Million US$), 2020 - 2026

Figure 5‑1: By Raw Material - Global Native Starch Market Share (%), 2014-2019

Figure 5‑2: By Raw Material – Forecast for Global Native Starch Market Share (%), 2020 - 2026

Figure 5‑3: By Region - Global Native Starch Market Share (%), 2014 – 2019

Figure 5‑4: By Region – Forecast for Global Native Starch Market Share (%), 2020 – 2026

Figure 6‑1: By Raw Materials - Global Native Starch Production Share (%), 2014 – 2019

Figure 6‑2: By Raw Materials – Forecast for Global Native Starch Production Share (%), 2020 – 2026

Figure 6‑3: By Region - Global Native Starch Production Share (%), 2014 – 2019

Figure 6‑4: By Region – Forecast for Global Native Starch Production Share (%), 2020 – 2026

Figure 8‑1: Global – Native Corn Starch Market (Million US$), 2014 – 2019

Figure 8‑2: Global – Forecast for Native Corn Starch Market (Million US$), 2020 – 2026

Figure 8‑3: Global – Native Wheat Starch Market (Million US$), 2014 – 2019

Figure 8‑4: Global – Forecast for Native Wheat Starch Market (Million US$), 2020 – 2026

Figure 8‑5: Global - Native Cassava Starch Market (Million US$), 2014 – 2019

Figure 8‑6: Global – Forecast for Native Cassava Starch Market (Million US$), 2020 – 2026

Figure 8‑7: Global – Native Potato Starch Market (Million US$), 2014 – 2019

Figure 8‑8: Global – Forecast for Native Potato Starch Market (Million US$), 2020 – 2026

Figure 9‑1: Americas - Native Starch Market (Million US$), 2014 - 2019

Figure 9‑2: Americas – Forecast for Native Starch Market (Million US$), 2020 – 2026

Figure 9‑3: Americas - Native Starch Raw Materials Market Share (%), 2014 - 2019

Figure 9‑4: Americas – Forecast for Native Starch Raw Materials Market Share (%), 2020 - 2026

Figure 9‑5: Americas –Native Corn Starch Market (Million US$), 2014 - 2019

Figure 9‑6: Americas – Forecast for Native Corn Starch Market (Million US$), 2020 - 2026

Figure 9‑7: Americas –Native Wheat Starch Market (Million US$), 2014 - 2019

Figure 9‑8: Americas – Forecast for Native Wheat Starch Market (Million US$), 2020 - 2026

Figure 9‑9: Americas –Native Cassava Starch Market (Million US$), 2014 – 2019

Figure 9‑10: Americas – Forecast for Native Cassava Starch Market (Million US$), 2020 – 2026

Figure 9‑11: Americas – Native Potato Starch Market (Million US$), 2014 – 2019

Figure 9‑12: Americas – Forecast for Native Potato Starch Market (Million US$), 2020 – 2026

Figure 10‑1: Europe - Native Starch Market (Million US$), 2014 - 2019

Figure 10‑2: Europe – Forecast for Native Starch Market (Million US$), 2020 – 2026

Figure 10‑3: Europe - Native Starch Raw Materials Market Share (%), 2014 – 2019

Figure 10‑4: Europe – Forecast for Native Starch Raw Materials Market Share (%), 2020 – 2026

Figure 10‑5: Europe –Native Corn Starch Market (Million US$), 2014 – 2019

Figure 10‑6: Europe – Forecast for Native Corn Starch Market (Million US$), 2020 – 2026

Figure 10‑7: Europe –Native Wheat Starch Market (Million US$), 2014 – 2016

Figure 10‑8: Europe – Forecast for Native Wheat Starch Market (Million US$), 2020 – 2026

Figure 10‑9: Europe –Native Potato Starch Market (Million US$), 2014 – 2019

Figure 10‑10: Europe – Forecast for Native Potato Starch Market (Million US$), 2020 – 2026

Figure 11‑1: Asia-Pacific - Native Starch Market (Million US$), 2014 - 2019

Figure 11‑2: Asia-Pacific – Forecast for Native Starch Market (Million US$), 2020 – 2026

Figure 11‑3: Asia-Pacific - Native Starch Raw Materials Market Share (%), 2014 – 2019

Figure 11‑4: Asia-Pacific – Forecast for Native Starch Raw Materials Market Share (%), 2020 – 2026

Figure 11‑5: Asia-Pacific –Native Corn Starch Market (Million US$), 2014 – 2019

Figure 11‑6: Asia-Pacific – Forecast for Native Corn Starch Market (Million US$), 2020– 2026

Figure 11‑7: Asia-Pacific –Native Wheat Starch Market (Million US$), 2014 – 2019

Figure 11‑8: Asia-Pacific – Forecast for Native Wheat Starch Market (Million US$), 2020 – 2026

Figure 11‑9: Asia-Pacific –Native Cassava Starch Market (Million US$), 2014 – 2019

Figure 11‑10: Asia-Pacific – Forecast for Native Cassava Starch Market (Million US$), 2020 – 2026

Figure 11‑11: Asia-Pacific –Native Potato Starch Market (Million US$), 2014 – 2019

Figure 11‑12: Asia-Pacific – Forecast for Native Potato Starch Market (Million US$), 2020 – 2026

Figure 12‑1: ROW - Native Starch Market (Million US$), 2014 - 2019

Figure 12‑2: ROW – Forecast for Native Starch Market (Million US$), 2020 – 2026

Figure 12‑3: ROW - Native Starch Raw Materials Market Share (%), 2014 – 2019

Figure 12‑4: ROW – Forecast for Native Starch Raw Materials Market Share (%), 2020 – 2026

Figure 12‑5: ROW –Native Corn Starch Market (Million US$), 2014 – 2019

Figure 12‑6: ROW – Forecast for Native Corn Starch Market (Million US$), 2020 – 2026

Figure 12‑7: ROW – Native Wheat Starch Market (Million US$), 2014 – 2019

Figure 12‑8: ROW – Forecast for Native Wheat Starch Market (Million US$), 2020 – 2026

Figure 12‑9: ROW –Native Cassava Starch Market (Million US$), 2014 – 2019

Figure 12‑10: ROW – Forecast for Native Cassava Starch Market (Million US$), 2020 – 2026

Figure 12‑11: ROW –Native Potato Starch Market (Million US$), 2014 – 2019

Figure 12‑12: ROW – Forecast for Native Potato Starch Market (Million US$), 2020 – 2026

Figure 13‑1: Confectionery and Drinks – Native Starch Consumption (Million Tonnes), 2014 - 2019

Figure 13‑2: Confectionery and Drinks – Forecast for Native Starch Consumption (Million Tonnes), 2020 – 2026

Figure 13‑3: Processed Food – Native Starch Consumption (Million Tonnes), 2014 - 2019

Figure 13‑4: Processed Food – Forecast for Native Starch Consumption (Million Tonnes), 2020 – 2026

Figure 13‑5: Corrugating & Paper Making – Native Starch Consumption (Million Tonnes), 2014 – 2019

Figure 13‑6: Corrugating & Paper Making – Forecast for Native Starch Consumption (Million Tonnes), 2020 – 2026

Figure 13‑7: Feed – Native Starch Consumption (Million Tonnes), 2014 – 2019

Figure 13‑8: Feed – Forecast for Native Starch Consumption (Million Tonnes), 2020 – 2026

Figure 13‑9: Pharma & Chemicals – Native Starch Consumption (Million Tonnes), 2014 – 2019

Figure 13‑10: Pharma & Chemicals – Forecast for Native Starch Consumption (Million Tonnes), 2020 – 2026

Figure 13‑11: Other non-food – Native Starch Consumption (Million Tonnes), 2014 – 2019

Figure 13‑12: Other non-food – Forecast for Native Starch Consumption (Million Tonnes), 2020 – 2026

Figure 14‑1: Starch Production Process

Figure 14‑2: Global Native Starch Production (Million Tonnes), 2014 - 2019

Figure 14‑3: Forecast for Global Native Starch Production (Million Tonnes), 2020 - 2026

Figure 15‑1: Global - Native Corn Starch Production (Million Tonnes), 2014 – 2019

Figure 15‑2: Global – Forecast for Native Corn Starch Production (Million Tonnes), 2020 – 2026

Figure 15‑3: Global - Native Wheat Starch Production (Million Tonnes), 2014 – 2019

Figure 15‑4: Global – Forecast for Native Wheat Starch Production (Million Tonnes), 2020 – 2026

Figure 15‑5: Global - Native Cassava Starch Production (Million Tonnes), 2014 – 2019

Figure 15‑6: Global – Forecast for Native Cassava Starch Production (Million Tonnes), 2020 – 2026

Figure 15‑7: Global – Native Potato Starch Production (Million Tonnes), 2014 – 2019

Figure 15‑8: Global – Forecast for Native Potato Starch Production (Million Tonnes), 2020 – 2026

Figure 16‑1: Americas - Native Starch Production (Million Tonnes), 2014 - 2019

Figure 16‑2: Americas – Forecast for Native Starch Production (Million Tonnes), 2020 - 2026

Figure 16‑3: Americas - Native Starch Raw Materials Production Share (%), 2014 – 2019

Figure 16‑4: Americas – Forecast for Native Starch Raw Materials Production Share (%), 2020 – 2026

Figure 16‑5: Americas – Native Corn Starch Production (Million Tonnes), 2014 – 2019

Figure 16‑6: Americas – Forecast for Native Corn Starch Production (Million Tonnes), 2020 – 2026

Figure 16‑7: Americas – Native Wheat Starch Production (Million Tonnes), 2014 – 2019

Figure 16‑8: Americas – Forecast for Native Wheat Starch Production (Million Tonnes), 2020 – 2026

Figure 16‑9: Americas – Native Cassava Starch Production (Million Tonnes), 2014 – 2019

Figure 16‑10: Americas – Forecast for Native Cassava Starch Production (Million Tonnes), 2020 – 2026

Figure 16‑11: Americas – Native Potato Starch Production (Million Tonnes), 2014 – 2019

Figure 16‑12: Americas – Forecast for Native Potato Starch Production (Million Tonnes), 2020 – 2026

Figure 17‑1: Europe - Native Starch Production (Million Tonnes), 2014 - 2019

Figure 17‑2: Europe – Forecast for Native Starch Production (Million Tonnes), 2020 - 2026

Figure 17‑3: Europe - Native Starch Raw Materials Production Share (%), 2014 – 2019

Figure 17‑4: Europe – Forecast for Native Starch Raw Materials Production Share (%), 2020 – 2026

Figure 17‑5: Europe – Native Corn Starch Production (Million Tonnes), 2014– 2019

Figure 17‑6: Europe – Forecast for Native Corn Starch Production (Million Tonnes), 2020 – 2026

Figure 17‑7: Europe – Native Wheat Starch Production (Million Tonnes), 2014 – 2019

Figure 17‑8: Europe – Forecast for Native Wheat Starch Production (Million Tonnes), 2020 – 2026

Figure 17‑9: Europe – Native Potato Starch Production (Million Tonnes), 2014 – 2019

Figure 17‑10: Europe – Forecast for Native Potato Starch Production (Million Tonnes), 2020 – 2026

Figure 18‑1: Asia-Pacific - Native Starch Production (Million Tonnes), 2014 - 2019

Figure 18‑2: Asia-Pacific – Forecast for Native Starch Production (Million Tonnes), 2020 – 2026

Figure 18‑3: Asia-Pacific - Native Starch Raw Materials Production Share (%), 2014 – 2019

Figure 18‑4: Asia-Pacific – Forecast for Native Starch Raw Materials Production Share (%), 2020 – 2026

Figure 18‑5: Asia-Pacific – Native Corn Starch Production (Million Tonnes), 2014 – 2019

Figure 18‑6: Asia-Pacific – Forecast for Native Corn Starch Production (Million Tonnes), 2020 – 2026

Figure 18‑7: Asia-Pacific – Native Wheat Starch Production (Million Tonnes), 2014 – 2019

Figure 18‑8: Asia-Pacific – Forecast for Native Wheat Starch Production (Million Tonnes), 2020 – 2026

Figure 18‑9: Asia-Pacific – Native Cassava Starch Production (Million Tonnes), 2014 – 2019

Figure 18‑10: Asia-Pacific – Forecast for Native Cassava Starch Production (Million Tonnes), 2020 – 2026

Figure 18‑11: Asia-Pacific – Native Potato Starch Production (Million Tonnes), 2014 – 2019

Figure 18‑12: Asia-Pacific – Forecast for Native Potato Starch Production (Million Tonnes), 2020 – 2026

Figure 19‑1: ROW - Native Starch Production (Million Tonnes), 2014 - 2019

Figure 19‑2: ROW – Forecast for Native Starch Production (Million Tonnes), 2020 - 2026

Figure 19‑3: ROW - Native Starch Raw Materials Production Share (%), 2014 – 2019

Figure 19‑4: ROW – Forecast for Native Starch Raw Materials Production Share (%), 2020 – 2026

Figure 19‑5: ROW – Native Corn Starch Production (Million Tonnes), 2014 – 2019

Figure 19‑6: ROW – Forecast for Native Corn Starch Production (Million Tonnes), 2020 – 2026

Figure 19‑7: ROW – Native Wheat Starch Production (Million Tonnes), 2014 – 2019

Figure 19‑8: ROW – Forecast for Native Wheat Starch Production (Million Tonnes), 2020 – 2026

Figure 19‑9: ROW – Native Cassava Starch Production (Million Tonnes), 2014 – 2019

Figure 19‑10: ROW – Forecast for Native Cassava Starch Production (Million Tonnes), 2020 – 2026

Figure 19‑11: ROW – Native Potato Starch Production (Million Tonnes), 2014 – 2019

Figure 19‑12: ROW – Forecast for Native Potato Starch Production (Million Tonnes), 2020 – 2026

Figure 20‑1: Starch Raw Materials Value Chain

Figure 20‑2: Corn Starch Production Process

Figure 20‑3: Wheat Starch Production Process

Figure 20‑4: Cassava Starch Production Process

Figure 20‑5: Potato Starch Production Process

Figure 21‑1: Cargill – Net Revenue (Million US$), 2014 – 2019

Figure 21‑2: Cargill – Forecast for Net Revenue (Million US$), 2020 – 2026

Figure 21‑3: Ingredion – Net Sales (Million US$), 2014 – 2019

Figure 21‑4: Ingredion – Forecast for Net Sales (Million US$), 2020 – 2026

Figure 21‑5: ADM – Net Revenue (Million US$), 2011 – 2019

Figure 21‑6: ADM – Forecast for Net Revenue (Million US$), 2020 – 2026

Figure 21‑7: Tate & Lyle – Net Sales (Million US$), 2014 – 2019

Figure 21‑8: Tate & Lyle – Forecast for Net Sales (Million US$), 2020 – 2026

List of Table:

Table 7‑1: By Industry – Global Native Starch Consumption Share (%), 2014 – 2019

Table 7‑2: By Industry – Forecast for Global Native Starch Consumption Share (%), 2020 – 2026

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com