Online Grocery Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowOnline Grocery Market Trends & Summary

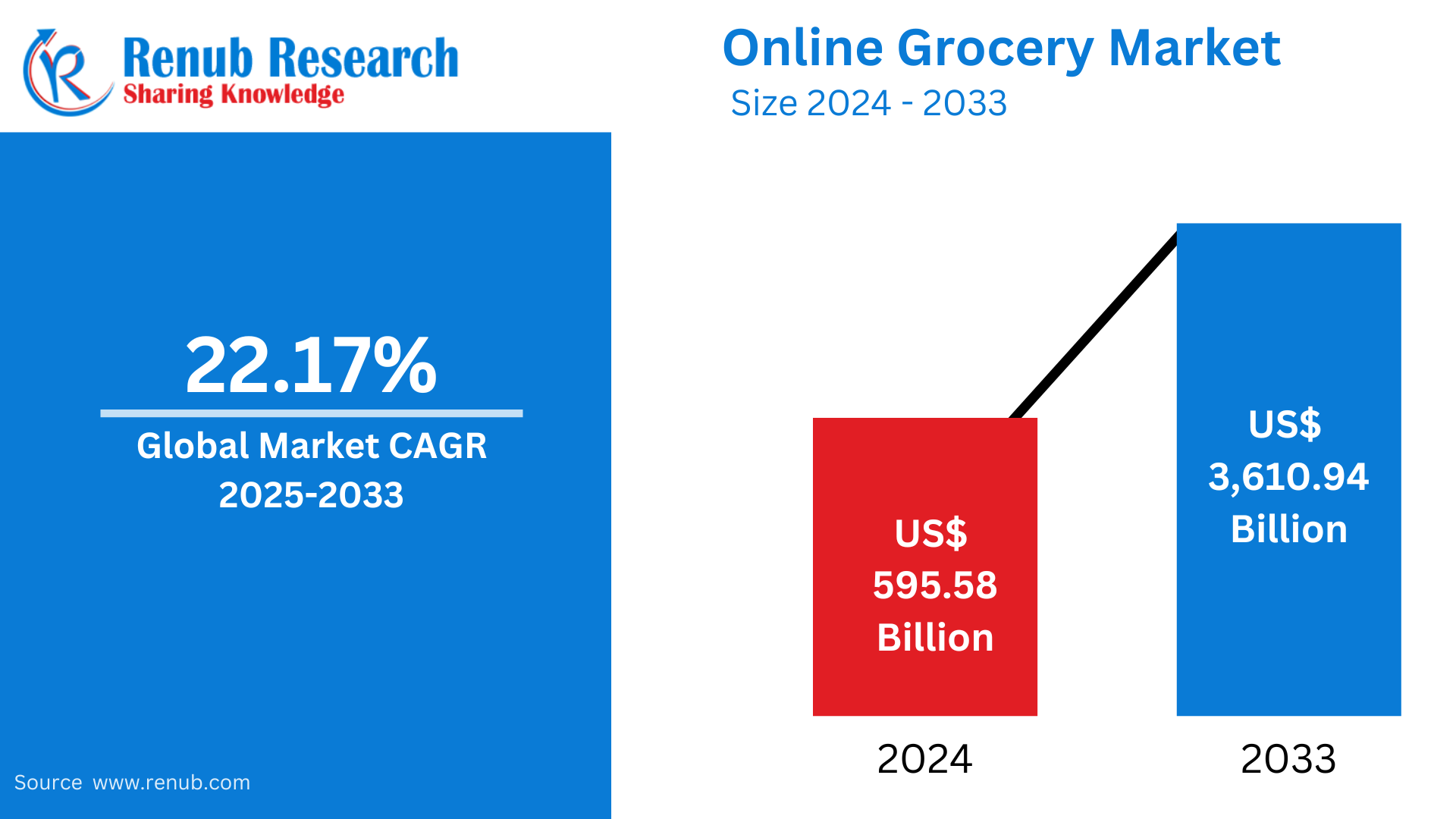

Online grocery market size was US$ 595.58 billion in 2024 and is projected to surpass US$ 3,610.94 billion by 2033 at a CAGR of 22.17% from 2025 to 2033. Progress is now largely driven by consumer preference for greater convenience, advanced technology in e-commerce, and the expansion of delivery services. It has been observed that rising digital platforms and changed shopping habits are major drivers of expansion in the online grocery market globally.

The report Online Grocery Market & Forecast covers by Products (Ready-to-eat Breakfast & Dairy, Staples & Cooking Essentials, Snacks & Beverages, Meat & Seafood, Fresh Produce, Others), Purchaser Type (Ready-to-eat Subscription Purchase, One Time Purchase), Delivery Type (Ready-to-eat Click & Collect, Home Delivery), Payment Mode (Online, Cash on Delivery), Regions and Company Analysis 2025-2033.

Online Grocery Market Outlooks

Online grocery shopping of food and household products through digital channels, usually through websites or mobile applications. Consumers can browse and order fresh produce, packaged foods, beverages, cleaning supplies, and personal care items, which are delivered to their doorstep. The online grocery model is convenient because customers can shop from the comfort of their homes and avoid visiting physical stores.

Online grocery services are commonly used by consumers who seek convenience and more flexibility in their shopping needs. More convenience-oriented, the majority of these platforms provide subscription services, personalized recommendations, and fast delivery options. This model also caters to a wider range of preferences, such as organic or specialty items, which may not be readily available in local stores. It is increasingly integrated with advanced technologies such as AI to better manage inventories, provide a good customer experience, and streamline logistics. Online grocery shopping is on the rise due to urbanization and changing consumer behaviors.

Growth Driver in the Online Grocery Market

Increased Digital Adoption and Internet Penetration

Internet access, smartphone penetration, and digital literacy have skyrocketed globally over the past few years. Consumers increasingly turn to online grocery shopping as the browser's convenience allows them to access various e-commerce sites with a few clicks. Many remote and rural areas are also gaining access to internet connectivity. With the adoption of digital technology now a day-to-day affair, the online grocery market can avail of a significantly more extensive, tech-savvy consumer base, which calls for steady growth and higher adoption. American adults aged 18+ will spend an average of 3 hours and 45 minutes daily on internet activities through mobile phones in 2024.

Increasing Demand for Convenient and Time-Saving Products

Customers go online to shop for groceries because it saves time, and the hectic life and busy schedules at work. It saves time from visiting the actual store, which also saves travel and check-out time. By the way, convenience is valued highly for this service to working professionals, young families and mobility challenges. It also boasts some other features as scheduled deliveries and automated reordering, letting consumers receive fresh groceries at their doorstep, with practically no effort. That is the crux of online grocery market growth: convenience. Enhanced Technology: enhanced value for better experience in online grocery shopping

The advanced technology of AI-powered recommendation, voice-activated ordering, and secure payment

Analytics over data allows retailers to personalise product offerings according to varied user expectations thereby improving the user engagement and loyalty. Some more features, including virtual try-on of products, real-time delivery tracking, and optimised logistics of deliveries are further contributing towards optimizing the e-commerce website that makes it a more engaging portal as well. With such a tech-enabled platform coupled with improved satisfaction and retention, new customers will likely be attracted to this space, supporting long-term growth in the online grocery market. TikTok's e-commerce business was finally launched in the United States in June 2023, after the company had tested the feature several months prior.

Challenges in the Online Grocery Market

Logistics and Delivery Complexity

Logistics and delivery are the most challenging in this online grocery market, mainly because most items sell in perishable categories. Fresh produce, dairy products, and all perishable items require special handling and efficient, speed-based logistics that ensure no reduction in quality. It is difficult to control costs while meeting customer expectations regarding speed, accuracy, and freshness; this is particularly difficult in densely populated areas or with underdeveloped infrastructure. In addition, last-mile delivery is expensive, and order mistakes or delayed delivery can impact customer satisfaction. Companies in this sector are always in need of investments in technology, extra distribution centers, and refrigerated storage solutions to enhance logistics, which is a significant operational complexity and cost.

Competition and Price Sensitivity

The grocery online market is also relatively competitive, considering the nature of notable players and other low-profile competitors competing for market share. This competition usually leads to intense pricing strategies, which hurt profitability. Price-sensitive consumers comparing prices across channels will force firms to offer the best prices, promotions, and loyalty rewards. Furthermore, because of logistics network scale advantages enjoyed by large retailers, new entrants have a harder time maintaining a customer base. In a price-sensitive marketplace, having the right balance between affordability and quality at manageable standards is a real challenge for any online grocery product.

Online Ready-to-eat Subscription Purchase Grocery Market

The demand for convenience food choices is causing a rapid surge in the market for online ready-to-eat subscription purchase groceries. The trend in this space involves subscription purchase services wherein subscribers receive ready-to-eat meal kits or individual meals at home. This model caters to busy lifestyles and a demand for healthier, hassle-free meals. The market is driven by the rise of online platforms, enhanced by features like customization, flexible delivery, and dietary preferences. Innovations in packaging, meal variety, and sustainable sourcing also contribute to its expanding popularity globally.

Home Delivery Online Grocery Market

Home delivery e-groceries have witnessed dramatic growth in view of increasing comfort and convenience needs associated with e-commerce. Today grocery orders from such stores as supermarkets, dairy or fresh produce houses, packaged-goods retailers or household products retailer can be dispatched to a door-step. Pressing needs or health-related preferences and need to shop without even touching are encouraging this trend, which has sped up with times. Major players like Amazon Fresh, Walmart, and local grocery chains offer flexible delivery options, with same-day or scheduled deliveries. Mobile apps and smart technologies also enhance the customer experience, driving further market expansion.

United States Online Grocery Market

The United States is a dominant player in the online grocery market due to its advanced e-commerce infrastructure and tech-savvy population. Convenience, in particular ordering groceries online has become so popular that home delivery or pick up is more favorable to the majority of the consumers. Among major grocery chains Walmart and Kroger have placed substantial investments on an online platform to sell its diverse products. Not to mention the third party Instacart is also driving up the number for online grocery purchases. With continuous growth demand in faster deliveries, convenience focused innovation, in U.S markets it continues. In April 2024, Walmart launched a new grocery brand to keep shoppers. The big-box retailer said it will introduce a private label called Bettergoods, which will offer a range of more trend-driven and chef-inspired foods.

United Kingdom Online Grocery Market

The United Kingdom has a highly developed online grocery market, with many consumers regularly shopping for groceries online. The market leaders include the following retailers: Tesco, Sainsbury's, and Asda, with competitive delivery and pickup services. The growth in food delivery services like Ocado and the rise of partnerships with delivery platforms have further helped to boost the market. A shift towards healthy products and contactless shopping during the COVID-19 pandemic has also accelerated online grocery shopping in the UK. Sept 2024, Co-op, the British co-operative group, has also begun to offer 24-hour online grocery delivery across UK to increase the demand for shopping at odd hours.

China Online Grocery Market

E-commerce and mobile payments are driving the fast growth of the China online grocery market. The main players in the market are Alibaba's Tmall and JD.com, which have vast grocery items in their portfolios, including fresh produce, packaged goods, and household products. In addition, convenience delivery services and technology integration, such as AI for inventory management, further improve customer experience. China's robust digital ecosystem and the trend of convenience shopping accelerate the fast growth of the country's online grocery sector. Feb 2023, Douyin has launched an online e-commerce platform. This is the company's entry into the online supermarket segment, which is expected to make the already crowded e-commerce space even more competitive.

Brazil Online Grocery Market

Brazil is the online grocery market leader in Latin America, with the demand for digital food and household shopping solutions increasing. Companies like Carrefour and GPA are the major players that offer grocery services online to Brazilian consumers. The increased use of smartphones and easier access to the internet have opened up online grocery shopping to many people, particularly in urban regions. Moreover, the COVID-19 pandemic fast-tracked the adoption of online grocery shopping. As more and more consumers go digital, Brazilian retailers expand their e-commerce offerings to include a wider range of products and quicker delivery options. In October 2024, iFood, Brazil's largest food delivery service, made a significant push into the online grocery space. It recently acquired a minority stake in Shopper, a very popular e-commerce platform for delivering supermarket products.

United Arab Emirates Online Grocery Market

The online grocery market is growing rapidly in the United Arab Emirates (UAE) as internet penetration rates are high, and the population is tech-savvy. Online grocery shopping becomes an essential component of the market due to hectic lifestyles and convenience demands among its residents. Carrefour UAE, a well-known giant platform, and regional players like Instashop and Zadina provide various grocery products with easy delivery services. The well-structured logistics base in the UAE and rising consumer acceptance of the online mode accelerate the growth pace of the e-grocery market in this region. Dec 2024, Carrefour UAE is launching an all-day express grocery delivery service in Dubai to provide customers with quick and convenient access to groceries.

Online Grocery Market Segments

Products – Market breakup in 6 viewpoints:

1. Ready-to-eat Breakfast & Dairy

2. Staples & Cooking Essentials

3. Snacks & Beverages

4. Meat & Seafood

5. Fresh Produce

6. Others

Purchaser Type – Market breakup in 2 viewpoints:

1. Ready-to-eat Subscription Purchase

2. One Time Purchase

Delivery Type – Market breakup in 2 viewpoints:

1. Ready-to-eat Click & Collect

2. Home Delivery

Payment Mode – Market breakup in 2 viewpoints:

1. Online

2. Cash on Delivery

Country – Market breakup of 25 Countries:

1. North America

1.1 United States

1.2 Canada

2. Europe

2.1 France

2.2 Germany

2.3 Italy

2.4 Spain

2.5 United Kingdom

2.6 Belgium

2.7 Netherland

2.8 Turkey

3. Asia Pacific

3.1 China

3.2 Japan

3.3 India

3.4 South Korea

3.5 Thailand

3.6 Malaysia

3.7 Indonesia

3.8 Australia

3.9 New Zealand

4. Latin America

4.1 Brazil

4.2 Mexico

4.3 Argentina

5. Middle East & Africa

5.1 Saudi Arabia

5.2 UAE

5.3 South Africa

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Tesco Plc.

2. Walmart Inc.

3. Auchan SA

4. The Kroger Co.

5. Carrefour

6. Costco Wholesale Corporation

7. Koninklijke Ahold Delhaize N.V.

8. Target Corporation

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product, Purchase Type, Delivery Type, Payment Method and Countries |

| Countries Covered |

|

| Companies Covered |

1. Tesco Plc. |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected market size of the online grocery market in 2033?

-

What is the expected CAGR for the online grocery market from 2025 to 2033?

-

Which consumer preference is the primary driver of the online grocery market growth?

-

How does AI contribute to the growth of the online grocery market?

-

What are some major challenges in the online grocery market related to logistics?

-

Which delivery method is becoming more popular in the online grocery market?

-

Which regions are showing the most significant growth in the online grocery sector?

-

How is the competition in the online grocery market impacting pricing strategies?

-

What is the role of ready-to-eat subscription services in the online grocery market?

-

Which companies are the leading players in the global online grocery market?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Online Grocery Market

6. Market Share Analysis

6.1 By Product

6.2 By Purchase Type

6.3 By Delivery Type

6.4 By Payment Method

6.5 By Countries

7. Product

7.1 Breakfast & Dairy

7.2 Staples & Cooking Essentials

7.3 Snacks & Beverages

7.4 Meat & Seafood

7.5 Fresh Produce

7.6 Others

8. Purchase Type

8.1 Subscription Purchase

8.2 One Time Purchase

9. Delivery Type

9.1 Click & Collect

9.2 Home Delivery

10. Payment Method

10.1 Online

10.2 Cash on Delivery

11. Countries

11.1 North America

11.1.1 United States

11.1.2 Canada

11.2 Europe

11.2.1 France

11.2.2 Germany

11.2.3 Italy

11.2.4 Spain

11.2.5 United Kingdom

11.2.6 Belgium

11.2.7 Netherlands

11.2.8 Turkey

11.3 Asia Pacific

11.3.1 China

11.3.2 Japan

11.3.3 India

11.3.4 South Korea

11.3.5 Thailand

11.3.6 Malaysia

11.3.7 Indonesia

11.3.8 Australia

11.3.9 New Zealand

11.4 Latin America

11.4.1 Brazil

11.4.2 Mexico

11.4.3 Argentina

11.5 Middle East & Africa

11.5.1 Saudi Arabia

11.5.2 UAE

11.5.3 South Africa

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threat

14. Key Players

14.1 Tesco Plc.

14.1.1 Overview

14.1.2 Key Persons

14.1.3 Recent Development & Strategies

14.1.4 Revenue Analysis

14.2 Walmart Inc.

14.2.1 Overview

14.2.2 Key Persons

14.2.3 Recent Development & Strategies

14.2.4 Revenue Analysis

14.3 Auchan SA

14.3.1 Overview

14.3.2 Key Persons

14.3.3 Recent Development & Strategies

14.3.4 Revenue Analysis

14.4 The Kroger Co.

14.4.1 Overview

14.4.2 Key Persons

14.4.3 Recent Development & Strategies

14.4.4 Revenue Analysis

14.5 Carrefour

14.5.1 Overview

14.5.2 Key Persons

14.5.3 Recent Development & Strategies

14.5.4 Revenue Analysis

14.6 Costco Wholesale Corporation

14.6.1 Overview

14.6.2 Key Persons

14.6.3 Recent Development & Strategies

14.6.4 Revenue Analysis

14.7 Koninklijke Ahold Delhaize N.V.

14.7.1 Overview

14.7.2 Key Persons

14.7.3 Recent Development & Strategies

14.7.4 Revenue Analysis

14.8 Target Corporation

14.8.1 Overview

14.8.2 Key Persons

14.8.3 Recent Development & Strategies

14.8.4 Revenue Analysis

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com