Middle East Air Conditioner Market Forecast Report by Type (Window Type, Split Type, Precision Air Conditioning, Variable Refrigerant Flow (VRF)), End User (Residential, Commercial, Industrial) Countries (Saudi Arabia, United Arab Emirates, Oman, Qatar, Kuwait, Others) and Company Analysis 2025-2033

Buy NowMiddle East Air Conditioner Market Analysis

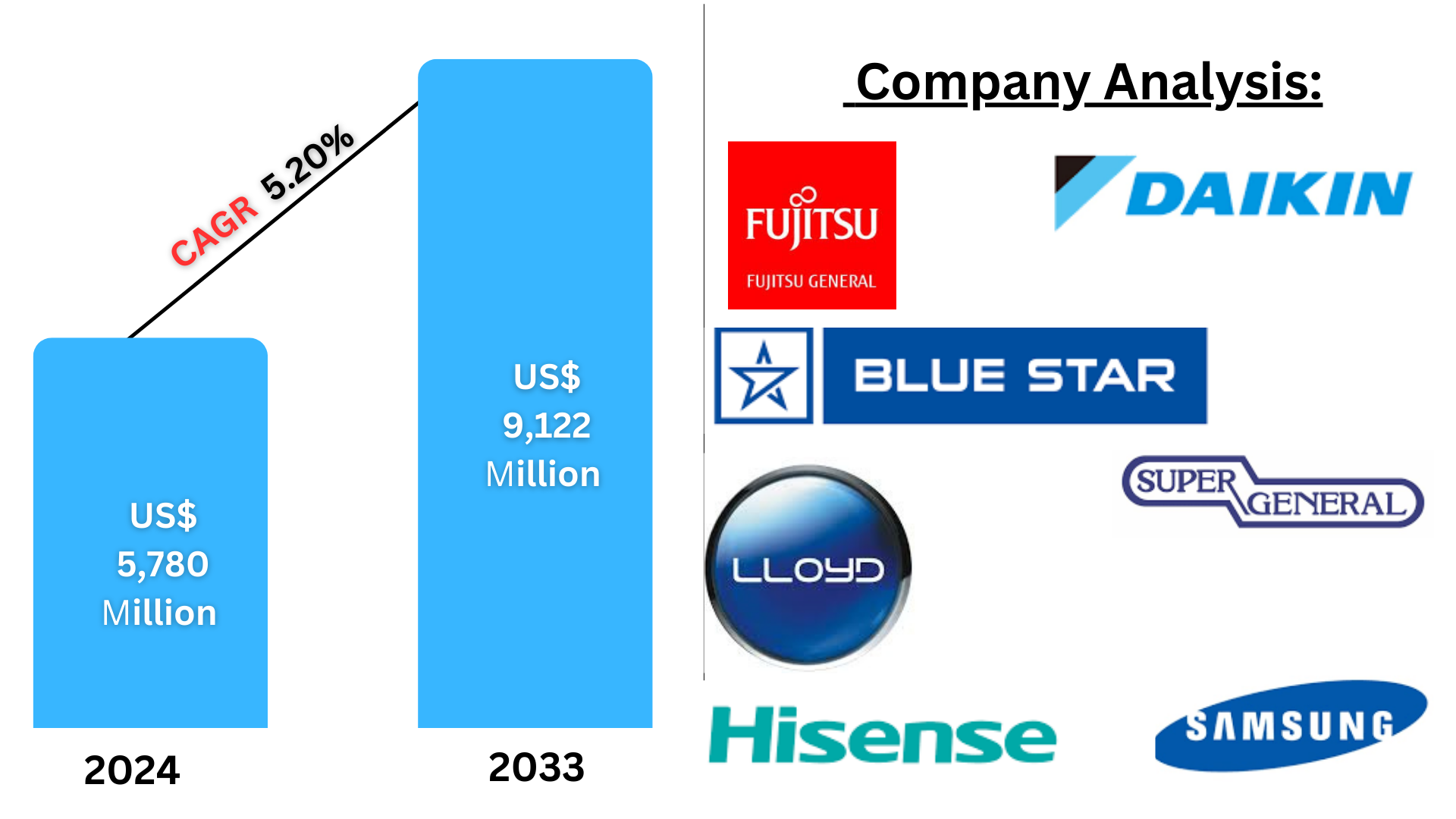

The Middle East Air Conditioner market is expected to grow at a compound annual growth rate (CAGR) of 5.20% from 2025 to 2033, from US$ 5,780 Million in 2024 to US$ 9,122 Million by 2033. Extreme heat, fast urbanization, growing disposable incomes, and growing construction projects are the main drivers of the Middle East air conditioner market. The market is growing as a result of rising demands for eco-friendly, energy-efficient technology as well as higher comfort standards. The need for cooling solutions is also increased by the region's expanding population and climate change.

Middle East Air Conditioner Industry Overview

The hot and dry climate, fast urbanization, and rising disposable incomes in the Middle East have all contributed to the industry's notable expansion. Since temperatures frequently rise above 40°C (104°F), air conditioning is necessary for day-to-day living, especially in the commercial, industrial, and residential sectors. Large-scale construction projects in the Middle East are also driving up demand for air conditioning systems since contemporary infrastructure developments—such as skyscrapers, shopping centers, and apartment complexes—need sophisticated cooling systems.

The adoption of eco-friendly and energy-saving technologies by governments and consumers has made energy efficiency a top priority in recent years. Inverter technology, intelligent air conditioning systems, and eco-friendly refrigerants have all been adopted as a result of this trend. Furthermore, the move toward sustainable cooling systems has been sped up by growing concerns about climate change.

With rising populations and good living standards, nations like the United Arab Emirates, Saudi Arabia, and Qatar are leading this market expansion. The desire for comfort and elegance is fueling innovation, opening doors for new competitors and cooling system technology breakthroughs.

Population expansion, economic activity, and unsustainable consumption rates have made energy efficiency a growing concern for the United Arab Emirates. The government's focus on green construction projects is expected to result in a major boost in the region's demand for HVAC systems and services. For example, Dubai's government wants to convert 30,000 buildings and reduce the city's energy usage by 30% by 2030. This program seeks to boost consumer demand and is one of the UAE's many important energy conservation efforts.

The Dubai Statistics Center estimates that 56.52 terawatt hours of electricity were consumed overall in the United Arab Emirates' emirate of Dubai in 2023. In 2023, the commercial sector accounted for roughly half of all electricity usage. The demand for energy-efficient HVAC systems will rise as a result of this electricity consumption, which will further fuel market expansion.

Driving Forces of Middle East Air Conditioner Market

Infrastructure Development and Urbanization

The need for air conditioning systems is being driven by the Middle East's rapid urbanization and the region's ongoing extensive infrastructural development. In order to maintain comfort in contemporary urban settings, sophisticated cooling technologies are needed during the construction of residential buildings, business complexes, shopping malls, and skyscrapers. As more people relocate to cities, air conditioning is becoming more and more necessary in both new construction and old buildings. In places like Dubai, Riyadh, and Doha, where the intense summer heat necessitates air conditioning, this development is particularly noticeable. The demand for high-performance, energy-efficient AC systems is being further accelerated by the continuous increase in construction in these areas.

Sustainability and Energy Efficiency

Through incentives and restrictions, governments around the Middle East are aggressively promoting sustainable cooling solutions and energy-efficient technologies. Advanced air conditioning systems are becoming more popular as a result of policies designed to lower carbon emissions and energy usage. For instance, in order to guarantee lower energy consumption and a less negative impact on the environment, energy efficiency standards for air conditioners are being imposed. Certain nations provide tax breaks or subsidies to companies and individuals who make investments in energy-efficient, environmentally friendly systems. Furthermore, programs like Saudi Arabia's Vision 2030 and the Dubai Green Building Code place a strong emphasis on sustainability, which increases demand for high-performance, energy-efficient air conditioning systems. The transition to more environmentally friendly cooling options is being sped up by these government initiatives.

Growth in Government Initiatives

Through incentives and restrictions, governments around the Middle East are aggressively promoting sustainable cooling solutions and energy-efficient technologies. Advanced air conditioning systems are becoming more popular as a result of policies designed to lower carbon emissions and energy usage. For instance, in order to guarantee lower energy consumption and a less negative impact on the environment, energy efficiency standards for air conditioners are being imposed. Certain nations provide tax breaks or subsidies to companies and individuals who make investments in energy-efficient, environmentally friendly systems. Furthermore, programs like Saudi Arabia's Vision 2030 and the Dubai Green Building Code place a strong emphasis on sustainability, which increases demand for high-performance, energy-efficient air conditioning systems. The transition to more environmentally friendly cooling options is being sped up by these government initiatives.

Middle East Air Conditioner Market Overview by Countries

Countries like the United Arab Emirates, Saudi Arabia, Qatar, and Kuwait lead the Middle East air conditioner market due to the region's intense heat and fast urbanization. While Saudi Arabia and Qatar concentrate on energy-efficient technologies for expanding infrastructure needs, the United Arab Emirates is a leader in luxury cooling systems. An overview by country is as follows:

United Arab Emirates Air Conditioner Market

Because of the country's harsh environment, fast urbanization, and high level of life, the United Arab Emirates (UAE) has one of the biggest air conditioner markets in the Middle East. Both residential and business spaces require air conditioning since summer temperatures frequently surpass 40°C (104°F). The demand for sophisticated cooling systems in high-rise buildings, shopping centers, and upscale developments is fueled by the UAE's burgeoning construction industry, especially in places like Dubai and Abu Dhabi. Inverter air conditioners and smart cooling systems are also becoming more and more popular as consumers show a preference for energy-efficient and eco-friendly air conditioners. The transition to environmentally friendly technologies is further accelerated by government rules that support sustainability.

Saudi Arabia Air Conditioner Market

The market for air conditioners in Saudi Arabia is fueled by the nation's high temperatures, fast urbanization, and extensive infrastructural development. Air conditioning is essential for comfort in both residential and business settings because summer temperatures frequently approach 50°C (122°F). Ongoing construction projects in places like Riyadh, Jeddah, and Neom, where smart cities and contemporary buildings require high-performance cooling systems, are driving the industry. Environmentally friendly and energy-efficient air conditioners are becoming more and more popular, especially those with low global warming potential (GWP) refrigerants and inverter technology. Sustainability is also emphasized in Saudi Arabia's Vision 2030, which promotes the use of green technologies. The demand for sophisticated, energy-efficient cooling systems is driven by these reasons together.

Qatar Air Conditioner Market

The harsh environment of Qatar, where summer temperatures frequently reach above 40°C (104°F), drives the market for air conditioners. Air conditioning is therefore necessary for day-to-day living. The need for sophisticated cooling solutions in the residential and commercial sectors is rising as a result of the city's fast urbanization and substantial infrastructural development, particularly in Doha. Large-scale urban developments and stadiums for the 2022 FIFA World Cup are examples of major projects that call for sustainable and effective AC systems. In order to lower energy usage, energy-efficient technologies like inverters and smart air conditioners are becoming more and more popular in Qatar. Adoption of high-performance, environmentally friendly air conditioners is also encouraged nationwide by government programs that support sustainability and green construction requirements.

Type- Industry is divided into 4 viewpoints:

- Window Type

- Split Type

- Precision Air Conditioning

- Variable Refrigerant Flow (VRF)

End Users- Industry is divided into 3 viewpoints:

- Residential

- Commercial

- Industrial

Countries - Industry is divided into 6 viewpoints:

- Saudi Arabia

- United Arab Emirates

- Oman

- Qatar

- Kuwait

- Others

All companies have been covered with 4 Viewpoints

- Overview

- Recent Development & Strategies

- Product Portfolio

- Financial Insights

Company Analysis

- Daikin Industries, LTD.

- Fujitsu General (Middle East) FZE

- Blue Star

- Samsung

- Llyod

- Hisense

- Super General

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Type, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Middle East Conditioner Market Analysis

5.1 Market

5.2 Volume

6. Market Share

6.1 Type

6.2 End User

6.3 Country

7. Saudi Arabia

7.1 By Type

7.1.1 Window Type

7.1.1.1 Market

7.1.1.2 Volume

7.1.2 Split Type

7.1.2.1 Market

7.1.2.2 Volume

7.1.3 Precision Air Conditioning

7.1.3.1 Market

7.1.3.2 Volume

7.1.4 Variable Refrigerant Flow (VRF)

7.1.4.1 Market

7.1.4.2 Volume

7.2 End User

7.2.1 Residential

7.2.2 Commercial

7.2.3 Industrial

8. United Arab Emirates

8.1 By Type

8.1.1 Window Type

8.1.1.1 Market

8.1.1.2 Volume

8.1.2 Split Type

8.1.2.1 Market

8.1.2.2 Volume

8.1.3 Precision Air Conditioning

8.1.3.1 Market

8.1.3.2 Volume

8.1.4 Variable Refrigerant Flow (VRF)

8.1.4.1 Market

8.1.4.2 Volume

8.2 End User

8.2.1 Residential

8.2.2 Commercial

8.2.3 Industrial

9. Oman

9.1 By Type

9.1.1 Window Type

9.1.1.1 Market

9.1.1.2 Volume

9.1.2 Split Type

9.1.2.1 Market

9.1.2.2 Volume

9.1.3 Precision Air Conditioning

9.1.3.1 Market

9.1.3.2 Volume

9.1.4 Variable Refrigerant Flow (VRF)

9.1.4.1 Market

9.1.4.2 Volume

9.2 End User

9.2.1 Residential

9.2.2 Commercial

9.2.3 Industrial

10. Qatar

10.1 By Type

10.1.1 Window Type

10.1.1.1 Market

10.1.1.2 Volume

10.1.2 Split Type

10.1.2.1 Market

10.1.2.2 Volume

10.1.3 Precision Air Conditioning

10.1.3.1 Market

10.1.3.2 Volume

10.1.4 Variable Refrigerant Flow (VRF)

10.1.4.1 Market

10.1.4.2 Volume

10.2 End User

10.2.1 Residential

10.2.2 Commercial

10.2.3 Industrial

11. Kuwait

11.1 By Type

11.1.1 Window Type

11.1.1.1 Market

11.1.1.2 Volume

11.1.2 Split Type

11.1.2.1 Market

11.1.2.2 Volume

11.1.3 Precision Air Conditioning

11.1.3.1 Market

11.1.3.2 Volume

11.1.4 Variable Refrigerant Flow (VRF)

11.1.4.1 Market

11.1.4.2 Volume

11.2 End User

11.2.1 Residential

11.2.2 Commercial

11.2.3 Industrial

12. Others

12.1 By Type

12.1.1 Window Type

12.1.1.1 Market

12.1.1.2 Volume

12.1.2 Split Type

12.1.2.1 Market

12.1.2.2 Volume

12.1.3 Precision Air Conditioning

12.1.3.1 Market

12.1.3.2 Volume

12.1.4 Variable Refrigerant Flow (VRF)

12.1.4.1 Market

12.1.4.2 Volume

12.2 End User

12.2.1 Residential

12.2.2 Commercial

12.2.3 Industrial

13. Porter’s Five Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Rivalry

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1 Strength

14.2 Weakness

14.3 Opportunity

14.4 Threat

15. Key Players Analysis

15.1 Daikin Industries, LTD.

15.1.1 Overview

15.1.2 Recent Development & Strategies

15.1.3 Product Portfolio

15.1.4 Financial Insight

15.2 Fujitsu General (Middle East) FZE

15.2.1 Overview

15.2.2 Recent Development & Strategies

15.2.3 Product Portfolio

15.2.4 Financial Insight

15.3 Blue star

15.3.1 Overview

15.3.2 Recent Development & Strategies

15.3.3 Product Portfolio

15.3.4 Financial Insight

15.4 Samsung

15.4.1 Overview

15.4.2 Recent Development & Strategies

15.4.3 Product Portfolio

15.4.4 Financial Insight

15.5 Lloyad

15.5.1 Overview

15.5.2 Recent Development & Strategies

15.5.3 Product Portfolio

15.5.4 Financial Insight

15.6 Hisense

15.6.1 Overview

15.6.2 Recent Development & Strategies

15.6.3 Product Portfolio

15.6.4 Financial Insight

15.7 SUPER GENERAL

15.7.1 Overview

15.7.2 Recent Development & Strategies

15.7.3 Product Portfolio

15.7.4 Financial Insight

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com