North America Baby Food Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowNorth America Baby Food Market Trends & Summary

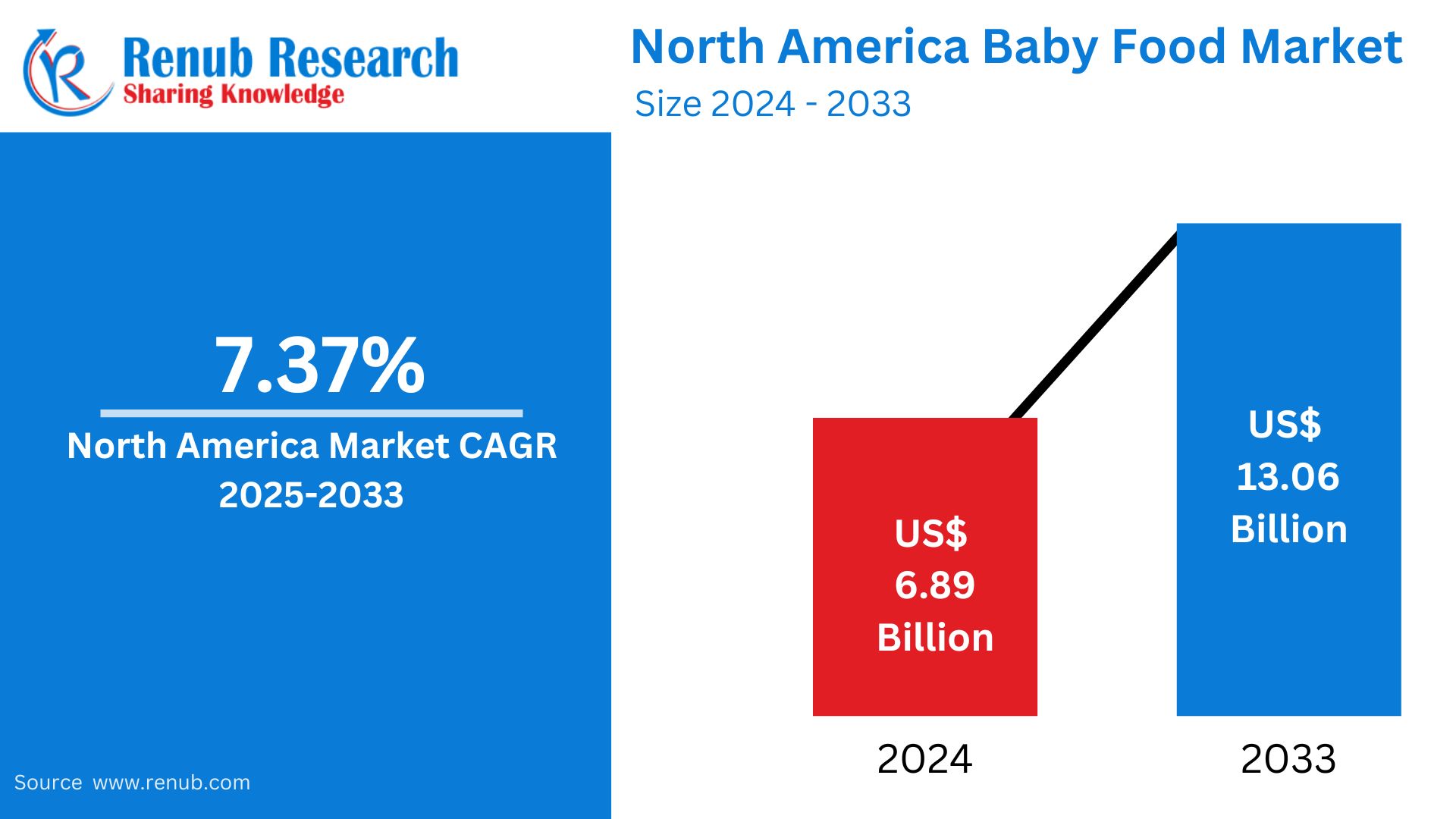

The North America Baby Food Market is estimated to be worth US$ 6.89 billion in 2024 and is anticipated to grow at a CAGR of 7.37% during the forecast period of 2025 to 2033, reaching a value of US$ 13.06 billion by 2033. Drivers include increasing demand for organic and natural baby food, heightened health consciousness among parents, and innovations in infant nutrition.

The report North America Baby Food Market Forecast covers by Food Type (Milk Formula, Dried Food, Prepared, Others), Distribution Channel (Supermarkets & Hypermarkets, Drugstores/Pharmacies, Convenience Stores, Online Stores, Others), Countries (Unites States, Canada, Mexico), Company Analysis 2025-2033.

North America Baby Food Market Outlooks

Baby food is specially prepared soft, easily digestible food items for infants and toddlers, usually between four months and two years of age. These foods contain necessary nutrients, vitamins, and minerals required for a child's early development and growth. Baby food is available in different forms, such as purees, cereals, snacks, and formula, to suit different dietary requirements. In North America, baby food is extensively utilized by parents looking for convenient, healthy, and safe feeding for their kids.

Organic and non-GMO baby food is becoming increasingly popular as a result of increased awareness regarding pesticides and artificial additives. Fortified baby food with iron, DHA, and probiotics also aids in brain development and digestion. Ready-to-eat pouches and organic cereals are favored by many parents, making feeding convenient while on the move. The growth of plant-based and allergen-free baby food further increases market options. With more awareness of infant nutrition and health, demand for quality baby food is on the rise in North America.

Drives of Growth in the North America Baby Food Market

Increasing Demand for Organic and Clean-Label Baby Food

North American parents are increasingly turning to organic, non-GMO, and preservative-free baby food as a result of pesticide, artificial additive, and allergen concerns. The need for clean-label and minimally processed baby food has created the opportunity for organic purees, cereals, and snacks. This is being addressed by companies rolling out certified organic products that have rigorous safety and nutritional requirements. This trend is especially evident among premium baby food brands, which emphasize high-quality ingredients and transparent sourcing, continuing to fuel market growth. Feb 2022, Sprout Organics is expanding its product family with a co-branded range alongside "CoComelon," one of its popular characters in the form of J.J., YoYo, and TomTom. The move launches a selection of veggie-full pureed meals and healthful snacks constructed using real organic foods, ushering in "CoComelon's" excitement at meal times for children right across North America.

Increasing Sensitivity to Baby Food Nutrition and Well-being

Today, parents are more aware of the importance of early childhood nutrition, resulting in greater demand for baby food fortified with essential vitamins, minerals, probiotics, and DHA for brain growth. Fortified baby food, such as iron-fortified cereals and omega-3-enriched purees, is becoming a choice of preference. Pediatrician advice promoting balanced diet and allergen-free products has also helped fuel growth in plant-based and dairy-free baby food products, contributing to market growth. The Centers for Disease Control and Prevention states that there were 3.6 million births in the U.S. in 2023, with the number expected to rise to 3.62 million in 2024.

E-Commerce and Direct-to-Consumer Sales Expansion

The e-commerce and subscription baby food model have revolutionized the market terrain. Parents are increasingly shopping for baby food from online platforms, brand portals, and food delivery websites, enjoying convenience, greater product varieties, and personalized diet plans. Direct-to-consumer companies selling customized baby meal plans and home delivery services are becoming popular, further driving North American sales. The digital era enables brands to communicate directly with consumers and keep up with shifting dietary trends. Oct2024, the sole mom-founded pediatric nutrition brand, is introducing a new grass-fed Whole Milk Infant Formula. This product gives U.S. parents more choices while maintaining Bobbie's high standards. The formula shows Bobbie's conviction that formula should use simple, high-quality ingredients that are made in America.

Challenges in the North America Baby Food Market

High Competition and Market Saturation

The North American baby food market is highly competitive, with large global brands, private labels, and organic emerging companies competing for consumer attention. This has resulted in price pressures and lower profit margins for manufacturers. Moreover, the popularity of homemade baby food among parents looking for lower-cost and fresher food options poses an additional challenge to packaged baby food companies. To differentiate themselves, brands need to innovate in terms of maintaining premium quality, added-value products constantly.

Regulatory and Safety Challenges

Stringent food safety regulations, including those imposed by the FDA and USDA, mandate that baby food companies adhere to high safety, quality, and labeling standards. Recent issues with heavy metals in baby food have seen heightened regulatory attention, compelling businesses to step up testing procedures and accountability. Adhering to such regulations incurs expense and inefficiency in production, affecting small brands that cannot cope with such rigorous expectations.

North America Baby Milk Formula Market

The North America baby milk formula market is expanding as a result of rising demand for nutritionally complete and fortified infant formulas. Parents increasingly depend on baby formula as a substitute or complement to breastfeeding, particularly among working parents. Organic, lactose-free, and hypoallergenic formulas are being launched by manufacturers to meet the varied dietary requirements. The availability of strict safety guidelines and quality control standards guarantees baby formula products are of high nutritional and safety standards. Moreover, advancements in probiotic-enriched and DHA-enriched formulas are pushing market demand, with parents going for the best cognitive and immune system development solutions for their babies.

North America Dried Milk Food Formula Market

The North America dried milk food formula market is experiencing high growth due to increased shelf life, storage convenience, and easy usage over liquid formulas. Dried milk formula is favored by traveling families and parents seeking affordable feeding options. The market offers a range of organic, soy, and goat milk-based dried formulas for infants with allergies or dietary needs. Fortification with necessary vitamins, minerals, and probiotics is the focus for companies to improve nutritional value. Growing parental knowledge regarding nutrition among early childhood fuels demand for premium and specialty dried milk formulas.

North America Baby Food Drugstores/Pharmacies Market

Drugstores and pharmacies are important in the North America baby food market, providing a reliable retailing channel for parents looking for safe and good quality baby food offerings. Most parents are likely to buy infant formula, organic baby foods, and allergy-proof foods at pharmacies because of product authenticity and recommendation from qualified experts, namely, pharmacists. Top pharmacy retailers in the country are extending the baby food counter with products from the categories organic, fortified, and special dietary. Subcription-based services in pharmacies for formuala reseplenishments as well as nutrients are additionally improving market expansion.

North America Baby Food Online Stores Market

The growth of e-commerce and online retail platforms has revolutionized the North America baby food market, providing parents with convenience, greater product assortment, and home delivery. Online retailers offer access to niche baby food brands, organic foods, and subscription meal plans that are not found in neighborhood supermarkets. Amazon, Walmart, and direct-to-consumer brand websites have experienced a boom in baby food sales. Furthermore, online reviews, comparison websites, and expert advice assist parents in making well-informed buying decisions. As more dependence is placed on online shopping for baby products, the online market is likely to experience steady growth.

United States Baby Food Market

The United States baby food market leads North America with robust demand for organic and fortified baby food, high disposable incomes, and well-established retail distribution channels. US parents demand nutrient-rich, allergen-free, and non-GMO baby food, which is leading brands to launch more organic and functional food products. Growth of plant-based infant food and probiotic-fortified baby formulas is an indication of increasing health awareness. Also, government regulations regarding baby food safety and labeling maintain high-quality standards, leading to increased trust and market growth.

Canada Baby Food Market

Canada's market for baby food is experiencing gradual growth with the growing demand for organic, gluten-free, and allergen-safe products. Parents opt for healthy and preservative-free baby foods, resulting in the popularity of clean-label brands. Increased presence of health-aware retail chains and e-commerce has enhanced availability of premium baby food products. The support of governments in encouraging breastfeeding and awareness about infant nutrition also shapes purchasing decisions, resulting in the popularity of fortified and plant-based baby food among Canadian families.

Mexico Baby Food Market

The Mexico baby food market is expanding with urbanization, growing disposable incomes, and rising awareness of infant nutrition. Traditional homemade baby food is still prevalent, but there is increasing demand for convenient and fortified baby food among working parents. Iron-fortified cereals, organic fruit purees, and probiotic-enriched formulas are becoming popular among brands. Supermarkets and online stores are responsible for widening product availability. With health-conscious trends gaining momentum, organic and clean-label baby food products are increasingly becoming popular in Mexico.

North America Baby Food Market Segments

Food Type

- Milk Formula

- Dried Food

- Prepared

- Others

Distribution Channel

- Supermarkets & Hypermarkets

- Drugstores/Pharmacies

- Convenience Stores

- Online Stores

- Others

Countries

- Unites States

- Canada

- Mexico

the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Company Analysis

- Kraft Heinz Company

- Abbott Laboratories

- Hero Group (Beech-Nut Nutrition Corporation)

- Hain Celestial Group, Inc.

- Nestlé S.A.

- Reckitt Benckiser Group plc (Mead Johnson & Company, LLC)

- Amara Organics Foods

- Danone S.A.

- Lactalis (Stonyfield Farm, Inc.)

- Sun-Maid Growers of California

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Food Type, Distribution Channel and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the estimated market value of the North America baby food market in 2024?

-

What is the expected CAGR of the North America baby food market from 2025 to 2033?

-

What factors are driving the growth of organic and clean-label baby food in North America?

-

How is the rise of e-commerce impacting baby food sales in North America?

-

What are the major challenges facing the North America baby food market?

-

Which distribution channels are most popular for baby food sales in North America?

-

How is the demand for baby milk formula evolving in the North America market?

-

What role do drugstores and pharmacies play in baby food distribution?

-

Which countries in North America are covered in this market analysis?

-

Who are the key players in the North America baby food market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Baby Food Market

6. Market Share

6.1 By Food Type

6.2 By Distribution Channel

6.3 By Countries

7. Food type

7.1 Milk Formula

7.2 Dried Food

7.3 Prepared

7.4 Others

8. Distribution Channel

8.1 Supermarkets & Hypermarkets

8.2 Drugstores/Pharmacies

8.3 Convenience Stores

8.4 Online Stores

8.5 Others

9. Countries

9.1 Unites States

9.2 Canada

9.3 Mexico

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1 Kraft Heinz Company

12.1.1 Overview

12.1.2 Key Persons

12.1.3 Recent Development

12.1.4 Revenue

12.2 Abbott Laboratories

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development

12.2.4 Revenue

12.3 Hero Group (Beech-Nut Nutrition Corporation)

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development

12.3.4 Revenue

12.4 Hain Celestial Group, Inc.

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development

12.4.4 Revenue

12.5 Nestlé S.A.

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development

12.5.4 Revenue

12.6 Reckitt Benckiser Group plc (Mead Johnson & Company, LLC)

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development

12.6.4 Revenue

12.7 Amara Organics Foods

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development

12.7.4 Revenue

12.8 Danone S.A.

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development

12.8.4 Revenue

12.9 Lactalis (Stonyfield Farm, Inc.)

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Recent Development

12.9.4 Revenue

12.10 Sun-Maid Growers of California

12.10.1 Overview

12.10.2 Key Persons

12.10.3 Recent Development

12.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com