North America Processed Meat Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowNorth America Processed Meat Market Trends & Summary

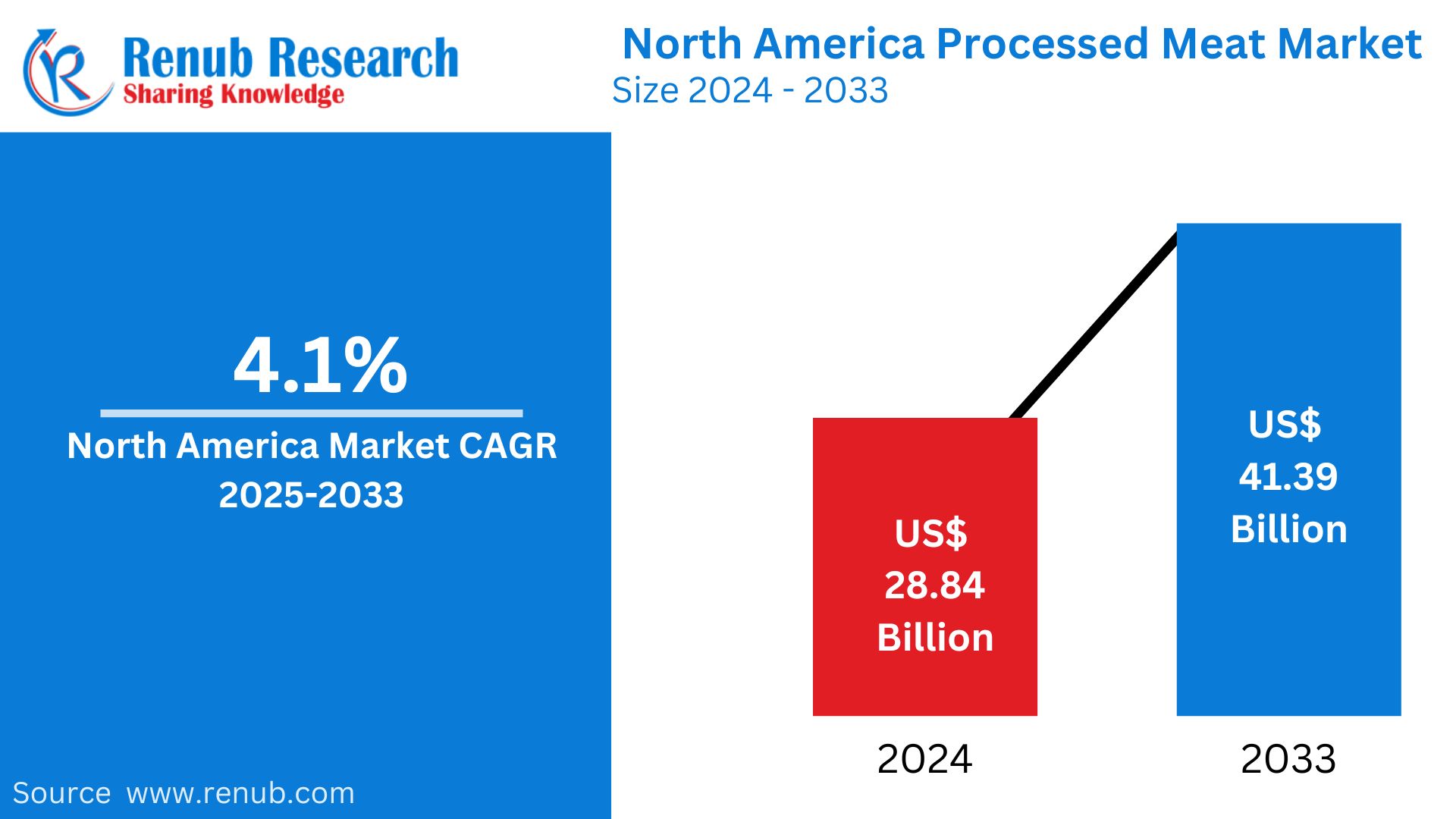

The North American processed meat market is expected to grow appreciably, at USD 41.39 million by 2033 from USD 28.84 million in 2024, with a growth rate of 4.1% from 2025 to 2033. The growth is influenced by the increasing demand for convenience foods from consumers, rising consumption of fast foods, and improvement in food processing technology. The increasing expansion of retail channels also supports the growth of the market in the region.

The report North America Processed Meat Market Forecast covers by Meat Types (Poultry, Beef, Pork, Others), Processed Types (Frozen, Chilled, Canned), Distribution Channels (Hypermarkets and Supermarket, Convenience Stores, Online Retail Stores, Others), Country (United States, Canada, Mexico) and Company Analysis 2025-2033.

North America Processed Meat Market Outlooks

Processed meat is a product altered using techniques like curing, smoking, salting, fermentation, or the addition of preservatives to improve flavor, texture, and shelf life. Some examples of processed meat are sausages, bacon, ham, hot dogs, deli meats, and canned meat. All these are commonly used due to convenience, extended storage life, and intense flavor, thus forming a regular feature in most households as well as food service outlets.

Processed meat is prevalent in North America, fueled by hectic lifestyles and a desire for ready-to-eat or convenient-to-cook food. The fast-food sector is highly dependent on processed meat items, adding to the demand. The market is also growing with the availability of various flavors, organic, and plant-based meat substitutes. Consumers like processed meats despite health concerns because they are affordable and delicious. Increased supermarket outlets and online grocery stores have further enhanced process meat availability throughout North America.

Growth Drivers within the North America Processed Meat Market

Increased Demand for Ready-to-Eat and Convenient Foods

North Americans' busy lifestyle has considerably grown the demand for ready-to-eat convenient process meat products. Working professionals, students, and busy households opt for pre-packaged meats like deli, hot dogs, and frozen meat products that need less preparation. The increased demand for meal delivery services and quick-service restaurants also has increased the processed meat market. As there has been an advancement in packaging and preservation technology, the shelf life of processed meat products has increased, additionally increasing consumer demand. Oct. 2024, BrucePac of Durant, Okla. is recalling nearly 11.8 million pounds of ready-to-eat poultry and meat products because they have possible Listeria monocytogenes contamination, reports the U.S. Department of Agriculture's FSIS.

Expansion of Retail and E-Commerce Channels

The expansion of hypermarkets, supermarkets, and e-commerce websites has greatly augmented the processed meat industry in North America. Global retail chains like Walmart, Costco, and Kroger provide extensive ranges of processed meat products and make them easily available. Home delivery services of e-commerce sites like Amazon and Instacart have made it easy to shop. Moreover, online promotional and marketing campaigns have contributed significantly towards raising consumer education levels and making buying decisions, stimulating sales of processed meat products across segments. The rising demand for online platforms to buy meat products has been fueled by high rates of internet penetration in North America. As of 2024, the United States has a rate of 97.1%, Canada has 94.3%, and Mexico has 83.2%. This technology shift has enabled processors to tap into broader consumer bases while providing product integrity via improved cold chain logistics and smart packaging innovations.

Product Development Innovation and Healthier Options

In line with shifting consumer choices for healthier lifestyles through healthier food choices, meat processors have set out to innovate the introduction of reduced-preservative, lower-sodium, and organic content processed meat products. The popularity of antibiotic-free, hormone-free, and grass-fed meat alternatives has increased, with brands responding to health-aware consumers. In addition, alternative protein sources and plant-based products are on the rise, offering new processed meat alternatives for vegetarians and flexitarians alike. This expansion of product lines has been responsible for continued market growth while filling the health gaps of conventional processed meat. April 2023: HERDEZ® brand has introduced its HERDEZ™ Mexican Refrigerated Entrées line, including HERDEZ™ Chicken Shredded in Mild Chipotle Sauce and HERDEZ™ Carnitas Slow Cooked Pork.

Challenges in the North American Processed Meat Market

Health Issues and Regulatory Issues

Increased awareness of health hazards from processed meats, including obesity, heart disease, and cancer, has prompted closer watch by health organizations and regulatory agencies. The World Health Organization (WHO) has labeled processed meat as a carcinogen, prompting many consumers to cut back on consumption. North American governments have enforced strict labeling laws and guidelines to encourage ingredient sourcing and processing transparency. In response, companies are under pressure to re-formulate products with healthier ingredients while preserving taste and quality.

Fluctuations in Raw Material Costs and Supply Chain Disruptions

The price of raw materials such as meat, spices, and packaging materials varies with climate change, livestock illness, and restrictions on trade. Also, the supply chain can be affected by disruptions such as transport delays and shortages of labor, thereby affecting the supply of processed meat products. These pose volatility in the pricing for the manufacturers and the consumers. Firms have to implement cost-efficient measures, like local procurement and supply chain efficiency, to manage these risks and provide consistent availability of products.

North America Poultry Processed Meat Market

Poultry-processed meat such as chicken nuggets, sausages, deli cuts, and frozen wings continues to lead in North America. The popularity of poultry stems from its cost-effectiveness, perceived health benefits, and compatibility with most cuisines. Market leaders produce antibiotic-free and organic poultry to satisfy health-aware consumers. The demand for high-protein and low-fat meat options also sustains the growth of the poultry processed meat market in the region.

North America Beef Processed Meat Market

Beef-derived processed meat products such as burgers, hot dogs, and corned beef are extremely popular in North America. Premium and grass-fed beef have gained popularity with consumers demanding better quality and ethically produced meat. Steakhouses and fast-food chains drive beef consumption. Red meat health concerns have driven leaner beef products with less preservative content to attract health-conscious consumers.

North America Frozen Processed Meat Market

Frozen processed meats, including pre-cooked hamburgers, sausage, and meatballs, enjoy extensive consumption from their longer shelf life and ready-to-eat convenience. As more working people and students sought frozen meals with increasing demand, the market kept growing. Recent advances in the freezing technologies are enhancing product qualities by preserving tastes and textures without losing freshness. Increased supermarket frozen food sections as well as e-grocer services also back the growth in this segment.

North America Canned Processed Meat Market

Canned processed meats, such as spam, corned beef, and canned chicken, continue to be a major item in several North American diets. The reasons are obvious -- extended shelf life, making these convenient for survival foods and hassle-free meal-making. Steady demand has been maintained by the convenience and competitiveness of canned meats, especially on the part of cost-conscious shoppers. The trend towards protein-loaded ready-to-consume foods and meals has fueled growth in this segment as well.

North American Hypermarkets and Supermarket Processed Meat Market

Hypermarkets and supermarkets are the key distribution channels for processed meat in North America. Large retailers such as Walmart, Costco, and Kroger sell a wide variety of processed meat products to suit different consumer tastes. The retailers appeal to consumers through promotional offers, bulk purchases, and in-store sampling. The rising popularity of private-label processed meat brands in supermarkets has also helped grow the market, providing quality products at affordable prices.

North America Online Retail Meat Market Processed

E-commerce has transformed the processed meat industry, with shoppers now preferring online shopping for groceries. Online retailers like Amazon Fresh, Instacart, and brand websites offer easy access to frozen and fresh processed meat items. Meal kits on subscription, offering pre-packaged processed meat, have also gained traction. Offering digital payment options, speedy delivery services, and discounts has driven online sales of processed meat substantially in North America.

United States Processed Meat Market

The United States leads the North American processed meat market because of strong consumer demand, a prominent fast-food culture, and common retail availability. Major brands innovate constantly, incorporating organic and reduced-sodium meats, to appease health-orientated buyers. The United States market has well-established channels of distribution, sophisticated processing systems, and calculated marketing strategies to its advantage. In spite of health concerns, processed meat continues to be an integral part of American diets, with growing acceptance of healthier options and value-added meat products. July 2024 – The U.S. Department of Agriculture (USDA) Secretary stated that the Biden-Harris Administration is investing in building robust food supply chains, improving meat and poultry processing, developing improved marketplaces for producers, and reducing the cost of food.

Canada Processed Meat Market

Canada's processed meat market is fueled by customer demand for convenience, product variety, and growth in retail channels. Local meat, which is of high quality, is in demand by Canadian consumers, which has fueled a rise in the demand for organic and grass-fed products. Food safety and transparency are assured through the robust regulatory environment in the country, impacting buying behavior. Although health issues influence consumption behavior, producers are launching reformulated offerings with less sodium and preservatives to respond to changing consumer preferences. E-commerce and meal-kit delivery have further fueled growth in the Canadian market. January 2025, Maple Leaf Foods is increasing profitability of plant-based by diversifying its line of fresh meat alternatives to keep up with increased consumer demand for more healthy and sustainable food choices. The company seeks to dominate both conventional and plant-based markets.

North America Processed Meat Market Segments

Meat Types

- Poultry

- Beef

- Pork

- Others

Processed Types

- Frozen

- Chilled

- Canned

Distribution Channels

- Hypermarkets and Supermarket

- Convenience Stores

- Online Retail Stores

- Others

Country

- United States

- Canada

- Mexico

All the Key players have been covered from 4 Viewpoints:

- Overviews

- Key Person

- Recent Developments

- Revenue

Key Players Analysis

- Hormel foods

- Tyson Foods

- Conagra Brands Inc

- General Mills

- The Kraft Heinz Company

- Cargill, Incorporated

- Pilgrim’s Pride Corp

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Meat Type, Processed Type, Distribution Channels and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the North America processed meat market by 2033?

-

What is the expected growth rate of the market from 2025 to 2033?

-

Which factors are driving the growth of the processed meat market in North America?

-

What are the major challenges faced by the processed meat industry in North America?

-

How has the expansion of retail and e-commerce channels influenced the processed meat market?

-

What types of processed meats are covered in the report?

-

Which distribution channels are analyzed in the report?

-

How are health concerns impacting the processed meat market?

-

What role does innovation in product development play in the market’s growth?

-

Which key companies are analyzed in the report?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Processed Meat Market

5.1 Historical Market Trends

5.2 Market Forecast

6. Market Share

6.1 By Meat Types

6.2 By Processed Types

6.3 By Distribution Channels

6.4 By Country

7. Meat Types

7.1 Poultry

7.2 Beef

7.3 Pork

7.4 Others

8. Processed Types

8.1 Frozen

8.2 Chilled

8.3 Canned

9. Distribution Channels

9.1 Hypermarkets and Supermarket

9.2 Convenience Stores

9.3 Online Retail Stores

9.4 Others

10. By Country

10.1 United States

10.2 Canada

10.3 Mexico

11. Porter’s Five Forces

11.1 Bargaining Power of Buyer

11.2 Bargaining Power of Supplier

11.3 Threat of New Entrants

11.4 Rivalry among Existing Competitors

11.5 Threat of Substitute Products

12. SWOT Analysis

12.1 Strengths

12.2 Weaknesses

12.3 Opportunities

12.4 Threats

13. Key Players Analysis

13.1 Hormel foods

13.1.1 Overview

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenues

13.2 Tyson Foods

13.2.1 Overview

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenues

13.3 Conagra Brands Inc.

13.3.1 Overview

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenues

13.4 General Mills

13.4.1 Overview

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenues

13.5 The Kraft Heinz Company

13.5.1 Overview

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenues

13.6 Cargill, Incorporated

13.6.1 Overview

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenues

13.7 Pilgrim’s Pride Corp

13.7.1 Overview

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenues

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com