Gluten Free Food Market Global Forecast Report by Product Type (Bakery, Confectionery, Snacks, Beverages, Dairy Products, Ready Meals, Baby Food, Others), Form (Liquid Form, Solid Form), Source(Animal Sources, Dairy, Meat, Plant Sources, Pulses, Oilseed, Rice, Corn, Others), Distribution Channel (Conventional stores, Hotels & restaurants, Educational institutes, E-retailers, Specialty services, Hospitals & drug stores), Countries and Company Analysis 2025-2033

Buy NowGluten Free Food Market Analysis

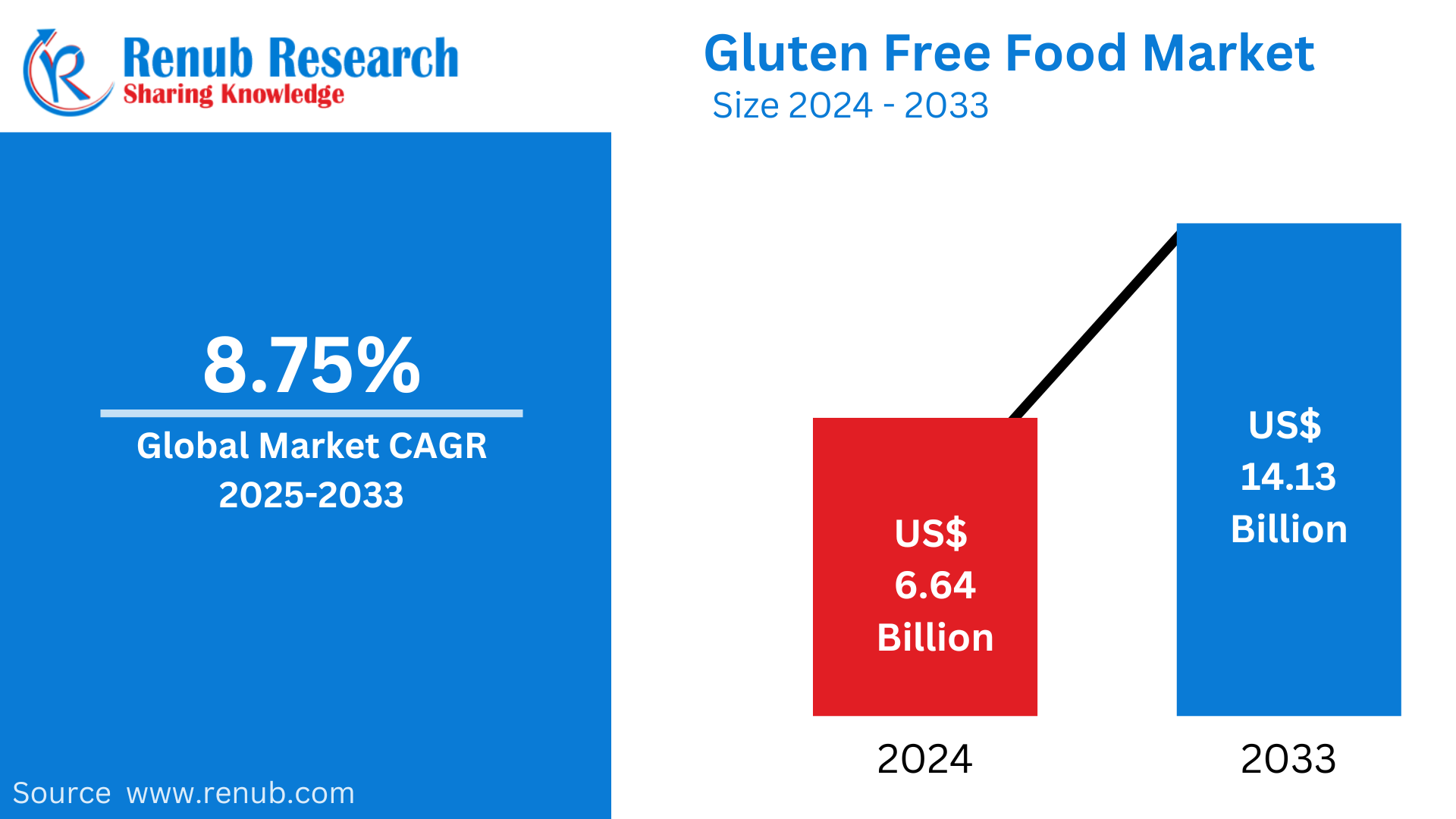

The Global Gluten Free Food Market will reach US$ 14.13 Billion by 2033, up from US$ 6.64 Billion in 2024, with a CAGR of 8.75% between 2025 and 2033. Growing awareness of gluten-related health problems, such as celiac disease and sensitivities, is driving growth in the market for gluten-free foods. Market expansion is driven by rising customer demand for better lifestyles, a wider range of products, and greater accessibility in mainstream retail and foodservice. Dietary changes that favor plant-based and allergy-free meals also play a role.

Global Gluten Free Food Industry Overview

Products that don't include gluten, a protein present in wheat, barley, rye, and their derivatives, are referred to as gluten-free foods. For people with celiac disease, a disorder in which gluten causes immune system reactions that harm the intestines, this kind of food is crucial. People who have a gluten sensitivity or intolerance also steer clear of gluten. Naturally gluten-free grains like rice, quinoa, and corn, as well as goods produced with rice, almond, or coconut flour, are examples of gluten-free foods. As more consumers look for healthier or allergy-friendly diets, the market for gluten-free food has grown beyond individuals with medical needs.

The growing consumer focus on diet plans that incorporate grain-free food alternatives and people's growing awareness of the preventive steps that can be taken to manage gluten intolerance are two major factors driving the market growth for gluten-free products. Furthermore, one of the new developments in the market share of gluten-free products is the increasing use of eco-friendly, eye-catching packaging with clear labeling to attract customers. Another important factor driving expansion is the simple availability of ready-to-eat (RTE) gluten-free meals through online retail platforms, which is a result of the growing e-commerce sector.

Driving Forces of Gluten Free Food Market

Introduction of Beneficial Policies

The introduction of favorable regulations by governments across the world to encourage the use of gluten-free products at reasonable pricing is one of the major recent opportunities in the market for gluten-free products. At the AAHAR food show in April 2022, for instance, the Agricultural & Processed Food goods Export Development Authority (APEDA) introduced a variety of millet goods at reasonable costs for people of all ages, ranging from Rs. 5 to Rs. 15. Every millet product that APEDA introduced was gluten-free and patented, including jowar peanut butter, ragi peanut butter, khichadi, cream cookies, salt biscuits, milk biscuits, millet malts, etc. Furthermore, a number of organizations are offering certifications to brands in order to promote clean labeling, which aids in attracting customers.

The Association of European Coeliac Societies (AOECS), for instance, is a non-profit umbrella organization that runs and owns a gluten-free certification scheme that is known around the world thanks to its registered trademark, the Crossed Grain Symbol. Additionally, brand owners that comply with the AOECS Standard for gluten-free goods and the licensing requirements of the Grossed Grain Symbol are permitted to use this symbol in their pre-packaged food items. In order to provide food manufacturers and retailers with a reliable and affordable path to gluten-free food certification, SGS has teamed up with AOECS. Throughout the anticipated period, the market for gluten-free products will continue to be driven by these activities by various groups.

Growing Cases of Gluten Intolerance and Celiac Disease Will Increase Demand for Products

The demand for these kinds of food products has been driven by the notable rise in the prevalence of celiac disease and gluten sensitivity worldwide. A study that was published in the journal Clinical Gastroenterology and Hepatology estimates that 1.4% of people worldwide have been diagnosed with celiac disease. Advances in medical knowledge and improved diagnostic tools have made it possible to diagnose diseases more easily in persons from different geographical areas. Since avoiding gluten is currently the sole way to prevent celiac disease and gluten sensitivities, there is a greater demand for gluten-free foods.

The incidence of celiac disease is higher in women and children, according to studies, with 17 women and 21 children out of 100,000 being diagnosed with the condition. The 2020 report from the Celiac Disease Foundation states that over the past few decades, the prevalence of celiac disease has increased by 7.5% annually. Additionally, a number of government programs aimed at raising awareness of gluten sensitivity and the growing popularity of gluten-free meals in developing nations are expected to boost market sales.

Boosting Consumer Preference for "Free-from" Foods to Improve Market Results

There is a noticeable surge in demand for the "free-from" food category worldwide. In recent years, the clean-label and "free-from" categories have gone from being niche to becoming popular due to consumers' increased awareness of healthy eating. Customers gravitate toward foods that support them in controlling and preserving their general health. They look for substitute food and drink recipes that fit their diets and help them avoid food sensitivities.

By launching new items to meet the growing demand, manufacturers are also adjusting to the changing preferences of their customers. For example, Base Culture, one of the top frozen bread companies in the United States, debuted their newest gluten-free and shelf-stable breads under the Simply brand in February 2024. Tapioca, flax, hemp, chickpea, and coconut flour are among the clean flours used to make this basic bread line. Additionally, the product is now offered in a variety of flavors, including basic sandwich, super seed, and hint of honey. Additionally, the "free-from" food category can be improved thanks to expanding research and technical advancements, which is anticipated to support market expansion in the years to come.

Gluten Free Food Market Overview by Regions

Due to heightened knowledge of gluten-related illnesses, North America is leading the global market for gluten-free foods. Europe comes in second due to rising desire for solutions that are health-conscious. The Asia-Pacific area is developing, as nations like Australia and Japan are becoming more conscious of and embracing gluten-free diets. The following provides a market overview by region:

United States Gluten Free Food Market

Due to growing knowledge of gluten-related illnesses like celiac disease and gluten sensitivity, the US market for gluten-free foods is among the biggest in the world. For instance, celiac disease is thought to affect 1 in 133 Americans, or roughly 1% of the total population. Recent screening studies, however, suggest that the frequency in the US may be higher than 1%. Growing dietary preferences and health consciousness have increased demand for gluten-free goods. Bread, spaghetti, snacks, and baked products prepared with alternative flours including rice, almond, and coconut are among the many meals available in the market. The market has grown as a result of retail expansion, internet sales, and broad availability in restaurants and supermarkets. As consumers prioritize better lifestyles and allergen-free options, the gluten-free food market in the United States is predicted to continue growing.

Product introductions are a major driver of development in the US market for gluten-free foods as companies respond to growing customer demand by launching creative, varied products like breads, ready meals, and snacks. For instance, Feel Good Foods introduced new breakfast products in the US in November 2022, such as small bagels filled with cheese that is gluten-free. The small bagels filled with gluten-free cream cheese are light on the inside and crispy on the surface. Each bagel comes in two flavors—plain cream cheese and scallion cream cheese—and is topped with all the seasoning.

India Gluten Free Food Market

The market for gluten-free foods in India is expanding significantly due to growing knowledge of celiac disease, gluten intolerance, and the need for better, allergy-free diets. Rice, quinoa, and gluten-free baking flours are among the gluten-free substitutes that consumers are increasingly looking for. With the availability of gluten-free breads, snacks, and packaged goods in stores and online, the market is growing. The market is growing as a result of a growing urban middle class, rising lifestyle diseases, and growing health consciousness. Demand is also being fueled by raising awareness via social media and health initiatives.

United Kingdom Gluten Free Food Market

Growing awareness of gluten-related illnesses including celiac disease and gluten sensitivity is fueling the UK's gluten-free food market's rapid expansion. In the UK, 1 in 100 persons suffer from celiac disease, according to the Coeliac Organization United Kingdom, which is increasing demand for gluten-free foods. Gluten-free bread, snacks, and prepared meals are becoming more and more popular as a result of growing customer demand for healthier, allergy-free diets. Increased availability in health food stores, mainstream supermarkets, and internet platforms supports the market. Additionally, the clientele is rising beyond people with gluten-related diseases due to the growing trend of health-conscious eating and dietary preferences. Two major factors driving the industry are expanded retail distribution and innovative product offers.

Saudi Arabia Gluten Free Food Market

Due to increased knowledge of celiac disease and gluten intolerance, the market for gluten-free foods in Saudi Arabia is expanding. Demand for gluten-free bread, snacks, and cereals has expanded as a result of growing health consciousness and a move toward healthier eating practices. More products are available in supermarkets, health stores, and online marketplaces, which supports the market. With new products meeting a range of dietary requirements and preferences, the industry is growing as more people adopt gluten-free diets for lifestyle and health reasons.

Product Type- Industry is divided into 8 viewpoints:

- Bakery

- Confectionery

- Snacks

- Beverages

- Dairy Products

- Ready Meals

- Baby Food

- Others

Form- Industry is divided into 2 viewpoints:

- Liquid Form

- Solid Form

Source- Industry is divided into 9 viewpoints:

- Animal Sources

- Dairy

- Meat

- Plant Sources

- Pulses

- Oilseed

- Rice

- Corn

- Others

Distribution Channel- Industry is divided into 6 viewpoints:

- Conventional stores

- Hotels & restaurants

- Educational institutes

- E-retailers

- Specialty services

- Hospitals & drug stores

Countries- Industry is divided into 25 viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Malaysia

- Indonesia

- Australia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- Saudi Arabia

- United Arab Emirates

- South Africa

All companies have been covered with 4 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Financial Insights

Company Analysis

- General Mills

- The Hain Celestial Group Inc.

- Kellogg’s Company

- ConAgra Brands Inc.

- The Kraft Heinz Company

- Raisio PLC

- Hero Group AG

- DuPont de Nemours, Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Form, Source, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challengers

5. Global Gluten Free Food Market

6. Market Share Analysis

6.1 By Product Type

6.2 By Form

6.3 By Source

6.4 By Distribution Channel

6.5 By Countries

7. Product Type

7.1 Bakery

7.2 Confectionery

7.3 Snacks

7.4 Beverages

7.5 Dairy Products

7.6 Ready Meals

7.7 Baby Food

7.8 Others

8. Form

8.1 Liquid Form

8.2 Solid Form

9. Source

9.1 Animal Sources

9.1.1 Dairy

9.1.2 Meat

9.2 Plant Sources

9.2.1 Pulses

9.2.2 Oilseed

9.2.3 Rice

9.2.4 Corn

9.2.5 Others

10. Distribution Channel

10.1 Conventional stores

10.2 Hotels & restaurants

10.3 Educational institutes

10.4 E-retailers

10.5 Specialty services

10.6 Hospitals & drug stores

11. Countries

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherlands

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 South Korea

11.3.5 Thailand

11.3.6 Malaysia

11.3.7 Indonesia

11.3.8 Australia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.2 UAE

11.5.3 South Africa

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players Analysis

14.1 General Mills

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development

14.1.4 Product Portfolio

14.1.5 Revenue

14.2 The Hain Celestial Group Inc.

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development

14.2.4 Product Portfolio

14.2.5 Revenue

14.3 Kellogg’s Company

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development

14.3.4 Product Portfolio

14.3.5 Revenue

14.4 ConAgra Brands Inc.

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development

14.4.4 Product Portfolio

14.4.5 Revenue

14.5 The Kraft Heinz Company

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development

14.5.4 Product Portfolio

14.5.5 Revenue

14.6 Raisio PLC

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development

14.6.4 Product Portfolio

14.6.5 Revenue

14.7 Hero Group AG

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development

14.7.4 Product Portfolio

14.7.5 Revenue

14.8 DuPont de Nemours, Inc.

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development

14.8.4 Product Portfolio

14.8.5 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com