Global Seafood Market Size and Share Analysis - Growth Trends and Forecast Report 2024-2032

Buy NowGlobal Seafood Market Trends & Summary

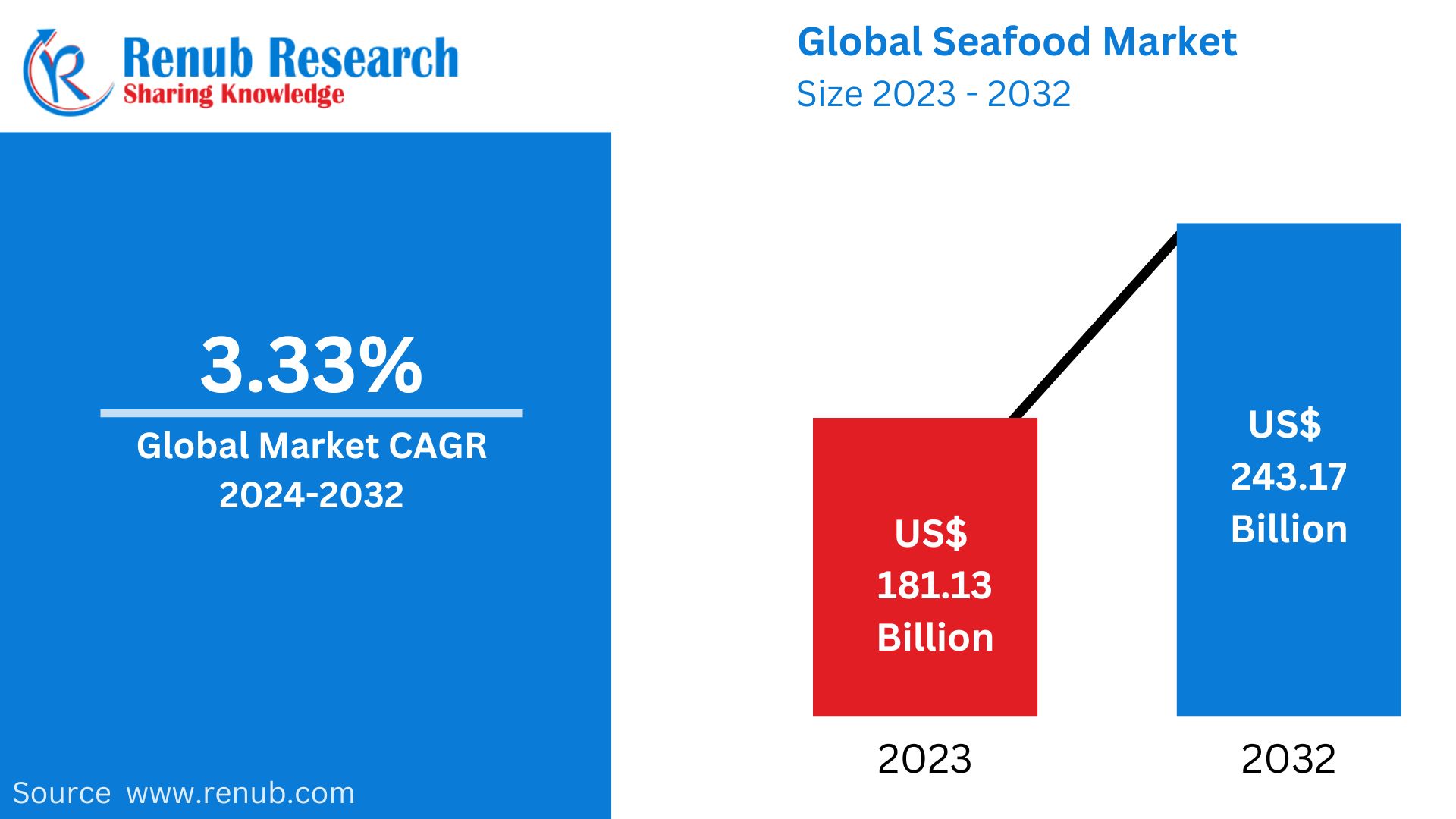

Global Seafood Market stands at US$ 181.13 billion and is expected to reach US$ 243.17 billion by 2032 at a Compound Annual Growth Rate of 3.33% from 2024 to 2032. This growth is associated with growth in disposable income, rise in per capita consumption, and shifts of dietary habit by embracing pescetarianism.

The report Global Seafood Market & Forecast covers by Form (Fresh, Frozen, Ambient, Canned & Processed Seafood), Type (Fish, Crustaceans, Molluscs, Others), Application (Retail, Institutions, Food Service) Countries and Company Analysis 2024-2032.

Seafood market Overview

Seafood is a broad term that describes many types of marine life eaten by humans such as fishes, shrimps, crabs and others. Seafood is a food that is loaded with nutrients that human beings need in their diet. It is rich in proteins, omega 3 fatty acid, vitamin D and B12 and minerals including zinc and iodine. It is important to note that these nutrients help to boost our health, boost the function of the brain and improve our heart’s health.

The consumption of seafood has several advantages that are evident across the world. Seafood is conventional in Asian and European diets and the consumption of such diets has been related to the low prevalence of cardiovascular diseases due to the presence of omega-3. For instance, salmon, mackerel and such other fishes are known to possess resounding health benefits for the heart such as decrease in inflammation and cholesterol. Besides, seafood has social economic significance; it creates employment opportunities especially among fishermen communities. It is also important considering that the global seafood market creates many millions of fishing, processing and distribution employment opportunities around the world.

Growth Drivers for the Global Seafood Market

Rising Health Consciousness

Rising consumer consciousness concerning the nutritional value of foods containing seafood propels the worldwide market. There is a growing trend of consumers wanting to make healthier purchases and healthy foods such as seafood contains, omega-3 fatty acids, lean proteins and essential vitamins. This is in light of a gradually increasing understanding of how seafood helps to enhance heart health, cognitive functioning as well as reduce inflammation in the body. Increasing consumer interest in the adoption of a healthier diet pattern, and therefore consumption of seafood, drives the global demand for assorted seafood products, including fresh fish and seafood convenience food. February, 2024, the The Dietary Guidelines for Americans suggest that one takes at least two weekly servings, or 8 ounces of seafood.

Expansion of Aquaculture

Aquaculture or fish farming in particular is rising rapidly and thus affecting the global seafood demand in a positive way. Aquaculture plays a crucial role of meeting the growing demand of fish in the market, hence reducing the have an effect of fishing practices on the supply of fish stock. They assist in fulfilling demand from the consumers as they reduce extra burden to exploited marine species. Flavor and texture of farmed seafood are higher as the technology in aquaculture has made products from animals to be better and more affordable. Increasing complexity observed in aqua industry is complementing supply to different markets leading to the growth of the market as it feeds the global population’s desire for seafood. In October 2022, Innovasea launched Realfish Pro, as an enhanced cloud-based aquaculture solution that helps fish farmers to remotely view, control, and track facility operations.

Increasing Population Worldwide

The increase in peoples demand for food is another factor that has a pull towards the growth of the seafood market. It is clear that as the globe’s population increases, the desire to feed people with proteins raises, and this includes seafood. Other factors which include urbanization and growth in per capita income in the developing world add to the increased levels of consumption. They are well liked in various population groups and cultures because seafood is tasty, healthy and varied. The growth of this demand has also led the seafood industry to direct more efforts in increasing production capacity and logistic systems so that seafood would remain as an essential food product to be consumed by many. According to the United Nations estimates made in November 2023, the world’s population will be 10 billion by 2050, and as such, people are going to be in dire need of food in general, fishing in particular. From “The Agricultural Outlook” which is a combined work of OECD and FAO, world cereal production is expected to rise by 13% by 2027 which will stimulate expansion of the seafood market containing. This has been found to be increasing and is expected to be beneficial to the business that deals with seafood manufacture.

Challenges in the Global Seafood Market

Overfishing and Sustainability Issues

This global seafood market has to face significant challenges because overfishing is damaging marine biodiversity and destroying ecosystems. Some fish stocks are being consumed at rates faster than their natural replenishment, leading to higher regulations and sustainability measures. Governments and organizations are promoting responsible fishing practice and expansion of aquaculture to rise in meeting the demand while causing minimal environmental damage. However, these practices are expensive to implement, and many small-scale fisheries cannot adapt. Consumer awareness of sustainable seafood sourcing also affects the industry, pushing businesses to adhere to certification standards such as MSC and ASC.

Supply Chain Disruptions and Increasing Costs

Climate change, geopolitical tensions, and economic fluctuations are all threats to supply chains in seafood markets around the world. Extreme weather conditions, commercial trade barriers, and pandemics have affected the production, processing, and distribution of seafood. Also, increased fuel prices will increase transportation costs, thereby increasing the cost of seafood for consumers. These factors strain the cost of producing production feeds, leading to insecurity in the market during fluctuations.

World Frozen Seafood Market

The frozen seafood market is gaining grounds because consumers seek convenience, have a longer shelf life, and enjoy the all-year-round availability of seafood products. In the freezing process, flash-freezing and IQF methods contribute significantly to maintaining the freshness, texture, and nutrients of seafood products. Compared with fresh seafood, frozen seafood also has fewer potential supply chain issues, so this is favored both by retailers and consumers. Growing demand for ready-to-cook and pre-marinated seafood products is driving the market further. However, competition from fresh seafood and preservatives in processed frozen products are the major issues in this segment. January 2023, Brasmar Group of Portugal has acquired UK-based Holmes Seafood, a frozen seafood specialist, to strengthen its market position. The deal will leverage Holmes Seafood's Billingsgate presence, improve product offerings, and expand distribution capabilities.

Global Fish Market

Fish is one of the most consumed seafood categories in the world because it contains high protein and essential nutrients such as omega-3 fatty acids. The fish and seafood market is influenced by increasing health consciousness, growing disposable incomes, and the need for protein-rich diets. The most popular fish varieties are salmon, tuna, cod, and tilapia. Aquaculture is also major in meeting global demand, especially in countries like China and Norway. However, fish farming, use of antibiotics, and water pollution are some of the issues that the aquaculture industry will need to take seriously in order to ensure sustainable growth. October 2024, Sustainable Fisheries Partnership launched the Aquaculture Feed Solutions Toolkit, addressing all three-climate change, habitat, and biodiversity risks in aquaculture feed. More than 80 tools, standards, and initiatives from different organizations combined with guidance and case studies can improve feed sustainability.

Seafood Retail Market

The seafood retail market is increasing as consumers want fresh, quality seafood from supermarkets, online, and specialty stores. The e-commerce and home delivery services have changed the way consumers buy seafood, giving access to many different products. The sales of seafood are mainly held in supermarkets and hypermarkets that have fresh seafood counters and frozen sections. In addition, consumers are also considering sustainable and organic seafood for purchasing. However, high price volatility and consumer concerns about food safety and traceability are challenges for retailers, who have to maintain strict quality control and supply chain transparency. Feb 2024, Essen-based retailer ALDI is introducing pollock portions for the first time on 28 February, offering sandwiches in original and dill pickle flavors under the Fremont Fish Market brand, at USD 4.99 (EUR 4.60).

United States Seafood Market

The U.S. seafood market is very large, resulting from increased consumption of fish, shellfish, and crustaceans. Increased health awareness and a growing demand for protein-rich diets are driving sales of seafood. Imports play a huge role in supplying the country's seafood demand. Sources of imports come mainly from Canada, China, and Vietnam. Initiatives for sustainable seafood through eco-certifications and traceability programs are increasingly gaining popularity among consumers. However, the market is still subjected to harsh conditions like overfishing, climate change effects on marine life, and also in periods of fluctuating seafood prices. Competition also comes from a rising plant-based seafood alternative. Jul 2024, Sojitz Corporation has purchased all takeout sushi businesses of Sushi Avenue Inc., which operates in more than 300 retail locations across the United States through its U.S. subsidiary. With its expertise in seafood from Japan, Sojitz forms a partnership with Marine Foods' U.S. subsidiary, MF America, in order to venture into the increasing U.S. sushi market. This will enable Sojitz to increase its seafood value chain as consumers increase their demand for diverse sushi products.

China Seafood Market

China is the world's largest producer, consumer, and exporter of seafood and has a highly thriving aquaculture industry providing both domestic and international markets. Rising incomes and urbanization are driving up seafood consumption, particularly for premium products such as shrimp, lobster, and salmon. Government support for sustainable aquaculture and seafood safety regulations are going to determine the future of the industry. However, factors such as pollution, disease outbreaks in fish farms, and trade restrictions with key partners like the U.S. and Europe will impact market dynamics. E-commerce and cold chain logistics are helping expand online seafood sales across China. Oct 2024, Chinese Meichu Foods introduced Salmon Cheese Roll, supplementing salmon's growing popularity in the country. The Wo Ai Yu brand is being sold by Meichu, which remains with high-end seafood imports.

South Korean Seafood Market

Seafood market of South Korea is dominated by very high per capita consumption and a strong demand for fresh fish, shellfish, and seaweed. Imports of seafood in the country are high and include massive quantities, with suppliers mainly including China, the U.S., and Norway. Traditionally, supermarkets and online grocery platforms are essential channels in the distribution of seafood. The market is experiencing a constant increase in demand for premium and imported seafood, for example, Norwegian salmon and Japanese tuna. Challenges to the industry generally include declining fish stocks and rising concerns regarding environmental issues on aquaculture. Umami Bioworks collaborated with Friends & Family Pet Food (FnF) in October 2024 to manufacture cell-cultivated fish into cat treats-the first product from FnF's sustainability-led expansion of its pet food brand. The Singapore-headquartered firm partnered with KCell Biosciences of South Korea and WSG to design a scalable, sustainable domestic pipeline for cell-based seafood in South Korea.

Brazil Seafood Market

Brazil’s seafood market is growing due to increasing consumer awareness of the health benefits of fish and shellfish. The country’s vast coastline and freshwater resources support a thriving fishing and aquaculture industry. Tilapia, shrimp, and catfish are among the most popular seafood choices. Government initiatives promoting sustainable fisheries and aquaculture expansion are driving growth. However, logistical challenges, including inadequate cold chain infrastructure and high transportation costs, limit market efficiency. Rising seafood imports from countries like Chile and China further face competition from the local producers. Still, Brazil's seafood industry continues growing. In September 2024, Brazil signed an agreement with the Norwegian Food Safety Authority (Mattilsynet) to let Norway export its aquaculture products, with salmon, to Brazil, which has a population of over 200 million.

Seafood Market in Saudi Arabia

The seafood market in Saudi Arabia is growing rapidly because of the efforts of the government to promote local seafood production and reduce dependence on imports. Vision 2030 aims to increase aquaculture projects and enhance food security. Demand for seafood, especially shrimp and grouper, is rising due to the shift in dietary preferences toward healthier protein sources. However, the country has related challenges such as limited domestic fish stocks and a cost associated with importing seafood. Investment in modern fish farming techniques and cold storage facilities would maintain market growth with a stable source of fresh seafood. It was announced on the Saudi stock exchange that, in November 2024, the board of Saudi Fisheries Company approved plans to establish an aquaculture company in Riyadh, Saudi Arabia's capital, pending the necessary approvals and licenses.

Norway Seafood Industry

Seafood is Norway main export product and it is well known and valued all over the world for its environmentally friendly fishing methods and its high standard products. Salmon stands as one of the most consumed fish across the globe and Norway is among the biggest suppliers of this fish. When it comes to sustainability the country is very vocally engaged and discerning with fish stock management and also invests significantly in the development of technology in the aquaculture sector. Research and development in sustainable fishing is supported by the Norwegian government with an aim of increasing the durability of the company alongside embracing environmental conservation. June 2024, seafood firm from Norway, Mathias Bjørge, is venturing into farmed Norwegian salmon market and building a new factory with a salmon processing line.

Spain Seafood Industry

Spain is another country where seafood is popular and consumed in diverse ways because of its rich culinary culture in Europe. Seafood is a part of Spanish cuisine and Spain’s seafood industry comprises of products like shellfish, sardines and anchovies. On the aspects of the country location, it strategically located along the Mediterranean and the Atlantic coasts which enable it to have a close access to the natural resources such as the seafood. Further, consumption, and exports also depend on Spain’s positive seafood processing and distribution base. As Spain continues to make its seafood dishes accessible to the global market, this also increases the country’s global standing in the industry and in the consumption sector. In February 2022, a new plant totaling 9,000 square meters in size in the Madrid area will introduce a range of new goods and enhance Lerøy’s market presence in Spain and Portugal.

Global Seafood Company News

In October 2023, With the goal of producing 100 tonnes of white-leg shrimp annually by the end of 2023, Nippon Suisan Kaisha Ltd. announced the launch of their land-based enterprise.

In April 2023, Thai Union joins Samut Sakhon City Development's marine garbage cleanup campaign in an effort to safeguard the local ecosystem.

In March 2023, Mowi ASA has constructed a brand-new, cutting-edge facility for the production of seafood in Hitra, Norway.

In May 2022, In Puerto Las Palmas, Spain, Nueva Pescanova announced the filing of their project to construct a new commercial octopus. The company has been working hard to create a technique for farming octopuses, and it recently declared that it had successfully raised, hatched, and incubated five generations of O. vulgaris octopuses in a test facility.

In March 2022, During Seafood Expo in North America, Del Pacifico Seafoods, a well-known specialty supplier of wild-caught Mexican shrimp, introduced a new range of farmed shrimp and oysters. The company's primary focus is on growing its aquaculture business in response to the increasing demand for shrimp in the food service and retail sectors. Del Pacifico is also attempting to produce oysters and shrimp using environmentally friendly harvesting and processing techniques.

Global Seafood Market Segments

Form- Industry is divided into 4 viewpoints:

- Fresh

- Frozen

- Ambient

- Canned & Processed Seafood

Type- Industry is divided into 4 viewpoints:

- Fish

- Crustaceans

- Molluscs

- Others

Application- Industry is divided into 3 viewpoints:

- Retail

- Institutions

- Food Service

Country: Industry is divided into 25 Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All companies have been covered with 5 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Financial Insight

Company Analysis

- Agrosuper S.A.

- Asian Sea Corporation Public Company Limited

- Austevoll Seafood ASA

- Bolton Group SRL

- Grieg Seafood ASA

- Maruha Nichiro Corporation

- Sysco Corporation

- Thai Union Group PCL

Report Details:

| Report Features | Details |

| Base Year |

2023 |

| Historical Period |

2019 - 2023 |

| Forecast Period |

2024 - 2032 |

| Market |

US$ Billion |

| Segment Covered |

Form, Type, Application,and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the global seafood industry by 2032?

-

What is the expected Compound Annual Growth Rate (CAGR) of the seafood market from 2024 to 2032?

-

Which factors are driving the growth of the global seafood market?

-

What are the major challenges faced by the seafood industry?

-

How does aquaculture contribute to the expansion of the seafood market?

-

Which region is the largest producer and consumer of seafood globally?

-

What role does sustainability play in the seafood industry, and what are the key initiatives being implemented?

-

How does the rise of e-commerce impact seafood sales and distribution?

-

What are the key segments of the seafood market based on form, type, and application?

-

Which companies are leading the global seafood market, and what are their recent developments?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Seafood Market

6. Market Share Analysis

6.1 Form

6.2 Type

6.3 Application

6.4 Country

7. Form

7.1 Fresh

7.2 Frozen

7.3 Ambient

7.4 Canned & Processed Seafood

8. Type

8.1 Fish

8.2 Crustaceans

8.3 Mollusca

8.4 Others

9. Application

9.1 Retail

9.2 Institutions

9.3 Food Service

10. Country

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Thailand

10.3.7 Malaysia

10.3.8 Indonesia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.5.3 UAE

11. Porter’s Five Forces

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Key Players

13.1 Agrosuper S.A.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Product Portfolio

13.1.5 Financial Insights

13.2 Asian Sea Corporation Public Company Limited

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Product Portfolio

13.2.5 Financial Insights

13.3 Austevoll Seafood ASA

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Product Portfolio

13.3.5 Financial Insights

13.4 Bolton Group SRL

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Product Portfolio

13.4.5 Financial Insights

13.5 Grieg Seafood ASA

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Product Portfolio

13.5.5 Financial Insights

13.6 Maruha Nichiro Corporation

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Product Portfolio

13.6.5 Financial Insights

13.7 Sysco Corporation

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Product Portfolio

13.7.5 Financial Insights

13.8 Thai Union Group PCL

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Product Portfolio

13.8.5 Financial Insights

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com