India Diesel Engine Market Forecast Report by Power Capacity (up to 0.5 MW, 0.5 MW-1MW, 1MW-2MW, 2MW-5MW, Above 5MW), Application (On-Road [Light Vehicles, Medium/Heavy Trucks, Light Trucks] Off-Road [Industrial/Construction Equipment, Power Generation, Agriculture Equipment, Marine Applications]), Regions (North, South, East & West India) and Company Analysis 2025-2033

Buy NowIndia Diesel Engine Market Size

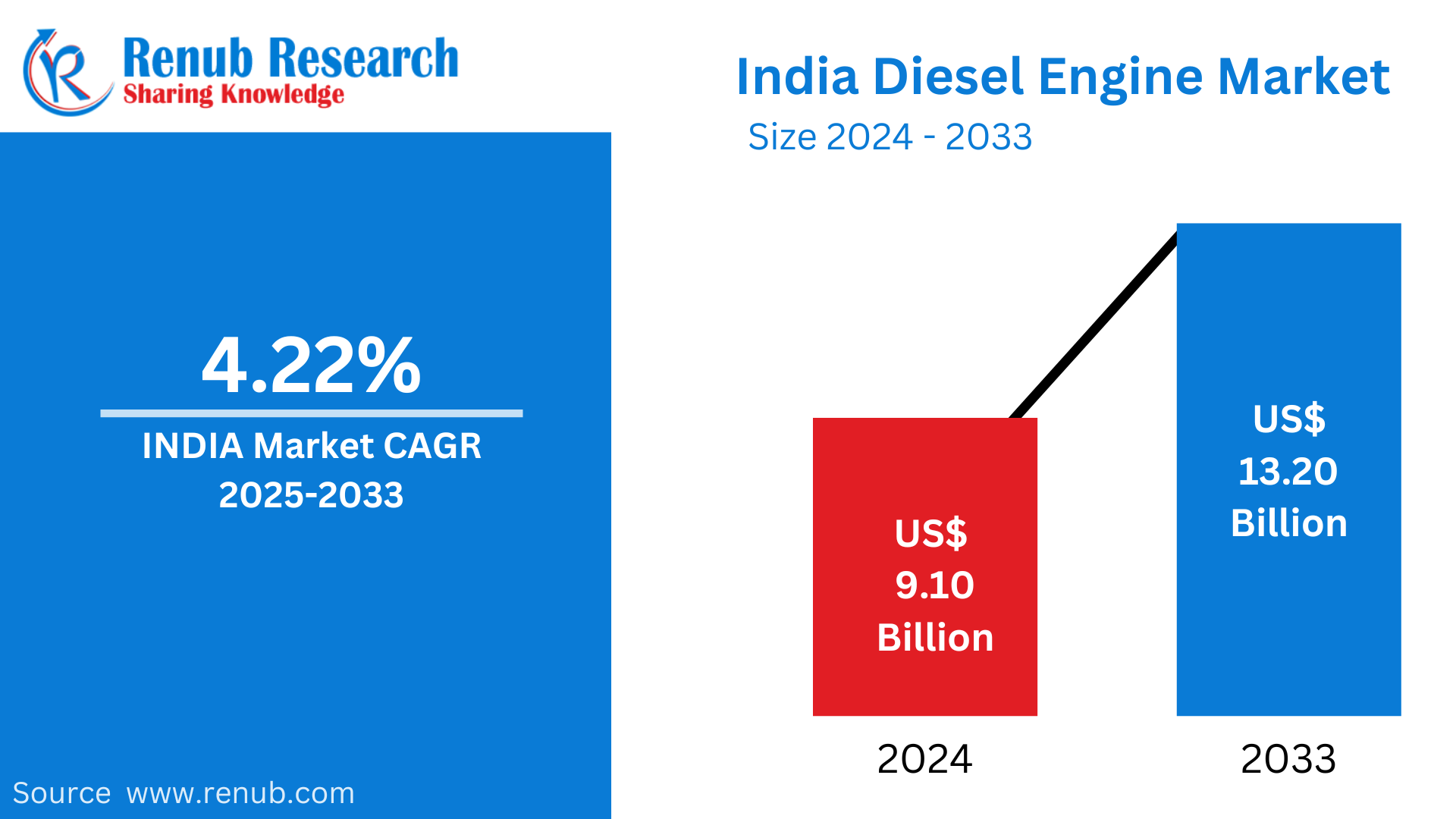

India Diesel Engine market is expected to reach US$ 9.10 billion in 2024 to US$ 13.20 billion by 2033, with a CAGR of 4.22 % from 2025 to 2033. Due to the extensive use of diesel engines in a variety of industries, including as power generation, construction, agriculture, and automobiles, the Indian market for diesel engines has been expanding significantly.

India Diesel Engine Industry Overview

Diesel engines are internal combustion engines that use the compression ignition idea. To ignite the fuel, a cylindrical vessel is filled with hot compressed air. Power and heat are produced by converting the chemical energy of the fuel into mechanical energy. Diesel engines are also noted for their high torque output, which qualifies them for heavy-duty applications such as tractors, locomotives, and marine vessels. Diesel engines are also widely employed in many different industries and have good thermal efficiency due to their high expansion ratio.

Diesel engines' tremendous torque output makes them ideal for heavy-duty applications. They are also more fuel-efficient than gasoline engines in situations that require a steady power output over a long distance or time. Additionally, one factor driving the growth of the diesel engine market is the requirement for reliable electricity in commercial, industrial, and residential settings.

Diesel engine nitrogen emissions have been connected to detrimental effects on the environment and human health. Concerns about air pollution and climate change lead to stricter emission standards. Additionally, the availability of natural gas has led to a push for natural gas engines, which are thought to be a good alternative to diesel engines. Therefore, throughout the duration of the forecast period, it is expected that this trend will restrain market expansion.

Growth Drivers for the India Diesel Engine Market

Growing Infrastructure Development

The expansion of India's infrastructure, especially in the building industry, is a key factor propelling the market for diesel engines. The need for diesel-powered machinery and equipment has increased as the nation concentrates on developing its road networks, highways, bridges, and urban infrastructure. Heavy equipment like excavators, bulldozers, cranes, and generators—all necessary for large-scale projects—are powered by diesel engines, which are a vital component of construction activities. Furthermore, diesel engines are frequently found in trucks and cement mixers, two types of transportation equipment that are essential for getting supplies to building sites. The need for dependable, high-performance diesel engines to fulfill these ambitious development ambitions is further fueled by the Indian government's increased infrastructure spending through programs like the Smart Cities Mission and the Bharatmala Pariyojana.

Increasing Government Support

In India, government assistance is a major factor propelling the market expansion for diesel engines. Programs like "Make in India" encourage the production of diesel engines and parts locally in an effort to increase domestic manufacturing and lessen reliance on imports. Investment in manufacturing facilities has resulted from this strategy, increasing production capacity and advancing technology. Furthermore, the need for diesel engines in the fields of building, transportation, and power generation is increased by infrastructure development programs like the Bharatmala Pariyojana, Pradhan Mantri Awas Yojana, and Smart Cities Mission. Diesel engines that are long-lasting and fuel-efficient are needed for these projects in order to power backup generators, cars, and machines. Diesel engines will continue to be used in both domestic and international markets because to the government's emphasis on enhancing infrastructure and encouraging local industry.

Rapid Industrialization

India's industrialization is a major factor driving the market for diesel engines since it raises demand for heavy-duty machinery and equipment due to the growth of the manufacturing, mining, and power generating industries. Large industrial equipment including excavators, drills, crushers, and generators used in mines and manufacturing facilities are powered by diesel engines. Diesel engines are favored in the mining sector due to their dependability and fuel efficiency, as activities are frequently conducted in isolated locations. In a similar vein, the power generation industry depends on diesel-powered generators to sustain off-grid locations and supply backup electricity. The demand for robust and high-performing diesel engines in these sectors is anticipated to increase as India's industrial boom continues, especially under programs like "Make in India," which will further propel market expansion.

India Diesel Engine Market Overview by Regions

Regional industrial centers including Maharashtra, Gujarat, Tamil Nadu, and Uttar Pradesh are driving the diesel engine market in India. While the northern and eastern areas concentrate on infrastructure development, mining, and agriculture, the western and southern states see considerable demand in the manufacturing and electricity sectors. An overview of the market by region is given below:

North India Diesel Engine Market

The market for diesel engines in North India is largely driven by the region's expanding industrial, agricultural, and infrastructure sectors. The demand for diesel engines is high in key states like Uttar Pradesh, Haryana, Punjab, and Rajasthan, especially in agriculture, where they power harvesters, tractors, and irrigation pumps. Manufacturing, mining, and construction also require heavy machinery and diesel-powered generators for operations, and the region's ongoing infrastructure development—including road projects, housing, and urban expansion under government schemes like Smart Cities Mission—also increases demand for diesel engines. Northern India also depends on diesel engines for backup systems and power generation in off-grid areas. With significant investment in infrastructure and industrialization, the North India diesel engine market is expected to grow further, driven by both agricultural and industrial applications.

South India Diesel Engine Market

The strong demand in industry, infrastructure development, and agriculture is driving the diesel engine market in South India. Diesel engines power tractors, irrigation pumps, and harvesting equipment in important agricultural states including Tamil Nadu, Karnataka, Andhra Pradesh, and Kerala. With robust automotive, textile, and chemical manufacturing industries that depend on diesel-powered equipment and backup generators, the area also has a robust industrial base. Additionally, the need for diesel engines in construction and transportation is fueled by the continuous expansion of infrastructure in cities like Chennai, Bengaluru, and Hyderabad, which is aided by government initiatives and urbanization. The need for off-grid and backup diesel engine solutions is further supported by South India's growing power generation capability, particularly in rural areas. In general, the market in this area is still being driven by infrastructural development, industrial growth, and agricultural expansion.

East India Diesel Engine Market

Mining, infrastructural development, and agriculture are the main drivers of the diesel engine market in East India. Strong agricultural industries can be found in important states like West Bengal, Odisha, Bihar, and Jharkhand. Tractors, irrigation pumps, and other farming equipment are powered by diesel engines. The need for diesel engines to power large machinery used in extraction and processing operations is further increased by the mining sector in states like Jharkhand and Odisha. Additionally, diesel-powered generators and construction equipment are needed for the region's expanding infrastructure development, which includes housing developments, bridges, and roadways. In rural and isolated locations with poor grid connectivity, diesel engines are also essential for producing electricity. The market for diesel engines is continuously growing in East India as a result of government initiatives and industrial development, especially in the mining, infrastructure, and agriculture sectors.

West India Diesel Engine Market

The market for diesel engines in West India is driven by a number of industries, including infrastructure, manufacturing, and agriculture. Important industrial centers with high demand for diesel engines in manufacturing, construction, and power generation include Maharashtra, Gujarat, and Rajasthan. The state of Maharashtra, which is home to Mumbai, the financial center of India, depends on diesel-powered generators for backup power in businesses and industry. Diesel engines are essential to Gujarat's booming industrial and automotive industries for generators, cars, and machinery. Additionally, the demand for construction machinery is increased by regional infrastructure projects, while the agricultural industry in Rajasthan requires diesel-powered farming equipment. In isolated locations, diesel engines are also necessary for off-grid power generation. West India continues to be a major market for diesel engines due to its continuous industrialization, infrastructural development, and agricultural activities, which supports the rise in the region.

Power Capacity Segmentation

| Segment | Percentage |

|---|---|

| up to 0.5 MW | xx% |

| 0.5 MW - 1MW | xx% |

| 1MW - 2MW | xx% |

| 2MW - 5MW | xx% |

| Above 5MW | xx% |

Application- Industry is divided into 2 viewpoints:

- On-Road

- Light Vehicles

- Medium/Heavy Trucks

- Light Trucks

- Off-Road

- Industrial/Construction Equipment

- Power Generation

- Agriculture Equipment

- Marine Applications

Regions- Industry is divided into 25 viewpoints:

- North India

- South India

- East India

- West India

All companies have been covered with 5 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis

- Kirloskar Oil Engines Ltd.

- Mahindra & Mahindra Ltd.

- MHI VST Diesel Engines Pvt Ltd.

- Simpson & Co. Ltd.

- Cooper Corporation Private Limited

- Kohler India Corporation Private Limited

- Bajaj Auto Limited

- Tata Motors limited

- Cummins India Limited

- Ashok Leyland Limited

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Power Capacity, Application and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

- What is the projected market size of the India Diesel Engine market by 2033?

- What is the expected CAGR of the India Diesel Engine market from 2025 to 2033?

- What are the key industries driving the demand for diesel engines in India?

- How does government support influence the growth of the diesel engine market in India?

- What are the major challenges faced by the India Diesel Engine market?

- How does rapid industrialization impact the demand for diesel engines in India?

- What are the primary applications of diesel engines in India?

- Which regions in India are the largest contributors to the diesel engine market?

- What role does infrastructure development play in the growth of the diesel engine market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Market Drivers

4.2 Market Restraints

4.3 Market Opportunities

5. Market Analysis

5.1 Introduction to Diesel Engines

5.2 Diesel Engine Types and Applications

5.3 Importance of Diesel Engines in India

5.4 Value Chain Analysis

5.5 Regulatory Framework

5.6 Market data

6. Market Share Analysis

6.1 By Power Capacity

6.2 By Application

6.3 By Region

7. Market Analysis by Power Capacity

7.1 Up to 0.5 MW

7.1.1 Market Trend

7.1.2 Market forecast

7.2 0.5 MW–1 MW

7.2.1 Market Trend

7.2.2 Market forecast

7.3 1 MW–2 MW

7.3.1 Market Trend

7.3.2 Market forecast

7.4 2 MW–5 MW

7.4.1 Market Trend

7.4.2 Market forecast

7.5 Above 5 MW

7.5.1 Market Trend

7.5.2 Market forecast

8. Market Analysis by Application

8.1 On-Road

8.1.1 Light Vehicles

8.1.2 Medium/Heavy Trucks

8.1.3 Light Trucks

8.2 Off-Road

8.2.1 Industrial/Construction Equipment

8.2.2 Power Generation

8.2.3 Agriculture Equipment

8.2.4 Marine Applications

9. Regional Analysis

9.1 North India

9.2 South India

9.3 East India

9.4 West India

10. Key Players Analysis

10.1 Kirloskar Oil Engines Ltd.

10.1.1 Overview

10.1.2 Key Persons

10.1.3 Recent Development & Strategies

10.1.4 Revenue Analysis

10.2 Mahindra & Mahindra Ltd.

10.2.1 Overview

10.2.2 Key Persons

10.2.3 Recent Development & Strategies

10.2.4 Revenue Analysis

10.3 MHI VST Diesel Engines Pvt Ltd.

10.3.1 Overview

10.3.2 Key Persons

10.3.3 Recent Development & Strategies

10.3.4 Revenue Analysis

10.4 Simpson & Co. Ltd.

10.4.1 Overview

10.4.2 Key Persons

10.4.3 Recent Development & Strategies

10.4.4 Revenue Analysis

10.5 Cooper Corporation Private Limited

10.5.1 Overview

10.5.2 Key Persons

10.5.3 Recent Development & Strategies

10.5.4 Revenue Analysis

10.6 Kohler India Corporation Private Limited

10.6.1 Overview

10.6.2 Key Persons

10.6.3 Recent Development & Strategies

10.6.4 Revenue Analysis

10.7 Bajaj Auto Limited

10.7.1 Overview

10.7.2 Key Persons

10.7.3 Recent Development & Strategies

10.7.4 Revenue Analysis

10.8 Tata Motors limited

10.8.1 Overview

10.8.2 Key Persons

10.8.3 Recent Development & Strategies

10.8.4 Revenue Analysis

10.9 Cummins India Limited

10.9.1 Overview

10.9.2 Key Persons

10.9.3 Recent Development & Strategies

10.9.4 Revenue Analysis

10.10 Ashok Leyland Limited

10.10.1 Overview

10.10.2 Key Persons

10.10.3 Recent Development & Strategies

10.10.4 Revenue Analysis

11. Survey Questionnaire - India Diesel Market

11.1 General Market Awareness

11.2 Market Drivers and Challenges

11.3 Product Features and Preferences

11.4 Technology and Trends

11.5 Purchase Behavior

11.6 Future Outlook

11.7 Demographic Information (Optional)

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com