India Cold Chain Market, Size, Share, Forecast 2024-2030, Industry Trends, Growth, Insight, Top Companies Analysis

Buy NowIndia Cold Chain Market Outlook

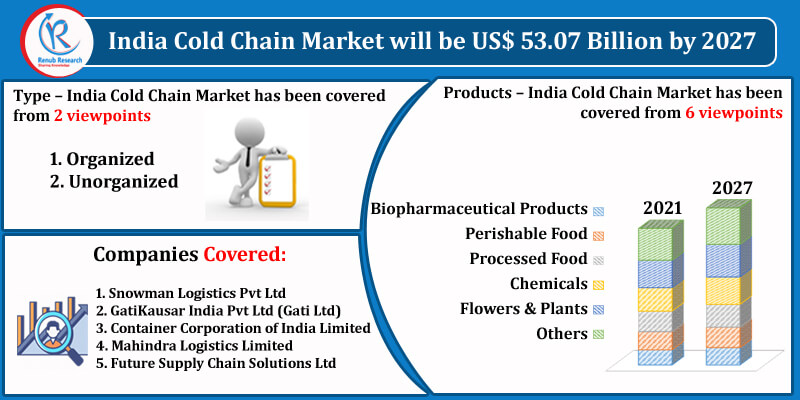

A cold chain indicates the transportation and warehousing of temperature-sensitive products from the point of origin to the end of consumption, which increases shelf life and prevents spoilage. Today, the cold chain industry in India is rising from a nascent scaffold, making it one of the encouraging fields in the warehousing and logistics industry. Moreover, thus far, cold storage facilities in India had only been limited mainly to storing perishable horticulture produce such as fruits and vegetables but now have expanded to numerous other products as well. According to Renub Research new report, India Cold Chain Market is expected to reach US$ 53.07 Billion by 2027.

The Realms of Indian Cold Chain Industry

The Indian Cold Chain Market revolves around the realms of Organized and Unorganized sectors. More recently, the organized industry's growth involves the application of cold chains across third-party logistics (3PLs), Quick service restaurants (QSR), retail, e-commerce. Recently, foodservice industries supported by changing consumption patterns have also brought the cold chain segments into focus. Thus, with the growth in organized food delivery, e-commerce remains a crucial driver for the cold chain sector in India.

Indian Cold Chain Industry will grow with double CAGR of 13.66% from 2021 to 2027

Nowadays, consumers demand many biopharmaceutical products, fresh perishable food (fruits, vegetables, meat, seafood, dairy products), processed food, chemicals, flowers, & plants, which are temperature-sensitive commodities requiring a cold chain infrastructure. Therefore, setting up a robust cold chain infrastructure is a crucial step in efficiently controlling their supply chains. The trend is now changing towards setting multipurpose cold storage and catering end-to-end services across the value chain.

Notwithstanding, pharmaceutical products are highly susceptible to temperature and time constraints, making cold chains essential for cold chain application. In the present situation where safe delivery of vaccines for mass immunization against COVID-19 is an absolute priority, the cold chain is in huge demand across a country-wide footprint. The development is primarily driven by apprehending increased market by organized cold chain operators, changing consumer behaviour for quality products, and securing supply reliability in a pandemic like situation.

In addition, traditional dairy products such as ghee (clarified butter), curd (yoghurt) and paneer (cottage cheese) are primarily catered to by the unorganized sector. However, with the increasing quality consciousness of consumers, organized sector play is expected to grow in these products in the years to come. Apart from this, the factors acting as catalysts for the cold chain industry includes rising emphasis on reducing food wastage and government initiatives like FDI relaxation.

COVID-19 Impact on Indian Cold Chain Industry

The pandemic has positively impacted the cold chain industry, fuelling the market for cold chain market. The widening adoption rate of packaged food & beverage products is an encouraging take for the growth of the cold chain in India. The COVID-19 impacted every industry's supply chain due to restricted trade during the pandemic, resulting in food manufacturers emphasizing food products and their storage to increase their shelf-life, which propelled the market for the cold chain.

Further, the explosion of COVID-19 also has created a shift toward an organized retail market to prevent further virus outbreaks. Consumers have stockpiled processed food stocks with a long shelf life to perishable foods, and limited trade movements between states have surpassed cold chain storage capacities in certain conditions. Hence, the Indian infrastructure underscores the need for the food value chain to move from open-air markets to a cold-chain model to preserve perishable items for a longer duration massively.

Cold Chain Industry is expanding at a faster pace in Tier I and Tier II cities of India:

The cold chain industrial clusters are concentrated in major metro cities. Cold Chain Industry has massive potential in Tier I (Delhi, Mumbai, Bangalore, Chennai, Hyderabad, Kolkata, Ahmedabad and Pune) and Tier-II cities (Gurgaon, Noida, Vellore, Coimbatore, Kochi, Thiruvananthapuram, Patna, Rajkot, Goa, Lucknow and Jaipur). Also, an uptick in investment activity amongst the cities is seen. Thus the industry is more likely to attract significant capital inflow and new capacity creation in the forthcoming years. Our research findings show that India Cold Chain Market Size was US$ 24.62 Billion in 2021.

Critical Companies Performance in India:

The Indian Cold Chain Industry is a fragmented market, consisting of many local players to cater to the growing expectations and demand. Remarkable of the major players in the market include Snowman Logistics Pvt Ltd, GatiKausar India Pvt Ltd (Gati Ltd), Container Corporation of India Limited, Mahindra Logistics Limited and Future Supply Chain Solutions Ltd.

Renub Research latest report “India Cold Chain Market, Global Forecast By Type (Organized and Unorganized), Products (Biopharmaceutical Products, Perishable Food (Fruits, Vegetables, Meat, Seafood, Dairy Products), Processed Food, Chemicals, Flowers & Plants and Others), Companies (Snowman Logistics Pvt Ltd, GatiKausar India Pvt Ltd (Gati Ltd), Container Corporation of India Limited, Mahindra Logistics Limited and Future Supply Chain Solutions Ltd)” provides a detailed analysis of India Cold Chain Industry.

Type – India Cold Chain Market has been covered from 2 viewpoints:

1. Organized

2. Unorganized

Products – India Cold Chain Market has been covered from 6 viewpoints:

1. Biopharmaceutical Products

2. Perishable Food (Fruits, Vegetables, Meat, Seafood, Dairy Products)

3. Processed Food

4. Chemicals

5. Flowers & Plants

6. Others

Company Insights:

• Overview

• Recent Development & Strategies

• Financial Insights

Companies Covered:

1. Snowman Logistics Pvt Ltd

2. GatiKausar India Pvt Ltd (Gati Ltd)

3. Container Corporation of India Limited

4. Mahindra Logistics Limited

5. Future Supply Chain Solutions Ltd

Report Details:

| Report Features | Details |

| Base Year | 2020 |

| Historical Period | 2017 - 2021 |

| Forecast Period | 2022-2027 |

| Market | US$ Billion |

| Segments Covered | Type, Products |

| Companies Covered | Snowman Logistics Pvt Ltd, GatiKausar India Pvt Ltd (Gati Ltd), Container Corporation of India Limited, Mahindra Logistics Limited and Future Supply Chain Solutions Ltd |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Questions This Report Answers:

The report on the India Cold Chain market covers:

- Analysis of the factors, market trends and insights, growth drivers and challenges and the impact COVID-19 on India Cold Chain Industry

- Characteristics of the leading players on the market

- Analysis of the competitive landscape

- Market shares of the Product type, End-users, Regions

How Can You Benefit from This Report?

- You will discover reliable and verified market data, with which you can confidently make smarter business decisions and drive your business

- You can add value to pitches and presentations by using verified market data

- Cost-effectively own a strategic analysis and you will gain competitive intelligence about the market and market trends

- Identify key market trends and insights

- You can build and execute upon a strong strategy based on verified data and with expert insights

- Discover how the market performed in the historical year in the last 4 years and how the market will perform in the upcoming years 6 years

- You can make important strategic decisions with confidence

- You can evaluate your position on the market

- Save your time and resources by not having to compile the whole research by yourself

- You will get all the data in one place

- Empower your marketing, branding, strategy, product and business development

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. India Cold Chain Market

6. Market Share

6.1 By Type

6.2 By Products

7. Type – India Cold Chain Market

7.1 Organized

7.2 Unorganized

8. Products – India Cold Chain Market

8.1 Biopharmaceutical Products

8.2 Perishable Food (Fruits, Vegetables, Meat, Seafood, Dairy Products)

8.3 Processed Food

8.4 Chemicals

8.5 Flowers & Plants

8.6 Others

9. Cold Chain Projects Assisted by MoFPI in States

10. List of Cold Chain Projects in Cities

11. Company Analysis

11.1 Snowman Logistics Pvt Ltd

11.1.1 Overview

11.1.2 Recent Development

11.1.3 Financial Insights

11.2 GatiKausar India Pvt Ltd (Gati Ltd)

11.2.1 Overview

11.2.2 Recent Development

11.2.3 Financial Insights

11.3 Container Corporation of India Limited

11.3.1 Overview

11.3.2 Recent Development

11.3.3 Financial Insights

11.4 Mahindra Logistics Limited

11.4.1 Overview

11.4.2 Recent Development

11.4.3 Financial Insights

11.5 Future Supply Chain Solutions Ltd

11.5.1 Overview

11.5.2 Recent Development

11.5.3 Financial Insights

List Figures:

Figure-01: India Cold Chain Market (Billion US$), 2017 – 2021

Figure-02: Forecast for – India Cold Chain Market (Billion US$), 2022 – 2027

Figure-03: Type – Organized Market (Billion US$), 2017 – 2021

Figure-04: Type – Forecast for Organized Market (Billion US$), 2022 – 2027

Figure-05: Type – Unorganized Market (Billion US$), 2017 – 2021

Figure-06: Type – Forecast for Unorganized Market (Billion US$), 2022 – 2027

Figure-07: Products – Biopharmaceutical Products Market (Billion US$), 2017 – 2021

Figure-08: Products – Forecast for Biopharmaceutical Products Market (Billion US$), 2022 – 2027

Figure-09: Products – Perishable Food (Fruits, Vegetables, Meat, Seafood, Dairy Products) Market (Billion US$), 2017 – 2021

Figure-10: Products – Forecast for Perishable Food (Fruits, Vegetables, Meat, Seafood, Dairy Products) Market (Billion US$), 2022 – 2027

Figure-11: Products – Processed Food Market (Billion US$), 2017 – 2021

Figure-12: Products – Forecast for Processed Food Market (Billion US$), 2022 – 2027

Figure-13: Products – Chemicals Market (Billion US$), 2017 – 2021

Figure-14: Products – Forecast for Chemicals Market (Billion US$), 2022 – 2027

Figure-15: Products – Flowers & Plants Market (Billion US$), 2017 – 2021

Figure-16: Products – Forecast for Flowers & Plants Market (Billion US$), 2022 – 2027

Figure-17: Products – Others Market (Million US$), 2017 – 2021

Figure-18: Products – Forecast for Others Market (Million US$), 2022 – 2027

Figure-19: Snowman Logistics Pvt Ltd – India Revenue (Million US$), 2017 – 2021

Figure-20: Snowman Logistics Pvt Ltd – Forecast for India Revenue (Million US$), 2022 – 2027

Figure-21: Gati Kausar India Pvt Ltd (Gati Ltd) – India Revenue (Million US$), 2017 – 2021

Figure-22: Gati Kausar India Pvt Ltd (Gati Ltd) – Forecast for India Revenue (Million US$), 2022 – 2027

Figure-23: Container Corporation of India Limited – India Revenue (Million US$), 2017 – 2021

Figure-24: Container Corporation of India Limited – Forecast for India Revenue (Million US$), 2022 – 2027

Figure-25: Mahindra Logistics Limited – India Revenue (Million US$), 2017 – 2021

Figure-26: Mahindra Logistics Limited – Forecast for India Revenue (Million US$), 2022 – 2027

Figure-27: Future Supply Chain Solutions Ltd – India Revenue (Million US$), 2017 – 2021

Figure-28: Future Supply Chain Solutions Ltd – Forecast for India Revenue (Million US$), 2022 – 2027

List Of Tables:

Table-01: India – Cold Chain Market Share by Type (Percent), 2017 – 2021

Table-02: India – Forecast for Cold Chain Market Share by Type (Percent), 2022 – 2027

Table-03: India – Cold Chain Market Share by Products (Percent), 2017 – 2021

Table-04: India – Forecast for Cold Chain Market Share by Products (Percent), 2022 – 2027

Table-05: Cold Chain Projects Assisted by MoFPI in States

Table-06: List of Cold Chain Projects in Cities

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com