North America Meat Substitutes Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowNorth America Meat Substitutes Market Trends & Summary

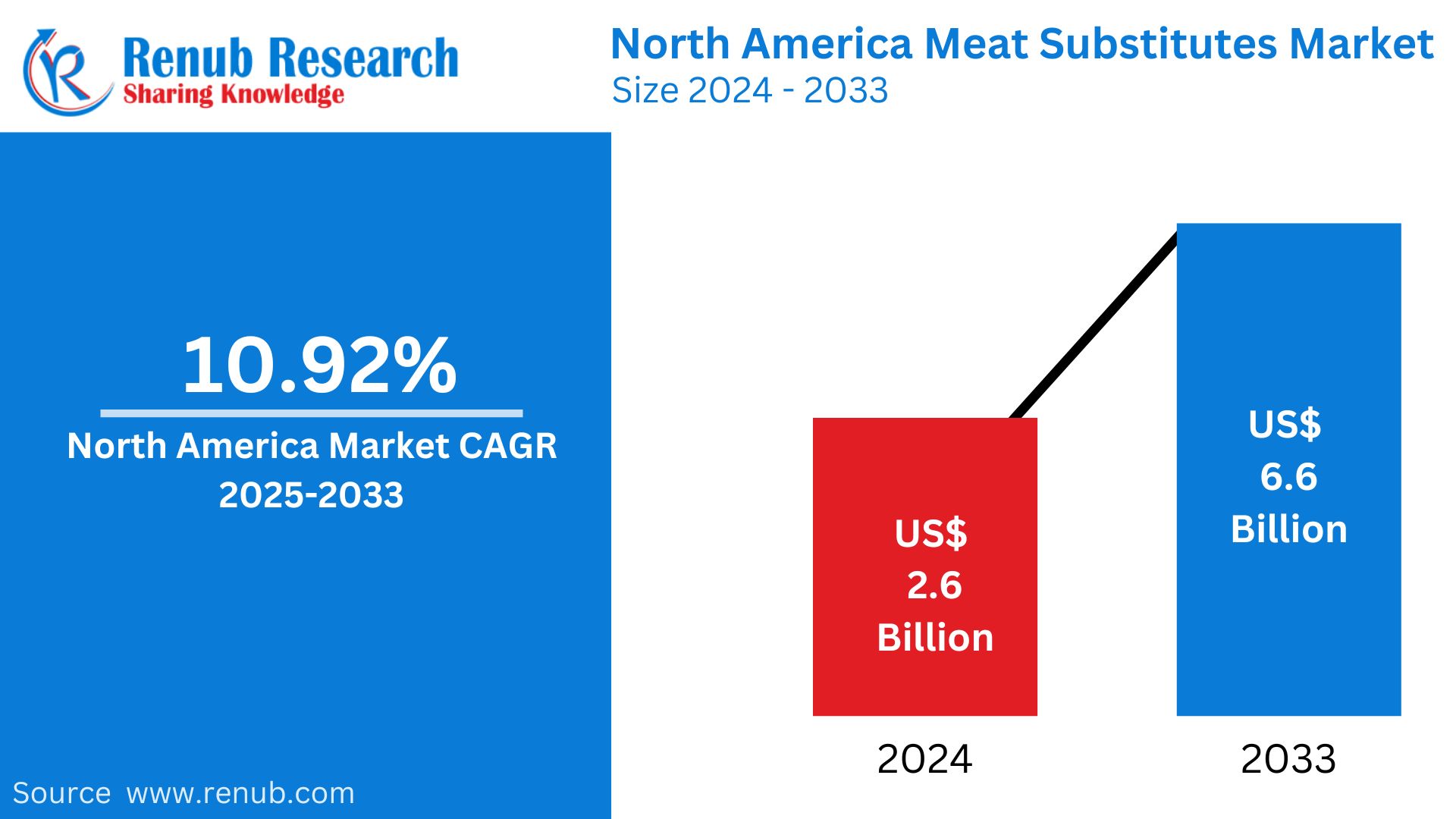

The North America Meat Substitutes Market was valued at USD 2.6 billion in 2024 and is anticipated to grow to USD 6.6 billion by 2033, with a CAGR of 10.92% during the 2025-2033 period. Growing demand for plant proteins, growing health awareness, and continuous advancements in food technology are driving the market growth, improving the taste and texture of alternative meat.

The report North America Meat Substitutes Market Forecast covers by Type (Tempeh, Textured Vegetable Protein, Tofu, Other Meat), Source (Soy, Wheat, Pea, Others), Product Type (Burger/Patties, Strips & Nuggets, Sausages, Ground), Distribution Channel (Food Service Channels, Retail Channels, Supermarkets and Hypermarkets, Specialty Stores, Online Channel, Others), Country and Company Analysis 2025-2033.

North America Meat Substitutes Market Outlooks

Meat substitutes are plant or laboratory-grown foods that mimic the taste, texture, and nutritional content of animal meat. These substitutes are normally produced from foodstuffs such as soy, pea protein, wheat gluten, and mycoprotein. They are usually fortified with key nutrients like iron, vitamin B12, and omega-3s to give a balanced diet to vegetarians, vegans, and health-conscious individuals.

Meat substitutes have seen their popularity explode in North America as awareness of health benefits, environmental considerations, and ethical animal welfare concerns have grown. Demand has also been driven by growth in flexitarian diets, which involve the reduction of meat consumption but not the complete avoidance of it. Brands like Beyond Meat and Impossible Foods have taken significant market share, with expansion into retail and foodservice channels. Restaurants and fast-food chains are also adding plant-based alternatives to their menus, bringing meat substitutes within reach of mainstream consumers and fueling quick market expansion in the region.

Growth Drivers in the North America Meat Substitutes Market

Increasing Health Consciousness

North American consumers are becoming more health-conscious and wellness-oriented, and this has created a huge demand for meat substitutes. They are being increasingly chosen for their lower cholesterol and saturated fat content. This is influenced by increasing awareness of the health hazards of red meat consumption, such as cardiovascular conditions and obesity. Manufacturers are reacting by extending their range of healthier, plant-based options that appeal to health-conscious consumers. Increased health consciousness in the U.S. is fueling demand for meat substitutes, with approximately 42.4% of adults being obese and numerous consumers looking for healthier protein sources. According to a 2023 Gallup survey, 41% of Americans have consumed plant-based alternatives, mainly for health purposes. Green concerns are especially affecting younger consumers.

Environmental Sustainability Concerns

Green consciousness is another major driver of the expansion of meat substitutes in North America. Conventional meat production is one of the primary causes of greenhouse gas emissions, deforestation, and water pollution. Consumers are turning to plant-based foods to lower their carbon footprint and encourage sustainability. This trend has led food producers to create innovative meat substitutes that have the same taste and texture but are more environmentally friendly. In 2024, Environmental sustainability is fueling the use of meat substitutes in the US. Agriculture accounts for almost 10% of greenhouse gas emissions, whereas plant-based alternatives such as pea protein emit less and require less land and water. The sustainability efforts of the Biden administration, such as the USDA's "Climate-Smart Agriculture," promote the development of plant-based industries and the transition towards sustainable food production.

Increasing Product Variety and Availability

The growing diversity and accessibility of meat alternatives in retail stores, hypermarkets, and internet platforms have been the main drivers of market expansion. The investments in research and development to develop products with a texture and flavor similar to that of meat have helped drive business. Alongside, food technologies have enabled creation of alternatives containing soy, peas, and various other protein material, facilitating users to switch into meat substitutes easily without compromising the taste and gratification. In September 2024, Impossible Foods has rolled out next-generation plant-based chicken nuggets for casual dining, quick service, and retail channels with enhanced texture and flavor to directly compete with meat analogues and take advantage of the growing plant-based chicken market.

Challenges in the North America Meat Substitutes Market

High Production Costs

One of the greatest challenges that the meat substitutes market in North America is facing is the high production cost. Ingredients like soy and pea protein need massive processing to have the perfect texture and taste, adding to the cost of production. Also, the expense of research and development of new plant-based meat alternatives contributes to the economic strain. Such additional costs trickle down to consumers, and as a result, meat substitutes become even more expensive than natural meat products.

Consumer Skepticism and Taste Preferences

Though plant-based diets are becoming increasingly popular, consumers are still wary of the taste and texture of meat substitutes. Some people find the plant-based option less satisfying than regular meat and hence do not want to switch. Also, there is a general view that meat substitutes have artificial add-ons or are excessively processed, which can keep health-focused consumers away. Conquering these taste and perception issues is the biggest challenge for firms in the sector.

North America Tempeh Meat Substitutes Market

Tempeh, a fermented soy food, has gained popularity in the North American market as a healthy meat alternative. Due to its high protein and fiber levels, tempeh is attractive to health-oriented consumers looking for plant-based protein. Tempeh is also popular due to its dense texture, making it an attractive ingredient for numerous dishes. As consumer demand for minimally processed, natural foods continues to expand, tempeh is poised to experience increased demand over the next few years.

North America Tofu Meat Substitutes Market

Tofu has been a regular feature in the diet of vegetarians and vegans for many years, and its demand in North America keeps increasing. Being derived from soybeans, tofu is high in protein and packed with all amino acids that the body needs, thus being an ideal meat substitute. It can be used across a wide range of cuisines because it easily absorbs flavors and can be prepared in many different ways. The increasing popularity of vegan and flexitarian consumers is driving market expansion for meat substitutes based on tofu.

North America Soy Meat Substitutes Market

Soy meat substitutes are one of the most common plant-based sources of protein in North America. Soy protein is extensively utilized for the manufacture of meat substitutes like burgers, sausages, and nuggets because it has the capacity to mimic the meat texture. Soy-based products' market keeps growing as manufacturers produce better formulations that improve taste and texture and comply with consumer expectations for sustainable and healthy alternatives.

North America Pea Meat Substitutes Market

Pea protein has turned out to be one of the most prominent ingredients in the market for meat alternatives as it possesses a high concentration of protein as well as contains no allergens. Pea meat alternatives prove especially attractive for people with gluten or soy allergy. Manufacturers are putting money into producing pea products with a similar texture and flavor as meat. Increasing demand for clean-label, non-GMO, and sustainably produced foods further fuels interest in pea meat alternatives.

North America Sausages Meat Substitutes Market

Plant sausages have become increasingly popular in North America as consumers look for convenient and familiar meat substitutes. They are usually manufactured from soy, pea, or wheat protein and are formulated to mimic the flavor and texture of conventional sausages. As more restaurants and fast-food outlets include plant sausage in their offerings, market demand keeps growing, and this is a major segment in the meat substitutes market.

North America Strips & Nuggets Meat Substitutes Market

Strips and nuggets are two of the most popular meat alternatives because of their convenience and versatility. They are typically produced from soy or pea protein and sold as direct substitutes for chicken strips and nuggets. This popularity is fueled by increasing demand from families, young people, and fast-food restaurants that are looking to expand their plant-based menu options. Ongoing innovation in texture and flavor is likely to continue to fuel this market segment.

North America Meat Substitutes Supermarkets and Hypermarkets Market

Supermarkets and hypermarkets dominate the distribution of meat substitutes in North America. These stores give consumers convenient access to a broad variety of plant-based foods. Most large grocery store chains are increasing their sections of plant-based foods due to growing consumer demand. Promotions, discounts, and in-store promotions are also fueling sales of meat substitutes through these channels.

United States Meat Substitutes Market

The United States is one of the largest markets for meat substitutes in the North American region. Rising interest in plant-based diet, rising investment in alternative protein start-ups, and a strong penetration of large food manufacturers are responsible for market growth. U.S. consumers are especially attracted by new-fangled meat substitute products that closely resemble the texture and flavor of meat, thus resulting in a highly competitive market environment. April 2023, plant-based meat industry leader Beyond Meat introduced Beyond Pepperoni and Beyond Chicken Fillet in April 2023 after the success of Beyond Steak.

Canada Meat Substitutes Market

Plant-based diets have been gaining acceptance in Canada with a huge rise in the sales of meat substitutes. The move of the Canadian government to ensure sustainable food practices and decrease the use of meat is favoring the market. In addition, the presence of plant-based products in grocery stores, restaurants, and fast food chains is facilitating Canadian consumers to include meat alternatives in their diet, fueling consistent market expansion. Apr 2024, Protein Industries Canada celebrated the launch of a joint project for scaling up Wamame Foods' new high protein product line with a taste event.

North America Meat Substitutes Market Segments

Type

- Tempeh

- Textured Vegetable Protein

- Tofu

- Other Meat

Source

- Soy

- Wheat

- Pea

- Others

Product Type

- Burger/Patties

- Strips & Nuggets

- Sausages

- Ground

Distribution Channel

- Food Service Channels

- Retail Channels

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Channel

- Others

Country

- Canada

- Mexico

- United States

- Rest of North America

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Key Players Analysis

- Amy's Kitchen Inc.

- Associated British Foods PLC

- Cargill Inc.

- Conagra Brands Inc.

- Hormel Foods Corporation

- Impossible Foods Inc.

- Maple Leaf Foods

- Nestle S.A.

- The Kellogg Company

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Type, Source, Product Type, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the North America meat substitutes market by 2033?

-

What is the expected CAGR of the market from 2025 to 2033?

-

What are the key factors driving the growth of the meat substitutes market in North America?

-

Which plant-based protein sources are commonly used in meat substitutes?

-

How are environmental sustainability concerns impacting consumer demand for meat substitutes?

-

What are the major challenges faced by the North America meat substitutes market?

-

Which distribution channels are contributing the most to the sales of meat substitutes?

-

What role do fast-food chains and restaurants play in the expansion of the meat substitutes market?

-

How is the demand for tempeh, tofu, and pea-based meat substitutes evolving?

-

Who are the key players in the North America meat substitutes market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Meat Substitutes Market

6. Market Share Analysis

6.1 By Type

6.2 By Source

6.3 By Product Type

6.4 By Distribution Channel

6.5 By Country

7. Type

7.1 Tempeh

7.2 Textured Vegetable Protein

7.3 Tofu

7.4 Other Meat

8. Source

8.1 Soy

8.2 Wheat

8.3 Pea

8.4 Others

9. Product Type

9.1 Burger/Patties

9.2 Strips & Nuggets

9.3 Sausages

9.4 Ground

10. Distribution Channel

10.1 Food Service Channels

10.2 Retail Channels

10.2.1 Supermarkets and Hypermarkets

10.2.2 Specialty Stores

10.2.3 Online Channel

10.2.4 Others

11. Country

11.1 Canada

11.2 Mexico

11.3 United States

11.4 Rest of North America

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Key Players Analysis

14.1 Amy's Kitchen Inc.

14.1.1 Overview

14.1.2 Key Person

14.1.3 Recent Developments

14.1.4 Revenue

14.2 Associated British Foods PLC

14.2.1 Overview

14.2.2 Key Person

14.2.3 Recent Developments

14.2.4 Revenue

14.3 Cargill Inc.

14.3.1 Overview

14.3.2 Key Person

14.3.3 Recent Developments

14.3.4 Revenue

14.4 Conagra Brands Inc.

14.4.1 Overview

14.4.2 Key Person

14.4.3 Recent Developments

14.4.4 Revenue

14.5 Hormel Foods Corporation

14.5.1 Overview

14.5.2 Key Person

14.5.3 Recent Developments

14.5.4 Revenue

14.6 Impossible Foods Inc.

14.6.1 Overview

14.6.2 Key Person

14.6.3 Recent Developments

14.6.4 Revenue

14.7 Maple Leaf Foods

14.7.1 Overview

14.7.2 Key Person

14.7.3 Recent Developments

14.7.4 Revenue

14.8 Nestle S.A.

14.8.1 Overview

14.8.2 Key Person

14.8.3 Recent Developments

14.8.4 Revenue

14.9 The Kellogg Company

14.9.1 Overview

14.9.2 Key Person

14.9.3 Recent Developments

14.9.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com