Household Cleaners Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowHousehold Cleaners Market Trends & Summary

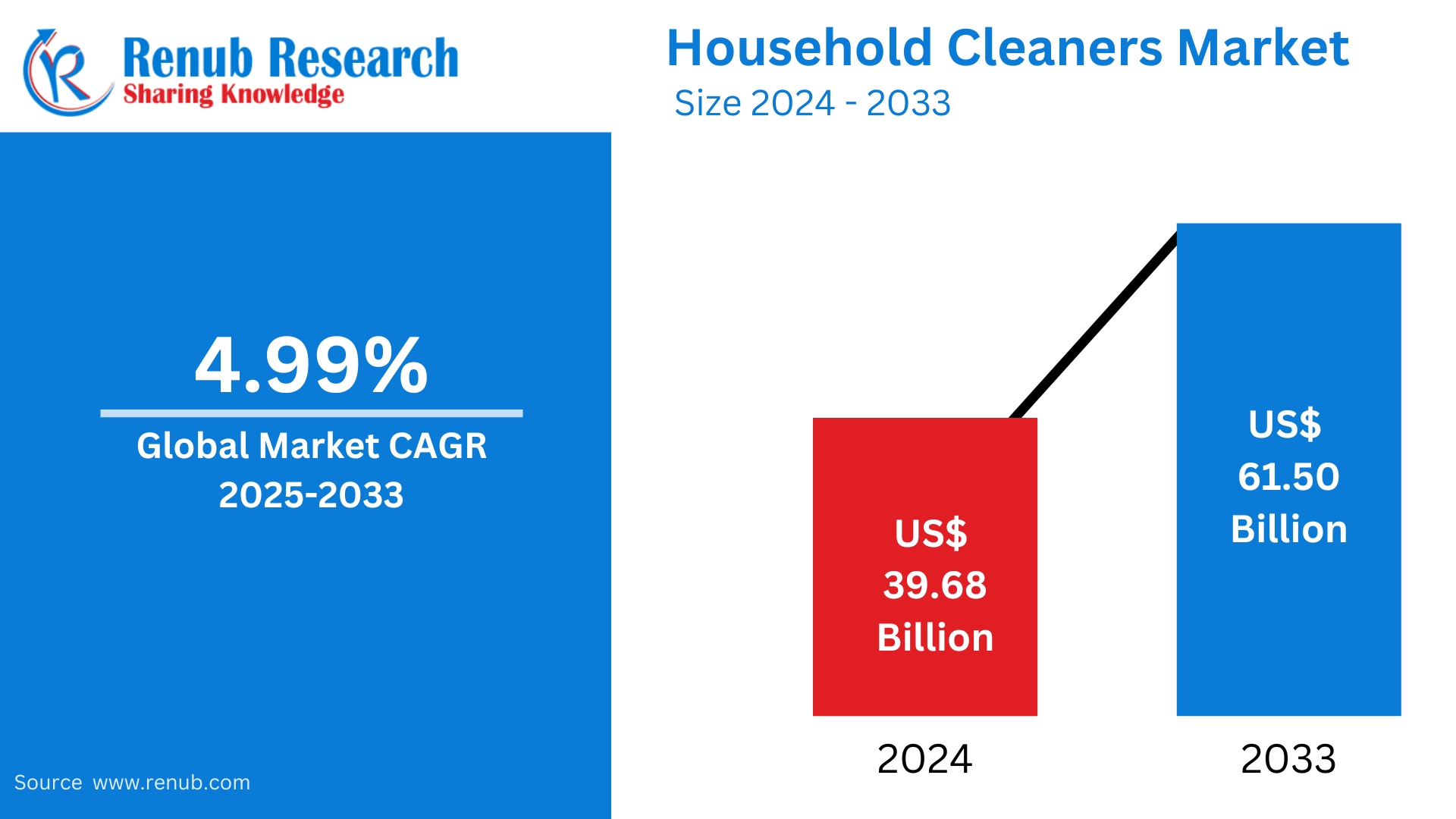

The global household cleaning products market was valued at USD 39.68 billion in the year 2024 and is expected to expand to USD 61.50 billion by the end of 2033, showing a compound annual growth rate of 4.99% from 2025 to 2033. These trends are boosted by increased hygiene awareness, urbanization, and demand for environmentally friendly cleaning products. With further innovations about product formulations and sustainability, the market is expected to boom over the assessment period.

The report Household Cleaners Market & Forecast covers by Type (Surface Cleaner, Glass Cleaner, Toilet Bowl Cleaner, Specialty Cleaners, Bleaches, Others), Application (Kitchen Cleaners, Bathroom Cleaners, Fabric Care, Floor Cleaner), Distribution Channel (Online, Offline), Country and Company Analysis 2025-2033

House cleaner outlooks

House cleaners are chemical cleaning agents for removing dirt, grime, stains, and harmful microorganisms from surfaces around the home. They are manufactured in various forms, such as liquids, powders, sprays, and wipes, containing active ingredients including detergents, disinfectants, enzymes, or abrasives. A household cleaner helps maintain hygiene by preventing the spreading of germs and creating a safe and comfortable living environment.

The various uses of household cleaners cover most parts of the house. Surface cleaners are excellent for countertops, tables, and floors. Glass cleaners ensure windows and mirrors without streaks. Bathroom cleaners address soap scum, mildew, and other tough stains in sinks, tubs, and tiles. Kitchen cleaners effectively degrease and sanitize appliances and surfaces. Laundry detergents eliminate stains and odors from fabrics. In addition, eco-friendly and specialty cleaners are for the households that require sustainable and hypoallergenic cleaning products, which reflects the diverse needs of modern consumers.

Growth Drivers in the Household Cleaners Market

Hygiene and Sanitation Awareness

The increased awareness of hygiene and sanitation, especially after the COVID-19 pandemic, has greatly increased the demand for household cleaners. Consumers now prioritize cleaning products that can eliminate harmful bacteria and viruses, leading to a surge in disinfectant-based and multi-purpose cleaners. Public health campaigns and educational initiatives further emphasize the importance of maintaining home cleanliness to prevent illnesses. This trend is prevalent in both developed and emerging markets, where health-conscious consumers actively seek advanced cleaning solutions that ensure safety for their families. September 2024, LIXIL and UNICEF announced a continued partnership through 2027 to further scale and intensify efforts in six countries to bring safe, clean toilets and hygiene solutions to more communities.

Increasing Urbanization and Changing Lifestyle

Intensification of rapid urbanization and increasing adoption of busy lifestyles have led to the increased demand for efficient, time-saving household cleaning products. Urban homes are generally smaller, and they need multi-purpose, space-saving cleaning products in the form of sprays, wipes, and multi-surface cleaners. Also, working professionals and dual-income families prefer easy cleaning products that ease the burden of household chores. With increasing disposable incomes and a penchant for convenience, premium and specialized cleaners have also become more widely accepted, further propelling the growth of the global household cleaners market. The world is becoming more urbanized, with the percentage of people living in cities increasing from about one-third in 1950 to more than half today. By 2050, the urban population is expected to more than double, with nearly 70% of the world's population living in cities.

Eco-Friendly and Sustainable Cleaning Products

The growing concern for environmental sustainability has driven demand for eco-friendly and biodegradable household cleaners. Consumers are increasingly preferring products made with natural ingredients, devoid of harmful chemicals, and packed in recyclable materials. Brands respond to such demand by offering green cleaning solutions that attract the environmentally sensitive buyer. Regulations from the government, encouraging sustainability practices and decreasing the emission of chemicals, have also motivated the segment. The spread of awareness of eco-friendly products is likely to create a significant driver for growth in the household cleaners market. Feb 2024 Premium Clean Ltd. is a small cleaning business that caters to private clients and businesses based in London. The growing demand for specialized cleaning services that were eco-friendly resulted in the need for the company to expand rapidly to meet the needs of its growing clientele.

Challenges in the Household Cleaners Market

High Competition and Pricing Pressure

The household cleaners market faces intense competition from global and regional players, which creates significant pricing pressure. Established brands compete with private-label products, often offering similar features at lower prices. Additionally, raw materials and manufacturing costs impact profit margins, especially for eco-friendly or premium products. To stay competitive, companies must balance pricing strategies with the quality and effectiveness of their offerings, which can be challenging in price-sensitive markets.

Stringent Rules and Compliance

There are strict regulations concerning the production and marketing of household cleaners regarding safety, chemical composition, and environmental impact. Manufacturers have to adhere to varied standards across geographies and often undergo rigorous testing and certification. This drives up production costs and increases the time taken for product development. Curbs on certain chemicals and sustainable packaging also pose challenges in the compliance process. Manufacturer failure to comply might even result in penalization or withdrawal of a particular product due to its hazard characteristics, hence potentially damaging brand value.

Household Cleaners Market in United States

United States is an intense competitor within North America with heavy public promotion toward hygiene, thereby coupled with some innovative cleaning products. It sees a good rate of rise of disinfecting cleaners and remains one of the most widely required household cleaners mainly by the city-based homes to ensure cleanliness there. And the increasing awareness of environmental concerns will lead to a greater demand for eco-friendly products. Manufacturers do face challenges in complying with strict regulations on chemical use and packaging standards that make it difficult to meet consumer demands while ensuring safety and compliance. In May 2023, SC Johnson introduced a new FamilyGuard Brand, a family of disinfectant formulas designed to help protect families against germs by disinfecting hard, non-porous surfaces.

Germany Household Cleaners Market

Germany is a key player in the European household cleaners market, where consumers increasingly favor sustainable and high-quality cleaning solutions. This market is characterized by a broad range of innovative products that appeal to the eco-conscious consumer who places environmental responsibility at the forefront of their purchasing decisions. In addition, the increased demand for green cleaning options is further enhanced by government efforts to encourage the use of green cleaning products along with strict ecological regulations that encourage biodegradable and chemical-free alternatives. These factors altogether compose a dynamic marketplace landscape, highlighting the increased demand of the company for sociality towards sustainability. January 2022: The Henkel corporation planned to bring its home and laundry division alongside its beauty care divisions under common roof. Combination of the business is hoped from the new planks for providing new consumer brand.

China Household Cleaners Market

China is witnessing a tremendous transformation in its urban landscape, where a rapidly growing population is increasingly opting for modern conveniences. This shift and rising disposable incomes have sparked a burgeoning demand for household cleaning products. Consumers are moving away from traditional cleaning methods, embracing contemporary solutions such as multi-surface cleaners and powerful disinfectants that promise efficiency and efficacy. In addition, there is increased awareness of hygiene and cleanliness among the public, which is encouraged by government campaigns that advocate for sanitation and cleanliness standards. These campaigns emphasize the need to maintain a clean living environment, thus increasing market growth. However, manufacturers are negatively affected by the price sensitivity of consumers, who often look for effective solutions without straining their pockets. Dec 2024 E-Home Household Service Holdings Limited, an integrated home services provider in China, announced that it had introduced AI robotic, automatic cleaning equipment for public place cleaning projects commissioned by e-Home to realize intelligent cleaning services in public places.

Brazil Household Cleaners Market

The household cleaners market in Brazil is growing strongly, driven by urbanization and the increasing demand for cost-effective, multi-purpose cleaning solutions. As the number of people migrating to cities increases, so does the demand for multifunctional cleaning agents that can complete different tasks in an efficient manner. This trend is further driven by the growing purchasing power of the expanding middle-class population, thereby increasing the capacity of more households to spend money on quality cleaning products. However, for international brands, there are a lot of challenges that include volatility in the economy that influences spending habits by consumers and the need to adapt affordable pricing strategies to stay in the game with this market landscape. Oct 2023 Ypê Cleaning brand taps pop culture to launch an all-products-in-one campaign from DPZ Agency and Hungry Man.

Household Cleaners Market in South Africa

Robust growth of the market is happening in South Africa primarily driven by rising awareness towards hygiene and sanitation practices. Today, people residing in cities prefer multipurpose, green, and cleaning agents for healthy sustainability, thereby becoming healthier and more eco-friendly. Yet this very promising scenario comes across a heavy hurdle because premium cleaning agents have lesser availability in the rural area. Furthermore, the high cost of production for such desired commodities has become an immense barrier for widespread market coverage and access within South Africa.

Type- Market breakup in 6 viewpoints:

- Surface Cleaner

- Glass Cleaner

- Toilet Bowl Cleaner

- Specialty Cleaners

- Bleaches

- Others

Application- Market breakup in 4 viewpoints:

- Kitchen Cleaners

- Bathroom Cleaners

- Fabric Care

- Floor Cleaner

Distribution Channel- Market breakup in 2 viewpoints:

- Online

- Offline

Country- Market breakup from 25 Country viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

All the Key players have been covered from 5 Viewpoints:

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Financial Insights

Company Analysis

- Church & Dwight Co. Inc.

- Colgate-Palmolive Company

- Henkel AG & Company KGaA

- Reckitt Benckiser Group plc.

- The Procter & Gamble Company

- Unilever Plc

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Application, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered | 1. Church & Dwight Co. Inc. 2. Colgate-Palmolive Company 3. Henkel AG & Company KGaA 4. Reckitt Benckiser Group plc. 5. The Procter & Gamble Company 6. Unilever Plc |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What was the global household cleaners market value in 2024?

-

What is the projected market size for household cleaners by 2033?

-

What is the expected compound annual growth rate (CAGR) for the market from 2025 to 2033?

-

What are the main types of household cleaners covered in the report?

-

Which applications are the primary drivers for household cleaner demand?

-

What distribution channels are analyzed in the report for household cleaners?

-

What are the major growth drivers for the household cleaners market?

-

What challenges are faced by manufacturers in the household cleaners industry?

-

Which countries have significant market demand for household cleaners?

-

Who are the key players in the household cleaners market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Household Cleaners Market

6. Market Share Analysis

6.1 Type

6.2 Application

6.3 Distribution Channel

6.4 Country

7. Type

7.1 Surface Cleaner

7.2 Glass Cleaner

7.3 Toilet Bowl Cleaner

7.4 Specialty Cleaners

7.5 Bleaches

7.6 Others

8. Application

8.1 Kitchen Cleaners

8.2 Bathroom Cleaners

8.3 Fabric Care

8.4 Floor Cleaner

9. Distribution Channel

9.1 Online

9.2 Offline

10. Country

10.1 North America

10.1.1 United States

10.1.2 Canada

10.2 Europe

10.2.1 France

10.2.2 Germany

10.2.3 Italy

10.2.4 Spain

10.2.5 United Kingdom

10.2.6 Belgium

10.2.7 Netherlands

10.2.8 Turkey

10.3 Asia Pacific

10.3.1 China

10.3.2 Japan

10.3.3 India

10.3.4 Australia

10.3.5 South Korea

10.3.6 Thailand

10.3.7 Malaysia

10.3.8 Indonesia

10.3.9 New Zealand

10.4 Latin America

10.4.1 Brazil

10.4.2 Mexico

10.4.3 Argentina

10.5 Middle East & Africa

10.5.1 South Africa

10.5.2 Saudi Arabia

10.5.3 UAE

11. Porter’s Five Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threat

13. Company Analysis

13.1 Church & Dwight Co. Inc.

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Product Portfolio

13.1.5 Financial Insights

13.2 Colgate-Palmolive Company

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Product Portfolio

13.2.5 Financial Insights

13.3 Henkel AG & Company KGaA

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Product Portfolio

13.3.5 Financial Insights

13.4 Reckitt Benckiser Group plc.

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Product Portfolio

13.4.5 Financial Insights

13.5 The Procter & Gamble Company

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Product Portfolio

13.5.5 Financial Insights

13.6 Unilever Plc

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Product Portfolio

13.6.5 Financial Insights

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com