North America Sports Drinks Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowNorth America Sports Drinks Market Trends & Summary

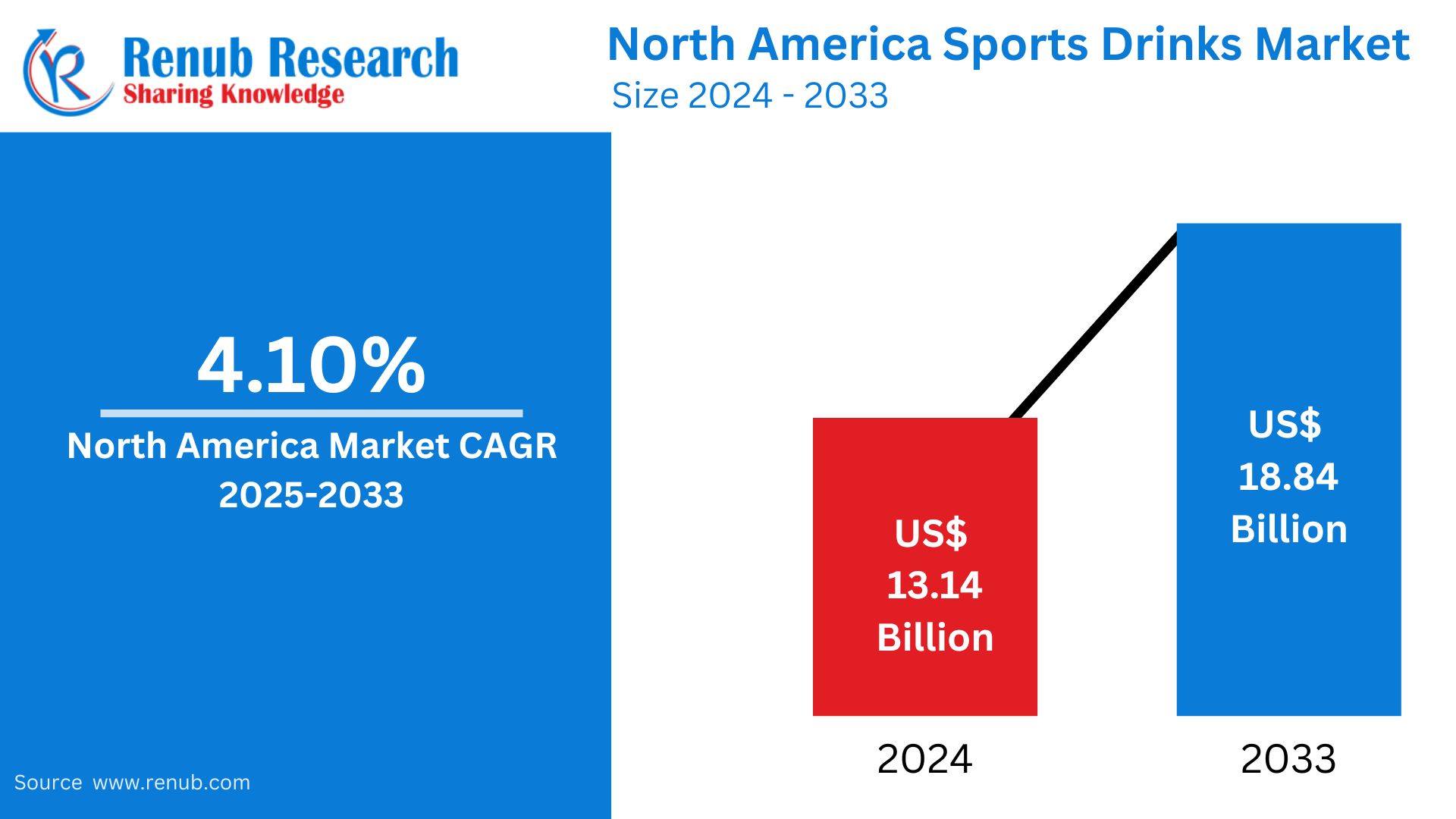

North America Sports Drinks market is expected to reach US$ 18.84 billion by 2033 from US$ 13.14 billion in 2024, with a CAGR of 4.10% from 2025 to 2033. Growing consumer demand for functional beverages, hydration emphasis, creative product formulations, increased awareness of the advantages for athletic performance and recovery, and increased engagement in sports and fitness activities are the main drivers of the sports drink market in North America.

North America Sports Drinks Market Report by Soft Drink Type (Electrolyte-Enhanced Water, Hypertonic, Hypotonic, Isotonic, Protein-based Sport Drinks), Packaging Type (Aseptic packages, Metal Can, PET Bottles), Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Online Retail, Specialty Stores, Others), Countries and Company Analysis 2025-2033

North America Sports Drinks Industry Overview

Growing public awareness of the value of hydration and recovery during physical activity has contributed to the notable expansion of the sports drink market in North America. Sports drinks are well-liked by both athletes and fitness enthusiasts since they are designed to improve hydration, replace electrolytes, and give energy. From conventional electrolyte-based drinks to those with additional vitamins, minerals, and natural ingredients, this industry offers a vast array of goods.

Additionally, the popularity of these beverages has been extended beyond top athletes to the general health-conscious consumer due to advancements in product formulations, such as zero-calorie, low-sugar, and plant-based choices.

The growing emphasis on functional beverages that provide performance-enhancing advantages is a major factor propelling the market's expansion. In addition to seeking hydration, consumers are searching for beverages that offer further advantages including increased energy, faster recovery, and better endurance. Products that meet these demands are becoming more and more in demand as fitness-related activities like cycling, jogging, and gym workouts gain popularity. The market is now more competitive as companies keep coming up with new tastes, ingredients, and packaging. Additionally, sports drinks are now more widely available thanks to the growth of e-commerce platforms, which has increased consumer reach throughout North America.

The sports drink market in North America is undergoing a dramatic change as a result of shifting customer tastes and increased health consciousness. With 64% of US consumers indicating in 2022 that they prefer beverages with natural and transparent ingredients, manufacturers are reacting to the growing demand for clean-label products. Major brands have been forced to reformulate their products as a result of this change, removing artificial sweeteners and adding natural substitutes. The business has also seen some noteworthy breakthroughs, such as Gatorade's announcement of an unflavored water product for early 2024 and PepsiCo's debut of plant-based Muscle Milk in September 2023, which show how adaptable the sector is to shifting consumer preferences.

In the market for sports drinks, sustainability has become a significant determinant of consumer choice. In 2022, an astounding 82% of North American customers said they would be willing to pay more for goods packaged sustainably. Companies like Coca-Cola have committed to making 25% of their packaging reusable by 2030, demonstrating the active pursuit of environmentally friendly efforts by major corporations. Recycled PET bottles and sustainable packaging options are becoming increasingly popular in the industry, which reflects a larger commitment to environmental responsibility and satisfies consumer demands for eco-friendly goods.

Growth Drivers for the North America Sports Drinks Market

Increasing Health and Fitness Awareness

Consumers' growing health consciousness is driving up demand for functionally beneficial beverages that enhance performance, recuperation, and hydration. Sports drinks have gained popularity among athletes, fitness enthusiasts, and the general public who are interested in leading active lives. These beverages are made to aid in electrolyte replacement and supply vital nutrients. Nowadays, more people understand how important it is to stay hydrated when engaging in physical activities, such as yoga, outdoor sports, or exercise. Because of this, sports drinks are now available to a wider range of consumers who are looking for healthier, more efficient ways to keep energized and recuperate after exercises.

Rising Participation in Sports and Fitness Activities

One of the main factors influencing the demand for sports beverages is the rise in both recreational and competitive sports activity. Hydration and electrolyte replenishment are essential as more people participate in physical activities including cycling, running, and gym sessions. Sports beverages offer sustained energy throughout extended physical exercise, assist avoid muscle cramps, and help maintain adequate hydration levels. The rise in sports and fitness activity has led to a rise in the consumption of drinks that improve athletic performance and recuperation in addition to satisfying thirst. Sports drinks are now a necessary component of many active people's routines due to the growing fitness culture in North America, which is propelling the market's expansion.

Increased Focus on Hydration and Recovery

Customers are looking for specialty drinks that aid in maximizing these processes as they become more conscious of the significance of staying hydrated for both athletic performance and recuperation. Maintaining adequate hydration is essential for improving endurance and general performance during physical activity, as well as avoiding weariness and cramping in the muscles. Sports beverages that replace electrolytes, replace lost fluids, and promote a speedier recovery have therefore become more and more popular. Key components including salt, potassium, and magnesium are frequently found in these beverages; they aid in maintaining fluid balance and preventing dehydration. Demand for these specialty beverages has increased as athletes and fitness enthusiasts place a higher priority on recuperation to sustain optimal performance, positioning hydration-focused sports drinks as a significant market niche within the beverage industry.

Challenges in the North America Sports Drinks Market

Consumer Skepticism Over Effectiveness

The market for sports drinks is facing an increasing obstacle in the form of casual consumers' doubts about the need for these goods, particularly among those who do not participate in high-intensity sports or exercise. Many customers prefer more straightforward options like water or coconut water because they doubt that specialty drinks are actually necessary for regular hydration and recuperation. Demand for drinks that offer more than simply hydration—such as extra nutritional benefits or functional components like protein, vitamins, or adaptogens—is rising as fitness and health trends change. Because traditional sports drinks are sometimes seen as superfluous for people with lower activity levels or little exercise routines, this shift in consumer expectations has made it more difficult for them to appeal to a wider audience.

Competition from Alternatives

Other beverage categories, such as bottled water, coconut water, and plant-based hydration beverages, which are increasingly seen as healthier options, are posing a serious threat to the sports drinks business. The increased customer desire for clean-label, organic, and plant-based products is in line with these options, which are frequently seen as more natural and devoid of artificial additives. Plant-based beverages provide hydration along with other nutritional advantages like vitamins or antioxidants, while coconut water is a popular option because of its natural electrolyte content. In order to stay relevant in the increasingly saturated beverage market, sports drink manufacturers must innovate and set themselves apart by providing special benefits like clean formulations or functional ingredients. Traditional sports drinks run the risk of losing market share to these new competitors if they don't innovate.

North America Sports Drinks Market Overview by Regions

By countries, the North America Sports Drinks market is divided into United States, Canada, Mexico, Rest of North America.

United States Sports Drinks Market

The burgeoning fitness culture and increased health consciousness have made the US sports drink sector a significant part of the beverage business. Sports beverages are well-liked for hydration and electrolyte replacement both during and after physical activity. Performance-enhancing hydration solutions are becoming more and more popular as more people participate in sports, fitness regimens, and active lifestyles. Additionally, manufacturers are launching products with useful ingredients like vitamins, minerals, and plant-based alternatives, reflecting a trend toward healthier, low-sugar, and natural formulations. But substitutes like bottled water, plant-based hydration beverages, and coconut water are becoming more and more competitive. In spite of this, the U.S. market is still strong because to advancements in flavors and formulations catered to particular fitness requirements and tastes.

Canada Sports Drinks Market

The market for sports drinks in Canada has grown steadily due to rising levels of participation in fitness and sports. More health-conscious Canadians are looking for hydration products that offer practical advantages like increased energy and better recuperation in addition to electrolyte replenishment. Demand for sports beverages with less sugar, natural ingredients, and extra vitamins and minerals has increased as a result of this change in consumer expectations. Sports drinks are popular among athletes as well as recreational exercisers and health enthusiasts due to the expanding fitness culture. However, there are obstacles because of competition from healthy options like bottled water and coconut water, as well as worries about sugar consumption. Despite this, the market for sports drinks in Canada is still robust, with innovative product choices satisfying the demands of a vibrant, health-conscious consumer base.

Mexico Sports Drinks Market

The demand for sports drinks is expanding in Mexico as a result of people's growing interest in fitness and active living. Products that provide hydration and performance benefits are becoming more and more popular as more people participate in sports, gym activities, and outdoor fitness. In Mexico, sports beverages are well-liked for restoring electrolytes and promoting recuperation after physical activity. Alternative hydration options, such as coconut water and bottled water, which are seen as healthier and more natural solutions, are competing with the market, nevertheless. Consumers are looking for sports drinks with less sugar, natural ingredients, and more nutritional value as health consciousness rises. As producers launch cutting-edge goods to meet the changing demands of Mexican customers who are concerned with their health and well-being, the market keeps growing.

North America Sports Drinks Market Segments

Soft Drink Type – Market breakup from 5 viewpoints

-

Electrolyte-Enhanced Water

-

Hypertonic

-

Hypotonic

-

Isotonic

-

Protein-based Sport Drinks

Packaging Type – Market breakup from 3 viewpoints

- Aseptic packages

- Metal Can

- PET Bottles

Distribution Channel – Market breakup from 5 viewpoints

- Supermarket/Hypermarket

- Convenience Stores

- Online Retail

- Specialty Stores

- Others

North America Sports Drinks Market

- Canada

- Mexico

- United States

- Rest of North America

Company Analysis for North America Protein

1. Abbott Laboratories

2. Aje Group

3. Bluetriton Brands Holdings, Inc.

4. Congo Brands

5. Costco Wholesale Corporation

6. Keurig Dr Pepper, Inc.

7. Monster Beverage Corporation

8. PepsiCo, Inc.

9. Sabormex SA de CV

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Soft Drink Type, By Packaging Type, By Distribution Channel and By Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the expected market size of the North America sports drinks industry by 2033?

-

What is the forecasted CAGR for the North America sports drinks market from 2025 to 2033?

-

What are the key factors driving the growth of the sports drinks market in North America?

-

How are changing consumer preferences influencing the sports drinks industry?

-

Which packaging types are commonly used for sports drinks in North America?

-

What role does sustainability play in shaping consumer choices in the sports drinks market?

-

Which distribution channels are most commonly used for sports drink sales in North America?

-

What are the major challenges faced by the North America sports drinks market?

-

Who are the key players in the North America sports drinks industry?

-

How does the sports drinks market in the U.S. compare to Canada and Mexico?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. North America Sports Drinks Market

6. Market Share Analysis

6.1 By Soft Drink Type

6.2 By Packaging Type

6.3 By Distribution Channel

6.4 By Country

7. Soft Drink Type

7.1 Electrolyte-Enhanced Water

7.2 Hypertonic

7.3 Hypotonic

7.4 Isotonic

7.5 Protein-based Sport Drinks

8. Packaging Type

8.1 Aseptic packages

8.2 Metal Can

8.3 PET Bottles

9. Distribution Channel

9.1 Supermarket/Hypermarket

9.2 Convenience Stores

9.3 Online Retail

9.4 Specialty Stores

9.5 Others

10. Country

10.1 Canada

10.2 Mexico

10.3 United States

10.4 Rest of North America

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 Abbott Laboratories

13.1.1 Overview

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Aje Group

13.2.1 Overview

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 Bluetriton Brands Holdings, Inc.

13.3.1 Overview

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 Congo Brands

13.4.1 Overview

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Costco Wholesale Corporation

13.5.1 Overview

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Keurig Dr Pepper, Inc.

13.6.1 Overview

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Monster Beverage Corporation

13.7.1 Overview

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 PepsiCo, Inc.

13.8.1 Overview

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

13.9 Sabormex SA de CV

13.9.1 Overview

13.9.2 Key Person

13.9.3 Recent Developments

13.9.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com