North America Organic Starch Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowNorth America Organic Starch Market Trends & Summary

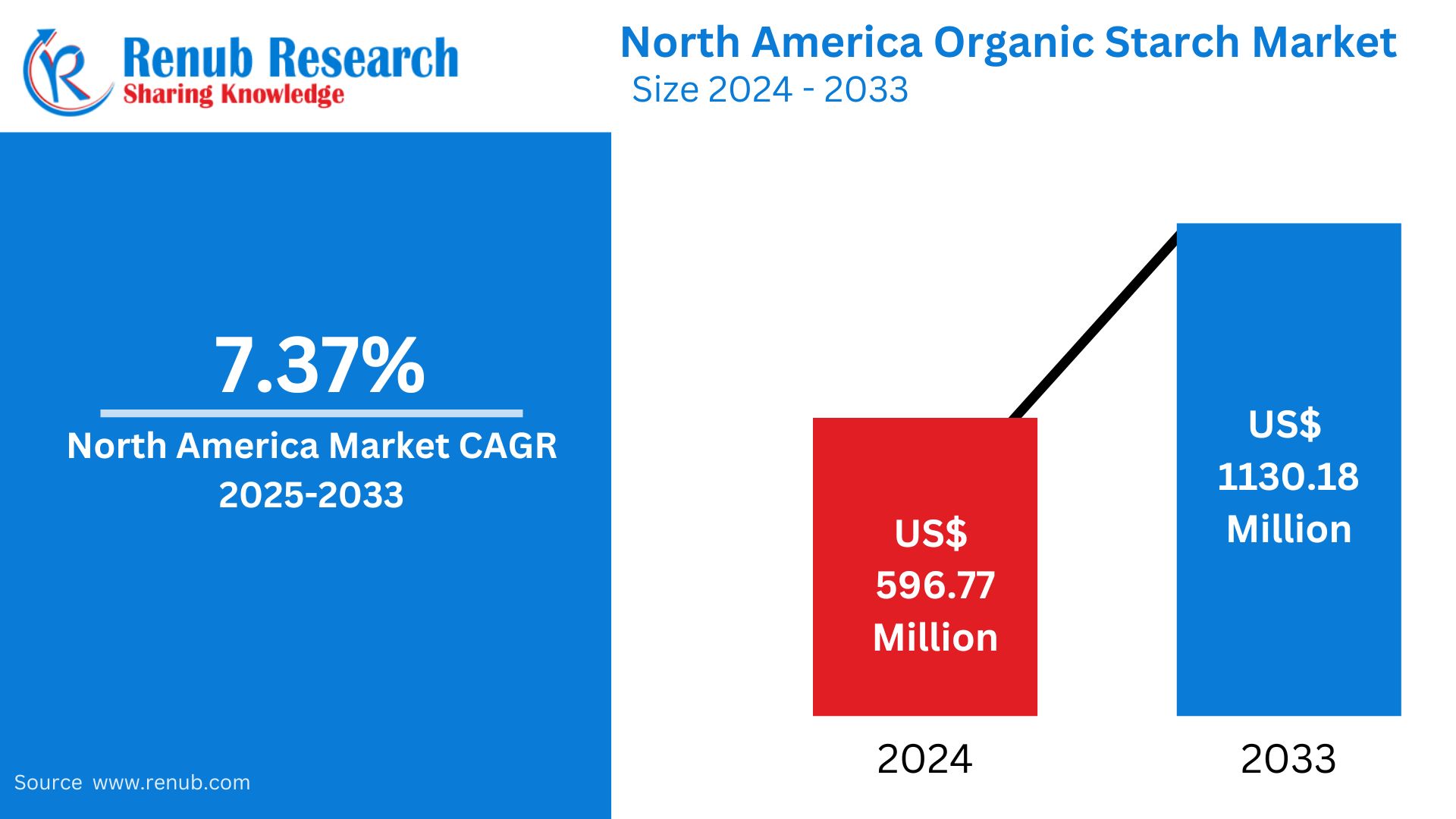

North America Organic Starch Market was valued at US$ 596.77 million in 2024 and is expected to expand at a CAGR of 7.37% during 2025-2033 and reach US$ 1130.18 million by 2033. It is driven by mounting demand for natural, organic, and clean-label food ingredients, widening food, pharmaceutical, and bio-based industries applications, and growing consumer choice for health-driven and sustainable offerings.

The report North America Organic Starch Market Forecast covers by Ingredient (Potato, Wheat, Corn, Other), End User (Bakery, Meat, Confectionery, Dry Blends), Countries (Unites States, Canada, Mexico), Company 2025-2033.

North America Organic Starch Market Outlooks

Organic starch is a natural carbohydrate that is extracted from organic origins like corn, potatoes, wheat, rice, and tapioca, which are grown without artificial fertilizers, pesticides, or genetically modified organisms (GMOs). It is an emulsifying, binding, and stabilizing ingredient in the food industry. Unlike traditional starch, organic starch has strict organic certification requirements, hence it is highly sought after in the clean-label and health-conscious markets.

Organic starch is extensively utilized across North America in the food and beverage segment for soups, sauces, bakery items, dairy products, and gluten-free foods. Organic starch plays an important role in the pharmaceutical industry, as it is utilized for capsule coatings and in medicine formulations. Organic starch finds applications in the cosmetic industry as a natural absorbent in powders and cosmetics. Moreover, it is also picking up in biodegradable packaging and bio-based adhesives, supporting sustainability. As consumers increasingly demand natural and green alternatives, the market for organic starch is growing in North America.

Growth Drivers in the North American Organic Starch Market

Increased Demand for Clean-Label and Organic Foods

North American consumers are increasingly demanding clean-label and organic food products, which are fueling demand for organic starch as a natural product. With increased health risk awareness regarding synthetic additives and GMOs, food producers are substituting traditional starch with organic starch. Strict regulation of food labeling and higher demand for natural stabilizers, binders, and thickeners favor the organic starch market. The trend is strongest in the bakery, dairy, and gluten-free categories, where organic starch is applied to provide functional benefits and clean-label status. October 2022, Roquette, the global leader in plant-based ingredients, has introduced a new range of organic pea ingredients, such as organic pea starch and organic pea protein, manufactured at its Portage la Prairie factory in Canada. The ingredients are supplied by a network of organic pea farmers, offering customers quality, reliability, and traceability back to the farm.

Expansion of Organic Farming and Sustainable Practices

The growth of organic agriculture in North America has enhanced the supply of organic raw materials for starch manufacturing. Government support and certifications such as USDA Organic and Canada Organic have motivated farmers to adopt sustainable farming practices. This transition boosts the supply chain for organic starch and supports the increasing demand for sustainable and eco-friendly food ingredients. Organic starch is increasingly becoming popular as businesses focus on carbon-neutral operations and sustainable sourcing. May 2023 – The Agriculture Secretary revealed that the USDA is boosting assistance for the domestic organic market and producers going organic through extra funding. This is under the USDA's Organic Transition Initiative, which began in fall 2022, to support existing organic farmers and those transitioning into organic production.

Growing Use in Non-Food Sectors

Outside of the food industry, organic starch is increasingly relevant in the pharmaceutical, cosmetic, and biodegradable packaging industries. In pharmaceuticals, it is utilized as an excipient in the formulation of drugs, while in cosmetics, it is added to powders and skincare products as a natural absorber. Organic starch is also being researched for use in bioplastics and green adhesives, which contribute to the transition toward sustainable and biodegradable materials. These increasing uses support market diversification and long-term growth. August 2024, Roquette Frères, the plant-based ingredient leader, increased its tapioca-based cook-up starches: CLEARAM R 4010, CLEARAM TR 3010, CLEARAM TR 2510, and CLEARAM TR 2010. These starches improve texture in dairy desserts, sauces, and bakery fillings by increasing consistency, viscosity, and elasticity.

Challenges in the North America Organic Starch Market

High Production Costs and Limited Supply

Organic starch production entails rigorous certification procedures, more expensive farming practices, and less crop yield than traditional starch producers. Organic production necessitates the use of natural fertilizers and pesticide-free plant growth, with the tendency of generating higher cost of production. Moreover, fewer certified organic farms limit the supply of raw material overall, pushing organic starch product prices higher. This is the cost component that presents a difficulty for producers that compete with traditional starch options.

Market Competition from Conventional and Modified Starches

Organic starch is challenged by competition from conventional and modified starches, which are less expensive and more abundant. Most industries, primarily processed foods and industrial uses, depend on chemically modified starches due to their improved stability, functionality, and affordability. The task for organic starch manufacturers is to equal the performance of modified starches while upholding organic integrity.

North America Organic Potato Starch Market

The North America organic potato starch market is growing because of its application in gluten-free baking, meat processing, and dairy alternatives. Organic potato starch provides good water-binding and texturizing functionality and is a go-to option for clean-label thickening and stabilizing agents. It is commonly used in soups, sauces, baby food, and plant-based meat substitutes. Its neutral flavor, high viscosity, and allergen-free status also make it perfect for organic food products. Organic potato starch is experiencing steady growth with rising demand for gluten-free and plant-based foods.

North America Organic Wheat Starch Market

Organic wheat starch is becoming popular in the bakery and confectionery sectors because of its light texture, water absorption, and ability to increase the elasticity of dough. It is applied in the production of bread, pastries, and pasta, where certification as organic is a selling argument. Due to rising demand for bakery products that are non-GMO and organic, producers are adding organic wheat starch to their products. It also has usage in the cosmetic and pharmaceutical sectors as a natural binder.

North America Organic Starch Bakery Market

The bakery sector is among North America's biggest users of organic starch. Organic starch improves the texture, water retention, and shelf life of baked items, and hence it is a key ingredient in bread, cakes, cookies, and pastries. The trend toward organic and gluten-free baking has boosted demand for organic corn, potato, and tapioca starches. Demand is fueled by consumers opting for chemical-free and non-GMO bakery products. Furthermore, bakery producers incorporate organic starch as a thickening material in fillings and frostings to preserve consistency.

North America Organic Starch Meat Market

Organic starch finds application in the meat industry as a binder and moisture-retaining agent in plant-based meat and processed meat. Organic starch enhances the texture and juiciness of foods like sausages, burgers, and deli slices. With the growth in organic and clean-label meat offerings, producers use organic potato and tapioca starches to address consumer demand. Organic starch is also commonly applied in coating and breading of fried meat products to achieve crispiness while ensuring organic certification requirements.

North America Organic Starch Dry Blends Market

The market for organic starch dry blends is increasing as it finds applications in seasoning blends, baking powders, instant soups, and drinks formulations. Organic starch enhances the mixability, flowability, and stability in dry food compositions. It is found in most pre-packaged bakery mixes, protein powders, and meal substitutes. Organic starch-based dry blends demand increases on account of the trend in convenience foods being organic and ready-to-cook. Manufacturers focus on non-GMO and gluten-free blends to cater to a broader health-conscious consumer base.

United States Organic Starch Market

The United States leads the North American market for organic starch, driven by high demand for organic food, expanding vegan communities, and strict USDA organic certification rules. The market is sustained by consumer acceptance of organic starch as a natural thickener for dairy substitutes, sauces, and gluten-free food products. Strong representation by top organic food brands and retailers contributes to market development. Moreover, expanded applications in biodegradable packaging and personal care products lead to diversification in the organic starch market in the United States.

Canada Organic Starch Market

Canada's organic starch market is growing because of increasing consumer awareness of clean-label products and the expansion of the organic farming sector. The demand for organic baby food, functional beverages, and plant-based proteins in the country is driving the use of organic starch as a natural stabilizer. Government initiatives for sustainable agriculture and organic certification schemes also boost the market. Moreover, Canada's emphasis on environmentally friendly food packaging solutions is boosting the usage of organic starch-based biodegradable packaging materials.

Mexico Organic Starch Market

The Mexican market for organic starch is growing due to increasing demand for organic processed foods, clean-label bakery products, and natural thickeners in traditional cuisine. Organic corn starch, specifically, is extensively utilized to produce tortillas, sauces, and soups. Growth of organic farming programs and export-driven organic food production upholds the organic starch supply chain. Mexico's growing natural cosmetics and personal care market is also propelling demand for organic starch as a binder and absorber in skincare and haircare products.

North America Organic Starch Market Segments

Ingredient

- Potato

- Wheat

- Corn

- Other

End User

- Bakery

- Meat

- Confectionery

- Dry Blends

Countries

- Unites States

- Canada

- Mexico

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Company Analysis

- Cargill, Incorporated

- ADM

- Tate & Lyle

- Ingredion

- Roquette Frères

- BASF

- Naturex S.A.

- The Kraft Heinz Company.

- Emsland Group

- American Key Food Products

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Ingredient, End User and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What was the market value of the North America Organic Starch Market in 2024?

-

What is the expected CAGR of the market from 2025 to 2033?

-

Which industries primarily use organic starch in North America?

-

What are the key factors driving the growth of the organic starch market?

-

How does organic starch differ from conventional starch?

-

Which country leads the organic starch market in North America?

-

What challenges does the organic starch market face?

-

How is organic starch used in the pharmaceutical industry?

-

Which companies are the key players in the North American organic starch market?

-

What role does organic starch play in the biodegradable packaging industry?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Organic Starch Market

6. Market Share

6.1 By Ingredient

6.2 By End-User

6.3 By Countries

7. Ingredient

7.1 Potato

7.2 Wheat

7.3 Corn

7.4 Other

8. End User

8.1 Bakery

8.2 Meat

8.3 Confectionery

8.4 Dry Blends

9. Countries

9.1 Unites States

9.2 Canada

9.3 Mexico

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Company Analysis

12.1.1 Cargill, Incorporated

12.1.2 Overview

12.1.3 Key Persons

12.1.4 Recent Development

12.1.5 Revenue

12.2 ADM

12.2.1 Overview

12.2.2 Key Persons

12.2.3 Recent Development

12.2.4 Revenue

12.3 Tate & Lyle

12.3.1 Overview

12.3.2 Key Persons

12.3.3 Recent Development

12.3.4 Revenue

12.4 Ingredion

12.4.1 Overview

12.4.2 Key Persons

12.4.3 Recent Development

12.4.4 Revenue

12.5 Roquette Frères

12.5.1 Overview

12.5.2 Key Persons

12.5.3 Recent Development

12.5.4 Revenue

12.6 BASF

12.6.1 Overview

12.6.2 Key Persons

12.6.3 Recent Development

12.6.4 Revenue

12.7 Naturex S.A.

12.7.1 Overview

12.7.2 Key Persons

12.7.3 Recent Development

12.7.4 Revenue

12.8 The Kraft Heinz Company.

12.8.1 Overview

12.8.2 Key Persons

12.8.3 Recent Development

12.8.4 Revenue

12.9 Emsland Group

12.9.1 Overview

12.9.2 Key Persons

12.9.3 Recent Development

12.9.4 Revenue

12.10 American Key Food Products

12.10.1 Overview

12.10.2 Key Persons

12.10.3 Recent Development

12.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com