Oman Fertilizer Market Size, Forecast 2025-2033, Industry Trends, Share, Growth, Insight, Impact of Inflation, Company Analysis

Buy NowOman Fertilizer Market Size & Summary

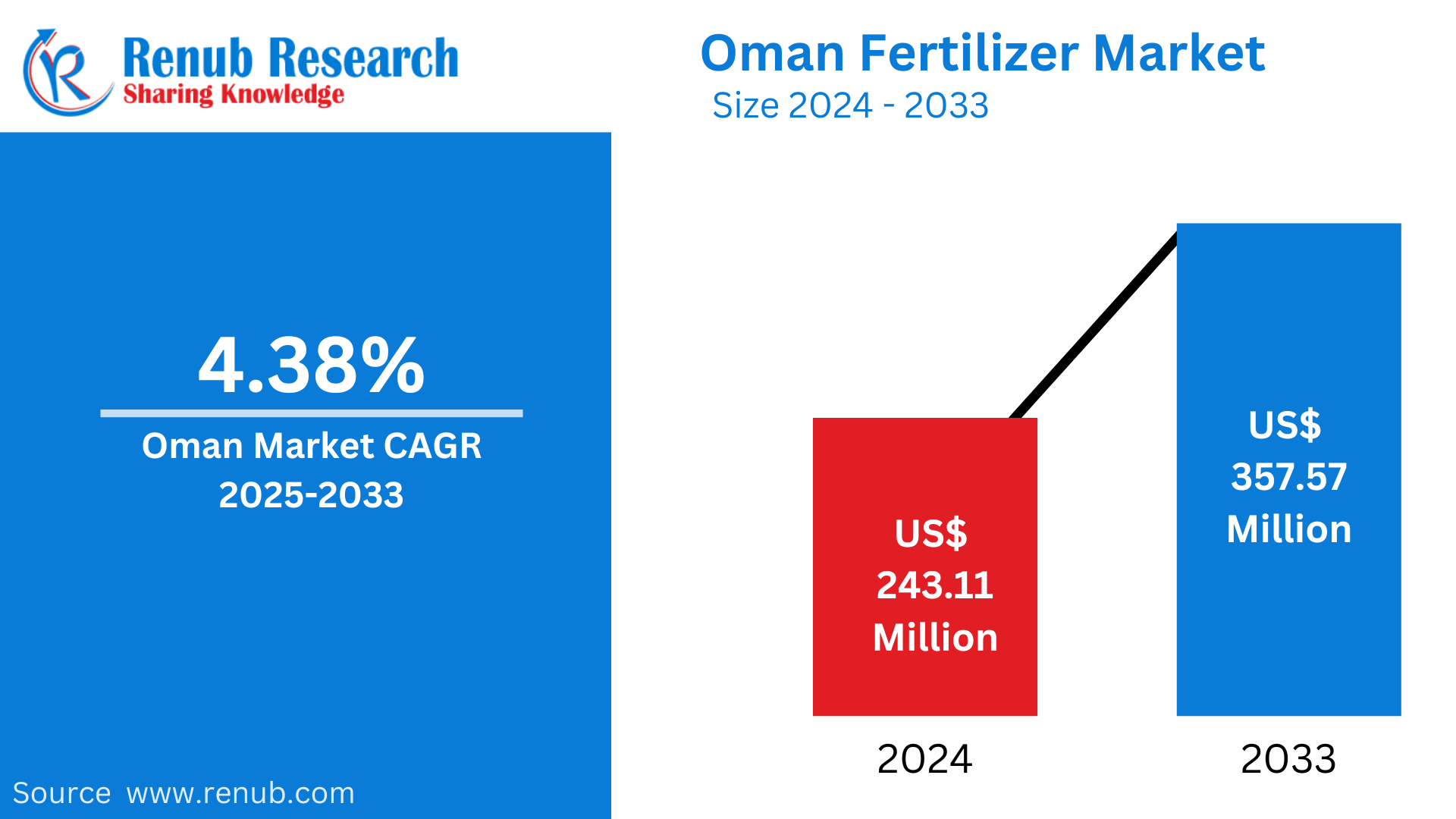

The Oman fertilizer market is expected to register a size of US$ 357.57 Million in 2033 from US$ 243.11 Million in 2024, growing at a CAGR of 4.38% during the forecast period 2025-2033. Government incentives for sustainable farming, growing agricultural activities, and increasing demand for high-yielding crops are drivers for growth. Technology advancements in the production of fertilizers and the adoption of green alternatives also support market growth.

Oman Fertilizer Market Forecast Report by Type (Nitrogen Fertilizers, Phosphate Fertilizers, Potash Fertilizers), Nitrogen Fertilizers (Ammonia (N), Ammonium Nitrate (N), Ammonium Phosphate (N), Ammonium Sulphate (N), Calcium Ammonium Nitrate (N), Potassium Nitrate (N), Urea (N), Urea Ammonium Nitrate (N), NK (N), NPK (N), NP (N), Others), Category (Organic, Inorganic), Form (Dry, Liquid), Application (Agriculture, Horticulture, Gardening, Others), Crop (Grassland, Vegetables, Fruits/Treenuts, Roots/Tubers, Sugar Crops, Fibre Crops, Other Oil Crops, Oil Palm, Soybeans, Other Cereals, Maize, Rice, Wheat, Others), and Company Analysis 2025-2033.

Oman Fertilizer Market Outlooks

Fertilizer is a chemical or organic material that is used on soil or crops to promote plant growth by providing necessary nutrients like nitrogen (N), phosphorus (P), and potassium (K). Fertilizers are an important part of contemporary agriculture, enhancing soil fertility and supporting increased crop yields. Fertilizers are also categorized into synthetic (chemical) fertilizers and organic fertilizers from natural resources such as compost or manure.

Fertilizers play a critical role in sustaining agriculture and food security in Oman. With the arid climate and scarce arable land, fertilizers assist in increasing soil productivity and facilitating effective water use for crop production. The government encourages the utilization of specialized fertilizers, such as desert-friendly and slow-release fertilizers, to maximize crop development in adverse conditions. Additionally, fertilizers support date palm farming, a significant agricultural sector in Oman, and contribute to horticulture, greenhouse farming, and fodder production for livestock. As Oman expands its agricultural sector, fertilizer demand continues to grow.

Growth Drivers in the Oman Fertilizer Market

Government Support for Agricultural Development

The Omani government actively promotes sustainable agricultural practices to enhance food security and reduce dependency on food imports. Programs like fertilizers' subsidies, irrigation system investments, and greenhouse farming support motivate farmers to apply fertilizers to enhance crop yields. Soil fertility and water-conserving agriculture policies further increase the demand for fertilizers. With continued initiatives to enhance the agriculture sector in Oman Vision 2040, the market for fertilizers will expand as farmers increasingly use sophisticated fertilization methods. February 2025, The Ministry of Housing and Urban Planning (MHUP) is to build three farm cities in Saham (North Batinah), Dhahirah, and the Najd area of Dhofar, each needing $7.8bn investment for improving food security and economic diversification. Each city will have an area of approximately 50 square kilometers, with work already commenced in Saham and Najd after the design phase carried out in 2024.

Increased Demand for High-Yield Crops and Sustainable Agriculture

A larger demand for high-yielding crops in Oman, brought about by population increase and higher food demands, exists now. Fertilizers enhance agricultural productivity, improve soil fertility and crop yields, and are a key element in contemporary agriculture. There is a trend towards greener and cleaner fertilizers as well, e.g., bio-based and organic fertilizers that not only assist in keeping soils healthy but decrease environmental pressure too. This is propelling growth in Oman's fertilizer market. Jan 2025, Oman has unveiled its first eco-friendly marine fish farm project at Al Musannah, producing Sea Bream. The pilot has an eight-tonne capacity and employs Recirculating Aquaculture System (RAS) technology.

Greenhouse and Controlled Environment Agriculture Growth

Oman's extreme desert climate and shortage of water make greenhouse farming and controlled-environment agriculture grow. These agricultural practices need special fertilizers to maximize soil quality and plant growth. Water-soluble and slow-release fertilizers are finding greater application in greenhouse production to ensure nutrient uptake efficiency. As hydroponic and vertical farming gain momentum, fertilizer consumption will increase further as Oman invests in technology-intensive agriculture to enhance production. AUG 2024, Oman's first vertical farming company, Trufud Farm, is doubling down on the domestic demand in retail and bulk markets with the expansion of pesticide-free leafy greens and herbs.

Issues within the Oman Fertilizer Industry

Water Deficiency and Ground Degradation

Oman is largely affected by severe water scarcity, which restricts conventional farming practices. Overuse of chemical fertilizers can result in soil contamination, salinization, and water pollution, decreasing long-term soil fertility. Fertilizer use must be balanced with sustainable water resources management, further increasing dependence on specialized fertilizers at higher costs. Efforts to achieve efficient fertilizer use and conservation of water pose a continuous challenge to the industry.

Heavy Dependence on Imported Fertilizers

Oman is heavily dependent on fertilizer imports, leaving the market vulnerable to international price volatility, supply chain disruptions, and geopolitical tensions. The absence of large-scale local fertilizer production raises costs for farmers and agribusiness firms. Moreover, dependence on imported fertilizers constrains the range of customized or specialized fertilizers appropriate for Oman's specific soil and climate, impacting agricultural efficiency.

Oman Nitrogen Fertilizer Market

Nitrogen fertilizers play a crucial role in enhancing crop growth and yield by providing nitrogen, the fundamental nutrient necessary for plant metabolism. In Oman, nitrogen fertilizers like urea, ammonium nitrate, and ammonium sulfate are commonly applied in crop production. They are especially useful in horticulture, greenhouse farming, and fodder crops. However, excessive nitrogen use can lead to soil degradation and water pollution, prompting a shift towards controlled-release and water-efficient nitrogen fertilizers. The market is expected to grow as Oman adopts advanced agricultural techniques to optimize nitrogen use. October 2023, The Nakheel Oman Development Company plans to increase its organic fertilizer plant in Salalah, Oman, to an annual production capacity of 100,000 tonnes within a year. As highlighted in the Times of Oman dated October 2, the facility, which has been set up in partnership with the Ministry of Agriculture, Fisheries, and Water Resources, produced 25,000 tonnes from its inception early this year, 2023.

Oman Ammonium Nitrate Fertilizer Market

Ammonium nitrate is a nitrogenous fertilizer highly effective in cultivating fruit, vegetables, and cereals. The fertilizer promotes the growth of the plant by facilitating the development of the roots as well as production of chlorophyll. In Oman, ammonium nitrate is typically used in intensive agriculture and greenhouse farming. However, its strict handling and storage regulations because of its explosive properties have resulted in controlled use. The market demand for granular and prilled ammonium nitrate fertilizers is on the rise, especially in commercial farms that need high-performance fertilizers to achieve optimum yield in hot and dry weather conditions.

Oman Urea Fertilizer Market

Urea is among the most popular nitrogen fertilizers in Oman because of its high nitrogen content and affordability. It is required for grain crops, vegetables, and fruit trees, enhancing crop yields in poor soils. Farmers use granular and liquid urea because it is easy to apply and rapidly absorbed by plants. High temperatures and water shortages in Oman, however, can cause urea volatilization and loss of nitrogen, making it less effective. Slow-release urea fertilizers and water-conserving application techniques are being demanded to enhance nitrogen uptake and reduce environmental pressure.

Oman Organic Fertilizer Market

The organic fertilizer market in Oman is picking up pace with heightened awareness of sustainable agriculture and ecological issues. Organic fertilizers, which are composted, manure, or plant material, enhance soil health and microbial processes while decreasing chemical residue. Oman's organic agriculture industry is growing, and government incentives encourage the application of bio-fertilizers and organic soil conditioners. Organic fertilizer demand will grow as farmers transition to environmentally friendly and sustainable farming practices to fulfill consumer demand for healthier, chemical-free produce.

Oman Dry Fertilizer Market

Dry fertilizers such as granules and powders are commonly used in Oman because they have a long shelf life, are inexpensive, and can be easily applied. These fertilizers deliver essential nutrients in a slow-release pattern, supporting steady plant growth. Granular fertilizers are utilized for field crops, whereas powdered fertilizers are utilized in controlled-environment agriculture. Because Oman has an arid climate, the demand is rising for water-soluble dry fertilizers that reduce the loss of nutrients and enhance efficiency in drip irrigation and fertigation systems.

Oman Agriculture Fertilizer Market

The Oman agricultural fertilizer market is fueled by the growth of food production, greenhouse cultivation, and government incentives for agricultural sustainability. Fertilizers are needed to improve soil fertility and crop yields, especially in arid and semi-arid areas where natural soil nutrients are scarce. The market consists of chemical fertilizers (NPK, urea, and ammonium sulfate) and organic and bio-fertilizers. With an increasing emphasis on precision agriculture as well as water-conservative fertilizer application techniques, the market is anticipated to witness consistent growth.

Oman Vegetables Fertilizer Market

Fertilizers are an important component of vegetable cultivation in Oman, especially in greenhouses, hydroponics, and open-field cultivation. Nitrogen fertilizers such as urea and ammonium nitrate are used to enhance leafy vegetable growth, while phosphorus and potassium fertilizers support root and fruit growth in vegetables such as tomatoes, cucumbers, and peppers. With growing demand for fresh vegetables in Oman's urban areas, the application of specialty vegetable fertilizers, including organic and water-soluble products, is increasing to achieve high yields and quality crops.

Oman Rice Fertilizer Market

Even though rice production is limited in Oman, small-scale farming and experimental agricultural activities are dependent on fertilizers to enhance rice yields under controlled irrigation conditions. Rice needs nitrogen, phosphorus, and potassium fertilizers to grow correctly and develop grains. Slow-release nitrogen fertilizers and bio-fertilizers are increasingly being highlighted for their potential to enhance soil quality and minimize water contamination. With growing interest in sustainable rice cultivation and food security programs, Oman's niche rice fertilizer market is likely to expand at a steady pace. Yet, water scarcity is the main issue hindering large-scale rice farming.

Oman Fertilizer Market Segments

Type

- Nitrogen Fertilizers

- Phosphate Fertilizers

- Potash Fertilizers

Nitrogen Fertilizers

- Ammonia (N)

- Ammonium Nitrate (N)

- Ammonium Phosphate (N)

- Ammonium Sulphate (N)

- Calcium Ammonium Nitrate (N)

- Potassium Nitrate (N)

- Urea (N)

- Urea Ammonium Nitrate (N)

- NK (N)

- NPK (N)

- NP (N)

- Others

Category

- Organic

- Inorganic

Form

- Dry

- Liquid

Application

- Agriculture

- Horticulture

- Gardening

- Others

Crop

- Grassland

- Vegetables

- Fruits/Treenuts

- Roots/Tubers

- Sugar Crops

- Fibre Crops

- Other Oil Crops

- Oil Palm

- Soybeans

- Other Cereals

- Maize

- Rice

- Wheat

- Others

All the Key players have been covered from 4 Viewpoints:

- Overview

- Recent Development & Strategies

- Product Portfolio

- Financial Insights

Key Players Analysis

- Yara International ASA

- k+s ag

- CF Industries Holdings

- GrupaAzoty S.A

- ICL Group

- OCI NV

- Sociedad Quimica y Minera de Chile SA

- BASF SA

- PhosAgro

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

By type, By Nitrogen Fertilizers, By Category, By Form, By Application and By Crop |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

- What is the projected market size of the Oman fertilizer market in 2033?

- What is the expected CAGR of the Oman fertilizer market from 2025 to 2033?

- What are the key drivers of growth in the Oman fertilizer market?

- How is the Omani government supporting the agricultural sector?

- What impact does water scarcity have on fertilizer use in Oman?

- What are the major challenges facing the Oman fertilizer industry?

- What types of fertilizers are included in the market segmentation?

- How is the demand for organic fertilizers changing in Oman?

- What role does greenhouse and controlled-environment agriculture play in fertilizer demand?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

2.1 Data Sources

2.2 Research Approach and Process

2.3 Scope and Limitations

3. Executive Summary

3.1 Key Highlights of the Oman Fertilizer Market

3.2 Summary of Growth Projections (2025–2033)

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Market share Analysis

5.1 By Type

5.2 By Nitrogen Fertilizers

5.3 By Category

5.4 By Form

5.5 By Application

5.6 By Crop

6. Oman Fertilizer Current Market Landscape & Forecast

7. Type

7.1 Nitrogen Fertilizers

7.2 Phosphate Fertilizers

7.3 Potash Fertilizers

8. Nitrogen Fertilizers

8.1 Ammonia (N)

8.2 Ammonium Nitrate (N)

8.3 Ammonium Phosphate (N)

8.4 Ammonium Sulphate (N)

8.5 Calcium Ammonium Nitrate (N)

8.6 Potassium Nitrate (N)

8.7 Urea (N)

8.8 Urea Ammonium Nitrate (N)

8.9 NK (N)

8.10 NPK (N)

8.11 NP (N)

8.12 Others

9. Category

9.1 Organic

9.2 Inorganic

10. Form

10.1 Dry

10.2 Liquid

11. Application

11.1 Agriculture

11.2 Horticulture

11.3 Gardening

11.4 Others

12. Crop

12.1 Grassland

12.2 Vegetables

12.3 Fruits/Treenuts

12.4 Roots/Tubers

12.5 Sugar Crops

12.6 Fibre Crops

12.7 Other Oil Crops

12.8 Oil Palm

12.9 Soybeans

12.10 Other Cereals

12.11 Maize

12.12 Rice

12.13 Wheat

12.14 Others

13. Porter’s Five Forces Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Rivalry

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1.1 Strength

14.1.2 Weakness

14.1.3 Opportunity

14.1.4 Threat

15. Key Players Analysis

15.1 Yara International ASA

15.1.1 Overview

15.1.2 Recent Development & Strategies

15.1.3 Product Portfolio

15.1.4 Financial Insights

15.2 k+s ag

15.2.1 Overview

15.2.2 Recent Development & Strategies

15.2.3 Product Portfolio

15.2.4 Financial Insights

15.3 CF Industries Holdings

15.3.1 Overview

15.3.2 Recent Development & Strategies

15.3.3 Product Portfolio

15.3.4 Financial Insights

15.4 GrupaAzoty S.A

15.4.1 Overview

15.4.2 Recent Development & Strategies

15.4.3 Product Portfolio

15.4.4 Financial Insights

15.5 ICL Group

15.5.1 Overview

15.5.2 Recent Development & Strategies

15.5.3 Product Portfolio

15.5.4 Financial Insights

15.6 OCI NV

15.6.1 Overview

15.6.2 Recent Development & Strategies

15.6.3 Product Portfolio

15.6.4 Financial Insights

15.7 Sociedad Quimica y Minera de Chile SA

15.7.1 Overview

15.7.2 Recent Development & Strategies

15.7.3 Product Portfolio

15.7.4 Financial Insights

15.8 BASF SA

15.8.1 Overview

15.8.2 Recent Development & Strategies

15.8.3 Product Portfolio

15.8.4 Financial Insights

15.9 PhosAgro

15.9.1 Overview

15.9.2 Recent Development & Strategies

15.9.3 Product Portfolio

15.9.4 Financial Insights

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com