India Diesel Genset Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowIndia Diesel Genset Market Size & Summary

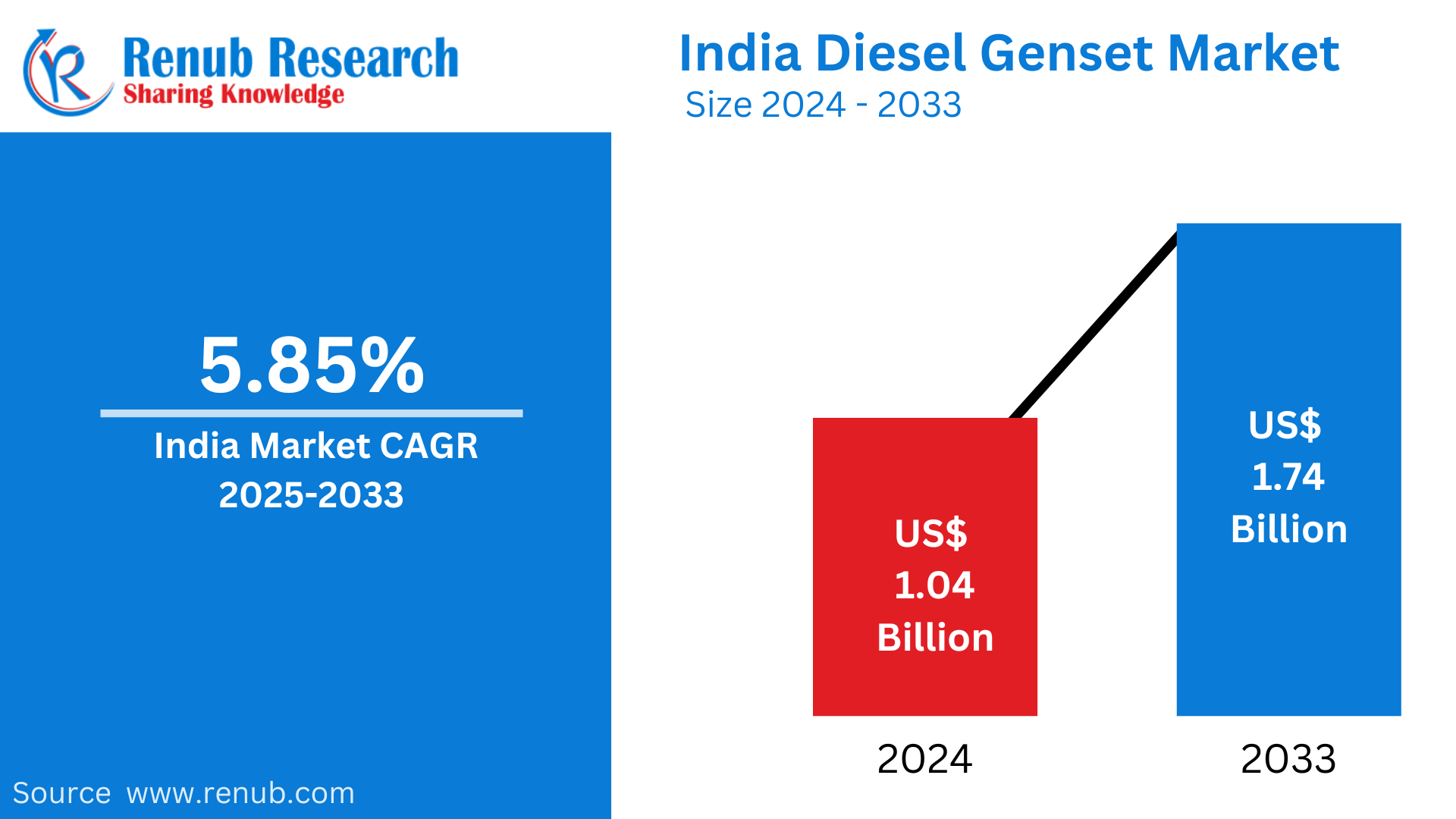

India Diesel Genset market is expected to reach US$ 1.74 billion by 2033 from US$ 1.04 billion in 2024, with a CAGR of 5.85% from 2025 to 2033. Increased power demand, an unstable electrical supply, industrial growth, infrastructure development, and the increased demand for backup power in the commercial, residential, and construction sectors are the main factors propelling the diesel genset market in India.

India Diesel Genset Market & Volume, Forecast by Kva Range Market and Volume (Low, Medium and High) End-User Market (Residential, Commercial and Industrial), Eastern and North Eastern Region Market (West Bengal, Odisha, Jharkhand and Others), Western Region Market (Gujarat, Maharashtra, and Others), Southern Region Market (Andhra Pradesh, Karnataka, Tamil Nadu, Telangana and Others), Northern and Central Region (Uttar Pradesh, Punjab, Haryana and Others), Company (Kirloskar Oil Engine, Mahindra & Mahindra Ltd, Ashok Leyland, Cummins India Ltd, Greaves Cotton Ltd, Caterpillar Inc., Escorts Limited, and Powerica Ltd.)” provides a complete analysis of India Diesel Genset industry.

India Diesel Genset Industry Overview

Due to the nation's rising power demands and frequent power outages, particularly in rural and semi-urban regions, the diesel genset business in India has experienced significant expansion. For a number of industries, residential complexes, telecoms, hospitals, and commercial institutions, diesel generators, often known as gensets, offer a dependable backup power source. These gensets are crucial for maintaining operations in areas with irregular or unstable grid electricity. Diesel-powered generators are widely used because they are affordable, simple to use, and readily available fuel. Diesel generator sets are also favored by enterprises, industries, and households due to their dependability and capacity to support both small- and large-scale operations.

Rapid urbanization, infrastructural development, and industrialization are some of the reasons driving the industry, as is the increased demand for a steady supply of electricity in vital industries. For ongoing operations in places without grid electricity, the construction sector in particular depends significantly on diesel gensets. Higher capacity gensets are becoming more and more necessary as industries become more energy-intensive in order to meet their power needs. Additionally, government programs to increase power infrastructure and enhance rural electrification are fueling the expansion of the diesel genset market. Manufacturers are being prompted to create more eco-friendly and energy-efficient solutions, like gensets with reduced emissions, as a result of the industry's struggles with growing fuel prices and environmental issues.

Due to recent investments in the telecom industry to improve connectivity in both urban and rural areas and satisfy the demands of a growing subscriber base, telecom towers are anticipated to dominate the market in terms of volume during the projected period under commercial applications. Due to this, telecom towers are being built all throughout India, which is raising the need for diesel generator sets.

According to Invest India, as of August 2022, India's telecom market had 1.17 billion subscribers, making it the second largest in the world. Additionally, the nation's overall tele-density is 83.25%. Additionally, whereas India's urban teledensity is 129.88%, the country's rural areas have a virtually untapped teledensity of 58.15%.

Growth Drivers for the India Diesel Genset Market

Rising Power Demand

The need for electricity has skyrocketed in India due to the country's expanding population and fast urbanization, especially in the commercial, industrial, and residential sectors. The demand for consistent and dependable power has increased as more people relocate to cities and economic activity grows. The government's efforts to promote infrastructural development, higher living standards, and industrial expansion all increase demand for power. Because of this circumstance, backup power systems such as diesel gensets are now needed to guarantee an uninterrupted power supply. Diesel generator sets provide an affordable and dependable way to meet power demands across a range of industries, particularly in places where power shortages are frequent or where grid electricity cannot keep up with peak demand.

Unreliable Grid Supply

Providing a steady and reliable power supply is a major difficulty for the electrical grid in many parts of India, particularly in rural and semi-urban areas. Power outages are common, and they can last for a long time, interfering with daily life and corporate operations. Diesel gensets are increasingly being used as a backup power source as a result of this problem. Diesel generators are especially useful in places with poor grid infrastructure or little access to dependable electricity. Diesel gensets are becoming more and more popular in areas where power outages occur because they guarantee that homes, businesses, and industries continue to run efficiently by offering a quick source of electricity.

Rising Industrial Growth

The need for diesel generator sets is being driven by the quick growth of India's infrastructure, building, and industrial industries. These sectors frequently function in areas with inadequate or nonexistent dependable grid power. For these industries, diesel generators provide a practical and affordable alternative that guarantees ongoing operations even in the event of an unstable power source. Diesel gensets provide a dependable power source that can support heavy gear and equipment, which helps maintain productivity in large-scale manufacturing facilities and construction sites. Diesel generator sets will become more and more necessary as India's infrastructure and industrialization expand, making them a crucial part of the nation's industrial growth and development plan.

Challenges in the India Diesel Genset Market

Maintenance and Operating Costs

For diesel generator sets to operate effectively and last a long time, regular and frequently costly maintenance is necessary. To maintain the equipment functioning properly, regular maintenance is required, which includes oil changes, filter replacements, and part replacements. Because they require specialist parts and have more complicated systems, larger diesel generator sets—which are usually used for commercial or industrial applications—have greater maintenance expenses. Furthermore, these gensets need to be serviced by qualified specialists, who might not always be available in rural or isolated locations. In the long term, diesel gensets may become less cost-effective for small-scale consumers due to higher operational costs. The financial advantages of using diesel power may be diminished by the whole cost of upkeep and repairs as well as fuel expenditures.

Rising Noise Pollution

Diesel generators are notoriously noisy when in use, which can be a major problem in urban, business, or residential settings. These machines' loud noises can interfere with daily living and be uncomfortable, particularly in crowded areas where noise pollution is becoming a bigger problem. Noise laws in some places may restrict the maximum noise levels that equipment can produce, which could result in limitations on the use of gensets or higher expenses for noise-cancelling equipment. Public opinion and acceptance may be impacted by the complaints made by surrounding businesses or residents due to the noise generated by diesel generators. In order to lessen noise pollution and adhere to more stringent restrictions, this environmental concern has pushed for the creation of quieter, more sustainable alternatives.

Maharashtra Diesel Genset Market

The state's industrialization, infrastructural development, and rising backup power need are driving Maharashtra's diesel genset market's steady growth. One of the most industrialized states in India, Maharashtra, is mostly dependent on diesel generators to power sectors like manufacturing, construction, telecommunications, and healthcare, particularly in places with erratic or inadequate grid power. Diesel gensets are an essential backup power source because the state also frequently experiences power outages. The growth of residential complexes and business organizations is another factor driving demand. Government programs encouraging industrial growth and infrastructure development continue to support the market's demand for dependable power sources like diesel gensets, despite obstacles including high fuel prices and environmental concerns.

Uttar Pradesh Diesel Genset Market

The growing need for dependable power solutions in both rural and urban areas is driving expansion in Uttar Pradesh's diesel genset industry. Uttar Pradesh, one of the most populated states in India, has serious problems with erratic electricity supplies, particularly in rural and semi-urban areas. To deal with these power outages, diesel generator sets are frequently utilized in the commercial, industrial, residential, and agricultural sectors. The increased need for backup power is also a result of the state's developing infrastructure, growing industrial base, and increasing urbanization. Diesel genset adoption is driven by the demand for reliable electricity during power outages, despite obstacles such fuel price changes and environmental concerns. The market is also being stimulated by government programs that assist industrial expansion and rural electrification.

West Bengal Diesel Genset Market

Due to frequent power outages and increased power demand in the commercial, residential, and industrial sectors, West Bengal's diesel genset market is expanding. In areas with unstable grid supply, the state's varied economy—which includes industries including manufacturing, agriculture, healthcare, and telecommunications—heavily depends on diesel generators for backup power. Diesel gensets are becoming more popular as a result of the increased need for reliable power brought on by growing urbanization and infrastructural development. Gensets continue to be a viable option despite worries about fuel prices and environmental effects, particularly in places with erratic electrical supply. Government programs for rural electrification and infrastructure development are also driving the industry, guaranteeing that diesel generator sets will remain essential to the state's power supply.

Andhra Pradesh Diesel Genset Market

The market for diesel generator sets in Andhra Pradesh is expanding as a result of the state's growing industrial base, agricultural activities, and the need for a dependable power source. The state's economy is heavily reliant on agriculture, and diesel generator sets are frequently utilized for farm-related tasks including water pumping and irrigation. Furthermore, gensets are essential to the commercial and industrial sectors, particularly in regions with unstable grid electricity. The need for backup power solutions is further increased by the frequent power outages in rural and semi-urban areas. The demand for continuous power is growing as the state continues to urbanize and build its infrastructure. Diesel gensets continue to be an affordable option for numerous Andhra Pradesh industries, despite obstacles like exorbitant fuel prices and environmental concerns.

Key Questions Answered in Report:

1. How big is the India Diesel Genset industry?

The India Diesel Genset market size was valued at US$ 1.04 billion in 2024 and is expected to reach US$ 1.74 billion in 2033.

2. What is the India Diesel Genset growth rate?

The India Diesel Genset market is expected to expand at a compound annual growth rate (CAGR) of 5.85% from 2025 to 2033.

3. Who are the key players in India Diesel Genset industry?

Some key players operating in the India Diesel Genset market includes Kirloskar Oil Engines, Mahindra & Mahindra Ltd., Ashok Leyland, Cummins India Ltd., Greaves Cotton Ltd., Catterpillar Inc., Escorts Ltd., Powerica Ltd.

4. What are the factors driving the India Diesel Genset industry?

Rapid urbanization, frequent power outages, infrastructure development, industrialization, and rising demand for continuous power across industries like telecom and healthcare are driving growth in India's diesel genset market.

5. What segments are covered in the India Diesel Genset Market report?

KVA Rating, End User, Region, and States segment are covered in this report

India Diesel Genset Market Segments

KVA Range – Market breakup from 3 Viewpoints:

1. Low KVA (10-50)

2. Medium KVA (50-500)

3. High KVA (above 500)

End-User – Market breakup from 2 Viewpoints:

1. Commercial

2. Industrial

States – Market breakup from viewpoints

10.1 West Bengal

10.2 Odisha

10.3 Jharkhand

10.4 Gujarat

10.5 Maharastra

10.6 Andhra Pradesh

10.7 Karnataka

10.8 Tamil Nadu

10.9 Telangana

10.10 Uttar Pradesh

10.11 Punjab

10.12 Haryana

10.13 Others

Company has been covered from 3 Viewpoints:

- Overview

- Recent Development

- Revenue

Company Analysis:

1. Kirloskar Oil Engine

2. Mahindra & Mahindra Ltd.

3. Ashok Leyland

4. Cummins India Ltd.

5. Caterpillar Inc.

6. Cooper Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By KVA Range, By End User & By States |

| Northern and Central Region |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. India Diesel Gensets Market

6. Market Share Analysis

6.1 By KVA Rating

6.2 By End User

6.3 By Region

6.4 By States

7. KVA Rating

7.1 5–75 KVA

7.2 75.1–375 KVA

7.3 375.1–750 KVA

7.4 750.1–1,000 KVA

7.5 1,000.1–2,000 KVA

7.6 Above 2,000 KVA

8. End User

8.1 Residential

8.2 Commercial

8.3 Industrial

9. Region

9.1 Eastern and North Eastern

9.2 Western

9.3 Southern

9.4 Northern & Central

10. States

10.1 West Bengal

10.2 Odisha

10.3 Jharkhand

10.4 Gujarat

10.5 Maharastra

10.6 Andhra Pradesh

10.7 Karnataka

10.8 Tamil Nadu

10.9 Telangana

10.10 Uttar Pradesh

10.11 Punjab

10.12 Haryana

10.13 Others

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 Kirloskar Oil Engines

13.1.1 Overview

13.1.2 Key Person

13.1.3 Recent Development

13.1.4 Revenue

13.2 Mahindra & Mahindra Ltd.

13.2.1 Overview

13.2.2 Key Person

13.2.3 Recent Development

13.2.4 Revenue

13.3 Ashok Leyland

13.3.1 Overview

13.3.2 Key Person

13.3.3 Recent Development

13.3.4 Revenue

13.4 Cummins India Ltd.

13.4.1 Overview

13.4.2 Key Person

13.4.3 Recent Development

13.4.4 Revenue

13.5 Greaves Cotton Ltd.

13.5.1 Overview

13.5.2 Key Person

13.5.3 Recent Development

13.5.4 Revenue

13.6 Catterpillar Inc.

13.6.1 Overview

13.6.2 Key Person

13.6.3 Recent Development

13.6.4 Revenue

13.7 Escorts Ltd.

13.7.1 Overview

13.7.2 Key Person

13.7.3 Recent Development

13.7.4 Revenue

13.8 Powerica Ltd.

13.8.1 Overview

13.8.2 Key Person

13.8.3 Recent Development

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com