Global In-Vitro Diagnostics Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowGlobal In-Vitro Diagnostics Market Trends & Summary

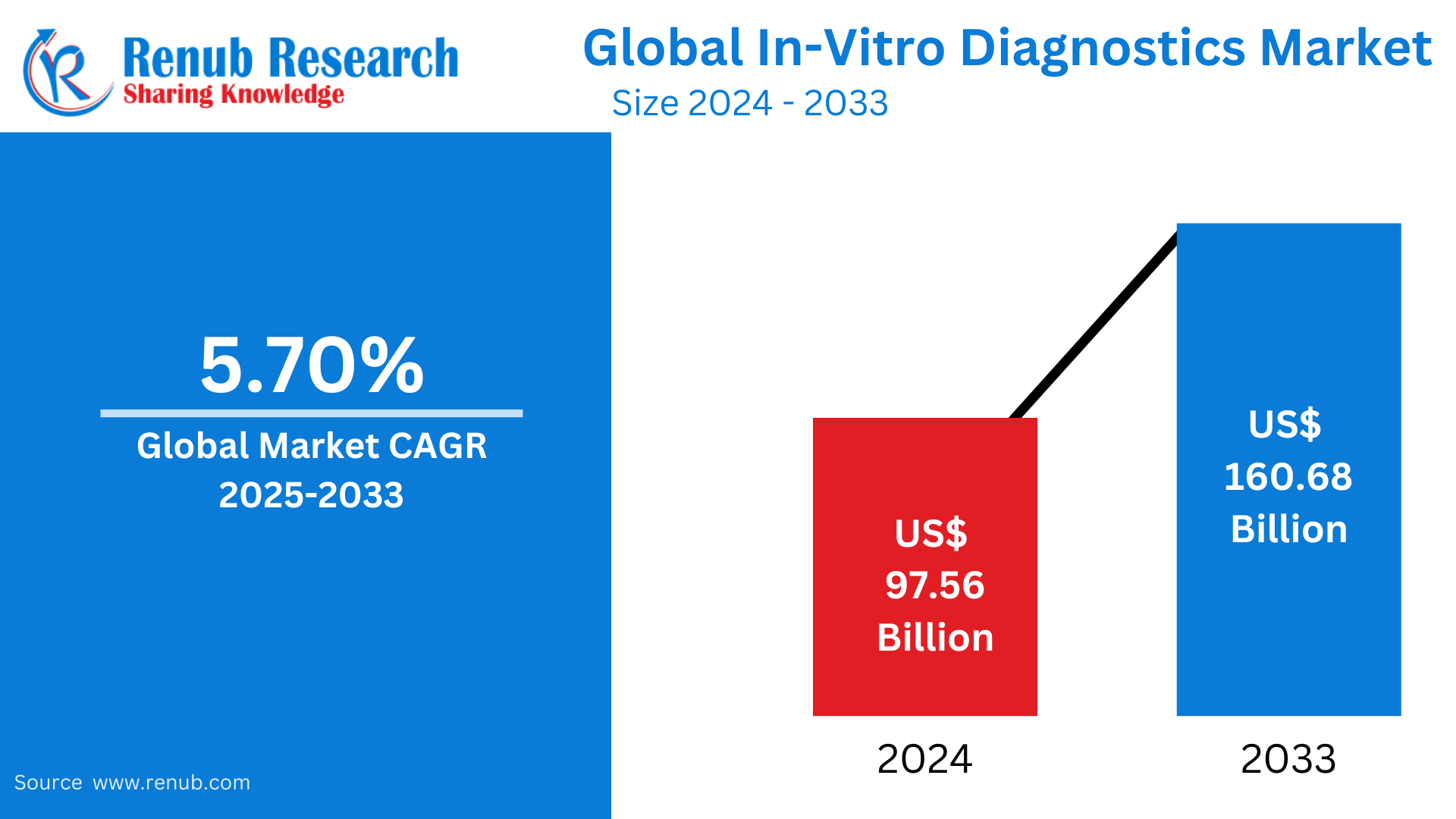

In-Vitro Diagnostics market is expected to reach US$ 160.68 billion by 2033 from US$ 97.56 billion in 2024, with a CAGR of 5.70% from 2025 to 2033. The main drivers propelling the in vitro diagnostics market share are the growing elderly population, the increasing prevalence of infectious diseases, the ongoing technology improvements, and the altering consumer preferences toward personalized medication.

The report In-Vitro Diagnostics Market Global covers by Test Type (Clinical Chemistry, Molecular Diagnostics, Immunodiagnostics, Hematology, Others), Product (Reagents and Kits, Instruments, Other), Usability (Disposable IVD Devices, Reusable IVD Devices), Application (Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Nephrology, Others), End User (Hospitals Laboratories, Clinical Laboratories, Point-of-care Testing Centers, Academic Institutes, Patients, Others), Countries and Company Analysis 2025-2033

In-Vitro Diagnostics Industry Overview

By offering vital instruments for illness diagnosis, monitoring, and prevention, the in-vitro Diagnostics (IVD) sector contributes significantly to the healthcare sector. In order to identify illnesses, ailments, or infections, in-vitro diagnostics tests samples—such as blood, urine, or tissue—outside the body. The industry produces a broad range of goods, such as platforms used in labs, clinics, and hospitals, as well as reagents, test kits, and diagnostics equipment. Applications for IVD solutions include genetic testing, infectious disease diagnosis, cancer detection, and the monitoring of long-term illnesses like diabetes. The IVD market is expanding due to growing technical breakthroughs such automation, point-of-care testing, and molecular diagnostics, which provide more precise, quick, and affordable diagnostics options.

The aging of the world's population, the increasing incidence of chronic diseases, and the growing emphasis on early disease detection are some of the drivers driving the IVD sector. The market is growing as a result of rising healthcare awareness and the need for individualized medicine. Further improving diagnostics capabilities and providing faster and more accurate results are advancements in artificial intelligence, machine learning, and next-generation sequencing (NGS). Patients' accessibility and convenience are also being improved by the continuous transition to point-of-care and home-based testing. The IVD business nevertheless faces obstacles like complicated regulations, the need for constant innovation, and preserving product quality while controlling expenses, despite these development factors. The market does, however, exhibit significant development potential.

A major contributing element to the growth of the worldwide in vitro diagnostics market is the aging population. Between 2015 and 2050, the proportion of the world's population over 60 will almost double, rising from 12% to 22%. Approximately 80% of elderly people will reside in low- and middle-income nations by 2050. As a result, the proportion of geriatric patients in the population has skyrocketed due to the increased life expectancy worldwide. Geriatrics and related morbidities like diabetes, cancer, cardiovascular disease, and neurodegenerative diseases like Alzheimer's disease are currently on a concerning trend because their numbers are rising at the same time that these conditions are becoming more common. The need for IVD products is growing as a result of these disorders, which necessitate the frequent use of diagnostics tests for early detection and monitoring management.

Growth Drivers for the In-Vitro Diagnostics Market

Growing Chronic Illness Prevalence

The market for in vitro diagnostics is experiencing new prospects due to the increasing prevalence of chronic diseases like diabetes, cardiovascular disease, and cancer. In addition, the market is expanding due to the growing need for in vitro diagnostics in the early diagnosis, monitoring, and treatment of serious illnesses. For example, 537 million people worldwide (20–79 years old) have diabetes, according to the 10th edition of the International Diabetes Federation Diabetes Atlas. Approximately 643 million people worldwide will have diabetes by 2030, and by 2045, that figure is predicted to rise to 783 million.

Furthermore, the market is being positively impacted by the widespread use of IVD tests by medical professionals to help them make well-informed treatment decisions because they enable early screening and risk factor identification, enabling prompt preventative interventions. As an illustration, Abbott Laboratories introduced the Panbio COVID-19 Ag Rapid Test Device, a quick COVID-19 antigen test. During the pandemic, the test was frequently utilized for screening and surveillance purposes and produced findings in as little as 15 minutes. Additionally, the Cobas pulse system, a blood glucose management tool with mobile digital health features intended to improve patient care, was introduced by Roche Diagnostics (Switzerland).

Additionally, the FDA approved Roche's VENTANA MMR RxDx Panel to determine which patients with dMMR solid tumors qualify for anti-PD-1 immunotherapy. Additionally, Medicover and ARUP Laboratories partnered in December 2023 to provide healthcare and diagnostics services throughout Europe. In order to select treatments for numerous hemophilia A patients, ARUP Laboratories and BioMarin Pharmaceutical Inc. introduced AAV5 DetectCDx.

Growing Priority for Personalized Medicine

The demand for in vitro diagnostics is being driven by the growing emphasis on personalized medicine, which seeks to customize medical care for each patient according to their genetic composition, lifestyle, and other variables. According to the tailored Medicine Coalition (PMC), for the fourth year in a row, more than one-third (33%) of newly approved FDA drugs in the United States were tailored medications. Accordingly, IVD tests—like genetic testing and companion diagnostics—offer vital information on the distinct traits of patients, allowing for tailored medicines and preventing needless treatments or negative side effects, which is also improving market dynamics.

Furthermore, the identification of certain disease subtypes and molecular targets is made easier by precision diagnostics, which is made possible by cutting-edge technologies like Next-Generation Sequencing (NGS) and companion diagnostics. For example, the Precision the Medicine Centre (PMC) and the Regional Molecular Diagnostics Service (RMDS) joined in August 2023 to introduce genomic technology for the detection of cancer in Northern Ireland. Furthermore, the WHO released the Essential Diagnostics List (EDL) in October 2023. This comprehensive list of IVD goods helps nations make judgments on diagnostics instruments. It provides recommendations based on evidence and ensures that the target population may get necessary products.

Constant Improvements in Technology

Technological developments such as molecular diagnostics, next-generation sequencing, and microfluidics have produced more accurate and robust test findings. Thus, the market statistics for in vitro diagnostics are being enhanced by advanced technology. For instance, ARUP Laboratories received a CE mark from EU-IVDR in November 2023 for its AAV5 DetectCDx, a companion diagnostics used to determine if patients with severe hemophilia A are eligible to receive BioMarin's novel gene therapy, Roctavian. The automation of diagnostics procedures, which lowers human error and boosts efficiency, is another growing trend that will help the industry in the near future.

Siemens Healthineers, for example, introduced the Atellica Solution, a clinical chemistry and immunoassay system that is completely automated. The system has an extensive assay menu, a high throughput, and effective clinical laboratory performance. In June 2023, Japan's Ministry of Health, Labor, and Welfare granted Toray Industries, Inc. marketing permission for the Toray APOA2-iTQ, which is used to diagnose pancreatic cancer. Additionally, Abbott's new laboratory Traumatic Brain Injury (TBI) blood test was approved by the US FDA.

Challenges in the In-Vitro Diagnostics Market

High Market Competition

With numerous well-established companies providing comparable products in a variety of categories, including immunoassays, molecular diagnostics, and point-of-care devices, the in-vitro diagnostics (IVD) market is extremely competitive. Businesses must always innovate to make sure their goods provide better performance, accuracy, and usability if they want to keep market share. However, as most devices produce results that are comparable, it might be challenging to differentiate based just on product quality. Competitive pricing may draw customers, but it also runs the danger of reducing profit margins, thus pricing tactics are also quite important. Businesses must strike a balance between providing affordable solutions and upholding strict quality and innovation standards. The competition is further heightened by low-cost rivals and new entries in expanding areas, which makes it difficult for established brands to maintain their lead.

Technological Complexity

The technological complexity of new devices and systems is increasing as the in-vitro diagnostics (IVD) business develops. Although they offer more accuracy and efficiency, innovations like automated platforms, next-generation sequencing, and molecular diagnostics also pose integration issues. One of the biggest challenges in healthcare settings is making sure new technologies are dependable and easy to use while still working with the current infrastructure. The implementation of cutting-edge diagnostics may be constrained by the lack of funding and technical know-how in many healthcare facilities. Manufacturers need to make significant investments in support services, comprehensive training, and smooth system integration. The difficulty of development and implementation is increased by making sure these solutions can be applied in a variety of contexts, including point-of-care settings and laboratories.

In-Vitro Diagnostics Market Overview by Regions

By countries, the global In-Vitro diagnostics market is divided into United States, Canada, France, Germany, Italy, Spain, United Kingdom, Belgium, Netherlands, Turkey, China, Japan, India, Australia, South Korea, Thailand, Malaysia, Indonesia, New Zealand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia and UAE.

United States In-Vitro Diagnostics Market

The increased prevalence of chronic diseases, the need for individualized medicine, and technical improvements have made the U.S. in-vitro diagnostics(IVD) market one of the biggest and most developed in the world. The market offers a large variety of diagnostics tools and tests, including point-of-care testing devices, immunoassays, and molecular diagnostics. Next-generation sequencing, automation, and artificial intelligence are changing the landscape by increasing the speed and accuracy of diagnosis. Furthermore, the market is expanding because to an aging population and a growing emphasis on early disease identification. The industry is largely shaped by regulatory approvals, especially those from the FDA, but payment issues continue to be a major worry. Notwithstanding these challenges, the U.S. industry is still growing as diagnostics advancements satisfy patient and clinician demands.

Furthermore, in January 2024, the American Cancer Society projected that the number of cancer cases diagnosed in the United States will rise to above 2 million in 2024, up from 1.9 million in 2023. Furthermore, the majority of hospital admissions and prescription fillings in the US are made by patients with chronic diseases, who also use healthcare facilities the most frequently. As a result, the high prevalence of the target and chronic illnesses increases the need for early diagnostics testing in the nation, which benefits the US in vitro diagnostics market. Therefore, during the projected period, these factors are anticipated to propel the growth of the US market.

United Kingdom In-Vitro Diagnostics Market

With a strong emphasis on technology improvements and the growing need for early and precise diagnostics, the UK's in-vitro diagnostics(IVD) market is well-established. An aging population, an increase in the prevalence of chronic diseases, and a greater focus on precision and personalized care are some of the main causes. Numerous diagnostics options are available on the market, including point-of-care devices, immunoassays, and molecular diagnostics. With faster and more precise outcomes, technological advancements like next-generation sequencing, artificial intelligence, and digital health solutions are changing the sector. High-quality products are guaranteed by UK regulatory requirements, such as those established by the Medicines and Healthcare Products Regulatory Agency (MHRA). The UK IVD market is still competitive and growing in spite of obstacles like reimbursement problems and post-Brexit legislative changes.

India In-Vitro Diagnostics Market

The market for in-vitro diagnostics (IVD) in India is growing quickly due to factors like increased chronic illness incidence, improving healthcare awareness, and an increasing need for early disease detection. Numerous products are available on the market, such as point-of-care devices, immunoassays, and molecular diagnostics. Automation, artificial intelligence, and better diagnostics tools are examples of technological developments that are improving test efficiency and accuracy. The market is expanding as a result of rising disposable incomes and health-conscious consumers. Demand is also being driven by government programs to increase access to healthcare and the growing emphasis on reasonably priced diagnostics. But there are also issues like complicated regulations, cost sensitivity, and limited infrastructure in remote areas. India's IVD market is still showing great growth potential.

Saudi Arabia In-Vitro Diagnostics Market

The market for in-vitro diagnostics (IVDs) in Saudi Arabia is expanding significantly due to an aging population, an increase in chronic illnesses, and growing awareness of the value of early diagnosis. As healthcare standards rise, there is a growing need for sophisticated diagnostics technologies such immunoassays, molecular diagnostics, and point-of-care testing equipment. The market is expanding even faster thanks to the Saudi government's Vision 2030 project, which aims to improve healthcare infrastructure and encourage the use of cutting-edge technologies. Additionally, the need for top-notch diagnostics services has increased due to a rise in medical tourism. But there are still issues including the necessity for trained healthcare workers, regulatory barriers, and expensive equipment. Notwithstanding these obstacles, the market is growing as a result of advancements in IVD solutions.

Global In-Vitro Diagnostics Market Segments

Test Type – Market breakup from 5 viewpoints

- Clinical Chemistry

- Molecular Diagnostics

- Immunodiagnostics

- Hematology

- Others

Product – Market breakup from 3 viewpoints

- Reagents and Kits

- Instruments

- Other

Usability – Market breakup from 5 viewpoints

- Disposable IVD Devices

- Reusable IVD Devices

Application – Market breakup from 7 viewpoints

- Infectious Disease

- Diabetes

- Cancer/Oncology

- Cardiology

- Autoimmune Disease

- Nephrology

- Others

End User – Market breakup from 5 viewpoints

- Clinical Laboratories

- Point-of-care Testing Centers

- Academic Institutes

- Patients

- Others

Countries

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Key Players Analysis

- Abbott Laboratories

- Agilent Technologies Inc.

- Biomerieux SA

- Bio-Rad Laboratories Inc.

- F. Hoffmann-La Roche Ltd

- Fujifilm Holdings Corporation

- Illumina Inc.

- Qiagen NV

- Quest Diagnostics

- Sysmex Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Test Type, By Product, By Usability, By Application, By End User and By Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the global in-vitro diagnostics market by 2033?

-

What is the expected CAGR of the in-vitro diagnostics market from 2025 to 2033?

-

Which factors are driving the growth of the in-vitro diagnostics market?

-

What are the main types of tests covered in the report?

-

How is the aging population contributing to the market's expansion?

-

What role does personalized medicine play in the growth of the in-vitro diagnostics market?

-

Which technological advancements are enhancing in-vitro diagnostics testing?

-

What are the key challenges faced by the in-vitro diagnostics market?

-

Which countries are covered in the market analysis?

-

Who are some of the key players in the in-vitro diagnostics industry?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global In Vitro Diagnostics Market

6. Market Share Analysis

6.1 By Test Type

6.2 By Product

6.3 By Usability

6.4 By Application

6.5 By End User

6.6 By Countries

7. Test Type

7.1 Clinical Chemistry

7.2 Molecular Diagnostics

7.3 Immunodiagnostics

7.4 Hematology

7.5 Others

8. Product

8.1 Reagents and Kits

8.2 Instruments

8.3 Other

9. Usability

9.1 Disposable IVD Devices

9.2 Reusable IVD Devices

10. Application

10.1 Infectious Disease

10.2 Diabetes

10.3 Cancer/Oncology

10.4 Cardiology

10.5 Autoimmune Disease

10.6 Nephrology

10.7 Others

11. End User

11.1 Hospitals Laboratories

11.2 Clinical Laboratories

11.3 Point-of-care Testing Centers

11.4 Academic Institutes

11.5 Patients

11.6 Others

12. Countries

12.1 North America

12.1.1 United States

12.1.2 Canada

12.2 Europe

12.2.1 France

12.2.2 Germany

12.2.3 Italy

12.2.4 Spain

12.2.5 United Kingdom

12.2.6 Belgium

12.2.7 Netherlands

12.2.8 Turkey

12.3 Asia Pacific

12.3.1 China

12.3.2 Japan

12.3.3 India

12.3.4 Australia

12.3.5 South Korea

12.3.6 Thailand

12.3.7 Malaysia

12.3.8 Indonesia

12.3.9 New Zealand

12.4 Latin America

12.4.1 Brazil

12.4.2 Mexico

12.4.3 Argentina

12.5 Middle East & Africa

12.5.1 South Africa

12.5.2 Saudi Arabia

12.5.3 UAE

13. Porter's Five Forces Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Competition

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1 Strength

14.2 Weakness

14.3 Opportunity

14.4 Threats

15. Key Players Analysis

15.1 Abbott Laboratories

15.1.1 Overview

15.1.2 Key Person

15.1.3 Recent Development

15.1.4 Revenue

15.2 Agilent Technologies Inc.

15.2.1 Overview

15.2.2 Key Person

15.2.3 Recent Development

15.2.4 Revenue

15.3 Biomerieux SA

15.3.1 Overview

15.3.2 Key Person

15.3.3 Recent Development

15.3.4 Revenue

15.4 Bio-Rad Laboratories Inc.

15.4.1 Overview

15.4.2 Key Person

15.4.3 Recent Development

15.4.4 Revenue

15.5 F. Hoffmann-La Roche Ltd

15.5.1 Overview

15.5.2 Key Person

15.5.3 Recent Development

15.5.4 Revenue

15.6 Fujifilm Holdings Corporation

15.6.1 Overview

15.6.2 Key Person

15.6.3 Recent Development

15.6.4 Revenue

15.7 Illumina Inc.

15.7.1 Overview

15.7.2 Key Person

15.7.3 Recent Development

15.7.4 Revenue

15.8 Qiagen NV

15.8.1 Overview

15.8.2 Key Person

15.8.3 Recent Development

15.8.4 Revenue

15.9 Quest Diagnostics

15.9.1 Overview

15.9.2 Key Person

15.9.3 Recent Development

15.9.4 Revenue

15.10 Sysmex Corporation

15.10.1 Overview

15.10.2 Key Person

15.10.3 Recent Development

15.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com