Global Shrimp Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowGlobal Shrimp Market Trends & Summary

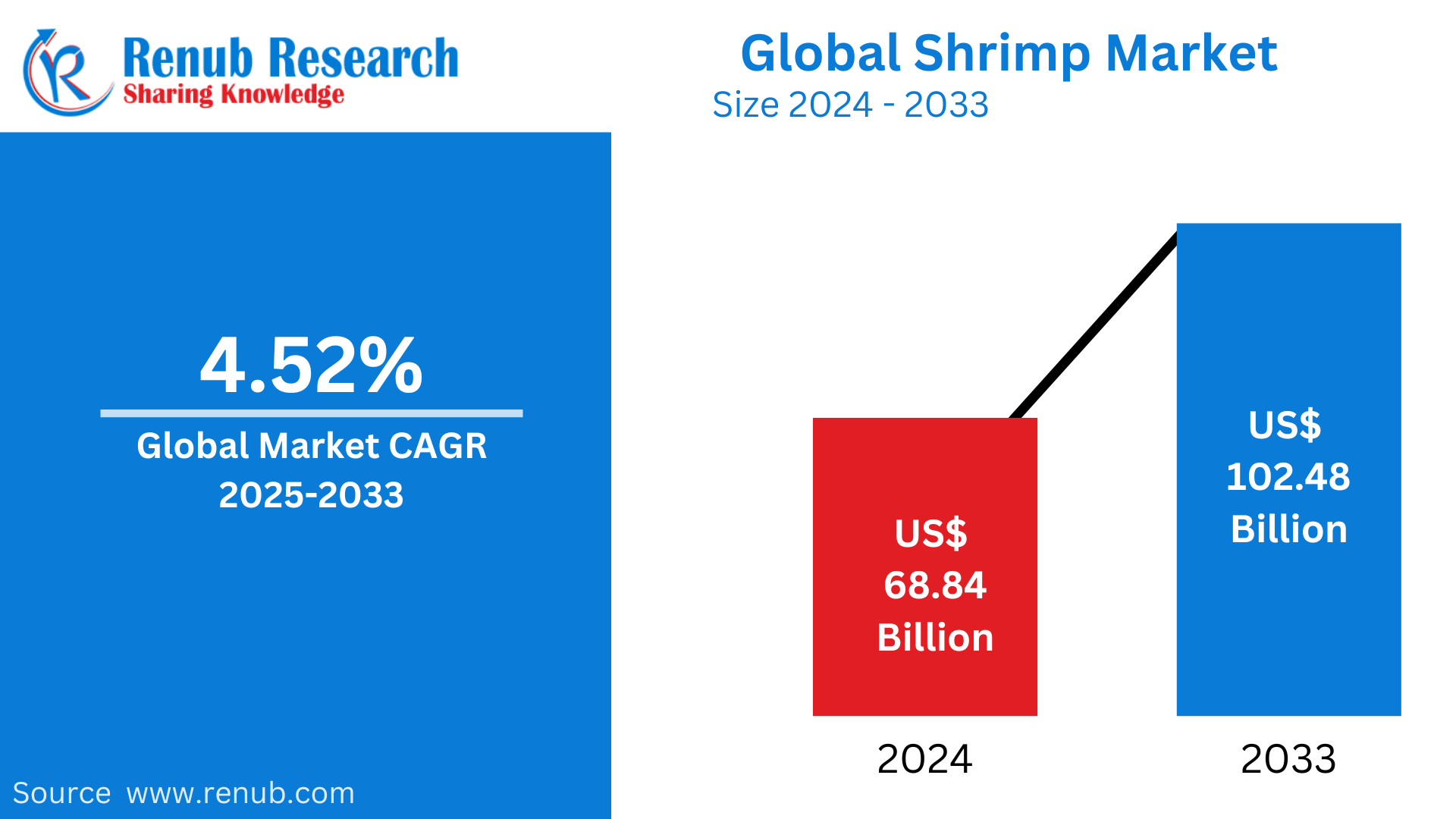

The market for shrimp was worth USD 68.84 billion in 2024 and is anticipated to grow to USD 102.48 billion by 2033, with a CAGR of 4.52%% during the period from 2025 to 2033. The growth of the market is fueled by the rise in seafood consumption, improved health awareness, and technological developments in aquaculture methods. Increased demand for frozen and processed shrimp also supports market growth across the world.

The report Global Shrimp Market Forecast covers by Species (L. vannamei, P. monodon, M.rosenbergii, Others), Size Category (<15, 15-20, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, >70), Product Form (Breaded, Cooked, Peeled, Green/Head-off, Green/Head-on, Other Forms), Country and Company Analysis 2025-2033.

Global Shrimp Market Outlooks

Shrimp is a small, sea-dwelling crustacean found extensively consumed as seafood globally. It is prized for its subtle flavor, high protein value, and low calorie intake, and thus serves as a favorite in healthy diets. Shrimp is available in several preparation forms, such as grilling, steaming, frying, or as an ingredient in soups and salads.

Nutritionally, shrimp is also high in such essential nutrients as omega-3 fatty acids, vitamin B12, iodine, and antioxidants astaxanthin, supporting brain function, cardiovascular health, and immune system defense. Omega-3 fatty acids lower inflammation and enhance heart health, whereas iodine aids thyroid function and metabolism. Moreover, shrimp is low in fat and high in protein, and it supports muscle building and weight control. Its antioxidant activity also plays a role in skin health and anti-aging. But those with shellfish allergies or cholesterol issues should eat shrimp carefully. Generally, shrimp is a nutrient-rich and healthy seafood option.

Growth Drivers in the Global Shrimp Market

Growing Demand for Protein-Rich Seafood

Shrimp is a low-fat, high-protein seafood option, which is favored by health-conscious consumers. The growing trend of healthy eating and fitness culture has increased shrimp consumption globally. Also, shrimp is a popular ingredient in many cuisines, and thus the demand is getting higher in restaurants and homemade food. With health concerns related to red meat consumption, increasing numbers of consumers are opting for lean protein-rich foods such as shrimp. The transition and rising popularity of pescatarian diets are greatly influencing market growth. June 2023, Norwegian aquafeed producer Skretting has introduced Elevia, a revolutionary new shrimp feed for hatcheries and nurseries. The development of Elevia aims to augment nutrition and improve water quality in order to support better larval performance, streamline feed management, and have a cleaner system.

Shrimp Aquaculture Expansion

Progress in shrimp cultivation has resulted in enhanced production and supply globally. India, Vietnam, Ecuador, and Indonesia allocate substantial investments into shrimp aquaculture to keep global markets with a steady supply. Sustainable aquaculture practices such as bio floc technology, recirculating aquaculture systems (RAS), and disease management have enhanced productivity and minimized mortality. This growth ensures shrimp is cheap and easily accessible, sustaining market growth. December 2024, Ace Aquatec's new A-HSU for Shrimp is a transportable system used to stun crustaceans prior to slaughter, which has been developed in cooperation with the producers of shrimp. The first to apply this system is a Thailand-based shrimp farm, with the support of the Shrimp Welfare Project.

Growing Demand for Processed and Value-Added Shrimp

There is a growing demand for processed and value-added shrimp, especially ready-to-eat and processed products in developed economies such as the United States, Europe, and Japan. The market demands convenience-driven seafood products such as frozen, cooked, and breaded shrimp, which have little to no preparation requirement. Expansion of supermarkets, hypermarkets, and internet-based food delivery outlets has further boosted the availability and accessibility of these products. The food service sector also comes into play, with restaurants and fast-food chains including shrimp-based products in their menus. February 2025, Labeyrie Fine Foods has invested €18 million in the opening of two new lines of production of cooked shrimp in its Delpierre unit in western France, doubling the production capacity annually to 18,000 metric tons.

Challenges in the Global Shrimp Market

Environmental Concerns and Sustainability Issues

Shrimp aquaculture has been criticized due to its environmental footprint, such as mangrove forest destruction, water pollution, and excessive use of antibiotics. Unsustainable practices have resulted in habitat loss and biodiversity loss. Consumers and authorities are demanding environmentally friendly and sustainable aquaculture, which demands significant investment and a change in operations for the shrimp aquaculture industry. Certification schemes like ASC (Aquaculture Stewardship Council) and MSC (Marine Stewardship Council) now affect purchasing choices.

Supply Chain Disruptions and Trade Barriers

Shrimp trade relies very much on international trade, so it is sensitive to disruptions in the supply chain due to climate change, pandemics, and geopolitical tensions. Volatility in feed, fuel, and transportation costs also affects profitability. Further, severe import controls and food safety laws in markets such as the EU and the US frequently result in export restrictions for the major shrimp-exporting countries.

Biggest Shrimp Species in the World

Shrimp species vary, but some grow exceptionally large, making them highly valued in the seafood industry. Among the largest shrimp species, the Giant Tiger Prawn (Penaeus monodon) is one of the biggest, reaching up to 13-14 inches (33-36 cm) in length. Found mainly in Southeast Asia, India, and Australia, this species is known for its firm texture and rich flavor.

Another giant species is the Giant Freshwater Prawn (Macrobrachium rosenbergii), also called Malaysian Prawn, which grows up to 12 inches (30 cm). It thrives in rivers and estuaries of Asia and Latin America and is prized for its tender meat and large claws. The Whiteleg Shrimp (Litopenaeus vannamei), commonly farmed worldwide, can reach 9 inches (23 cm) and is known for its mild flavor and adaptability to aquaculture. These giant shrimp species are crucial in global seafood markets, especially in high-end cuisine and commercial exports.

Shrimp Farming Industry

The shrimp aquaculture business is crucial to international aquaculture, supplying millions of tons of shrimp per year to cater to increasing consumer demand. India, Ecuador, Vietnam, Thailand, and Indonesia lead the world in shrimp production, with Whiteleg Shrimp (Litopenaeus vannamei) and Giant Tiger Prawn (Penaeus monodon) being the two most widely cultivated species.

Shrimp farming today is dependent on sophisticated aquaculture methods, such as bio floc technology, recirculating aquaculture systems (RAS), and disease-resistant shrimp varieties. Sustainable practices are gaining ground as the industry struggles with issues such as disease outbreaks, environmental issues, and market price fluctuations.

With growing international seafood consumption, shrimp farms are increasing. They adopt environmentally friendly feeds, better water management, and certifications such as ASC (Aquaculture Stewardship Council) to promote sustainable farming. The industry of shrimp farming is likely to increase with the development of technology and sustainability programs that improve production efficiency while reducing environmental effects.

The ICAR-Central Institute of Brackishwater Aquaculture (CIBA) has launched a revolutionary super-intensive precision shrimp farming technology that can revolutionize India's shrimp farming sector. It is aimed at main problems like outbreak of diseases, increasing cost of production, depressed prices, and global warming. At present, shrimp culture constitutes 70% of India's seafood export earnings worth Rs 46,000 crore with the annual production being around 10 lakh metric tonnes. In the Union Budget 2025, the Government of India increased the Kisan Credit Card (KCC) credit limit to INR 5 lakh (USD 5,773) to enhance credit availability for fishers, farmers, and fishery players. This step is expected to facilitate advanced farming methods and enhance rural development and economic resilience, reflecting the government's focus on inclusive financial assistance.

Global L. vannamei Shrimp Market

L. vannamei (Whiteleg shrimp) holds the dominance of the world's shrimp market because of its superior yield, resistance to disease, and low-cost farming practices. It is largely cultivated in Asia and Latin America and accounts for the highest traded species of shrimp globally. October 2022, Farmers in Kazakhstan have opened the nation's first shrimp farm near Almaty and are making plans for aquafeed and broodstock production.

Global P. monodon Shrimp Market

P. monodon (Black Tiger shrimp) is prized for its bigger size and superior flavor, which tends to command higher market prices. It is widely cultivated in India, Vietnam, and Bangladesh to supply luxury seafood markets and high-end restaurants.

Global 15-20 Size Shrimp Market

Shrimp in the 15-20 size category (per pound) is regarded as valuable and is generally utilized in upscale restaurants, buffets, and specialty seafood stores. Such shrimp types are demanded for grilled and high-quality seafood dishes.

Global 31-40 Size Shrimp Market

Shrimp sized 31-40 is perhaps the most universal category. It is used to a large degree in frozen shrimp products, breaded shrimp, and quick service restaurant fare and is thus found in heavy demand in the food service and retail markets.

Global Breaded Shrimp Market

The breaded shrimp segment is expanding due to increasing demand for frozen and ready-to-cook seafood options. It is popular in fast-food chains and supermarket frozen sections, catering to consumers who seek quick and convenient meal options.

Global Cooked Shrimp Market

Cooked shrimp is widely used in pre-packaged seafood meals and food service applications. Consumers prefer pre-cooked shrimp for its easy preparation, making it a growing segment in domestic and international markets.

Global Green/Head-on Shrimp Market

Green shrimp (head-on) is dominated by export and gourmet markets, particularly in Europe and Asia. It addresses high-end seafood retailers and upmarket restaurants that concentrate on whole, fresh shrimp dishes.

United States Shrimp Market

The U.S. is a major shrimp consumer, and demand is influenced by restaurant chains, supermarkets, and frozen food stores. Convenience-based products like cooked and breaded shrimp are in demand by consumers, promoting imports from Ecuador, India, and Vietnam. April 2023, CP Foods introduced Homegrown Shrimp USA, an Indiantown, Florida, sustainable shrimp farm, which was a major shrimp project in the U.S.

Italy Shrimp Market

Italy boasts a high seafood culture, and shrimp finds extensive use in Mediterranean food. Fresh and wild-caught demand for shrimp remains strong, while premium offerings such as Black Tiger shrimp enjoy hefty sales in top-end seafood chains. Mar 2022, Lisaqua raises €4.9m to open France's first land-based shrimp farm. FoodNavigator sits down with co-founder and CEO Gabriel Boneu to discuss the firm's green production system.

China Shrimp Market

China is the world's leading producer and consumer of shrimp. Although domestic aquaculture is robust, imports of frozen and high-quality shrimp are increasing as a result of urbanization and increased disposable incomes. The food service sector is the major force behind China's shrimp market. February 2025, China topped the list as the biggest importer of Vietnamese shrimp in 2023 with imports worth $834 million, outpacing the U.S. at $756 million, reported VASEP. Shrimp exports are expected to hit $3.9 billion in 2024, a 14% year-on-year growth, with China imports up 39%.

UAE Shrimp Market

The UAE is a seafood-infused market, with high-end hotels, upscale restaurants, and supermarkets being the key drivers for shrimp consumption. With the influence of strong expat and tourist markets, demand for imported shrimp species, such as Vannamei and Black Tiger shrimp, continues to be high. January 2025, Al Islami Foods, the UAE halal poultry and meat specialist, is introducing a new range of Extra Large Shrimps. The range is made up of three types of wild-caught antibiotic- and hormone-free shrimps. Harvested from pristine waters and frozen immediately to retain nutritional content, these shrimps are keto- and high-protein friendly.

Global Shrimp Market Segments

Species

- L. vannamei

- P. monodon

- M.rosenbergii

- Others

Size Category

- <15

- 15-20

- 21-25

- 26-30

- 31-40

- 41-50

- 51-60

- 61-70

- >70

Product Form

- Breaded

- Cooked

- Peeled

- Green/Head-off

- Green/Head-on

- Other Forms

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Person

- Recent Development

- Revenue

Key Players Analysis

- Avanti Feeds Ltd.

- High Liner Foods Inc.

- Surapon Foods

- Thai Union Group

- The Waterbase Ltd.

- Royal Greenland

- Maruha Nichiro Corporation

- Mowi ASA

- Charoen Pokphand Foods PCL

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Species, Size, Product Form and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Shrimp Market

6. Market Share Analysis

6.1 By Species

6.2 By Size

6.3 By Product Form

6.4 By Countries

7. Species

7.1 L. vannamei

7.2 P. monodon

7.3 M.rosenbergii

7.4 Others

8. Size Category

8.1 <15

8.2 15-20

8.3 21-25

8.4 26-30

8.5 31-40

8.6 41-50

8.7 51-60

8.8 61-70

8.9 >70

9. Product Form

9.1 Breaded

9.2 Cooked

9.3 Peeled

9.4 Green/Head-off

9.5 Green/Head-on

9.6 Other Forms

10. Countries

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherland

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Thailand

10.3.7 Malaysia

10.3.8 Indonesia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.5.3 UAE

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1.1 Strength

12.1.2 Weakness

12.1.3 Opportunity

12.1.4 Threat

13. Key Players Analysis

13.1 Avanti Feeds Ltd.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 High Liner Foods Inc.

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 Surapon Foods

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 Thai Union Group

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 The Waterbase Ltd.

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 Royal Greenland

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 Maruha Nichiro Corporation

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Mowi ASA

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

13.9 Charoen Pokphand Foods PCL

13.9.1 Overview

13.9.2 Key Persons

13.9.3 Recent Development & Strategies

13.9.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com