India Frozen Food Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowIndia Frozen Food Market Trends & Summary

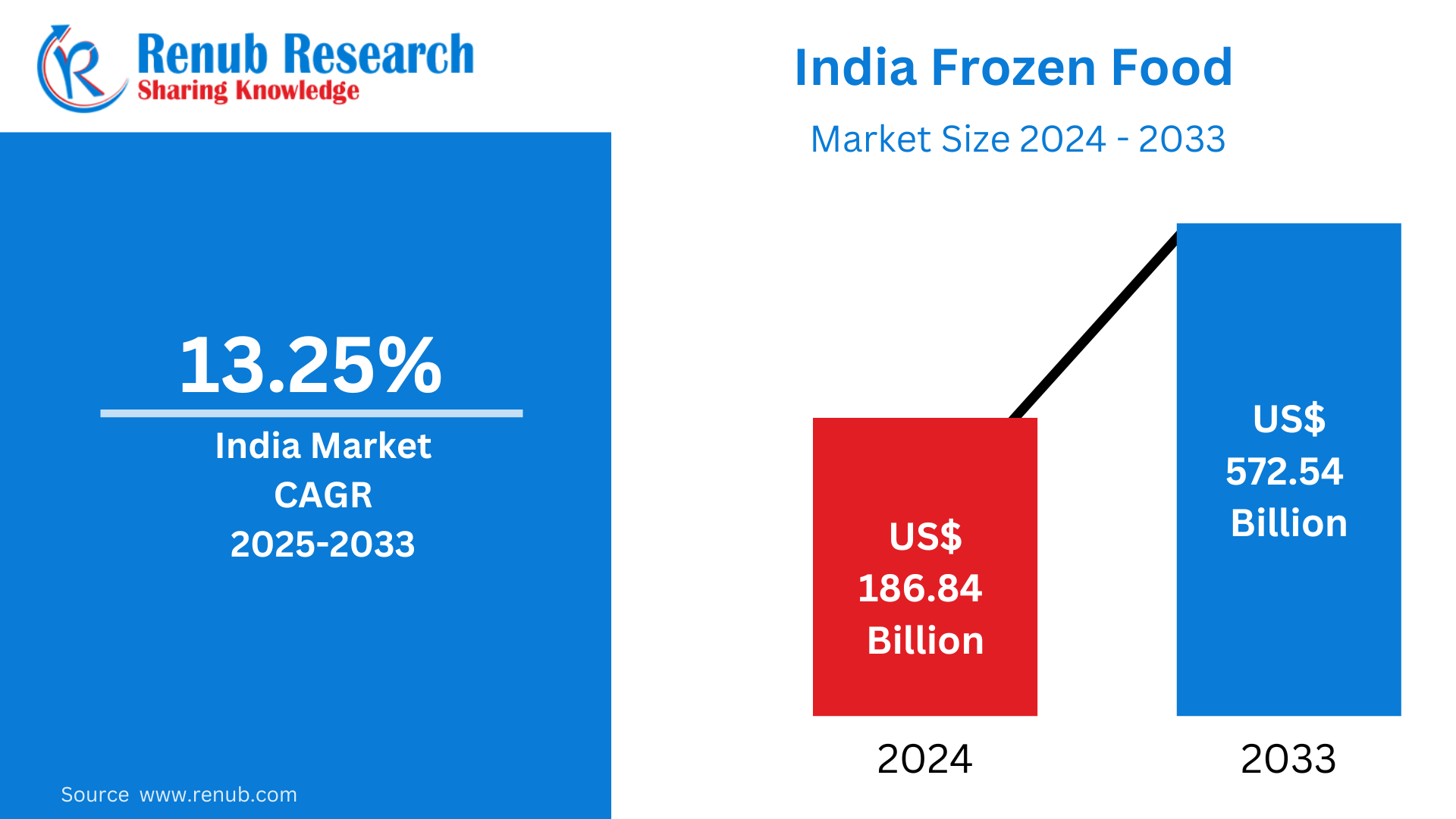

India Frozen Food market is expected to reach US$ 186.84 billion in 2024 to US$ 572.54 billion by 2033, with a CAGR of 13.25% from 2025 to 2033. Among the main factors propelling the market are rapid urbanization, rising disposable incomes, shifting dietary and lifestyle patterns, improvements in cold chain infrastructure, heightened awareness of global food trends, and easier access to products through supermarkets and online retail.

The report India Frozen Food Market & Forecast covers by Category (Staple Foods, Dairy Products and Alternatives, Snacks, Cooking Ingredients and Meals), [Product Type (Fruit & Vegetables (Peas, Mushroom, Carrots, Beans, Corn), Non-Veg (Meat & Fish/Seafood) Product (Chicken, Fish, Mutton, Beef, Pork, Others), Potatoes (French Fries, Tikki, Potato Wedges, Potato Bites, Smileys), Frozen Bakery Products (Biscuit & Cookies, Bread & Pizza Dough, Rolls & Pastry), Ready Meals, Soup, Others)], Age Group (Under 18, 18-30, 30-45, 45 & Above), Distribution Channels (Supermarket/Hypermarket, Online Retail Channel, Convenient Stores, Other Distribution Channels), Region (North & Central region, Southern region, Western region, Eastern region) and Company Analysis 2025-2033.

India Frozen Food Industry Overview

Edible foods that have been frozen are referred to as frozen food. Products including fruits, vegetables, meat, poultry, and fish are included, as are baked goods and cooked meals. By converting any remaining moisture into ice, the freezing process slows down the breakdown process and prevents the formation of most bacterial species, extending the shelf life and safety of the food. By preserving nutritional value, this method makes otherwise seasonal food available all year long. The capacity of frozen food to preserve and make seasonal products available year-round is one of its main benefits. Furthermore, customers with hectic, contemporary lifestyles place a great value on the convenience that frozen food products provide, especially with regard to meal planning and preparation time.

The Indian frozen food market is mostly driven by a confluence of many socioeconomic and cultural variables, including the country's fast urbanization, rising disposable incomes, and the growing middle class. In addition, a positive prognosis for market expansion is being created by the growing demand for ready-to-eat (RTE) and convenient food products because of their longer shelf life and ability to save time. Furthermore, the industry is expanding as a result of rising awareness of foreign cuisine trends and a move toward Western eating habits brought on by travel abroad and global media. The industry is also being driven forward by notable advancements in cold storage and supply chain infrastructure, which guarantee improved product accessibility and quality. The market expansion is being reinforced at the same time by the execution of several government programs supporting the food processing sectors. Additionally, shifting consumer attitudes regarding the nutritional benefits of frozen food supported by data are assisting in dispelling long-standing misconceptions and promoting greater acceptance among Indian consumers.

Growth Drivers for the India Frozen Food Market

Increasing Urbanization and Lifestyle Shifts to Support Market Growth

Growing urbanization in India is causing significant changes in food and lifestyle patterns, primarily due to shifting work schedules and rising disposable expenditures. The increasing number of time-pressed urbanites in India who are searching for quick, easy, and convenient meals creates a favorable atmosphere for market progress. Due to their variety, affordability, and year-round availability, frozen food products are becoming more and more popular as people's time to cook traditional, time-consuming foods decreases as life gets faster. Furthermore, the rise in nuclear households and the number of working women in India have increased demand for these products.

Due to the growing popularity of frozen pasta, pizza, and desserts, as well as the influence of Western culture and eating habits, the business is experiencing significant growth potential.

Notable developments in cold chain infrastructure technology

India's frozen food business has been driven in large part by ongoing technical developments in the country's cold chain transportation and storage facilities. Strong cold chain systems are necessary to preserve frozen food products' quality and prolong their shelf life, which eventually affects consumer demand and satisfaction. In addition, improved cold storage facilities, refrigerated transportation, and effective logistics networks have increased product availability and accessibility in India's rural and urban locations, which has fueled market expansion. Furthermore, the market has lucrative growth prospects due to the execution of several beneficial government initiatives aimed at fortifying the cold chain infrastructure. These developments have also made it possible for supermarkets and online shopping platforms to grow, which are now essential frozen food delivery routes.

India Frozen Food Market Overview by Regions

Due to busy lifestyles and rising disposable income, the frozen food market in India is expanding quickly, with significant demand in major cities like Delhi, Mumbai, and Bangalore. Due to increased availability and knowledge of frozen food options, Tier 2 and Tier 3 cities are also expanding. An overview of the market by region is given below:

North & Central India Frozen Food Market

Due to busy lives, changing customer preferences, and growing urbanization, the frozen food business in North and Central India is growing significantly. Convenient, ready-to-eat frozen snacks, veggies, and meat items are in high demand in major cities like Delhi, Chandigarh, Jaipur, Lucknow, and Bhopal. Frozen meal solutions, which provide convenience without sacrificing quality, have become more popular in North India as a result of rising disposable incomes and an increase in the number of working professionals. Due to increased awareness and better delivery systems, frozen foods are becoming more popular in Central India. Growth is also being fueled by the availability of both domestic and foreign frozen food brands. The frozen food business in these areas is anticipated to continue growing as retail chains and e-commerce platforms expand.

Southern India Frozen Food Market

Southern India's frozen food market is expanding quickly due to factors such growing urbanization, changing dietary habits, and convenience demands. The use of frozen food items, like as ready-to-eat meals, frozen meat, veggies, and snacks, is most prevalent in cities like Bangalore, Chennai, Hyderabad, and Kochi. The time-saving and convenient qualities of frozen foods are valued by the region's busy urban population, especially among young professionals and working families. This expansion is also being fueled by rising disposable incomes, better distribution networks, and more consumer knowledge of both domestic and foreign frozen food brands. Furthermore, frozen food is becoming more widely available due to South India's growing retail and e-commerce industries. The frozen food market in Southern India is anticipated to grow steadily over the next several years due to the growing need for quick and simple meal alternatives.

India Frozen Food Company News

In July 2022, the domestic coffee firm Continental Coffee (CCL) launched their plant-based frozen meal brand, "Continental Greenbird," in India. With Continental Greenbird, CCL first offered four types of plant-based meat: mutton-like keema, chicken-like nuggets, chicken-like seekh kebab, and chicken-like sausage.

In April 2022, Prasuma, an Indian company that specialized in frozen foods and chilled meat, has expanded its portfolio to include new snacks. The company added frozen chicken nuggets, frozen spring rolls with chicken and vegetables, frozen mini samosas with chicken and vegetables, mutton and chicken seekh kababs, and bacon to its lineup of frozen delicacies.

India Frozen Food Market Segments

Category- Industry is divided into 4 viewpoints:

- Staple Foods

- Dairy Products and Alternatives

- Snacks

- Cooking Ingredients and Meals

Product Type- Industry is divided into 7 viewpoints:

1. Fruit & Vegetables

- Peas

- Mushroom

- Carrots

- Beans

- Corn

- Others

2. Non-Veg (Meat & Fish/Seafood) Product

- Chicken

- Fish

- Mutton

- Beef

- Pork

- Others

3. Potatoes

- French Fries

- Tikki

- Potato Wedges

- Potato Bites

- Smileys

- Others

4. Frozen Bakery Products

- Biscuit & Cookies

- Bread & Pizza Dough

- Rolls & Pastry

- Others

5. Ready Meals

6. Soup

7. Others

Age Group - Industry is divided into 4 viewpoints:

- Under 18

- 18-30

- 30-45

- 45 & Above

Distribution Channels - Industry is divided into 4 viewpoints:

- Supermarket/Hypermarket

- Online Retail Channel

- Convenient Stores

- Other Distribution Channels

Regions - Industry is divided into 4 viewpoints:

- North & Central region

- Southern region

- Western region

- Eastern region

All companies have been covered with 5 Viewpoints

- Overview

- Key Persons

- Recent Development & Strategies

- Product Portfolio

- Financial Insights

Company Analysis

- Nestle

- ITC Limited

- Arla Foods

- Hershey's

- Apex Frozen Foods Ltd

- Godrej Agrovet Ltd.

- Venky's (India) Ltd.

- Conagra Brands

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Lead Type, End User and Regions |

| Regions Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the CAGR of the India Frozen Food Market from 2025 to 2033?

-

Which factors are driving the growth of the India Frozen Food Market?

-

What are the main product categories in the India Frozen Food Market?

-

How is urbanization impacting the demand for frozen food in India?

-

Which distribution channels are significant in the India Frozen Food Market?

-

What role does cold chain infrastructure play in the market's growth?

-

Which regions in India have the highest demand for frozen food?

-

How are changing consumer preferences influencing the market?

-

What are some recent developments in the India Frozen Food industry?

-

Which companies are leading in the India Frozen Food Market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

4.3 Opportunities

5. India Frozen Food Market

6. Market Share Analysis

6.1 By Category

6.2 By Product Type

6.3 By Non-Veg (Meat & Fish/Seafood) Product

6.4 By Fruit & Vegetables

6.5 By Age Group

6.6 By Distribution Channel

6.7 By Region

7. Category

7.1 Staple Foods

7.2 Dairy Products and Alternatives

7.3 Snacks

7.4 Cooking Ingredients and Meals

8. Product Type

8.1 Fruit & Vegetables

8.1.1 Peas

8.1.2 Mushroom

8.1.3 Carrots

8.1.4 Beans

8.1.5 Corn

8.1.6 Others

8.2 Non-Veg (Meat & Fish/Seafood) Product

8.2.1 Chicken

8.2.2 Fish

8.2.3 Mutton

8.2.4 Beef

8.2.5 Pork

8.2.6 Others

8.3 Potatoes

8.3.1 French Fries

8.3.2 Tikki

8.3.3 Potato Wedges

8.3.4 Potato Bites

8.3.5 Smileys

8.3.6 Others

8.4 Frozen Bakery Products

8.4.1 Biscuit & Cookies

8.4.2 Bread & Pizza Dough

8.4.3 Rolls & Pastry

8.4.4 Others

8.5 Ready Meals

8.6 Soup

8.7 Others

9. Age Group

9.1 Under 18

9.2 18-30

9.3 30-45

9.4 45 & Above

10. Distribution Channels

10.1 Supermarket/Hypermarket

10.2 Online Retail Channel

10.3 Convenient Stores

10.4 Other Distribution Channels

11. Region

11.1 North & Central region

11.2 Southern region

11.3 Western region

11.4 Eastern region

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1.1 Strength

13.1.2 Weakness

13.1.3 Opportunity

13.1.4 Threat

14. Key Players Analysis

14.1 Nestle

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Product Portfolio

14.1.4 Recent Development & Strategies

14.1.5 Revenue Analysis

14.2 ITC Limited

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Product Portfolio

14.2.4 Recent Development & Strategies

14.2.5 Revenue Analysis

14.3 Arla Foods

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Product Portfolio

14.3.4 Recent Development & Strategies

14.3.5 Revenue Analysis

14.4 Hershey's

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Product Portfolio

14.4.4 Recent Development & Strategies

14.4.5 Revenue Analysis

14.5 Apex Frozen Foods Ltd

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Product Portfolio

14.5.4 Recent Development & Strategies

14.5.5 Revenue Analysis

14.6 Godrej Agrovet Ltd.

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Product Portfolio

14.6.4 Recent Development & Strategies

14.6.5 Revenue Analysis

14.7 Venky's (India) Ltd.

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Product Portfolio

14.7.4 Recent Development & Strategies

14.7.5 Revenue Analysis

14.8 Conagra Brands

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Product Portfolio

14.8.4 Recent Development & Strategies

14.8.5 Revenue Analysis

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com