Global Paper Packaging Market Report Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowPaper Packaging Market Trends & Summary

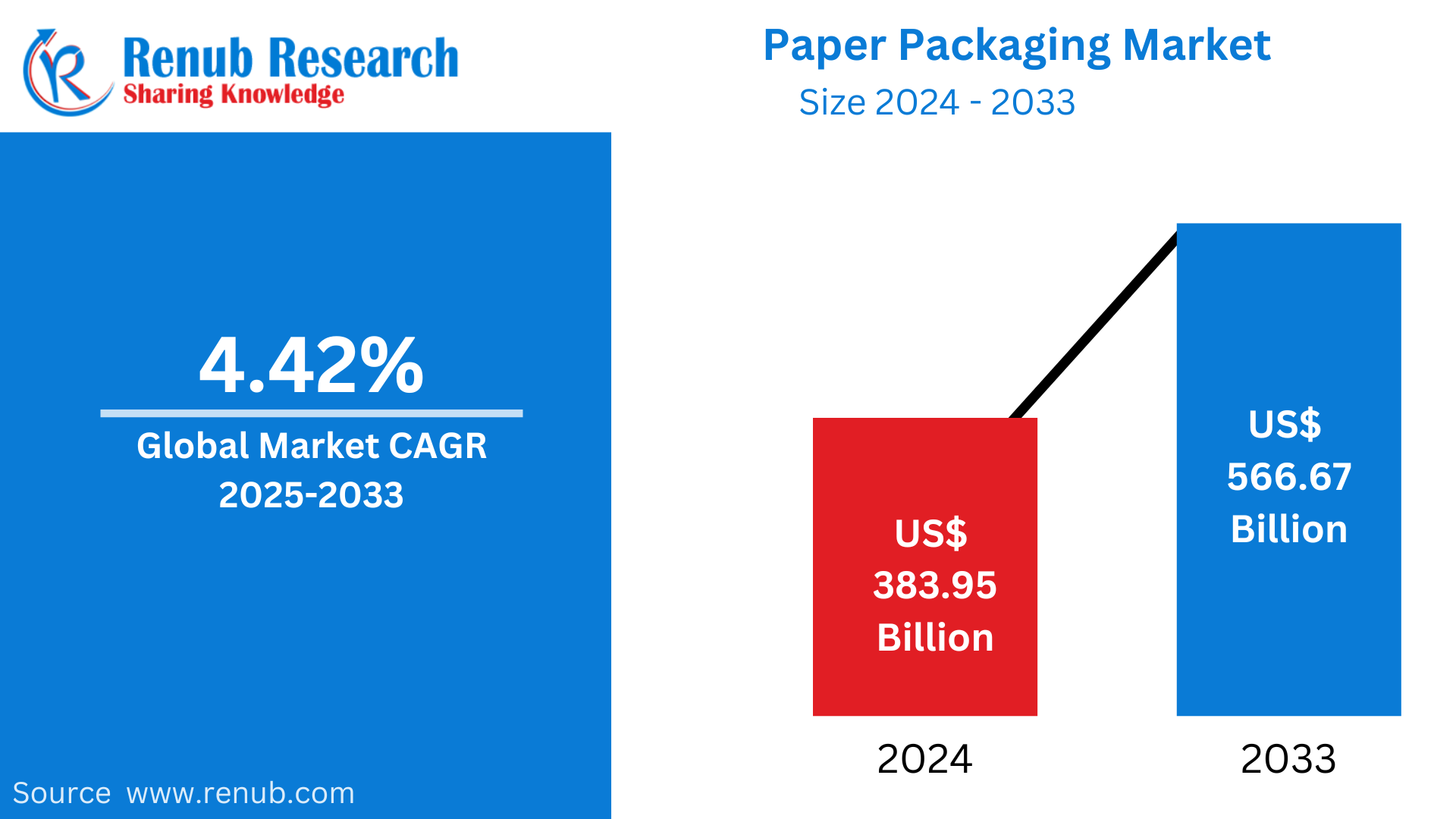

The market for paper packaging is likely to be worth USD 383.95 billion in 2024 and is likely to expand at a compound annual growth rate (CAGR) of 4.42% between 2025 and 2033. The market is likely to be valued at USD 566.67 billion by 2033 due to increased demand for sustainable and eco-friendly packaging from industries as customers and companies move towards environmentally friendly options.

Global Paper Packaging Market Report by Product Type (Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others) End Use (Food & Beverage, E-Commerce, Electrical & Electronic, Home Care, Personal Care & Cosmetic, Automotive & Industrial, Healthcare, Others) Countries and Company Analysis, 2025-2033.

Paper Packaging Market Outlook

Paper packaging is the utilization of paper-based products, including cardboard, kraft paper, and corrugated sheets, to make containers, wraps, and cushioning for goods. Famous for being lightweight, versatile, and recyclable, paper packaging is an environmentally friendly substitute for plastic and other non-biodegradable materials. It helps in minimizing environmental footprint and complying with sustainable standards.

Paper packaging is commonly utilized across industries for many applications. Within the food and beverage industry, it is utilized for wrapping, takeaway boxes, and cartons to maintain freshness and ensure handling safety. The retail and e-commerce sectors utilize paper packaging for shipping boxes, shopping bags, and transportation padding. It is also applied within the cosmetics and personal care sector for environmentally friendly product packaging and branding. With increasing consumer demand for eco-friendly solutions, paper packaging is increasingly popular due to its renewable, biodegradable, and affordable nature, making it a central part of sustainable packaging strategies.

Growth Drivers in the Paper Packaging Market

Increased Demand for Sustainable Packaging

With increasing environmental concerns, companies and consumers are moving towards green solutions. Paper packaging, being recyclable, biodegradable, and renewable, is becoming increasingly popular as a substitute for plastic. Governments across the globe are bringing in stringent regulations and prohibition of single-use plastics, pushing further the use of paper packaging. The food, retail, and e-commerce sectors are embracing paper-based materials at full throttle to comply with sustainable policies and register consumer demand for eco-friendly products. September 2024, Marigold Health Foods has partnered with Sonoco to launch fully recyclable packaging for its plant-based food range, such as stock cubes, sauces, and meat and fish alternatives.

Expansion of the E-commerce Industry

The speedy growth of the e-commerce industry has tremendously increased demand for paper packaging. As online shopping goes mainstream, companies need strong, light, and affordable packaging materials for shipping and handling. Corrugated boxes, folding cartons, and paper fillers are being used more and more to provide protection for products in transit. Furthermore, the growth of direct-to-consumer brands and subscription services has also spurred on the need for new paper-based packaging solutions. September, 2024, Mondi, the sustainable packaging leader, has introduced new recyclable Protective Mailers consisting solely of paper. Developed with Amazon, these innovative mailers allow eCommerce companies to securely ship goods without plastic bubble wrap and are fully recyclable in paper waste streams.

Advancements in Paper Packaging Technology

Technological innovations in the paper packaging industry have enhanced the functionality, durability, and aesthetics of paper-based materials. The development of moisture-resistant, food-safe, and lightweight paper packaging has opened new opportunities in sectors such as food and beverages, pharmaceuticals, and cosmetics. Personalization and branding possibilities, including premium printing, embossing, and sustainable coatings, have transformed paper packaging into a go-to option for companies that wish to enhance their brand reputation and end-user experience. Dec 2024, VTT Technical Research Centre of Finland, in collaboration with Aalto University and Finnish partners, has developed a continuous process for forming cardboard into origami-like structures for fiber-based packaging.

Challenges in the Paper Packaging Market

High Production Costs

Paper packaging production entails a high cost associated with raw materials, energy consumption, and water. The volatility of the price of wood pulp, a raw material critical for production, contributes to manufacturers' costs. Moreover, investments in innovative machinery and technology for sustainable and tailor-made packaging raise the cost, which makes it difficult for small and medium-sized businesses to remain competitive in the market.

Competition from Alternative Materials

Even though paper packaging is environmentally friendly, it is challenged by other green materials like biodegradable plastics, glass, and metal. These products have their own specific strengths, like being more durable, reusable, or having barrier ability, so they are well-suited to be applied in particular uses. In addition, some consumers view paper packaging as less strong or less versatile, thereby restricting its use in heavy-duty packaging applications.

Corrugated Boxes Paper Packaging Market

The corrugated boxes market is a major player in the paper packaging industry, providing strength, durability, and flexibility for different uses. The boxes are widely utilized in the logistics and e-commerce sectors to provide safe transportation of products. Their light weight lowers shipping expenses, while their recyclability meets sustainability objectives. Technological advancements, including water-resistant coatings and improved printing methods, have seen their applications increase in the food, beverage, and retail industries. Increased online shopping and international trade have led to an anticipated steady rise in demand for corrugated boxes.

Folding Boxes and Cases Paper Packaging Market

Folding boxes and cases are flexible paper packaging products employed in retail, cosmetics, and pharmaceutical industries. These items pose great branding possibilities by providing customizable print designs and quality prints. They offer minimalist yet rugged packaging that is light and able to cushion products during transit and storage. Folding box demand has boomed along with the rise of e-commerce and direct-to-consumer brands. Moreover, advancements in material science, including the creation of moisture-resistant and food-grade coatings, have further increased their use in the food and beverage sector. Their recyclability and affordability make them a choice of first preference for eco-friendly packaging.

Food & Beverage Paper Packaging Market

Paper packaging within the food and beverage sector is gaining popularity owing to its eco-friendly and food-safe nature. Paper cups, trays, wraps, and cartons are extensively used to pack a wide range of food items, ranging from takeout foods to grocery products. Increased demand for ready-to-consume foods and drinks has spurred the demand for convenient and eco-friendly packaging solutions. Grease-resistant coatings and compostable packaging have also added to the popularity of paper packaging. As consumers become increasingly conscious of sustainability, food and beverage businesses are turning to paper packaging to lower their carbon footprint and enhance brand loyalty.

Home Care Paper Packaging Market

The home care paper packaging industry serves products such as detergents, cleaning sprays, and personal care products. As companies shift away from plastic packaging, paper-based ones are becoming more prominent due to their sustainability and cosmetic attraction. Flexible design options and high-definition prints enable manufacturers to push branding while ensuring sustainability. Paper packaging solutions such as boxes, wraps, and pouches become the preferred choices for their biodegradable nature. With increasing consciousness regarding environmental protection, consumers are looking for home care products that are packaged in recyclable materials, thus boosting demand for paper packaging in this category. Advances in moisture-resistant and strong paper materials also contribute to its growth.

United States Paper Packaging Market

The United States is a prominent market for paper packaging, fueled by high demand from sectors such as food and beverages, e-commerce, and retail. The nation's increasing emphasis on sustainability and government policies encouraging environmentally friendly packaging have propelled the transition towards paper-based packaging. Technological advancements in paper packaging, including high-performance coatings and printing technologies, have further driven market expansion. The growth of e-commerce, along with growing consumer awareness regarding environmental concerns, continues to fuel demand for items such as corrugated boxes, paper bags, and folding cartons. The market will see steady growth in the US over the next few years. December 2024, American Packaging Corporation (APC) introduced its new high-performance, sustainable, recycle-ready paper packaging, further growing its RE sustainable packaging offerings.

Germany Paper Packaging Market

Germany, a sustainability leader, is a major player in the paper packaging industry. The nation's stringent environmental laws and consumers' affinity for green products have driven the uptake of paper-based packaging solutions. Food, beverages, and retail are the main industries driving demand for innovative and sustainable packaging materials. Germany's high manufacturing capacity and focus on recycling infrastructure further drive market growth. Folding cartons, corrugated boxes, and paper bags are some of the most commonly used products, indicative of the country's efforts to minimize plastic waste. As sustainability continues to be of high concern, the German paper packaging industry is on track for steady growth. July 2024, Germany has released its first 100% paper-packaged chocolate bar, developed through a joint project between Koehler Paper and Nucao. Customers can now purchase chocolate bars and fruit snacks with this innovative green option.

India Paper Packaging Market

India's paper packaging industry is booming with the flourishing e-commerce economy, rising urbanization, and expanding environmental awareness. The surge has been induced by the efforts of the government in promoting greener packaging products along with its bans on the use of single-use plastics. Sectors of food and beverage, pharmaceutical, and retail sectors are propelling the demand for such products as corrugated boxes, paper bags, and folding cartons. India's large consumer market and increasing disposable incomes are further fueling growth in the market. Investment in cutting-edge manufacturing technologies and easy availability of cost-effective raw material make India an important player in the international paper packaging market. The Indian Paper Manufacturers Association finds that paper consumption will grow at 6–7% per annum to reach 30 million tons by FY 2026–2027, primarily fueled by expansion in organized retail and literacy and education orientation.

UAE Paper Packaging Market

The paper packaging market in the UAE is growing at a fast pace, influenced by rising demand for green packaging solutions across sectors like food and beverages, e-commerce, and retail. The country’s focus on reducing plastic waste and promoting eco-friendly practices has spurred the adoption of paper-based packaging materials. Corrugated boxes, paper bags, and folding cartons are widely used across various sectors. The UAE’s strategic location as a trade hub and its growing emphasis on sustainability initiatives further support market growth. As businesses align with environmental goals, the paper packaging market in the UAE is poised for significant development in the coming years.

Paper Packaging Market Segments

Product Type – Market breakup in 5 viewpoints:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

End Use – Market breakup in 8 viewpoints:

- Food & Beverage

- E-Commerce

- Electrical & Electronic

- Home Care

- Personal Care & Cosmetic

- Automotive & Industrial

- Healthcare

- Others

Country – Market breakup in 25 viewpoints:

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- the Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered from 4 Viewpoints:

- Overview

- Recent Development & Strategies

- Product Portfolio & Product Launch in Last 1 Year

- Revenue

Company Analysis:

- Amcor

- DS Smith PLC

- Pactiv Evergreen Inc.

- WestRock Company

- Mondi Group Plc

- Smurfit Kappa

- Mayr-Melnhof Karton AG

- Billerud

- Stora Enso Oyj

- Rengo Co. Ltd.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Product Type, By End Use and By Country |

| Countries Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Global Paper Packaging Market

6. Market Share Analysis

6.1 Product Type

6.2 End Use

6.3 Country

7. Product Type

7.1 Corrugated Boxes

7.2 Folding Boxes and Cases

7.3 Liquid Paperboard Cartons

7.4 Paper Bags and Sacks

7.5 Others

8. End Use

8.1 Food & Beverage

8.2 E-Commerce

8.3 Electrical & Electronic

8.4 Home Care

8.5 Personal Care & Cosmetic

8.6 Automotive & Industrial

8.7 Healthcare

8.8 Others

9. Country

9.1 North America

9.1.1 United States

9.1.2 Canada

9.2 Europe

9.2.1 France

9.2.2 Germany

9.2.3 Italy

9.2.4 Spain

9.2.5 United Kingdom

9.2.6 Belgium

9.2.7 Netherlands

9.2.8 Turkey

9.3 Asia Pacific

9.3.1 China

9.3.2 Japan

9.3.3 India

9.3.4 Australia

9.3.5 South Korea

9.3.6 Thailand

9.3.7 Malaysia

9.3.8 Indonesia

9.3.9 New Zealand

9.4 Latin America

9.4.1 Brazil

9.4.2 Mexico

9.4.3 Argentina

9.5 Middle East & Africa

9.5.1 South Africa

9.5.2 Saudi Arabia

9.5.3 UAE

10. Porter’s Five Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Rivalry

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis Market

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players

12.1 Amcor

12.1.1 Overview

12.1.2 Key persons

12.1.3 Recent Development & Strategies

12.1.4 Product Portfolio & Product Launch in Last 1 Year

12.1.5 Revenue

12.2 DS Smith PLC

12.2.1 Overview

12.2.2 Key persons

12.2.3 Recent Development & Strategies

12.2.4 Product Portfolio & Product Launch in Last 1 Year

12.2.5 Revenue

12.3 Pactiv Evergreen Inc.

12.3.1 Overview

12.3.2 Key persons

12.3.3 Recent Development & Strategies

12.3.4 Product Portfolio & Product Launch in Last 1 Year

12.3.5 Revenue

12.4 WestRock Company

12.4.1 Overview

12.4.2 Key persons

12.4.3 Recent Development & Strategies

12.4.4 Product Portfolio & Product Launch in Last 1 Year

12.4.5 Revenue

12.5 Mondi Group Plc

12.5.1 Overview

12.5.2 Key persons

12.5.3 Recent Development & Strategies

12.5.4 Product Portfolio & Product Launch in Last 1 Year

12.5.5 Revenue

12.6 Smurfit Kappa

12.6.1 Overview

12.6.2 Key persons

12.6.3 Recent Development & Strategies

12.6.4 Product Portfolio & Product Launch in Last 1 Year

12.6.5 Revenue

12.7 Mayr-Melnhof Karton AG

12.7.1 Overview

12.7.2 Key persons

12.7.3 Recent Development & Strategies

12.7.4 Product Portfolio & Product Launch in Last 1 Year

12.7.5 Revenue

12.8 Billerud

12.8.1 Overview

12.8.2 Key persons

12.8.3 Recent Development & Strategies

12.8.4 Product Portfolio & Product Launch in Last 1 Year

12.8.5 Revenue

12.9 Stora Enso Oyj

12.9.1 Overview

12.9.2 Key persons

12.9.3 Recent Development & Strategies

12.9.4 Product Portfolio & Product Launch in Last 1 Year

12.9.5 Revenue

12.10 Rengo Co. Ltd.

12.10.1 Overview

12.10.2 Key persons

12.10.3 Recent Development & Strategies

12.10.4 Product Portfolio & Product Launch in Last 1 Year

12.10.5 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com