North America Chewing Gum Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowNorth America Chewing Gum Market Trends & Summary

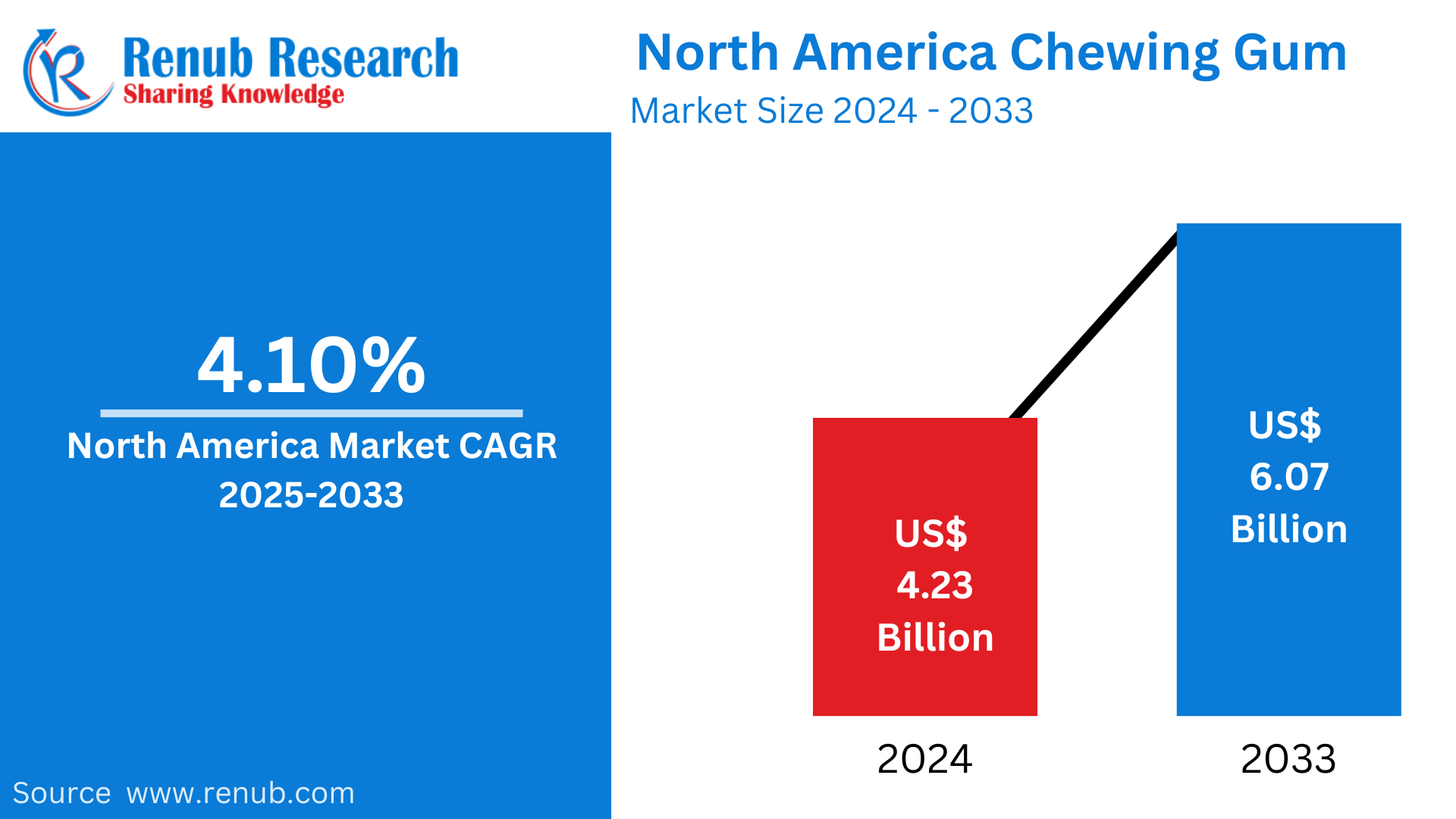

North America Chewing Gum market is expected to reach US$ 6.07 billion by 2033 from US$ 4.23 billion in 2024, with a CAGR of 4.10% from 2025 to 2033. The chewing gum market in North America is fueled by a number of factors, including growing consumer desire for high-end, organic products, developing distribution networks, creative packaging, greater awareness of oral health, and an increase in the use of gum for stress relief and entertainment.

North America Chewing Gum Market Report by Sugar Type (Sugar Free Chewing Gums, Sugared Chewing Gums), Product Type (Pellet, Stick/Tab, Centre-filled, Cut and Wrap, Ball, Others), Distribution Channel (Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Departmental Stores, Online, Others), Country (Canada, Mexico, United States, Rest of North America) and Company Analysis 2025-2033

North America Chewing Gum Industry Overview

The chewing gum market in North America has grown steadily thanks to a changing consumer base and a wide range of products. Gum's prominence as a utilitarian commodity and as a casual snack defines this market. Sugar-free gum has grown to be a popular trend, appealing to people who are concerned about their health, especially those who are trying to control their weight and oral health. The growth of functional gums, which offer extra advantages like stress reduction, energy-boosting chemicals, or even vitamins and supplements, has also helped the sector. The need for innovation and variety in the chewing gum market is only growing as more customers choose these useful options.

The market for chewing gum in North America is also impacted by changing customer tastes, such as a move toward organic and natural ingredients. Companies are responding to these shifts by launching goods that complement the expanding clean-label and non-GMO food trends. Gum's appeal as a portable, on-the-go snack is another factor driving its demand among a range of consumers, including young adults and senior citizens. Additionally, chewing gum is now more widely available and accessible thanks to the growth of e-commerce and contemporary retail channels, which gives businesses the opportunity to reach a larger audience. All things considered, the North American market is anticipated to keep expanding as a result of a confluence of changing consumer needs, innovation, and health trends.

With new statistics indicating that 45.5% of customers prefer mint-flavored gums and 29.1% choose fruit tastes, consumer taste preferences have gotten more varied and sophisticated. In order to satisfy consumer needs, manufacturers have expanded their product portfolios by developing novel tastes and formulations in response to this diversification in flavor preferences. As customers grow more conscious of their daily sugar intake—the average American consumes about 34 teaspoons of sugar per day—the industry has also seen a noticeable shift toward sugar-free options.

Chewing gum retail has seen significant change, especially in the digital sphere. About 92% of Americans had internet connectivity as of 2023, which fueled the explosive expansion of e-commerce platforms in the candy industry. Big firms like Walmart, Target, and Aldi are increasing their online presence as traditional retailers build omnichannel strategies in response to this digital revolution. With 150,174 locations operating nationwide as of January 2023, the convenience store industry continues to be a vital distribution channel, highlighting the industry's continuous reliance on physical retail presence.

Growth Drivers for the North America Chewing Gum Market

Convenience and On-the-Go Consumption

Chewing gum is a great option for people with hectic schedules because of its mobility and simplicity of use. Chewing gum is a discreet and easy way to improve alertness, reduce stress, and freshen breath in today's fast-paced environment where people are always on the go. Unlike snacks that call for more work or utensils, it is a great way to stay energized without requiring extra time for preparation. Gum's popularity is increased by the ease with which consumers can carry it in their pockets or bags while traveling, working, or commuting. Chewing gum's popularity is sustained by its ease and multipurpose advantages, which make it a popular snack among people of all ages.

Natural and Organic Ingredients

Natural and organic chewing gum are in high demand as consumer tastes move toward more sustainable and healthful solutions. Customers are choosing items with cleaner labels and no artificial additives because they are growing more sensitive about the substances in their meals. As a result, numerous chewing gum companies have launched products using ingredients that are sustainable, organic, and non-GMO. These gums support the larger clean-label movement because they don't include artificial sweeteners, colors, or preservatives. Brands appeal to consumers that care about the environment by using eco-friendly packaging and natural gums like chicle. This trend serves consumers looking for more ethical and environmentally responsible options in addition to meeting the desire for healthier products.

E-Commerce and Distribution Channels

The chewing gum market's growth has been greatly impacted by the development of retail distribution channels and the proliferation of e-commerce. Chewing gum companies are using e-commerce platforms to reach a larger audience as more people shop online, particularly on mobile devices. Online retailers offer convenience by enabling customers to buy their favorite gum kinds without ever leaving their homes. Furthermore, gum's growing availability in supermarkets, convenience stores, and vending machines guarantees accessibility in a variety of contexts, including during breaks at work and grocery shopping. These developing distribution networks give businesses additional chances to interact with a range of consumer groups and meet rising demand in various geographical areas, which increases sales and market penetration.

Challenges in the North America Chewing Gum Market

Health Concerns Over Artificial Ingredients

production costs are frequently the result of the growing demand for premium, organic, and clean-label. The market for chewing gum is still facing serious health issues over artificial additives, especially with regard to sugar alcohols like sorbitol and sweeteners like aspartame. Some people are concerned about the possible long-term health repercussions of these artificial additives, even though sugar-free gums have become more and more popular among consumers who are health-conscious. Artificial sweeteners have been connected in studies to a number of problems, including headaches, upset stomachs, and possible metabolic disturbances. As a result, more customers are rejecting synthetic additives and looking for alternatives composed of natural and organic materials. As a result of this change in customer preferences, companies are being forced to come out with new gums that support the clean-label trend by using naturally derived sweeteners like xylitol, stevia, or honey. Manufacturers must strike a balance between flavor and health concerns as consumer demand for cleaner, healthier products grows.

Declining Traditional Gum Consumption

Consumption of traditional chewing gum has been gradually declining, particularly among younger customers who are becoming more interested in healthier and more useful snack options. Chewing gum is finding it difficult to hold onto its position as a favorite snack as this group moves toward snacks like protein bars, almonds, and smoothies that are thought to have health benefits. Younger consumers are more concerned about their health and frequently consider traditional gum to be an indulgence rather than a wise purchase. Manufacturers of gum face a difficulty as a result of this change; they must adjust by launching goods that cater to these shifting consumer tastes. To attract the interest of contemporary snackers, innovations like gums with extra health advantages, organic ingredients, or functional qualities like stress reduction or energy boosts are crucial.

North America Chewing Gum Market Overview by Regions

By countries, the North America Chewing Gum market is divided into Canada, Mexico, United States, Rest of North America.

United States Chewing Gum Market

Due to the high demand from consumers for both conventional and novel gum products, the chewing gum market in the United States represents a sizeable portion of the larger confectionary industry. As consumers place a higher priority on oral health and look for products that offer extra advantages like stress relief, energy boosts, or digestive health, sugar-free and functional gum options are becoming more and more popular. With both new and existing businesses always innovating to meet changing consumer demands, the market is extremely competitive. Although traditional gum usage is being challenged by younger populations who are gravitating toward healthier snacking, clean-label goods, natural ingredients, and novel tastes are drawing in this market. The market's appeal and reach among a wide range of consumer groups have also been boosted by the expansion of retail channels and the advent of e-commerce, which have improved accessibility.

Canada Chewing Gum Market

The demand for both conventional and functional gum products is fueling the steady growth of the chewing gum industry in Canada. Sugar-free gum choices, which support tooth health and accommodate calorie restriction, are becoming more and more popular among health-conscious Canadians. Gums with extra advantages, like those that increase energy or reduce stress, are also becoming more and more popular. Additionally, consumers are gravitating toward natural and organic gum options as they look for goods devoid of artificial sugars and additives. Local and international firms are fighting for market share in this very competitive industry by innovating their flavors, packaging, and ingredients. A wider range of gum products are now available to consumers nationwide thanks to the growth of e-commerce and retail distribution channels.

Mexico Chewing Gum Market

The market for chewing gum in Mexico is expanding due to rising demand for both conventional and sugar-free gum. Customers are gravitating toward gum solutions that provide advantages like cavity prevention and fresh breath as oral health awareness grows. Particularly, sugar-free gums are growing in popularity among health-conscious people trying to cut back on sugar or control their caloric intake. Functional gum types that offer advantages like stress reduction or energy boost are also becoming more popular. As consumers seek cleaner, more sustainable solutions, the market is also seeing a trend toward natural and organic products. Convenience stores, supermarkets, and online marketplaces are among the growing distribution outlets that are making chewing gum more widely available in Mexico.

North America Chewing Gum Market Segments

Sugar Type

• Sugar Free Chewing Gums

• Sugared Chewing Gums

Product Type

• Pellet

• Stick/Tab

• Centre-filled

• Cut and Wrap

• Ball

• Others

Distribution Channel

• Supermarkets and Hypermarkets

• Pharmacies

• Convenience Stores

• Departmental Stores

• Online

• Others

Country

• Canada

• Mexico

• United States

• Rest of North America

All the Key players have been covered from 4 Viewpoints

• Overview

• Key Persons

• Recent Development

• Revenue

Key Players Analysis

1. Canel's Group

2. Church & Dwight Co. Inc.

3. Focus Foods Inc.

4. Ford Gum & Machine Company Inc.

5. Gerrit J. Verburg Co.

6. Lotte Corporation

7. Mars Incorporated

8. Mondelēz International Inc.

9. Simply Gum Inc.

10. The Hershey Company

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Sugar Type, By Product Type, By Distribution Channel and By Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. North America Chewing Gum Market

6. Market Share Analysis

6.1 By Sugar Type

6.2 By Product Type

6.3 By Distribution Channel

6.4 By Country

7. Sugar Type

7.1 Sugar Free Chewing Gums

7.2 Sugared Chewing Gums

8. Product Type

8.1 Pellet

8.2 Stick/Tab

8.3 Centre-filled

8.4 Cut and Wrap

8.5 Ball

8.6 Others

9. Distribution Channel

9.1 Supermarkets and Hypermarkets

9.2 Pharmacies

9.3 Convenience Stores

9.4 Departmental Stores

9.5 Online

9.6 Others

10. Country

10.1 Canada

10.2 Mexico

10.3 United States

10.4 Rest of North America

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 Canel's Group

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Church & Dwight Co. Inc.

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Focus Foods Inc.

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Ford Gum & Machine Company Inc.

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Gerrit J. Verburg Co.

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Lotte Corporation

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Mars Incorporated

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 Mondelēz International Inc.

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

13.9 Simply Gum Inc.

13.9.1 Overviews

13.9.2 Key Person

13.9.3 Recent Developments

13.9.4 Revenue

13.10 The Hershey Company

13.10.1 Overviews

13.10.2 Key Person

13.10.3 Recent Developments

13.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com