North America Dietary Supplement Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowNorth America Dietary Supplement Market Trends & Summary

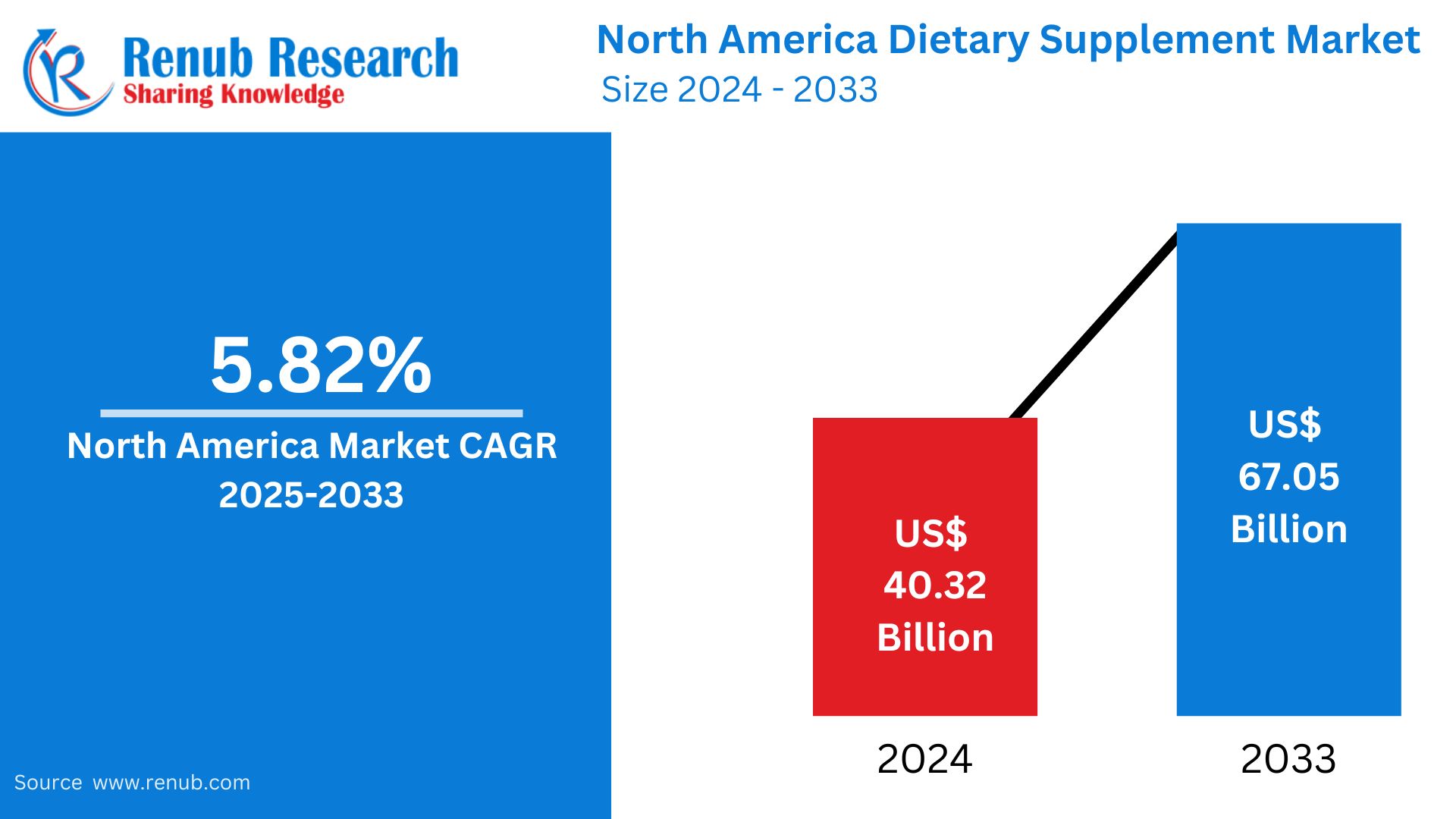

The North America Dietary Supplement Market was valued at US$ 40.32 billion in 2024 and expected to reach US$ 67.05 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.82% from 2025 through 2033. The market is fueled by growing consumer health awareness, rising demand for organic and natural supplements, and increasing adoption of personalized nutrition products.

The report North America Dietary Supplement Market Forecast covers by Product Type (Vitamins and Minerals, Proteins and Amino Acids, Fatty Acids, Herbal Supplements, Enzymes, Other), Form (Soft Gels, Capsules, Tablets, Powder, Gummies, Liquids, Others), Application (General Health, Energy and Weight Management, Gastrointestinal Health, Bone and Joint Health, Immunity, Cardiac Arrest, Diabetes, Anti-Cancer, Others), Distribution Channel (Supermarkets/hypermarkets, Pharmacies/drug Stores, Online Retail Stores, Other), Country and Company Analysis 2025-2033.

North America Dietary Supplement Market Outlooks

Dietary supplements are items intended to complement the diet and supply important nutrients like vitamins, minerals, amino acids, herbs, or other healthful substances. Supplements may be found in many forms such as tablets, capsules, powders, and liquids. They are used to fill in the gaps of nutrients, enhance general health, and enhance functions of the body like immune function, digestion, and mental function.

In North America, supplements are commonly consumed owing to heightened health awareness, ageing populations, and interest in preventive healthcare. Customers depend on supplements for weight loss, muscle building, bone wellness, and mental health. There has also been a sharp growth in demand for natural and organic ingredients with the majority opting for plant-based and clean-label solutions. Also, nutrigenomics advancement and trends in personalized nutrition have led to increased adoption of personalized supplements based on individual health requirements. The North American dietary supplement market keeps expanding as a result of changes in lifestyles and rising awareness of long-term wellness benefits.

Growth Drivers in the North American Dietary Supplement Market

Increasing Health Awareness and Preventive Healthcare Trends

North American consumers are more concerned with overall health and the prevention of chronic diseases. As awareness about nutrition increases, individuals are including dietary supplements in their daily lives to enhance immunity, heart health, and mental health. Preventive healthcare is a major trend, with consumers actively looking for vitamins, minerals, and herbal supplements to prevent health issues before they become critical. Demand for natural, plant-based, and clean-label offerings has also accelerated, further accelerating the growth of the dietary supplement industry. In May 2024, Bayer introduced a One A Day social media campaign starring former NFL star Julian Edelman to fight wellness misinformation. The campaign appeared across key social media platforms, such as Instagram, Facebook, and TikTok. Its main intention was to get people to offer truthful reports on their wellness journeys, pushing against the frequently overly optimistic or psuedoscientific narratives prevalent in online well-being communities.

Aging Population and Greater Nutritional Deficiencies

North America contains a fast aging population, which includes a very large percentage of consumers aged more than 50. Older consumers tend to encounter nutritional deficiencies on account of differences in metabolism, dietary limitations, and medical illnesses. Calcium, vitamin D, and omega-3 fatty acids are critical for bone density, cardiovascular, and brain function. This shift in demographics fuels the need for specialized dietary supplements that address healthy aging and enhance the quality of life. The population of individuals aged 60 years and above in Northern America is estimated to increase from 79 million in 2017 to 123 million in 2050, while the share of the region in the world's older population is likely to fall from 8.2 percent to 5.9 percent, according to the United Nations.

Expansion of E-commerce and Personalized Nutrition

The development of internet retailing has helped immensely to open up the market for dietary supplements. E-commerce websites make products readily accessible to consumers along with product ratings and recommendations tailored to their individual needs. In addition, developments in nutrigenomics and customized nutrition have provided for targeted supplement programs dependent upon a person's genetic profile, lifestyle, and health objectives. Subscription models and direct-to-consumer brands take advantage of this phenomenon, providing tailored supplement solutions to a health- and tech-conscious consumer base. In November 2024, Persona Nutrition, a personalized dietary supplement subscription company, introduced a white-label solution to enable other brands to get into the space of personalized subscriptions with its know-how.

Challenges in the North American Dietary Supplement Market

Stringent Regulations and Compliance Issues

The food supplement market is strictly regulated in North America by organizations like the U.S. Food and Drug Administration (FDA) and Health Canada. Purveyors must ensure that their products follow safety, labeling, and marketing laws. Conformity with Good Manufacturing Practices (GMP) and strict quality testing can prove expensive and time-consuming, which can be problematic for smaller brands. Furthermore, regulatory oversight of health claims and ingredient safety could stifle product innovation and retard market entry.

Rising Concerns Over Product Efficacy and Misinformation

Increasing Concerns Regarding Product Efficacy and Misinformation Customers are increasingly questioning the efficacy and legitimacy of dietary supplements. Cases of deceptive health claims, adulteration, and counterfeiting have raised questions about trust in the market. Customers want increased transparency on sourcing of ingredients, clinical trials, and third-party testing. Companies that do not offer transparent and science-based information risk losing consumer trust and credibility, and companies need to spend on quality assurance and consumer education.

North America Vitamins and Minerals Dietary Supplement Market

Vitamins and minerals continue to be the foundation of the dietary supplement market in North America. Key vitamins C, D, zinc, and iron are commonly taken to maintain immunity, bone health, and general well-being. Multivitamin demand has increased as a result of hectic lifestyles, dietary deficiencies, and preventive healthcare. Brands are creating innovative organic, vegan, and gummy products to meet varied consumer needs. The vitamins and minerals category is anticipated to advance with consumers focusing on health and wellbeing.

North America Dietary Supplement Capsules Market

Capsules are among the most sought-after supplement forms because they are easy to swallow, have exact dosage, and have a long shelf life. Capsules are more preferred than tablets or powders by many consumers because they are flavorless, easy to use, and tend to have fewer additives. This category consists of numerous supplements ranging from multivitamins and probiotics to herbal extracts and omega-3 fatty acids. The growth of plant-based and gelatin-free capsules has opened up the market to vegetarian and vegan consumers.

North America General Health Dietary Supplement Market

General health supplements are for the wide range of consumers seeking overall health. The offerings consist of primary vitamins, minerals, antioxidants, and herbal supplements aimed at optimizing digestive health, energy, and mental focus. The trend for holistic wellness and functional nutrition promotes demand for panacea-style supplement solutions that give consumers overall wellness and long-term health. The inclusion of adaptogens, probiotics, and superfoods is also found in general health offerings to appeal to health-conscious individuals.

North America Immunity Dietary Supplement Market

The COVID-19 pandemic led to a major boost in consumer demand for immunity-boosting supplements. Supplements with vitamin C, vitamin D, zinc, elderberry, and echinacea have seen an uptick in demand. As immune health takes center stage for consumers, brands emphasize novel delivery forms like effervescent tablets, gummies, and liquid supplements. Research on immunity-enhancing ingredients will continue to propel product development and market growth in this space.

North America Dietary Supplement Pharmacies/Drug Stores Market

Pharmacies and drug stores continue to be an important channel of distribution for dietary supplements in North America. These stores are where consumers turn for high-quality, science-formulated supplements that healthcare professionals recommend. Large chains of pharmacies sell over-the-counter vitamins, minerals, and specialty supplements to address different health concerns. Increased private-label supplement availability in drug stores has also driven market growth, offering affordable choices for consumers.

United States Dietary Supplement Market

The United States is the biggest market for dietary supplements in North America, fueled by a robust culture of health and wellness. There is high demand for weight control, sports nutrition, and immune-boosting supplements among American consumers, prioritizing functional nutrition. The regulatory control of the FDA guarantees the safety and quality of products. Nevertheless, growing customer skepticism regarding supplement effectiveness has boosted transparency-driven brands that sell third-party tested items. The United States market still grows with breakthroughs in bespoke nutrition and vegan supplements. In February 2024, Herbalife Nutrition debuted the 'GLP-1 Nutrition Companion' line of novel food and supplement products for persons taking GLP-1 and other anti-obesity drugs. This range incorporates Herbalife's flagship protein shake, plus a range of support nutritional supplements.

Canada Dietary Supplement Market

The Canadian dietary supplement market is expanding as a result of expanded consumer awareness and government encouragement for health and wellness programs. The Canadian populace is very responsive to natural and organic supplements, resulting in heightened demand for herbal and plant-based vitamins. Regulatory control by Health Canada guarantees product safety, increasing consumer confidence in the market. Dietary supplements are largely sold through e-commerce, with online stores providing a wide variety of products designed for particular health requirements. Aug 2023, Vitux is building its first North American dietary supplement manufacturing plant in Canada to satisfy growing global demand for its Smart Chew system, which delivers nutrients in the form of a chewable jelly.

North America Dietary Supplement Market Segments

Product Type

- Vitamins and Minerals

- Proteins and Amino Acids

- Fatty Acids

- Herbal Supplements

- Enzymes

- Other

Form

- Soft Gels

- Capsules

- Tablets

- Powder

- Gummies

- Liquids

- Others

Application

- General Health

- Energy and Weight Management

- Gastrointestinal Health

- Bone and Joint Health

- Immunity

- Cardiac Arrest

- Diabetes

- Anti-Cancer

- Others

Distribution Channel

- Supermarkets/hypermarkets

- Pharmacies/drug Stores

- Online Retail Stores

- Other

Country

- United States

- Canada

- Mexico

- Rest of North America

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Key Players Analysis

- Abbott

- Amway Corporation

- Glanbia PLC

- Bayer AG

- NOW Food

- The Carlyle Group

- Nutraceutics Inc.

- Herbalife Nutrition

- Forest Remedies

- Procter & Gamble

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Form, Application, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the North America dietary supplement market by 2033?

-

What is the expected compound annual growth rate (CAGR) of the market from 2025 to 2033?

-

Which factors are driving the growth of the dietary supplement market in North America?

-

What are the major product types covered in the market analysis?

-

How is the aging population influencing the demand for dietary supplements in North America?

-

What role does e-commerce play in the expansion of the dietary supplement market?

-

What are the key challenges faced by the dietary supplement market in North America?

-

Which distribution channels are analyzed in the report for dietary supplement sales?

-

What is the significance of personalized nutrition in the dietary supplement industry?

-

Which key players are dominating the North America dietary supplement market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Dietary Supplement Market

6. Market Share Analysis

6.1 Type

6.2 Form

6.3 Application

6.4 Distribution Channel

6.5 Country

7. Product Type

7.1 Vitamins and Minerals

7.2 Proteins and Amino Acids

7.3 Fatty Acids

7.4 Herbal Supplements

7.5 Enzymes

7.6 Other

8. Form

8.1 Soft Gels

8.2 Capsules

8.3 Tablets

8.4 Powder

8.5 Gummies

8.6 Liquids

8.7 Others

9. Application

9.1 General Health

9.2 Energy and Weight Management

9.3 Gastrointestinal Health

9.4 Bone and Joint Health

9.5 Immunity

9.6 Cardiac Arrest

9.7 Diabetes

9.8 Anti-Cancer

9.9 Others

10. Distribution Channel

10.1 Supermarkets/hypermarkets

10.2 Pharmacies/drug Stores

10.3 Online Retail Stores

10.4 Other

11. Country

11.1 United States

11.2 Canada

11.3 Mexico

11.4 Rest of North America

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Key Players Analysis

14.1 Abbott

14.1.1 Overview

14.1.2 Key Person

14.1.3 Recent Developments

14.1.4 Revenue

14.2 Amway Corporation

14.2.1 Overview

14.2.2 Key Person

14.2.3 Recent Developments

14.2.4 Revenue

14.3 Glanbia PLC

14.3.1 Overview

14.3.2 Key Person

14.3.3 Recent Developments

14.3.4 Revenue

14.4 Bayer AG

14.4.1 Overview

14.4.2 Key Person

14.4.3 Recent Developments

14.4.4 Revenue

14.5 NOW Food

14.5.1 Overview

14.5.2 Key Person

14.5.3 Recent Developments

14.5.4 Revenue

14.6 The Carlyle Group

14.6.1 Overview

14.6.2 Key Person

14.6.3 Recent Developments

14.6.4 Revenue

14.7 Nutraceutics Inc.

14.7.1 Overview

14.7.2 Key Person

14.7.3 Recent Developments

14.7.4 Revenue

14.8 Herbalife Nutrition

14.8.1 Overview

14.8.2 Key Person

14.8.3 Recent Developments

14.8.4 Revenue

14.9 Forest Remedies

14.9.1 Overview

14.9.2 Key Person

14.9.3 Recent Developments

14.9.4 Revenue

14.10 Procter & Gamble

14.10.1 Overview

14.10.2 Key Person

14.10.3 Recent Developments

14.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com