India Gas Genset Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowIndia Gas Genset Market Size & Summary

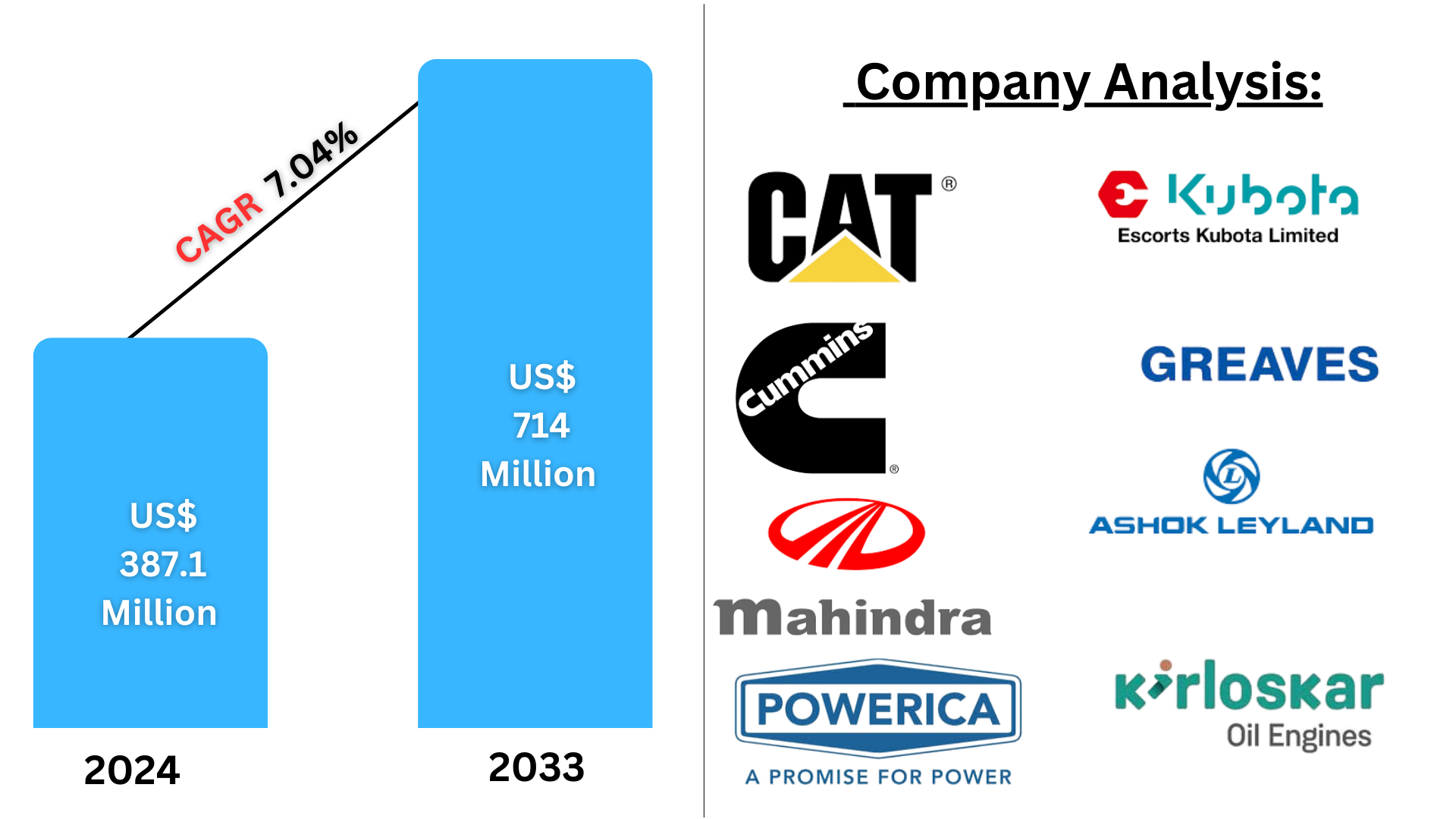

India Gas Genset market is expected to reach US$ 714 million by 2033 from US$ 387.1 million in 2024, with a CAGR of 7.04% from 2025 to 2033. The necessity for dependable, environmentally friendly backup power, government incentives, industrial growth, and the growing demand for clean energy are the main factors propelling India's gas genset business.

India Gas Genset Market by KVA Range (Up to 75kVA, 76 kVA-350 kVA, 351kVA-750kVA, Above 750kVA), End User (Residential, Commercial, Industrial), and States (Assam, Gujarat, Delhi, Uttar Pradesh, Haryana, Karnataka, Madhya Pradesh, Maharashtra, West Bengal, Tamil Nadu, Others) Analysis 2025-2033

India Gas Genset Industry Overview

Due to the nation's efforts to reduce its carbon footprint and the growing demand for cleaner energy sources, the gas genset business in India has experienced substantial growth. Compared to conventional diesel generators, gas gensets—which run on natural gas or LPG—are thought to be more ecologically benign. Businesses and residential areas are using gas-powered gensets to supply dependable backup power as a result of infrastructural development, industrial expansion, and rising power demands. Gas gensets are a popular option for companies wishing to implement sustainable power solutions because of its many benefits, which include lower emissions, cheaper fuel, and increased efficiency. The use of gas generator sets in urban and industrial areas has also increased due to India's expanding natural gas supply.

The demand for gas generator sets has increased significantly as a result of the Indian government's efforts to advance sustainability and clean energy. Gas gensets are becoming more appealing due to policies like the National Clean Energy Fund and incentives for companies utilizing green technologies. Gas genset adoption is particularly common in the commercial and industrial sectors, where large-scale operations necessitate a consistent and dependable power source. But despite these benefits, obstacles including greater upfront costs and scarce natural gas supplies in rural areas still prevent them from being widely used. However, the Indian gas genset market is anticipated to keep expanding as the government shifts its emphasis to clean energy and lessens dependency on fossil fuels.

The Indian Environment Ministry updated the emissions regulations for power producers in February 2022. The new regulations will take effect in July 2023 and require units up to 800 kW to meet them. All fuels, including hydrogen, will be subject to the India Genset Emission Standards-IV+. Diesel generators are one of the main causes of the widespread air pollution, according to the ministry, which is why the new emission standards were released. The new emission regulations include technical requirements like compression ignition (CI) and positive ignition (PI) as well as limits on individual pollutants including nitrogen oxide (NO), hydrocarbons (HCs), carbon monoxide (CO), and particulate matter (PM).

Additionally, in February 2022, the Central Pollution Control Board (CPCB) proposed a three-pronged strategy to reduce pollution from diesel gensets in order to curb the widespread air pollution in the Delhi-NCR region. The strategy calls for the elimination of diesel gensets older than 15 years, the requirement that gensets up to 800 kW be retrofitted with emission control devices, and the imposition of stricter emission standards for newer gensets that require them.

Growth Drivers for the India Gas Genset Market

Government Support for Clean Energy

With a range of regulations, incentives, and subsidies, the Indian government has been aggressively promoting the switch to cleaner energy sources. Reducing the nation's dependency on fossil fuels and minimizing its negative effects on the environment are the goals of programs like the National Clean Energy Fund and those that support renewable energy technologies. Due to its lower emissions than conventional diesel-powered gensets, gas gensets—which run on natural gas or LPG—are a component of this shift towards greener energy. Government assistance has reduced the cost and increased the accessibility of gas generator sets for companies, promoting their use in a variety of sectors. The demand for gas generator sets is being driven by these policies, which are in line with India's pledge to cut carbon emissions and move toward a greener economy.

Environmental Concerns

Businesses are facing mounting pressure to implement sustainable and eco-friendly operations as environmental concerns increase. Industries are looking at alternatives to traditional power production technologies, particularly diesel generators, due to air pollution and its detrimental impact on the environment and human health. Because gas gensets can generate lower levels of particulate matter and greenhouse gas emissions, they are thought to be a greener choice. They are therefore a popular option for businesses looking to reduce their carbon footprint while maintaining a steady supply of electricity. As businesses seek to align their operations with environmental sustainability goals, the demand for gas gensets has increased dramatically due to the growing awareness of climate change and the need for cleaner technology.

Increasing Industrialization

The need for a steady and dependable power supply has increased due to India's fast industrialization, particularly in the manufacturing, infrastructure, and commercial sectors. Power outages can result in large losses in efficiency and productivity for businesses that run around the clock. Due to their higher fuel efficiency, cheaper operating costs, and less environmental impact than conventional diesel generators, gas gensets have become the perfect choice for these businesses. Production lines and other vital processes are protected from grid outages by the continuous power provided by gas gensets. Additionally, because of their reduced emissions, they are better suited for sectors seeking to comply with sustainability objectives and environmental standards. The need for gas generator sets is anticipated to increase as India's industrialization proceeds, making them a crucial component of these industries' power generation infrastructure.

Challenges in the India Gas Genset Market

Limited Availability of Natural Gas

Natural gas is still scarce in rural and isolated parts of India, even as its supply is expanding in urban and industrial areas. The usage of gas generator sets is challenging in many areas, especially in rural or less developed areas where natural gas pipelines are not directly accessible. The extensive use of gas-powered generators in places with little or no dependable grid electricity is hampered by this limited fuel source. Businesses and industries in these areas could have to rely on less environmentally friendly and more costly diesel generators as alternatives if they don't have reliable access to natural gas. Consequently, the growth of gas generator adoption is impeded in these impoverished regions.

Infrastructure and Distribution Challenges

Many regions of India still lack the pipelines, storage facilities, and distribution networks necessary for the extensive distribution and transportation of natural gas. Even while big towns and industrial centers are receiving more natural gas, access to this fuel source remains extremely difficult in distant locations. The viability of employing gas gensets in these areas is restricted by the absence of suitable infrastructure to sustain the steady supply of natural gas. The adoption of gas gensets in places where electricity reliability is essential is further delayed by the substantial time and money needed to create this infrastructure. The full potential of gas gensets nationwide cannot be achieved without strong infrastructure.

Maharashtra Gas Genset Market

The development of the state and rising demand for dependable, clean energy sources are driving Maharashtra's gas genset market's steady expansion. Gas gensets provide an effective and environmentally responsible alternative for large industries that depend on continuous power, including manufacturing, textiles, chemicals, and information technology. As natural gas availability has improved with growing infrastructure, gas gensets have been widely adopted in urban areas and industrial hubs like Mumbai, Pune, and Nashik. The market for gas generator sets has been further boosted by the state's emphasis on sustainability and lowering carbon emissions, particularly in industries trying to comply with environmental standards. Although there are issues with natural gas availability in rural regions, Maharashtra's expanding infrastructure and dedication to greener energy sources are propelling the use of gas generator sets in a variety of industries.

Uttar Pradesh Gas Genset Market

The market for gas generator sets in Uttar Pradesh is expanding due to the growing need for dependable and environmentally friendly power solutions in the commercial, industrial, and agricultural sectors. A steady power supply is necessary for the state's expanding industrial base, which is primarily focused on manufacturing, textiles, and food processing. Gas gensets offer an effective and less polluting substitute for diesel generators. Gas gensets are becoming more popular in rural areas for agricultural tasks like irrigation, where reliable power is crucial. Remote areas still face difficulties in obtaining natural gas, but these obstacles are being addressed by government programs promoting cleaner energy and pipeline network expansion. The demand for gas gensets is anticipated to continue growing, especially in urban areas, as a result of the state's dedication to sustainability and industrial expansion.

West Bengal Gas Genset Market

The market for gas generator sets in West Bengal is expanding as a result of rising urbanization and industrialization as well as the need for dependable, clean energy sources. Since the state's various industrial sectors—such as steel, textiles, and manufacturing—need a steady supply of electricity, gas gensets are the best option because they use less fuel and produce less pollution than diesel generators. With the help of better natural gas infrastructure, gas-powered generator sets are becoming more and more popular in urban areas like Kolkata. Gas generators are also useful for irrigation and other farm-related tasks in West Bengal's agricultural industry. The state's emphasis on cleaner energy, along with government incentives for eco-friendly technologies, is propelling the expansion of the gas genset industry in both urban and industrial sectors, despite obstacles such as limited availability to natural gas in rural areas.

Karnataka Gas Genset Market

state's industrial boom, rising power demand, and focus on environmentally friendly solutions are all contributing to Karnataka's gas genset market's expansion. Karnataka, which is heavily involved in industries like manufacturing, information technology, textiles, and pharmaceuticals, needs consistent, dependable power to run its businesses. Industries seeking to minimize their operational expenses and carbon impact are increasingly choosing gas gensets because they are more fuel-efficient and emit fewer pollutants than diesel counterparts. Better natural gas infrastructure in cities like Bangalore encourages the use of gas-powered generators. Furthermore, the state's agricultural industry is depending more and more on gas generators for irrigation. The demand for gas gensets in Karnataka is anticipated to keep rising in both the urban and industrial sectors as a result of the government's promotion of greener energy sources.

India Diesel Genset Market Segments

India Diesel Genset Industry is breakup in 2 parts

- Market

- Volume

By Kva Range - India Diesel Genset Market and Volume been covered from 3 viewpoints

1. Low

2. Medium

3. High

End Users – India Diesel Genset Market has been covered from 3 viewpoints

1. Residential

2. Commercial

3. Industrial

Regions – India Diesel Genset Market has been covered from 4 viewpoints

1. Eastern Region

2. Western Region

3. Southern Region

4. Northern & Central Region

Eastern and North Eastern Region Market has been covered from 4 viewpoints

1. West Bengal

2. Odisha

3. Jharkhand

4. Others

Western Region Market has been covered from 3 viewpoints

1. Gujarat

2. Maharashtra

3. Others

Southern Region Market has been covered from 5 viewpoints

1. Andhra Pradesh

2. Karnataka

3. Tamil Naidu

4. Telangana

5. Others

Northern and Central Region Market has been covered from 4 viewpoints

9.1 Assam

9.2 Gujarat

9.3 Delhi

9.4 Uttar Pradesh

9.5 Haryana

9.6 Karnataka

9.7 Madhya Pradesh

9.8 Maharastra

9.9 West Bengal

9.10 Tamil Nadu

9.11 Others

Company Analysis: All the companies have been studied from three points

• Overview

• Recent Developments

• Sales Analysis

Companies Covered

1. Kirloskar Oil Engine

2. Mahindra & Mahindra Ltd

3. Ashok Leyland

4. Cummins India Ltd

5. Greaves Cotton Ltd

6. Caterpillar Inc.

7. Escorts Limited

8. Powerica Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

By KVA Range, By End User & By States |

| Northern and Central Region |

|

| Companies Covered |

1. Kirloskar Oil Engine 2. Mahindra & Mahindra Ltd 3. Ashok Leyland 4. Cummins India Ltd 5. Greaves Cotton Ltd 6. Caterpillar Inc. 7. Escorts Limited 8. Powerica Ltd. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

- What is the projected market size of the India Gas Genset industry by 2033?

- What is the expected CAGR of the India Gas Genset market from 2025 to 2033?

- What are the key factors driving the growth of the India Gas Genset market?

- Which segments are covered in the India Gas Genset market report?

- What are the major challenges facing the India Gas Genset market?

- How do government policies and environmental regulations impact the gas genset industry in India?

- What are the key applications of gas gensets in different sectors?

- Which states in India have the highest demand for gas gensets?

- How does the availability of natural gas infrastructure affect the adoption of gas gensets?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. India Gas Gensets Market

6. Market Share Analysis

6.1 By KVA Range

6.2 By End User

6.3 By States

7. KVA Range

7.1 Up to 75kVA

7.2 76 kVA-350 kVA

7.3 351kVA-750kVA

7.4 Above 750kVA

8. End User

8.1 Residential

8.2 Commercial

8.3 Industrial

9. Top 10 States

9.1 Assam

9.2 Gujarat

9.3 Delhi

9.4 Uttar Pradesh

9.5 Haryana

9.6 Karnataka

9.7 Madhya Pradesh

9.8 Maharastra

9.9 West Bengal

9.10 Tamil Nadu

9.11 Others

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Kirloskar Oil Engines

12.1.1 Overview

12.1.2 Key Person

12.1.3 Recent Development

12.1.4 Revenue

12.2 Mahindra & Mahindra Ltd.

12.2.1 Overview

12.2.2 Key Person

12.2.3 Recent Development

12.2.4 Revenue

12.3 Ashok Leyland

12.3.1 Overview

12.3.2 Key Person

12.3.3 Recent Development

12.3.4 Revenue

12.4 Cummins India Ltd.

12.4.1 Overview

12.4.2 Key Person

12.4.3 Recent Development

12.4.4 Revenue

12.5 Catterpillar Inc.

12.5.1 Overview

12.5.2 Key Person

12.5.3 Recent Development

12.5.4 Revenue

12.6 Escorts Ltd.

12.6.1 Overview

12.6.2 Key Person

12.6.3 Recent Development

12.6.4 Revenue

12.7 Powerica Ltd.

12.7.1 Overview

12.7.2 Key Person

12.7.3 Recent Development

12.7.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com