India Watch Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowIndia Watch Market Trends & Summary

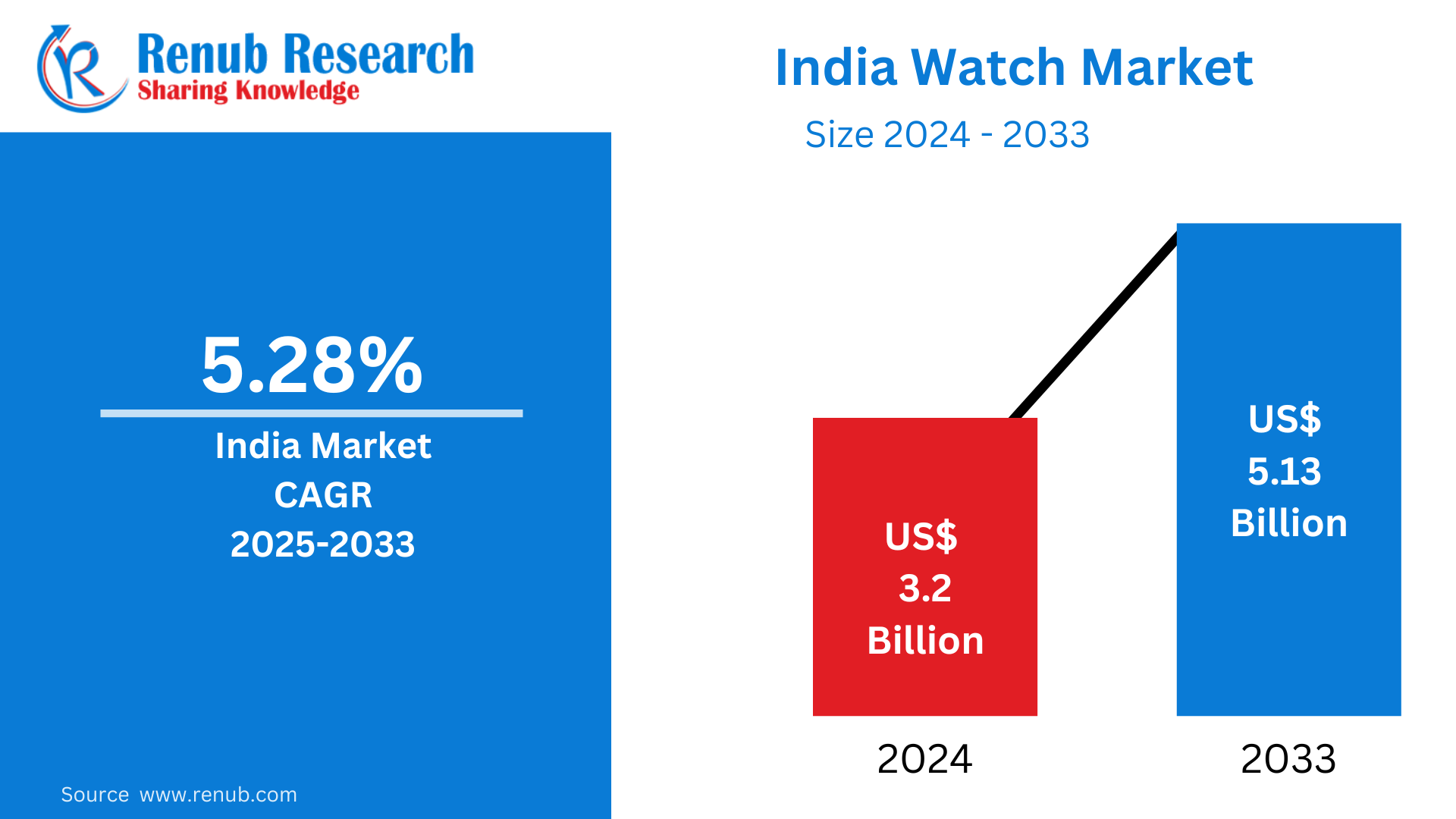

India's Watch Market was valued at US$ 3.2 billion in 2024 and is expected to reach US$ 5.13 billion by 2033, growing at a CAGR of 5.28 % from 2025-2033. The growth in disposable incomes, surging demand for smartwatches, and expanding desire for luxury and branded watches are fueling market growth in India's complex and dynamic watch industry.

India Watch Market Forecast Report by Type (Quatz Watches, Electronic Watches, Mechanical Watches), Gender (Men, Women, Unisex), Price Range (Luxury, Non-Luxury), Distribution Channel (Hyper Market/Super Market, Convenience Stores, Online), Company Analysis 2025-2033.

India Watch Market Outlooks

A watch is a wristwatch or pocket watch used to tell time and, in contemporary versions, provide other features like alarms, calendars, heart rate monitoring, and GPS tracking. Watches are divided into mechanical, quartz, and electronic smartwatches based on the type of consumer requirement.

Watches are extremely popular in India across different segments, ranging from budget-friendly daily wear to premium and luxury watches. Popular brands such as Titan, Fastrack, and Sonata control the country's domestic market, while high-end consumers patronize international brands such as Rolex, Omega, and Casio. The increase in the usage of smartwatches, facilitated by brands such as Apple, Samsung, and Noise, portrays India's escalating population of technology-aware consumers. With a rise in the adoption of fashionable accessories, watches not only serve the purpose of a timekeeper but also as fashion statements and indicators of status. The growing middle class, e-commerce expansion, and digitalization keep pushing the watch industry's popularity and development in India.

Growth Drivers in India Watch Market

Growing Disposable Income and Aspirational Purchasing

Growing middle-class population and disposable income in India are the major growth drivers for the watch market. People are buying more branded and luxury watches as symbols of status and lifestyle. As urbanization spreads, demand for luxury watches by well-known brands such as Rolex, TAG Heuer, and Omega is growing. Additionally, domestic luxury brands such as Titan and Ethos are riding the wave by launching affordable luxury lines. As India's economy continues to rise steadily, consumers are increasingly spending on fashionable, good-quality watches, pushing the market ahead. According to McKinsey, total average real household disposable income would be 318,896 rupees ($7,740) in 2025 from 113,744 in 2005, a compound annual growth rate of 5.3 percent.

Sustained Growth of Smartwatches and Wearable Technology

The smartwatch market is growing exponentially in India due to rising health consciousness, fitness culture, and digital connectivity. Companies such as Apple, Samsung, Noise, and boAt are dominating the market with smartwatches that support fitness tracking, heart rate tracking, and smartphone integration. Smartwatches have become more appealing to the new generation, especially urban tech-loving consumers, in comparison to basic watches. Ease of access for feature-loaded products from local players also fuels growth. As technology in wearables improves, smartwatch demand will keep rising, transforming India's watch market. Feb 2025, Lava's smartwatch brand Prowatch has announced the Prowatch X, a feature-loaded wearable for health-conscious and technologically inclined customers. The ₹4,499 smartwatch injects health monitoring and navigation into the affordable space.

E-Commerce and Online Retail Growth

Online stores like Amazon, Flipkart, and Myntra have transformed the watch market of India by delivering a vast majority of brands and models to users across the country. Online shopping offers price competitiveness, promotions, and simple finance options, leading to increased sales volume. Further, digital marketing, influencer partnerships, and virtual try-on technologies increase customer interaction. Online shopping is especially advantageous for luxury brands and international players, who can now access Indian consumers directly without geographical stores. This online revolution is strongly contributing to market growth. January 2025, Amazon is rolling out Watch and Shop, an innovative interactive feature that enables Indian customers to shop while watching interactive video content. Watch and Shop will revolutionize the way customers discover and buy products in every category, from electronics to fashion and home necessities.

India Watch Market Challenges

Unorganized and Counterfeit Markets Competition

India's watch industry is also strongly impacted by unorganized players and counterfeits. Most customers continue to opt for locally made, unbranded watches because they are cheap. Also, fake copies of luxury and branded watches permeate the market, diminishing the reputation and sales of authentic brands. Although manufacturers have tried to fight counterfeiting by employing authentication features, unauthorized sellers still affect brand reputation and profitability.

Shifting Consumer Preferences Towards Smart Devices

As smartphone and smartwatch usage increases, mechanical and quartz watches experience waning demand, particularly among younger generations. People use their smartphones as a time-telling device, minimizing the need for wristwatches. Additionally, as smartwatch technology advances, it is increasingly replacing conventional wristwatches, especially in the budget and mid-range segments. Brands need to innovate and incorporate technology to stay relevant in this new environment.

India Electronic Watch Market

The electronic watch category, led by smartwatches, is among the fastest-growing segments in India. Tech-savvy shoppers and fitness enthusiasts opt for smartwatches from companies such as Apple, Samsung, and Fitbit due to their innovative features such as step tracking, sleep tracking, and call functionality. Indian players like Noise and boAt also provide budget-friendly options, thus making electronic watches more affordable for a larger number of buyers. As wearables evolve with more sophisticated technology and AI integration, the demand for electronic watches in India will keep increasing.

India Mechanical Watch Market

Mechanical watches occupy a niche but high-end place in the Indian watch market. Luxury watch collectors and enthusiasts prefer brands such as Rolex, Omega, and Grand Seiko due to their craftsmanship and rarity. Indian watchmaker Titan has also ventured into the high-end mechanical watch segment with detailed automatic models. While mechanical watches are costly, their longevity and prestige value appeal to high-end buyers. Limited series releases and brand heritage also enhance demand in this category.

India Quartz Watches Market

Quartz watches dominate India’s mass-market segment due to their affordability, precision, and low maintenance. Brands like Titan, Casio, and Fastrack lead this category with stylish yet cost-effective designs. Many consumers prefer quartz watches for daily use, as they offer excellent durability and battery life. Despite competition from smartwatches, quartz watches remain popular among budget-conscious buyers and those who appreciate traditional timepieces.

India Men’s Watch Market

The Indian men's watch market is extremely varied, with everything from high-end Swiss watches such as TAG Heuer to daily watches from Timex and Fastrack. Businessmen prefer traditional analog watches, while young consumers prefer sports and smartwatches. Demand for tough, multi-feature watches is also on the rise, with Casio G-Shock and Garmin being popular brands. With fashion-forward men looking for fashionable and functional watches, the market keeps growing.

India Luxury Watch Market

Indian luxury watch market is seeing steady expansion driven by the growing disposable income and the quest for high-end brands such as Rolex, Audemars Piguet, and Patek Philippe. Luxuries watches have become status icons and investment goods for many upscale buyers. Used luxury watch markets are also picking up with places like Ethos and Kapoor Watch Company selling luxury watches to high-net-worth buyers. The rise in prosperity in India means the demand for luxury watches will grow further.

India Convenience Stores Watch Market

In India, convenience stores stock a range of affordable quartz and digital watches that usually find their target customers in students and regular consumers. The watches are useful, inexpensive, and are easily available through neighborhood retail points and hypermarkets. They might not directly rival the branded or luxury category but meet a particular market need that desires inexpensive yet effective timepiece solutions on a daily basis. Availability in such everyday retail stores provides stable demand.

India Online Convenience Stores Watch Market

Online convenience stores have played an important role in the growth of the Indian watch market, selling a vast variety of timepieces at reasonable prices. Online e-commerce sites such as Flipkart, Amazon, and Tata Cliq offer competitive discounts, instalment payments, and home delivery, increasing consumer access to watches. Digital natives and influencer marketing also increase online sales. As internet penetration and smartphone penetration increase, sales of watches are likely to skyrocket online in India.

India Watch Market Segments

Type

- Quatz Watches

- Electronic Watches

- Mechanical Watches

Gender

- Men

- Women

- Unisex

Price Range

- Luxury

- Non-Luxury

Distribution Channel

- Hyper Market/Super Market

- Convenience Stores

- Online

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Key Players Analysis

- Seiko Holdings Corporation

- Casio Computer Co. Ltd

- Timex Group

- Rolex SA

- Compagnie Financière Richemont S.A

- The Swatch Group Ltd

- Citizen Watch Co. Ltd.

- Fossil Group Inc.

- Google LLC (Fitbit Inc.)

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Type, By Gender, By Price Range and By Distribution Channel |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the Indian watch industry by 2033?

-

What is the expected CAGR of the Indian watch market from 2025 to 2033?

-

Which factors are driving the growth of the Indian watch market?

-

How is the rise in disposable income influencing the luxury watch segment in India?

-

What role do smartwatches play in shaping the Indian watch market?

-

Which brands dominate the smartwatch segment in India?

-

How has e-commerce contributed to the growth of the Indian watch market?

-

What challenges does the Indian watch industry face, particularly regarding counterfeit products?

-

Why are quartz watches still popular among Indian consumers despite the rise of smartwatches?

-

Which distribution channels are most effective for selling watches in India?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. India Watch Market

6. Market Share Analysis

6.1 By Type

6.2 By Gender

6.3 By Price Range

6.4 By Distribution Channel

7. Type

7.1 Quatz Watches

7.2 Electronic Watches

7.3 Mechanical Watches

8. Gender

8.1 Men

8.2 Women

8.3 Unisex

9. Price Range

9.1 Luxury

9.2 Non-Luxury

10. Distribution

10.1 Hyper Market/Super Market

10.2 Convenience Stores

10.3 Online

11. Porter’s Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Rivalry

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1.1 Strength

12.1.2 Weakness

12.1.3 Opportunity

12.1.4 Threat

13. Key Players Analysis

13.1 Seiko Holdings Corporation

13.1.1 Overview

13.1.2 Key Persons

13.1.3 Recent Development & Strategies

13.1.4 Revenue Analysis

13.2 Casio Computer Co. Ltd

13.2.1 Overview

13.2.2 Key Persons

13.2.3 Recent Development & Strategies

13.2.4 Revenue Analysis

13.3 Timex Group

13.3.1 Overview

13.3.2 Key Persons

13.3.3 Recent Development & Strategies

13.3.4 Revenue Analysis

13.4 Rolex SA

13.4.1 Overview

13.4.2 Key Persons

13.4.3 Recent Development & Strategies

13.4.4 Revenue Analysis

13.5 Compagnie Financière Richemont S.A

13.5.1 Overview

13.5.2 Key Persons

13.5.3 Recent Development & Strategies

13.5.4 Revenue Analysis

13.6 The Swatch Group Ltd

13.6.1 Overview

13.6.2 Key Persons

13.6.3 Recent Development & Strategies

13.6.4 Revenue Analysis

13.7 Citizen Watch Co. Ltd.

13.7.1 Overview

13.7.2 Key Persons

13.7.3 Recent Development & Strategies

13.7.4 Revenue Analysis

13.8 Fossil Group Inc.

13.8.1 Overview

13.8.2 Key Persons

13.8.3 Recent Development & Strategies

13.8.4 Revenue Analysis

13.9 Google LLC (Fitbit Inc.)

13.9.1 Overview

13.9.2 Key Persons

13.9.3 Recent Development & Strategies

13.9.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com