Olive Oil Market Report by BY Type (Extra Virgin Olive Oil, Virgin Olive Oil, Others), Industry (Food and Beverages, Cosmetics, Pharmaceuticals), End-User (Food Service, Food Processing, Retail), Consumption( EU-27, Turkey, Morocco, Tunisia, Syrian Arab Republic, Algeria, Argentina, Lebanon, Jordan, Chile, Others), Production (EU-27, Turkey, Morocco, Tunisia, Syrian Arab Republic, Algeria, Argentina, Lebanon, Jordan, Chile, Others), Import (United States, EU-27, Brazil, Japan, Canada, China, Australia, Turkey, Russian Federation, Saudi Arabia, Others), Export (EU-27, Tunisia, Turkey, Syrian Arab Republic, Morocco, Argentina, Chile, United States, Lebanon, Jordan, Others), Company Analysis 2023-2028

Buy NowOlive Oil Market Analysis

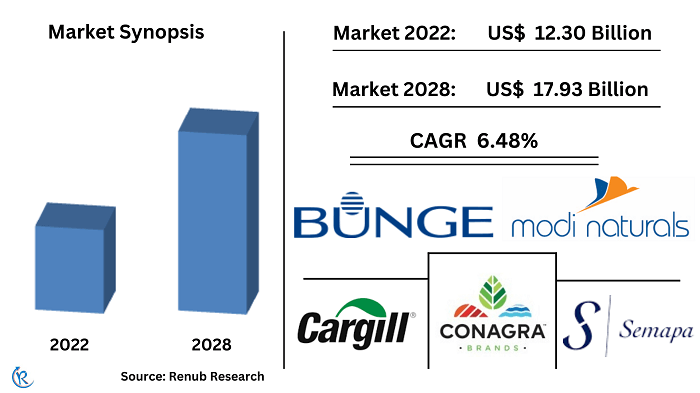

Global Olive Oil Market will reach US$ 17.93 Billion by 2028, according to Renub Research. Olive Oil is a leading crop worldwide; on an average, millions of Tons are produced yearly. It is the natural Oil extracted from olives, the fruit of the olive tree, and made by grinding and removing the Oil by mechanical or chemical means. As per our research findings, Global Olive Oil Industry will grow at a CAGR of 6.48% from 2022 to 2028.

Moreover, rising awareness among consumers regarding health benefits and massive demand for olive Oil in different industries like food & beverages, personal care products, and the pharmaceutical industry has significantly driven the market. However, High costs and climate and economic problems create the biggest challenges for the olive oil market's growth.

Olive Oil Companies News

Modi Naturals

In 2024, Modi Naturals plans to launch the Oleev Kitchen sub-brand, which will offer pasta and peanut butter. The company aims to generate 3% of its business from this sub-brand in the first year and 5–10% in the following years.

Modi Naturals Limited (MNL) has partnered with health enthusiast Kalki Koechlin to promote their flagship product, Oleev Olive Pomace Oil. Oleev is the brand of MNL that deals with food and beverages. The partnership was formed in 2023.

Cargill Inc

In June 2022, Cargill announced plans to construct a new USD 200 Million palm oil refinery in Indonesia to boost its efforts to broaden a sustainable palm delivery chain and offer established deforestation-unfastened products to customers.

In 2023, Cargill forayed into India with its edible oil portfolio and launched Gemini Pureit™, India’s leading sunflower oil brand in the region.

Bunge Limited

In October 2023, Bunge Ltd.'s joint venture with IOI Corporation is set to acquire a newly constructed, port-based refinery from Fuji Oil New Orleans, LLC. The refinery is situated in the Avondale Terminal of International-Matex Tank Terminals in Louisiana.

June 2023, Bunge Ltd. and Chevron's Renewable Energy Group Inc., a Chevron Corp. subsidiary, acquired Argentinian seed company ChacraserviciosSrl. from Italian energy company Adamant Group.

Olive oil consumption has changed significantly in the EU 27

By Consumption, the Olive oil industry has been classified into eleven parts EU-27, Turkey, Morocco, Tunisia, Syrian Arab Republic, Algeria, Argentina, Lebanon, Jordan, Chile, and Others. EU-27 captured the largest market share due to increasing per capita income; useful in skin care products, helps reduce the risk of heart disease and cancer like breast and colorectal cancer, and mainly drives the market.

In the EU, Italy and Spain are the largest consumers of olive oil, with annual consumptions of around 500,000 tons each. At the same time, Greece has the most extensive EU most significant pitta consumption, with about 14/per person per year.

Furthermore, Olive oil consumption is also growing in the Asia-Pacific region. However, Japan, Korea, and China are still the top destination countries with more consumption rate in 2022. According to this research report, Worldwide Olive Oil Market was US$ 12.30 Billion in 2022.

Challenges in the Olive Oil Market

Volatility in Olive Oil Prices

The olive oil market has a rather significant threat in the shape of fluctuations in the price levels. Market prices of olive oil are very volatile and this is because of so many reasons like weather conditions of the region where olive was grown, crop yields and political instabilities of the region. There is also unfavorable weather condition whereby the growth and productivity of olive is affected by unfavorable conditions such as droughts or storms thereby reducing yields and making the produce to be expensive. Additionally, this has a bearing on political instability which is evident in important olive producing countries like Spain and Italy; this makes the prices change globally. These fluctuations make it difficult for the producers and consumers in their financial planning in addition to posing challenges in determining a stable price for business. To overcome these problems and cultivate the company’s adaptability, it could be necessary to concentrate on the flexible supply chain concepts and risk mitigation instruments. However, the inherent randomness still does present a major problem despite these efforts put in place.

Fraud and Quality Assurance Issues

The major concern that has been found in the olive oil market is high incidence of fraud and quality concerns. Cheating includes relabelling, blending with inferior oil and faked origin common as it may be. They can manipulate the consumers harming their trust and the general credibility of the entire market. Testing and certification processes are, however, necessary, to guarantee the genuineness and quality of the olive oil products, although they are costly and time consuming. Furthermore, due to the lack of similar laws and rules in distinct countries, that imparts a challenge to provide proper quality assurance effectively. In order to address them, there is a need to enforce better regulation that will help to address the above problems of consumers and maintain the integrity of the market by improving its traceability and increasing industry transparency.

Europe is the continent that produces the enormous amount of Olive Oil in the World

Based on Production, the Olive Oil market globally was segmented into eleven such EU-27, Turkey, Morocco, Tunisia, Syrian Arab Republic, Algeria, Argentina, Lebanon, Jordan, Chile, and Others. In the Production list of the top 10 largest olive oil countries in the world, four are European, with Spain, Greece, and Italy sitting at the top.

The cultivation of olive trees mainly drives the growth and demand of high-quality oil farmers' awareness and socio-economic culture. According to the Food Information and Control Agency, Spain produced 1.3 million Tunes of olive Oil in 2021, accounting for 42% of global olive oil production. All of them are countries belonging to the Mediterranean basin. Therefore, the Production of these countries accounts for about 80% of world production.

United States is the Largest Olive Oil Importer

By Import, the Olive Oil industry is divided into eleven types: United States, EU-27, Brazil, Japan, Canada, China, Australia, Turkey, Russian Federation, Saudi Arabia, and Others. Eight markets represent around 81% of the imports of olive and virgin olive oils worldwide, the United States, the European Union, Brazil, Japan, Canada, China, Australia, and Russia.

The United States captured the largest market share due to the rising Consumption of olives oil, less Production, rising urbanization and Globalization, Government favorable regulation in production techniques, and health-conscious consumers driving the growth of the United State Market.

Spain represented the major Exporting Country

By Export, Eu-27 holds the largest market share during the forecast period. The market has been segmented into eleven types such as EU-27, Tunisia, Turkey, Syrian Arab Republic, Morocco, Argentina, Chile, United States, Lebanon, Jordan, and Others.

Spain is the largest olive oil exporter, followed by Greece, Italy, Tunisia, and Portugal in the EU. However, European countries import most of their olive oil from other European countries because the most significant share of intra-European trade consists of bulk olive oil blended by the largest olive oil companies before bottling.

Saudi Arabia olive oil market

The consumption rate of olive oil is gradually increasing in Saudi Arabia owing to the changing trends of people opting for a healthier diet. Even though Saudi Arabia is not an olive oil producing nation, the country uses olive oil and imports it a lot to feed the growing desire. This trend is mainly because of a growing concern on the health benefits of the Mediterranean diet, particularly olive oil. Therefore, local distributors and retailers are now diversifying their stocks so as to offer different types of high-quality olive oil. Moreover, the Saudi government is aiming up domestic production through agricultural chemications and participating in joint ventures this will help the country to diversified its agricultural sector and minimize import reliance. As a development of its brands, in March 2022 Znaidi Food Industries introduced a new extra virgin olive oil brand “Maria Bonomo”. This brand’s new products are manufactured from Chetoui olives which are a conventional type of olives from Northern Tunisia.

Virgin Olive Oil will continue to grow in the Forecast Period

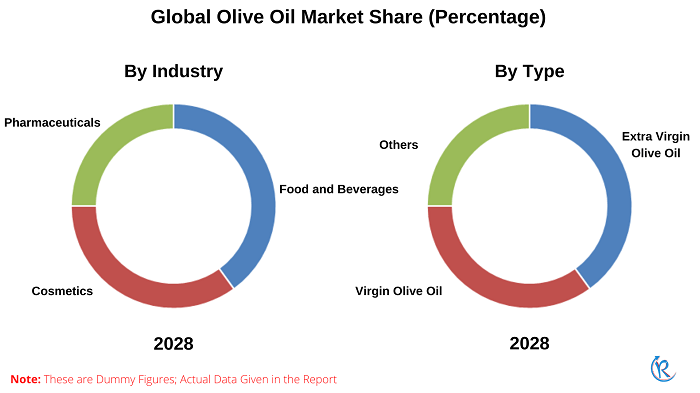

Based on Type, Worldwide Olive Oil Market is ked-up into Extra Virgin Olive Oil, Virgin Olive Oil, and Others. Virgin Olive Oil will dominate the market share due to increasing demand from health-aware consumers, as it is fruity but has some sensory defects. In addition, its acidity shall not exceed 2%. Furthermore, through advanced technology process methods, producers produce more virgin olive oil in the market. As a result, the largest producers of virgin olive oil are China, U.S., Brazil, Germany, and Mexico.

Food & Beverage Industry will capture more Share in Upcoming Years

Based on Industry, Food and Beverages dominated the largest market share during the forecast period because of the wide range of brand popularity of olive oil available in the market, creating more demand for consumers in the food and beverages industry. In addition, consumers' desire for a healthy lifestyle has increased the demand for olive oil in various food items. Therefore, the market is bifurcated into Food and Beverages, cosmetics, and Pharmaceuticals. Pharmaceuticals segment also holds a significant share as medicine. People commonly use olive oil for heart disease, diabetes, and high blood pressure.

Key Development

The primary key players covered in the report are Modi Naturals, Cargill, Inc., Bunge Limited, Conagra Brands, and Semapa.

In Feb, 2022, Olio Nuovo Extra Virgin Olive Oil, a batch released by Curation Foods, Inc. under the name Of Olive Oil & Vinegars, is seasonal oil with a flavor that is both fresh and powerful.

BY Type: – Market will be divided into three types

1. Extra Virgin Olive Oil

2. Virgin Olive Oil

3. Others

By Industry: – Market will be divided into three types

1. Food and Beverages

2. Cosmetics

3. Pharmaceuticals

End-User: – Market will be divided into three types

1. Food Service

2. Food Processing

3. Retail

Consumption: – Market will be divided into eleven types

1. EU-27

2. Turkey

3. Morocco

4. Tunisia

5. Syrian Arab Republic

6. Algeria

7. Argentina

8. Lebanon

9. Jordan

10. Chile

11. Others

Production: – Market will be divided into eleven types

1. EU-27

2. Turkey

3. Morocco

4. Tunisia

5. Syrian Arab Republic

6. Algeria

7. Argentina

8. Lebanon

9. Jordan

10. Chile

11. Others

Import: – Market will be divided into eleven types

1. United States

2. EU-27

3. Brazil

4. Japan

5. Canada

6. China

7. Australia

8. Turkey

9. Russian Federation

10. Saudi Arabia

11. Others

Export: – Market will be divided into eleven types

1. EU-27

2. Tunisia

3. Turkey

4. Syrian Arab Republic

5. Morocco

6. Argentina

7. Chile

8. United States

9. Lebanon

10. Jordan

11. Others

All key players have been covered from 3 viewpoints

1. Overviews

2. Recent Developments

3. Revenues

Company Analysis

1. Cargill Inc.

2. Modi Naturals

3. Ingredient

4. Bunge Limited

5. Conagra Brands

6. Semapa

Report Details:

Report Details:

| Report Features | Details |

| Base Year |

2022 |

| Historical Period |

2019 - 2023 |

| Forecast Period |

2024 - 2032 |

| Market |

US$ Billion |

| Segment Covered |

Type, Industry, End Use, Consumption, Production, Import, and Export |

| Countries Covered |

|

| Companies Covered |

1. Cargill Inc. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Frequently Asked Questions (FAQ):

1. How big is the Global Olive Oil Market?

2. What will drive the market size of the Global Olive Oil Market?

3. How did the ongoing coronavirus (COVID-19) pandemic impact the growth?

4. Which segment holds the largest market share?

5. How will the Global Olive Oil Market perform in 2028?

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenge

5. Global Olive Oil Market

6. Volume Analysis

6.1 By Consumption

6.2 By Production

6.3 By Import

6.4 By Export

7. Market Share

7.1 By Type

7.2 By Industry

8. Consuming countries

8.1 EU-27

8.1.1 Market

8.1.2 Volume

8.2 United States

8.2.1 Market

8.2.2 Volume

8.3 Turkey

8.3.1 Market

8.3.2 Volume

8.4 Morocco

8.4.1 Market

8.4.2 Volume

8.5 Algeria

8.5.1 Market

8.5.2 Volume

8.6 United Kingdom

8.6.1 Market

8.6.2 Volume

8.7 Brazil

8.7.1 Market

8.7.2 Volume

8.8 Japan

8.8.1 Market

8.8.2 Volume

8.9 Syrian Arab

8.9.1 Market

8.9.2 Volume

8.10 Australia

8.10.1 Market

8.10.2 Volume

8.11 Others

8.11.1 Market

8.11.2 Volume

9. Producing Countries

9.1 EU-27

9.2 Turkey

9.3 Tunisia

9.4 Morocco

9.5 Syrian Arab

9.6 Algeria

9.7 Argentina

9.8 Lebanon

9.9 Jordan

9.10 Chile

9.11 Others

10. Importing countries

10.1 United States

10.2 EU-27

10.3 United Kingdom

10.4 Brazil

10.5 Japan

10.6 China

10.7 Canada

10.8 Australia

10.9 Saudi Arabia

10.10 Turkey

10.11 Others

11. Exporting countries

11.1 EU-27

11.2 Tunisia

11.3 Syrian Arab

11.4 Turkey

11.5 Morocco

11.6 Argentina

11.7 Chile

11.8 United States

11.9 Lebanon

11.10 Australia

11.11 Others

12. Type

12.1 Extra Virgin Olive Oil

12.2 Virgin Olive Oil

12.3 Others

13. Industry

13.1 Food and beverages

13.2 Cosmetics

13.3 Pharmaceuticals

14. Key Players Analysis

14.1 Cargill Inc.

14.1.1 Business Overview

14.1.2 Sales Analysis

14.1.3 Recent Development

14.2 Modi Naturals

14.2.1 Business Overview

14.2.2 Sales Analysis

14.2.3 Recent Development

14.3 Bunge Limited

14.3.1 Business Overview

14.3.2 Sales Analysis

14.3.3 Recent Development

14.4 Conagra Brands (Bertolli®)

14.4.1 Business Overview

14.4.2 Sales Analysis

14.4.3 Recent Development

14.5 Semapa

14.5.1 Business Overview

14.5.2 Sales Analysis

14.5.3 Recent Development

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com