North America Savory Snacks Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowNorth America Savory Snacks Market Trends & Summary

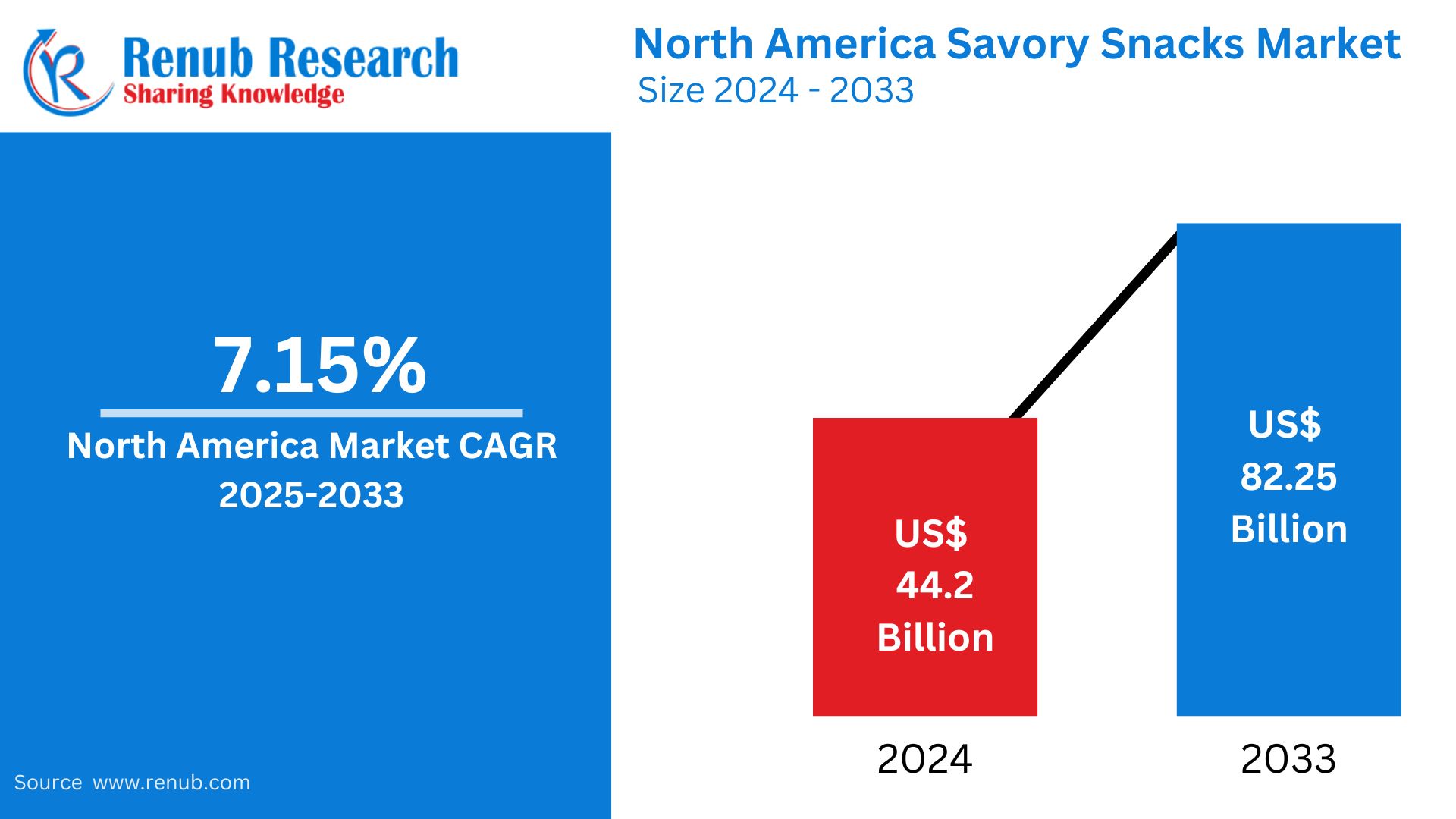

North America's market for savory snacks is growing consistently, buoyed by growing consumers' appetite for convenient and better-for-you snacking options. The market sized at US$ 44.2 billion in 2024 and is anticipated to grow to US$ 82.25 billion during 2033, growing with a CAGR of 7.15% over the forecast period of 2025 to 2033. Some of the key trends being observed are an enhanced focus towards baked, high-protein and low-fat baked snacks rather than conventional fried-based snacks.

The report North America Savory Snacks Market Forecast covers by Product (Potato Chips., Extruded Snacks, Nuts & Seeds, Popcorn, Others), Flavor (Roasted/Toasted, Barbeque, Spice, Meat, Others), Distribution Channels (Supermarket/Hypermarket, Specialty Retailers, Convenience Stores, Online Stores, Others), Country (United States, Canada, Mexico), Company Analysis 2025-2033.

North America Savory Snacks Market Outlooks

Savory snacks are salty, spicy, or umami-flavored food items eaten between meals. In contrast to sweet snacks, they consist of potato chips, popcorn, pretzels, nuts, cheese snacks, and meat-based items such as jerky. The snacks are enjoyed because they are convenient, come in a wide variety of flavors, and can suit various taste buds.

The market for savory snacks has increased considerably in North America due to shifting consumer lifestyles, hectic schedules, and the increasing trend for on-the-go foods. Health-conscious consumers also look for healthier options such as baked chips, low-sodium nuts, and protein-based snacks. Moreover, new flavors and special seasoning blends have widened the market. The impact of social media and promotional campaigns has also enhanced the popularity of these snacks, with companies launching organic, gluten-free, and plant-based variants to meet changing consumer demands. With ongoing innovation and rising demand, the market for savory snacks in North America is anticipated to register robust growth.

Drivers of Growth in the North American Savory Snacks Market

Growing Consumer Demand for Convenient and On-the-Go Snacks

The hectic lifestyles of North American consumers have driven demand for ready-to-eat, convenient savory snacks. Busy work schedules, travel, and a growing preference for quick convenience drives consumers to snackable items like nuts, chips, popcorn, and meat snacks. Convenience offered by single-serve and resealable packaging expands further, making savory snacks a convenient option for consumption at home or on the move. This is also fueled by the increasing number of working adults and students looking for easily accessible snacking options. Sept 2023, Ornua Foods North America introduced new Kerrygold Cheese Snacks, ready-to-eat cheese sticks that are gluten-free and a good source of protein. Packaged in eight-count packs, they're ideal as an instant snack, in lunchboxes, or on cheese boards.

Increasing Health-Conscious Snacking Trends

North American consumers are increasingly seeking healthier snack alternatives, and hence the rise of better-for-you-savory snacks. Manufacturers are launching products with lower sodium, less fat, and high-protein or fiber-based ingredients. Plant-based and gluten-free snacks are also gaining traction, prompting manufacturers to create innovative snacks using alternative ingredients like chickpeas, lentils, and quinoa. This move towards healthier snacking is growing the savory snacks category as people crave guilt-free indulgence without sacrificing taste. January 2023, Kellogg Co.'s RXBAR introduced its first line of granola in original, peanut butter, and chocolate flavors. Each serving is sweet, salty, crunchy, and has 10g of protein with easy-to-read ingredients.

Expansion of Flavors and Premiumization

North American consumers have become accustomed to novel and intense flavors, prompting innovation in the savory snacks industry. Businesses are bringing globally influenced flavors, hot and spicy flavors, and gourmet-style products to market to reach more consumers. Premiumization is one of the main trends, with brands debuting artisanal and organic savory snacks from quality ingredients. The mix of innovative flavor and premium offerings entices consumers' attention and enhances brand loyalty, which helps the market grow steadily. March 2024, Danone North America introduced the REMIX line of yogurt, including mix-ins, new flavors, and toppings for its brands: Light + Fit, Oikos, and Too Good & Co. Consumers can enjoy tasty and convenient on-the-go snacking through these offerings.

Challenges in the North American Potato Chips Market

Emerging Health Issues and Movement towards Healthier Options

Health-conscious consumers are cutting back on regular potato chips because of issues with high fat, sodium, and artificial ingredients. Consumers are moving to baked chips, air-popped foods, and alternative vegetable chips, which are viewed as healthier options. This change in consumer demand is a challenge for potato chip manufacturers, who have to reformulate products to respond to the need for healthier options without sacrificing taste and texture.

Fierce Market Competition and Price Elasticity

The North American potato chips industry is extremely competitive with many brands competing for market share. Private-label brands and multinational companies capture shelf space, exerting pricing pressure. Shoppers tend to look for value-for-money propositions, which compels premium brands to keep prices lower. The competitive environment pushes companies to continually innovate, invest in advertising, and provide promotion offers to secure customer loyalty.

North America Popcorn Market

Popcorn has become popular in North America as a healthier savory snack because of its low-calorie and high-fiber nature. Health-conscious consumers opt for air-popped and lightly seasoned types. Flavor innovation—such as sweet-savory blends, gourmet popcorn, and spicy flavors—has also drawn a broad consumer base. The popularity of ready-to-eat popcorn brands and microwave popcorn has further increased the market. With increasing consumer demand for portion-controlled, convenient snacks, popcorn continues to be a leader in the savory snacks category.

North America Roasted/Toasted Savory Snacks Market

Owing to their assumed health advantages, roasted and toasted savory snacks, i.e., nuts, seeds, and legumes, are seeing robust growth. These are rich in protein, fiber, and healthy fat, which makes them a choice among fitness enthusiasts and those with keto or high-protein diets. The market has been witnessing innovations such as flavored almonds, roasted chickpeas, and spiced pumpkin seeds to attract health-driven and flavor-seekers alike. With health-conscious snacking gaining prominence, the market for roasted and toasted snacks is set to increase continuously.

North America Meat Savory Snacks Market

Meat savory snacks including jerky, meat sticks, and protein bars have gained extensive popularity in North America. These snacks appeal to consumers who seek high-protein, low-carb, and keto versions. The market has spread beyond conventional beef jerky, with alternatives such as turkey, chicken, and plant-based meat substitutes available. Consumers in search of a healthy and filling snack with a long shelf life continue to propel demand for meat snacks. Emphasis on natural ingredients, fewer preservatives, and creative flavors further fuels market growth.

North America Savory Snacks Specialty Retailers Market

Specialty food retailers that specialize in gourmet snacks and artisanal savory snacks are gaining popularity in North America. The retailers offer consumers high-quality, specialty snack products such as organic chips, premium nuts, and artisanal popcorn. Specialty stores offer a unique shopping environment where consumers can sample a wide variety of different flavors and niche snack products. Demand for premium, natural, and non-GMO snacks has helped drive the consistent growth of specialty stores in the savory snack category. Feb. 2025, Kellanova Away From Home is introducing more than 15 new snacks for 2025 under brands such as Pringles, Cheez-It, Pop-Tarts, and Rice Krispies Treats.

North America Savory Snacks Online Stores Market

The North American market for savory snacks is growing at a rapid pace because of the convenience offered by home delivery and subscription options. More and more consumers prefer buying snacks from e-commerce sites such as Amazon, Walmart, and company websites. Online retailers offer access to a wider variety of products, including international and specialty brands. Subscription snack boxes and bulk purchases also help increase the market size, making online retail an important channel for savory snacks distribution.

United States Savory Snacks Market

The U.S. savory snacks market offers diverse products to suit consumer tastes. Health-focused snacks, indulgent snacks, and protein-rich snacks are all in vogue. U.S. consumers snack throughout the day, driving demand for chips, popcorn, and nut snacks. As interest in organic and non-GMO snacks grows, manufacturers are innovating to address evolving consumer needs. The competition consists of mature brands and new start-ups providing new and differentiated products. July 2024, KIND LLC initiated a campaign to enhance consumer loyalty by resolving the conflict surrounding healthy snacking. Addressing Gen Z, the campaign aims to offer delicious and healthy snack choices to revive this segment's loyalty.

Canada Savory Snacks Market

Growing consumers' preference for organic, natural, and domestic products shapes the Canadian savory snacks market. Healthier snack options are gaining mainstream popularity, such as baked chips, roasted nuts, and high-protein meat snacks. Multicultural flavors have also helped drive an increase in demand for global snack products. Retailers are adding a range of traditional and health-oriented snack options to offerings, making Canada's market for savory snacks dynamic and changing. Sept 2024, Protein Candy rolls out in Sobeys and Circle K locations, providing health-oriented millennials with more healthier snacking choices in Canada.

Mexico Savory Snacks Market

High cultural drivers and consumer affinity for strong, spicy tastes determine the savory snacks market in Mexico. Tortilla chips, spicy peanuts, and chili-popcorn are some of the top popular snack foods. The snacking market for on-the-go products is increasing, with big brands mainstreaming street-style snacks. Further, the emerging middle class and global exposure to foreign snack trends have broadened the market, propelling Mexico into a prominent position in North America's savory snack market. Sigma, a Mexican multinational, debuted Chocke-Obleas, an amaranth-flavored snack in the US in February 2022, presented as a guilt-free treat with true Mexican origins.

North America Savory Snacks Market Segments

Product

- Potato Chips

- Extruded Snacks

- Nuts & Seeds

- Popcorn

- Others

Flavor

- Roasted/Toasted

- Barbeque

- Spice

- Meat

- Others

Distribution Channels

- Supermarket/Hypermarket

- Specialty Retailers

- Convenience Stores

- Online Stores

- Others

By Country

- United States

- Canada

- Mexico

All the Key players have been covered from 4 Viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Company Analysis

- PepsiCo

- Mondelēz International

- THE HERSHEY COMPANY

- The Kraft Heinz Company

- General Mills Inc.

- Kellanova

- Utz Brands, Inc.

- LINK SNACKS, INC.

- Conagra Brands, Inc.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2021 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Flavor, Distribution Channels and Countries |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the North America savory snacks market by 2033?

-

What is the expected CAGR of the North America savory snacks market from 2025 to 2033?

-

Which product categories are covered in the market segmentation?

-

What are the key drivers of growth in the North America savory snacks market?

-

How are health-conscious snacking trends influencing the savory snacks market?

-

Which distribution channels are included in the report's analysis?

-

What challenges does the potato chips market face in North America?

-

How is the demand for online stores shaping the North America savory snacks market?

-

What are some examples of recent product innovations in the industry?

-

Which major companies are analyzed in the report?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. North America Savory Snacks Market

6. Market Share

6.1 By Product

6.2 By Flavor

6.3 By Distribution Channels

6.4 By Country

7. Product

7.1 Potato Chips

7.2 Extruded Snacks

7.3 Nuts & Seeds

7.4 Popcorn

7.5 Others

8. Flavor

8.1 Roasted/Toasted

8.2 Barbeque

8.3 Spice

8.4 Meat

8.5 Others

9. Distribution Channels

9.1 Supermarket/Hypermarket

9.2 Specialty Retailers

9.3 Convenience Stores

9.4 Online Stores

9.5 Others

10. By Country

10.1 United States

10.2 Canada

10.3 Mexico

11. Porter’s Five Forces

11.1 Bargaining Power of Buyer

11.2 Bargaining Power of Supplier

11.3 Threat of New Entrants

11.4 Rivalry among Existing Competitors

11.5 Threat of Substitute Products

12. SWOT Analysis

12.1 Strengths

12.2 Weaknesses

12.3 Opportunities

12.4 Threats

13. Key Players Analysis

13.1 PepsiCo

13.1.1 Overview

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenues

13.2 Mondelēz International

13.2.1 Overview

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenues

13.3 THE HERSHEY COMPANY

13.3.1 Overview

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenues

13.4 The Kraft Heinz Company

13.4.1 Overview

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenues

13.5 General Mills Inc.

13.5.1 Overview

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenues

13.6 Kellanova

13.6.1 Overview

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenues

13.7 Utz Brands, Inc.

13.7.1 Overview

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenues

13.8 LINK SNACKS, INC.

13.8.1 Overview

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenues

13.9 Conagra Brands, Inc.

13.9.1 Overview

13.9.2 Key Person

13.9.3 Recent Developments

13.9.4 Revenues

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com