North America Kidney Transplant Market, Size, Forecast 2023-2027, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

Buy NowNorth America Kidney Transplant Market Outlook

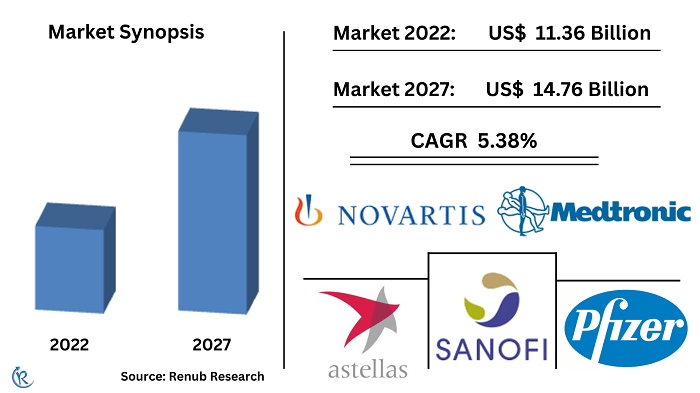

North America Kidney Transplant Market will increase by around US$ 14.76 Billion by 2027. A kidney transplant is a surgical surgery that a healthy kidney is used to replace a damaged or sick kidney donated by another person. The goal of the transplant is to improve or restore the function of the recipient's kidneys, allowing them to live healthier lives with less dependence on dialysis. The success of a kidney transplant is dependent on various factors, including donor-recipient compatibility, good post-operative care, and the recipient's overall health.

In the United States and Canada, there is a large population of individuals with kidney disease, and a significant portion of these individuals require dialysis or a kidney transplant to manage their condition. A kidney transplant can offer these individuals a better quality of life, increased lifespan, and improved health outcomes compared to relying on dialysis alone. Additionally, the availability of advanced medical technology and skilled medical professionals in North American countries make kidney transplantation a safe and effective option for eligible patients. According to our study, the number of kidney transplants in 2022 will be 30.67 thousand, rising to 39.44 thousand by 2027.

North America Kidney Transplant Market will grow at a CAGR of 5.38% during the Forecast Period

Growing demand for kidney transplantation is also one of the key drivers driving expansion potential in the North American sector in the next years. A kidney transplant is reliant on a variety of variables and circumstances. These disorders include renal failure caused by several factors, such as acute dehydration and kidney damage.

The unexpected spike in COVID-19 cases is also expected to raise demand for PPE kits and gloves in North America. Governments from all across the world have taken several initiatives to combat the spread of the new coronavirus. However, the installation of the lockdown has caused global disruptions in the manufacture, distribution, and delivery of medical supplies. Furthermore, health and clinic centers have declined drastically in recent years in order to preserve social distance. These issues will most likely restrict development opportunities in the kidney transplant industry in the next few years.

According to the (OPTN) Organ Procurement and Transplantation Network, 42,887 organ transplants will be done in the United States in 2022, a 3.7% increase over 2021. In addition, for the first time, over 25,000 kidney transplants were done in the United States. The number of 25,498 represented a 3.4 percent increase over 2021. Furthermore, factors such as increased public awareness of organ donation, the development of healthcare infrastructure, and the implementation of favorable reimbursement policies will contribute to the market's growth.

However, problems such as high transplantation costs and lengthy wait times are important impediments to the expansion of the North American kidney transplant industry. Nevertheless, the report shows that the North American kidney transplant market was at US$ 11.36 Billion in 2022.

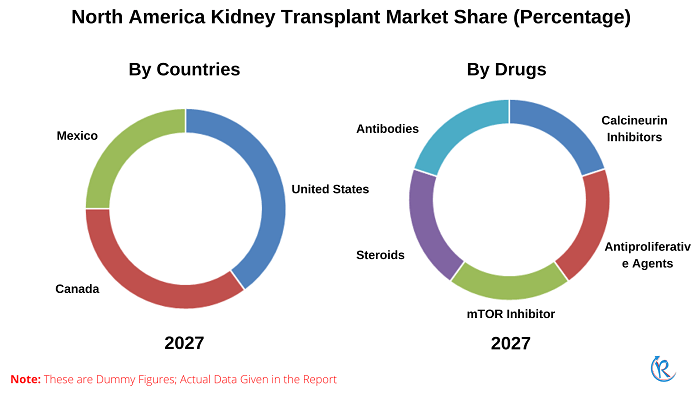

By Region: The United States captured the Highest Market Share

The North American Kidney Transplant Market is divided into; the United States, Mexico, and Canada. In the United States and Canada, there is a large population of individuals with kidney disease, and a significant portion of these individuals require dialysis or a kidney transplant to manage their condition. A kidney transplant can offer these individuals a better quality of life, increased lifespan, and improved health outcomes compared to relying on dialysis alone. Additionally, the availability of advanced medical technology and skilled medical professionals in North American countries make kidney transplantation a safe and effective option for eligible patients.

By Type: The Living Donor Transplant Market will rise in the Foreseeable Years

Based on types, the North American market is segmented into; deceased donor transplants and living donor transplants. The living donor transplant segment is forecasted to grow at a significant rate. As the living donor transplant takes place sooner, the kidney has fewer chances of rejection and lasts longer (15-20 years on average).

By Drugs: The Calcineurin Inhibitors Revenue will grow due to Advancement and Technology in the Healthcare Industry

The Drugs categorizes into; calcineurin inhibitors, antiproliferative agents, mTOR inhibitors, steroids, and antibodies. Calcineurin inhibitors are a class of immunosuppressive drugs used in the management of organ transplantation, including kidney transplantation, in North American countries. These drugs help prevent the rejection of the transplanted organ by suppressing the immune system's response to the foreign tissue. The two most commonly used calcineurin inhibitors in North America are Cyclosporine and Tacrolimus. Both drugs are highly effective in preventing rejection, but they have different side-effect profiles and dosing requirements. These drugs are administered orally or intravenously and are typically prescribed in combination with other immunosuppressive medications to provide a more complete and effective immunosuppression regimen for transplant patients. Patients on the waiting list vs. Liver organ transplants conducted in 2021 were 90,483 out of 25,498 transplants performed, According to the Organ Procurement and Transplantation Network Data.

Renub Research report titled “North America Kidney Transplant Market & Number, Forecast by Types (Deceased donor transplant, and living donor transplant), Drugs (Calcineurin inhibitors, Antiproliferative agents, mTor inhibitor, Steroids, and Antibodies), Region (United States, Canada, and Mexico)” studies the North America Kidney Transplant Industry.

Type – Kidney Transplant Market breakup from 3 viewpoints:

1. Deceased Donor Transplant

2. Living Donor Transplant

Drugs – Kidney Transplant Market breakup from 4 viewpoints

1. Calcineurin inhibitors

2. Antiproliferative agents

3. mTor inhibitor

4. Steroids

5. Antibodies

Region – Kidney Transplant Market breakup from 3 Regions:

1. United States

2. Canada

3. Mexico

Report Details:

| Report Features | Details |

| Base Year | 2022 |

| Historical Period | 2017 - 2022 |

| Forecast Period | 2023 - 2028 |

| Market | US$ Billion |

| Segment Covered | Types, Drugs, and Region |

| Region | United States, Canada, and Mexico |

| Companies Covered | Sanofi, Pfizer, Inc., Novartis AG., B. Braun MelsungenAG, Fresenius Medical Care, Medtronic Plc, Trans Medics GroupInc, and Astellas Pharma Inc. |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Kidney Transplant Number and Market

5.1 Kidney Transplant Number

5.2 Kidney Transplant Market

6. Share Analysis - North America Kidney Transplant Market

6.1 North America (United States, Mexico & Canada) – Kidney Transplant Number Share

6.2 North America (United States, Mexico & Canada) – Kidney Transplant Market Share

6.3 By Types Market Share

6.4 By Drugs Market Share

7. United States - Kidney Transplant Number and Market

7.1 United States – Kidney Transplant Number

7.2 United States – Kidney Transplant Market

8. Canada - Kidney Transplant Number and Market

8.1 Canada – Kidney Transplant Number

8.2 Canada – Kidney Transplant Market

9. Mexico- Kidney Transplant Number and Market

9.1 Mexico – Kidney Transplant Number

9.2 Mexico – Kidney Transplant Market

10. Types - Kidney Transplant Market

10.1 Deceased Donor Transplant

10.2 Living Donor Transplant

11. Drugs - Kidney Transplant Market

11.1 Calcineurin Inhibitors

11.2 Antiproliferative Agents

11.3 mTOR Inhibitor

11.4 Steroids

11.5 Antibodies

12. Company Analysis

12.1 Sanofi

12.1.1 Overview

12.1.2 Resent Development

12.1.3 Revenue

12.2 Pfizer, Inc.

12.2.1 Overview

12.2.2 Resent Development

12.2.3 Revenue

12.3 Novartis AG.

12.3.1 Overview

12.3.2 Resent Development

12.3.3 Revenue

12.4 B.Braun MelsungenAG

12.4.1 Overview

12.4.2 Resent Development

12.4.3 Revenue

12.5 Fresenius Medical Care

12.5.1 Overview

12.5.2 Resent Development

12.5.3 Revenue

12.6 Medtronic Plc

12.6.1 Overview

12.6.2 Resent Development

12.6.3 Revenue

12.7 TransMedics GroupInc

12.7.1 Overview

12.7.2 Resent Development

12.7.3 Revenue

12.8 Astellas Pharma Inc

12.8.1 Overview

12.8.2 Resent Development

12.8.3 Revenue

List of Figures:

Figure-01: North America – Kidney Transplant Market (Billion US$), 2017 – 2021

Figure-02: North America – Forecast for Kidney Transplant Market (Billion US$), 2022 – 2027

Figure-03: North America – Kidney Transplant Volume (Number), 2017 – 2021

Figure-04: North America – Forecast for Kidney Transplant Volume (Number), 2022 – 2027

Figure-05: United States – Kidney Transplant Market (Billion US$), 2017 – 2021

Figure-06: United States – Forecast for Kidney Transplant Market (Billion US$), 2022 – 2027

Figure-07: United States – Kidney Transplant Volume (Number), 2017 – 2021

Figure-08: United States – Forecast for Kidney Transplant Volume (Number), 2022 – 2027

Figure-09: Canada – Kidney Transplant Market (Million US$), 2017 – 2021

Figure-10: Canada – Forecast for Kidney Transplant Market (Million US$), 2022 – 2027

Figure-11: Canada – Kidney Transplant Volume (Number), 2017 – 2021

Figure-12: Canada – Forecast for Kidney Transplant Volume (Number), 2022 – 2027

Figure-13: Mexico – Kidney Transplant Market (Million US$), 2017 – 2021

Figure-14: Mexico – Forecast for Kidney Transplant Market (Million US$), 2022 – 2027

Figure-15: Mexico – Kidney Transplant Volume (Number), 2017 – 2021

Figure-16: Mexico – Forecast for Kidney Transplant Volume (Number), 2022 – 2027

Figure-17: Deceased Donor Transplant – Kidney Transplant Market (Million US$), 2017 – 2021

Figure-18: Deceased Donor Transplant – Forecast for Kidney Transplant Market (Million US$), 2022 – 2027

Figure-19: Living Donor Transplant – Kidney Transplant Market (Million US$), 2017 – 2021

Figure-20: Living Donor Transplant – Forecast for Kidney Transplant Market (Million US$), 2022 – 2027

Figure-21: Calcineurin Inhibitors – Kidney Transplant Market (Million US$), 2017 – 2021

Figure-22: Calcineurin Inhibitors – Forecast for Kidney Transplant Market (Million US$), 2022 – 2027

Figure-23: Antiproliferative Agents – Kidney Transplant Market (Million US$), 2017 – 2021

Figure-24: Antiproliferative Agents – Forecast for Kidney Transplant Market (Million US$), 2022 – 2027

Figure-25: mTOR Inhibitor – Kidney Transplant Market (Million US$), 2017 – 2021

Figure-26: mTOR Inhibitor – Forecast for Kidney Transplant Market (Million US$), 2022 – 2027

Figure-27: Steroids – Kidney Transplant Market (Million US$), 2017 – 2021

Figure-28: Steroids – Forecast for Kidney Transplant Market (Million US$), 2022 – 2027

Figure-29: Antibodies – Kidney Transplant Market (Million US$), 2017 – 2021

Figure-30: Antibodies – Forecast for Kidney Transplant Market (Million US$), 2022 – 2027

Figure-31: Sanofi – Global Revenue (Billion US$), 2017 – 2021

Figure-32: Sanofi – Forecast for Global Revenue (Billion US$), 2022 – 2027

Figure-33: Pfizer, Inc. – Global Revenue (Billion US$), 2017 – 2021

Figure-34: Pfizer, Inc. – Forecast for Global Revenue (Billion US$), 2022 – 2027

Figure-35: Novartis AG. – Global Revenue (Billion US$), 2017 – 2021

Figure-36: Novartis AG. – Forecast for Global Revenue (Billion US$), 2022 – 2027

Figure-37: B.Braun MelsungenAG – Global Revenue (Billion US$), 2017 – 2021

Figure-38: B.Braun MelsungenAG – Forecast for Global Revenue (Billion US$), 2022 – 2027

Figure-39: Fresenius Medical Care – Global Revenue (Billion US$), 2017 – 2021

Figure-40: Fresenius Medical Care – Forecast for Global Revenue (Billion US$), 2022 – 2027

Figure-41: Medtronic Plc – Global Revenue (Billion US$), 2017 – 2021

Figure-42: Medtronic Plc – Forecast for Global Revenue (Billion US$), 2022 – 2027

Figure-43: Trans Medics GroupInc – Global Revenue (Billion US$), 2017 – 2021

Figure-44: Trans Medics GroupInc – Forecast for Global Revenue (Billion US$), 2022 – 2027

Figure-45: Astellas Pharma Inc – Global Revenue (Billion US$), 2017 – 2021

Figure-46: Astellas Pharma Inc – Forecast for Global Revenue (Billion US$), 2022 – 2027

List of Tables:

Table-01: North America – Kidney Transplant Market Share by Countries (Percent), 2017 – 2021

Table-02: North America – Forecast for Kidney Transplant Market Share by Countries (Percent), 2022 – 2027

Table-03: North America – Kidney Transplant Volume Share by Countries (Percent), 2017 – 2021

Table-04: North America – Forecast for Kidney Transplant Volume Share by Countries (Percent), 2022 – 2027

Table-05: North America – Kidney Transplant Market Share by Type (Percent), 2017 – 2021

Table-06: North America – Forecast for Kidney Transplant Market Share by Type (Percent), 2022 – 2027

Table-07: North America – Kidney Transplant Market Share by Drugs (Percent), 2017 – 2021

Table-08: North America – Forecast for Kidney Transplant Market Share by Drugs (Percent), 2022 – 2027

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com