India Fertilizer Market to grow with a CAGR of 6.4% during 2020-2026, bolstered by Government PLI Scheme

07 Dec, 2021

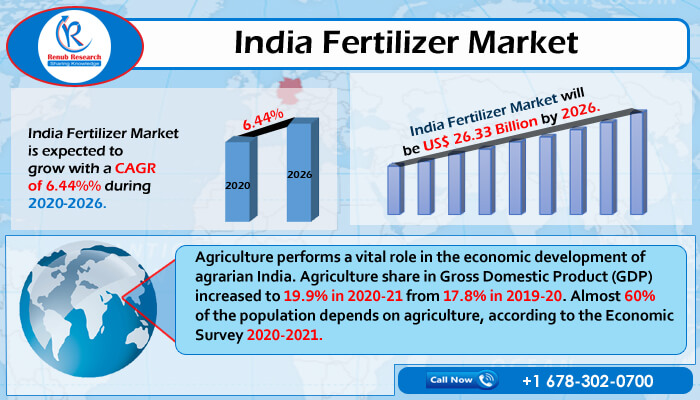

According to Renub Research latest report, “India Fertilizer Market, Impact of COVID-19, Forecast by Consumption, Industry Size, Growth Trends, Company Analysis, Financial Insight” finds that India Fertilizer Market is expected to be US$ 26.33 Billion by 2026. For ages, the fertilizer industry in India has played a pivotal supporting role to the Indian agricultural sector. Further, the farmers' growth in chemical fertilizers has been the secret of the nation's green revolution in the late sixties. Henceforth, today, India comes amongst the core producing and consuming countries of fertilizers in the world. Moreover, the Indian fertilizers market is also largely dependent on imports from various countries, especially potash fertilizers.

Role of Government in the Indian Fertilizer Industry:

The fertilizer industry is profoundly regulated and monitored by the Government. The difference amid the cost of production, which is higher than the price at which the fertilizer is sold to the beneficiary, is reimbursed by the Government in subsidies. Whenever funds are deficient, the Government either announces an additional subsidy amount or liquidates the pending sponsorship by arranging loans under a Special Banking Agreement (SBA). For instance, in 2020, Government brought PLI (production-linked incentives) scheme to promote domestic agrochemicals manufacturing and similarly, in 2021, DBT (Direct Benefit Transfer) scheme for fertilizer subsidy.

COVID-19 Impact on Indian Fertilizer Industry:

The rural demand and markets have been buoyed and very promising in India despite the coronavirus pandemic and macroeconomic uncertainty. This has translated into improving the underlying macros for the Indian fertilizer industry. Agricultural operations have been well placed and have grown back by a bumper Rabi harvest and good monsoon during the Kharif season.

With the normal monsoons and the rollout of the COVID vaccination program, the economic activities were normalized during FY21, which led to the acreage being favourable as well. So from that standpoint, the industry saw the consumption and the growth in demand for fertilizers continue in 2021.

Urea-the Major Utilized Fertilizer:

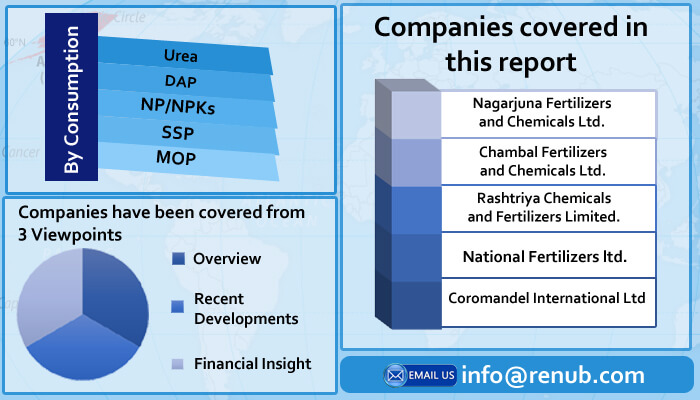

As per our analysis, Urea is the major utilized fertilizer followed by DAP, NP/NPCs, SSP, MOP, with domestic sales continuously growing. Urea fertilizers are capturing significant market share in 2021. In the years to come, we presume the demand for Urea to remain stable. The traditionally high usage and also the fact that the freeing up of retail prices for non-urea fertilizers, following the implementation of nutrient-based subsidy (NBS) for these fertilizers, has led to a significant price differential of urea vis-à-vis non-urea fertilizers.

Key Players in the Indian Fertilizer Market:

The fertilizer industry in India is fragmented, with a combination of cooperatives accumulating and a government-owned colossal market. The private companies are involved in a high degree of product innovation to tap the non-subsidy space. The major vital players in the Indian fertilizer market include Nagarjuna Fertilizers and Chemicals Ltd, Chambal Fertilizers and Chemicals Ltd, Rashtriya Chemicals and Fertilizers Limited, National Fertilizers Ltd, Coromandel International Ltd.

Market Summary:

By Consumption: We have covered the variants namely Urea, DAP, NP/NPKs, SSP, MOP.

By Production: We have studied the market and volume of Urea, DAP, Complex Fertilizers.

Company: The companies covered in the market include Nagarjuna Fertilizers and Chemicals Ltd, Chambal Fertilizers and Chemicals Ltd, Rashtriya Chemicals and Fertilizers Limited, National Fertilizers ltd, Coromandel International Ltd.

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com