Isopropyl Alcohol Market, Consumption & Forecast, Global Analysis: By Regions, Applications (Household, Cosmetics, Acetone etc)

Buy Now

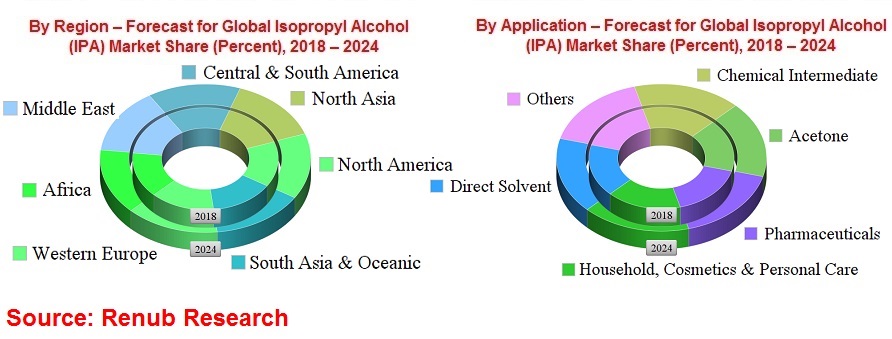

Renub Research report titled “Isopropyl Alcohol Market, Consumption & Forecast, Global Analysis: By Regions (North America, Western Europe, Central and South America, North Asia, South Asia and Oceanic, Africa and Middle East) By Applications (Direct Solvent, Household, Cosmetics and Personal Care, Chemical Intermediate, Acetone, Pharmaceuticals and Others)” studies the global Isopropyl Alcohol market and consumption.

Get Free Customization in This Report

Isopropyl Alcohol Market will reach close to US$ 6 Billion by the year 2024. Isopropyl Alcohol is a colourless, flammable and volatile liquid and a low-cost solvent. Isopropyl Alcohol finds numerous applications in various industries such as cosmetics, pharmaceutical, paints & coatings, cleaning, etc. It is used to create many other compounds such as ketene, methyl methacrylate, bisphenol A, diacetone alcohol mesityl oxide, methyl isobutyl ketone, hexylene glycol (2-methyl-2, 4-pentanediol) and isophorone.

Isopropyl Alcohol is produced from either the indirect hydration of propene or direct catalytic reduction of acetone.

Solvent applications of isopropyl alcohol include inks, surface coatings and processing solvent of natural products (such as fats, gums, vegetable and animal oils, waxes etc.). It is also used as a carrier in the production of food products, household cleaners, etc.

Request a free sample copy of the report: https://www.renub.com/contactus.php

Regional Outlook – North America and Asia-Pacific dominates the Market Share

On the basis of regions, the Isopropyl Alcohol market has been divided into 7 segments: North America, Western Europe, Central and South America, North Asia, South Asia and Oceanic, Africa and Middle East. The Isopropyl Alcohol market is mostly dominated by North America and Asia-Pacific. While on the basis of Consumption, North America is having the maximum consumption share among all the regions studied in this report.

Companies Financial Analysis

Some of the key participants in the global Isopropyl Alcohol market include Dow Chemicals, LG Chem, Carboclor, ISU Chemicals and Mitsui Chemicals Inc.

This 111 page report with 74 Figures and 2 Tables provides an in-depth analysis of the key growth drivers and challenging factors, market and consumption trends, and their projections for the upcoming years. The report has been analyzed from 2 major viewpoints.

1. Global Isopropyl Alcohol Market

• Regions

• Applications

2. Global Isopropyl Alcohol Consumption

• Regions

• Applications

By Region - Segmentation

1. North America

2. Western Europe

3. Central and South America

4. North Asia

5. South Asia and Oceanic

6. Africa

7. Middle East

By Application - Segmentation

1. Direct Solvent

2. Household, Cosmetics and Personal Care

3. Chemical Intermediate

4. Acetone

5. Pharmaceuticals

6. Others

Companies Analysis

1. Dow Chemicals

2. LG Chem

3. Carboclor

4. ISU Chemicals

5. Mitsui Chemicals, Inc.

Report Scope

• The report covers global and regional markets of isopropyl alcohol.

• Comprehensive data showing isopropyl alcohol capacities, consumption, market, drivers and challenges for isopropyl alcohol.

• The report indicates a wealth of information on isopropyl alcohol key players.

• Region market overview covers the following: consumption of isopropyl alcohol in a region.

1. Executive Summary

2. Introduction

2.1 Nomenclature

2.2 Manufacturing

2.3 Physical & Chemical Properties

2.4 Features

2.5 Applications and Usage

2.6 Safety & Toxicology

3. Global Isopropyl Alcohol (IPA) Market

4. Global Isopropyl Alcohol (IPA) Consumption

5. Market Share – Global Isopropyl Alcohol (IPA)

5.1 By Region – (North America, Western Europe, Central and South America, North Asia, South Asia and Oceanic, Africa, Middle East)

5.2 By Application – (Direct Solvent, Household, Cosmetics and Personal Care, Chemical Intermediate, Acetone, Pharmaceuticals, Others)

6. Consumption Share – Global Isopropyl Alcohol (IPA)

6.1 By Region

7. By Region – Global Isopropyl Alcohol (IPA) Market

7.1 North America

7.2 Western Europe

7.3 Central and South America

7.4 North Asia

7.5 South Asia and Oceanic

7.6 Africa

7.7 Middle East

8. By Region – Global Isopropyl Alcohol (IPA) Consumption

8.1 North America

8.2 Western Europe

8.3 Central and South America

8.4 North Asia

8.5 South Asia and Oceanic

8.6 Africa

8.7 Middle East

9. By Application – Global Isopropyl Alcohol (IPA) Market

9.1 Direct Solvent

9.2 Household, Cosmetics and Personal Care

9.3 Chemical Intermediate

9.4 Acetone

9.5 Pharmaceuticals

9.6 Others

10. By Application – Global Isopropyl Alcohol (IPA) Consumption

10.1 Direct Solvent

10.2 Household, Cosmetics and Personal Care

10.3 Chemical Intermediate

10.4 Acetone

10.5 Pharmaceuticals

10.6 Others

11. Companies Financial Highlights

11.1 Dow Chemicals

11.2 LG Chem

11.3 Carboclor

11.4 ISU Chemicals

11.5 Mitsui Chemicals, Inc.

12. Growth Drivers (Due to data confidentiality, growth drivers have not been disclosed in this table of contents)

12.1 Point No: 1

12.2 Point No: 2

12.3 Point No: 3

13. Challenges (Due to data confidentiality, challenges have not been disclosed in this table of contents)

13.1 Point No: 1

List of Figures

Figure 3‑1: Global Isopropyl Alcohol (IPA) Market (Billion US$), 2011 – 2017

Figure 3‑2: Forecast for Global Isopropyl Alcohol (IPA) Market (Billion US$), 2018 – 2024

Figure 4‑1: Global Isopropyl Alcohol (IPA) Consumption (Million Tonnes), 2011 - 2017

Figure 5‑1: By Region - Global Isopropyl Alcohol (IPA) Market Share (Percent), 2011 – 2017

Figure 5‑2: By Region – Forecast for Global Isopropyl Alcohol (IPA) Market Share (Percent), 2018 – 2024

Figure 5‑3: By Application - Global Isopropyl Alcohol (IPA) Market Share (Percent), 2011 – 2017

Figure 5‑4: By Application –Forecast for Global Isopropyl Alcohol (IPA) Market Share (Percent), 2018 – 2024

Figure 6‑1: By Region - Global Isopropyl Alcohol (IPA) Consumption Share (Percent), 2011 – 2017

Figure 6‑2: By Region – Forecast for Global Isopropyl Alcohol (IPA) Consumption Share (Percent), 2018 – 2024

Figure 7‑1: North America - Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 7‑2: North America –Forecast for Isopropyl Alcohol (IPA) Market (Million US$), 2018 – 2024

Figure 7‑3: Western Europe - Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 7‑4: Western Europe– Forecast for Isopropyl Alcohol (IPA) Market (Million US$), 2018 – 2024

Figure 7‑5: Central and South America - Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 7‑6: Central and South America – Forecast for Isopropyl Alcohol (IPA) Market (Million US$), 2018 – 2024

Figure 7‑7: North Asia - Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 7‑8: North Asia–Forecast for Isopropyl Alcohol (IPA) Market (Million US$), 2018 – 2024

Figure 7‑9: South Asia and Oceanic - Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 7‑10: South Asia and Oceanic–Forecast for Isopropyl Alcohol (IPA) Market (Million US$), 2018 – 2024

Figure 7‑11: Africa - Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 7‑12: Africa–Forecast for Isopropyl Alcohol (IPA) Market (Million US$), 2018 – 2024

Figure 7‑13: Middle East - Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 7‑14: Middle East–Forecast for Isopropyl Alcohol (IPA) Market (Million US$), 2018 – 2024

Figure 8‑1: North America - Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 8‑2: North America –Forecast for Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018 – 2024

Figure 8‑3: Western Europe - Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 8‑4: Western Europe–Forecast for Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018 – 2024

Figure 8‑5: Central and South America - Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 8‑6: Central and South America – Forecast for Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018 – 2024

Figure 8‑7: North Asia - Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 8‑8: North Asia – Forecast for Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018 – 2024

Figure 8‑9: South Asia and Oceanic - Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 8‑10: South Asia and Oceanic – Forecast for Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018 – 2024

Figure 8‑11: Africa - Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 8‑12: Africa – Forecast for Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018 – 2024

Figure 8‑13: Middle East - Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 8‑14: Middle East – Forecast for Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018 – 2024

Figure 9‑1: Direct Solvent - Global Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 9‑2: Direct Solvent – Forecast for Global Isopropyl Alcohol (IPA) Market (Million US$), 2018 – 2024

Figure 9‑3: Household, Cosmetics and Personal Care - Global Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 9‑4: Household, Cosmetics and Personal Care –Forecast for Global Isopropyl Alcohol (IPA) Market (Million US$), 2018 – 2024

Figure 9‑5: Chemical Intermediate - Global Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 9‑6: Chemical Intermediate–Forecast for Global Isopropyl Alcohol (IPA) Market (Million US$), 2018– 2024

Figure 9‑7: Acetone - Global Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 9‑8: Acetone–Forecast for Global Isopropyl Alcohol (IPA) Market (Million US$), 2018– 2024

Figure 9‑9: Pharmaceuticals - Global Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 9‑10: Pharmaceuticals – Forecast for Global Isopropyl Alcohol (IPA) Market (Million US$), 2018 – 2024

Figure 9‑11: Others - Global Isopropyl Alcohol (IPA) Market (Million US$), 2011 – 2017

Figure 9‑12: Others–Forecast for Global Isopropyl Alcohol (IPA) Market (Million US$), 2018– 2024

Figure 10‑1: Direct Solvent - Global Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 10‑2: Direct Solvent –Forecast for Global Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018– 2024

Figure 10‑3: Household, Cosmetics and Personal Care - Global Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 10‑4: Household, Cosmetics and Personal Care–Forecast for Global Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018– 2024

Figure 10‑5: Chemical Intermediate - World Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 10‑6: Chemical Intermediate–Forecast for World Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018– 2024

Figure 10‑7: Acetone - World Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 10‑8: Acetone – Forecast for World Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018– 2024

Figure 10‑9: Pharmaceuticals - World Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 10‑10: Pharmaceuticals–Forecast for World Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018– 2024

Figure 10‑11: Others - World Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2011 – 2017

Figure 10‑12: Others – Forecast for World Isopropyl Alcohol (IPA) Consumption (Thousand Tonnes), 2018– 2024

Figure 11‑1: Dow Chemicals – Financial Highlights (Million US$), 2011 – 2017

Figure 11‑2: Forecast for Dow Chemicals – Financial Highlights (Million US$), 2018 – 2024

Figure 11‑3: LG Chem – Financial Highlights (Million US$), 2011 – 2017

Figure 11‑4: Forecast for LG Chem – Financial Highlights (Million US$), 2018 – 2024

Figure 11‑5: Carboclor – Financial Highlights (Million US$), 2011 – 2017

Figure 11‑6: Forecast for Carboclor – Financial Highlights (Million US$), 2018 – 2024

Figure 11‑7: ISU Chemicals – Financial Highlights (Million US$), 2011 – 2017

Figure 11‑8: Forecast for ISU Chemicals – Financial Highlights (Million US$), 2018 – 2024

Figure 11‑9: Mitsui Chemicals, Inc. – Financial Highlights (Million US$), 2011 – 2017

Figure 11‑10: Forecast for Mitsui Chemicals, Inc. – Financial Highlights (Million US$), 2018 – 2024

Figure 12‑1: Global – Beauty and Personal Care Products Market (Billion US$) 2015 - 2016

Figure 12‑2: United States – Paints and Coatings Market (Billion US$), 2010 & 2015

Figure 12‑3: Global Pharmaceuticals Sales (Billion US$), 2013 and 2018

List of Tables

Table 2‑1: Typical Physical Properties of Isopropyl Alcohol (IPA)

Table 4‑1: Top 16 Plants listed by Capacity, (Thousand Tonnes/Year), 2014

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com