Radiofrequency Based Devices Market, Size, Global Forecast 2023-2030, Industry Trends, Growth, Share, Outlook, Impact of Inflation, Opportunity Company Analysis

Buy NowGet Free Customization in This Report

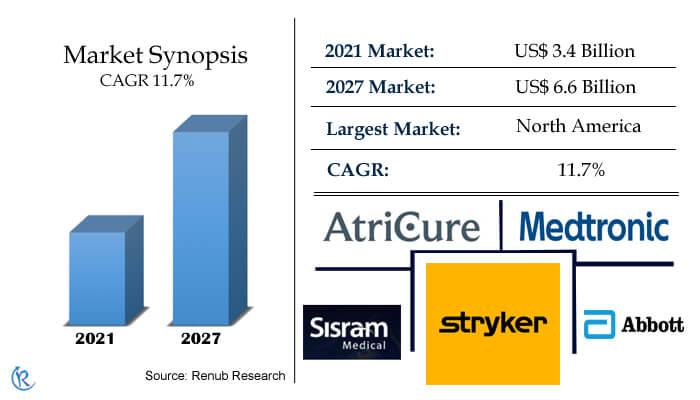

The Global Radiofrequency Based Devices Market is anticipated to reach US$ 6.6 Billion in 2027. Globally, the integration of radiofrequency (RF) waves is one of the technological advancements in treatment delivery whereby RF waves are utilized for heating and killing cells within the patient's body. Remarkably, the RF waves are being used in numerous medical specialties, together with aesthetics. Moreover, the competition in the global radiofrequency-based aesthetic devices market will intensify in the future, owing to new market entrants and patent expiration.

Global Radiofrequency Based Devices Market Size will expand with a double digit CAGR of 11.7% during 2021-2027

The growing geriatric population and increasing focus on enhancing physical appearance are significant factors driving radio-frequency-based devices market growth. Also, radiation treatment is considered crucial in palliative and curative cancer therapy in geriatric patients. In addition, a rising preference for minimally invasive and non-invasive procedures is an essential factor driving demand for radio frequency-based devices for treatment. Radiofrequency therapy aids as an effective option to plastic surgery, with minimal side effects, as well as it carries much less time and is almost painless.

Impact of Covid-19 on Global Radiofrequency-Based Devices Growth Trends

The COVID-19 had negatively affected the global radiofrequency-based devices industry during the initial period of 2020. The outbreak of Covid-19 declared the emergence of healthcare by the World Health Organization (WHO). Similarly, the governments levied nationwide lockdown and a prohibition on flights. In addition, due to the impulsive lockdown, the concerned activities on radiofrequency-based surgeries stopped and were postponed; the market encountered a decline.

However, the latter period of the pandemic demonstrates the significant growth of the market. Moreover, the usage of radio frequency-based devices is expected to increase, and the market will experience the foremost growth. The market shares are anticipated to have their average growth with the ascendance of the year 2021. As per our research findings, the Global Radiofrequency-Based Devices Industry was US$ 3.4 Billion in 2021.

Radiofrequency Generators Segment Accounts for Highest Market Share

The radio frequency-based devices market has been segmented into generators, radiofrequency probes, electrodes, and cannulas based on product. As per our analysis, the radiofrequency generators segment accounts for the highest market share throughout the study period. In the case of pain management, a radiofrequency generator transmits a small magnitude radiofrequency current utilizing insulated needle electrode to numb nerves, which transmit the pain signal to the brain. Similarly, radiofrequency probes will gain market traction during 2021-2027.

Aesthetics Segment Is Expected to Register Fastest Growth Rate

Based on application, the radio frequency-based devices market has been segmented into aesthetics devices, pain management devices, oncology devices, gynaecology devices, cardiology devices, and others. As per our analysis, the pain management segment accounts for the highest market share amongst other application segments within the global radiofrequency-based devices market throughout the study period. Besides, the aesthetics segment is expected to register the fastest growth rate over the forecast period. Wherein, increasing expenditure on cosmetic and aesthetic procedures has propelled the market's growth.

Globally the Hospital is The Most Preferred End-Use Segment

By end-use, the market is segregated into hospitals, ambulatory surgical centers, specialty clinics, and others. The developed infrastructure, high footfall, and increased healthcare expenses have made the hospital the most preferred end-use segment. Moreover, a surge in the volume of incidence of cancer and increasing use of radio frequency-based devices in the field of oncology in hospitals is expected to boost the segment's growth over the forecast period. In addition, the high demand for radiofrequency-based treatment is expanding the number of operating rooms assisting the evolution of the part, correspondingly boosting the growth of the Worldwide Radiofrequency-Based Devices Industry.

Latin America Radiofrequency-Based Devices Market Expects to Register a Significant Robust Growth

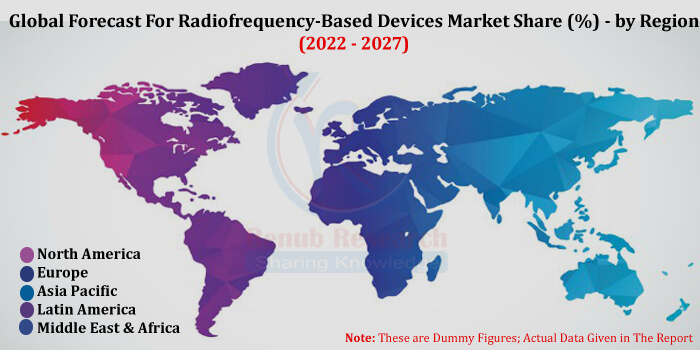

The dominance of the regional market in North America attributes to increasing investment in research and development of advanced radiofrequency devices, rising prevalence of chronic diseases, and increased healthcare expenditure. As per our analysis, the Latin America radiofrequency-based devices market is expected to register significantly robust during the forecast years, owing to a large patient pool suffering from chronic pain and rising demand for cosmetic skin care. Additionally, the growing geriatric population and advancing disposable income drive market expansion.

Competitive Landscape

In November 2020, Abbott Laboratories announced an IonicRF generator for nervous system pain management operating for non-surgical treatment approaches. The device is designed for minimally invasive treatment using radiofrequency ablation to target specific nerves and control pain signals transmitted to the brain.

The global radiofrequency-based devices market is relatively fragmented. The key companies are well-established and initiatives to develop and deploy new and more efficient technologies and products in the radio frequency-based devices market. Some prominent players operating in the radio frequency-based devices market are Abbott Laboratories, ALMA Lasers (Sisram Medical Ltd), AtriCure, Inc., Medtronic plc, Stryker, Conmed Corporation, Smith & Nephew plc, Boston Scientific Corporation, Inc.

Renub Research latest report “Radiofrequency Based Devices Market, Global Forecast By Product (Generators, Radiofrequency Probes, Electrodes and Cannulas), Application (Aesthetics Devices, Pain Management Devices, Oncology Devices, Gynaecology Devices, Cardiology Devices, and Others), End-User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, And Others), Region (North America, Europe, Asia Pacific, Latin America and Middle East Africa), Companies (Abbott Laboratories, ALMA Lasers (Sisram Medical Ltd), AtriCure, Inc., Medtronic plc, Stryker, Conmed Corporation, Smith & Nephew plc, Boston Scientific Corporation, Inc.)” provides a detailed analysis of Radiofrequency-Based Devices Industry.

Product - Breakup Covered from 4 viewpoints:

1. Generators

2. Radiofrequency Probes

3. Electrodes

4. Cannulas

Application - Breakup Covered from 6 viewpoints:

1. Aesthetics Device

2. Pain Management Device

3. Oncology Device

4. Gynecology Device

5. Cardiology Device

6. Others Device

End User - Breakup Covered from 3 viewpoints:

1. Hospital

2. Ambulatory Surgical Centers

3. Specialty Clinics, Others

Region - Breakup Covered from 5 viewpoints:

1. North America

2. Europe

3. Asia Pacific

4. Latin America

5. Middle East Africa

Company Insights:

• Overview

• Recent Development

• Revenue

Key Players:

1. Abbott Laboratories

2. ALMA Lasers (Sisram Medical Ltd)

3. AtriCure, Inc.

4. Medtronic plc

5. Stryker

6. Conmed Corporation

7. Smith & Nephew plc

8. Boston Scientific Corporation, Inc.

Report Details:

| Report Features | Details |

| Base Year | 2021 |

| Historical Period | 2016 - 2021 |

| Forecast Period | 2022-2027 |

| Market | US$ Billion |

| Segment Covered | Product, Application, End User, Region |

| Region Covered | North America, Europe, Asia Pacific, Latin America and Middle East Africa |

| Companies Covered | Abbott Laboratories, ALMA Lasers (Sisram Medical Ltd), AtriCure, Inc., Medtronic plc, Stryker, Conmed Corporation, Smith & Nephew plc, Boston Scientific Corporation, Inc. |

| Customization Scope | 20% Free Customization |

| Post-Sale Analyst Support | 1 Year (52 Weeks) |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Frequent Asked Questions:

- What was the market size of the global radiofrequency-based devices market in 2022?

- Which region is expected to account for maximum market share in the radiofrequency-based devices market during 2022-2027?

- Which is the most lucrative application in radiofrequency-based devices market?

- Which factors are expected to hamper adoption of radiofrequency-based devices?

- How did the ongoing coronavirus (COVID-19) pandemic impact the global radio frequency-based devices market?

1. Introduction

2. Research& Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

4.3 Opportunities

5. Global Radiofrequency-Based Devices Market

6. Market Share – Global Radiofrequency-Based Devices

6.1 By Product

6.2 By Application

6.3 By End User

6.4 By Region

7. Product - Global Radiofrequency-Based Devices Market

7.1 Generators

7.2 Radiofrequency Probes

7.3 Electrodes

7.4 Cannulas

8. Application - Global Radiofrequency-Based Devices Market

8.1 Aesthetics Device

8.2 Pain Management Device

8.3 Oncology Device

8.4 Gynecology Device

8.5 Cardiology Device

8.6 Others Device

9. End User - Global Radiofrequency-Based Devices Market

9.1 Hospital

9.2 Ambulatory Surgical Centers

9.3 Specialty Clinics, Others

10. Region - Global Radiofrequency-Based Devices Market

10.1 North America

10.2 Europe

10.3 Asia Pacific

10.4 Latin America

10.5 Middle East Africa

11. Porters Five Forces

11.1 Overview

11.2 Bargaining Power of Buyers

11.3 Bargaining Power of Suppliers

11.4 Degree of Competition

11.5 Threat of New Entrants

11.6 Threat of Substitutes

12. Key Players

12.1 Abbott Laboratories

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 ALMA Lasers (Sisram Medical Ltd)

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 AtriCure, Inc.

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 Medtronic plc

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 Stryker

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 Conmed Corporation

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

12.7 Smith & Nephew plc

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue

12.8 Boston Scientific Corporation Inc

12.8.1 Overview

12.8.2 Recent Development

12.8.3 Revenue

List Of Figures:

Figure-01: Global Radiofrequency-based Devices Market (Million US$), 2016 – 2021

Figure-02: Forecast for – Global Radiofrequency-based Devices Market (Million US$), 2022 – 2027

Figure-03: Product – Generators Market (Million US$), 2016 – 2021

Figure-04: Product – Forecast for Generators Market (Million US$), 2022 – 2027

Figure-05: Product – Radiofrequency Probs Market (Million US$), 2016 – 2021

Figure-06: Product – Forecast for Radiofrequency Probs Market (Million US$), 2022 – 2027

Figure-07: Product – Electrodes Market (Million US$), 2016 – 2021

Figure-08: Product – Forecast for Electrodes Market (Million US$), 2022 – 2027

Figure-09: Product – Cannulas Market (Million US$), 2016 – 2021

Figure-10: Product – Forecast for Cannulas Market (Million US$), 2022 – 2027

Figure-11: Application – Aesthetics Device Market (Million US$), 2016 – 2021

Figure-12: Application – Forecast for Aesthetics Device Market (Million US$), 2022 – 2027

Figure-13: Application – Pain Management Device Market (Million US$), 2016 – 2021

Figure-14: Application – Forecast for Pain Management Device Market (Million US$), 2022 – 2027

Figure-15: Application – Oncology Device Market (Million US$), 2016 – 2021

Figure-16: Application – Forecast for Oncology Device Market (Million US$), 2022 – 2027

Figure-17: Application – Gynecology Device Market (Million US$), 2016 – 2021

Figure-18: Application – Forecast for Gynecology Device Market (Million US$), 2022 – 2027

Figure-19: Application – Cardiology Device Market (Million US$), 2016 – 2021

Figure-20: Application – Forecast for Cardiology Device Market (Million US$), 2022 – 2027

Figure-21: Application – Others Device Market (Million US$), 2016 – 2021

Figure-22: Application – Forecast for Others Device Market (Million US$), 2022 – 2027

Figure-23: End User – Hospital Market (Million US$), 2016 – 2021

Figure-24: End User – Forecast for Hospital Market (Million US$), 2022 – 2027

Figure-25: End User – Ambulatory Surgical Centers Market (Million US$), 2016 – 2021

Figure-26: End User – Forecast for Ambulatory Surgical Centers Market (Million US$), 2022 – 2027

Figure-27: End User – Specialty Clinics, Others Market (Million US$), 2016 – 2021

Figure-28: End User – Forecast for Specialty Clinics, Others Market (Million US$), 2022 – 2027

Figure-29: North America – Radiofrequency-based Devices Market (Million US$), 2016 – 2021

Figure-30: North America – Forecast for Radiofrequency-based Devices Market (Million US$), 2022 – 2027

Figure-31: Europe – Radiofrequency-based Devices Market (Million US$), 2016 – 2021

Figure-32: Europe – Forecast for Radiofrequency-based Devices Market (Million US$), 2022 – 2027

Figure-33: Asia Pacific – Radiofrequency-based Devices Market (Million US$), 2016 – 2021

Figure-34: Asia Pacific – Forecast for Radiofrequency-based Devices Market (Million US$), 2022 – 2027

Figure-35: Latin America – Radiofrequency-based Devices Market (Million US$), 2016 – 2021

Figure-36: Latin America – Forecast for Radiofrequency-based Devices Market (Million US$), 2022 – 2027

Figure-37: Middle East Africa – Radiofrequency-based Devices Market (Million US$), 2016 – 2021

Figure-38: Middle East Africa – Forecast for Radiofrequency-based Devices Market (Million US$), 2022 – 2027

Figure-39: Abbott Laboratories – Global Revenue (Million US$), 2016 – 2021

Figure-40: Abbott Laboratories – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-41: ALMA Lasers (Sisram Medical Ltd) – Global Revenue (Million US$), 2016 – 2021

Figure-42: ALMA Lasers (Sisram Medical Ltd) – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-43: AtriCure, Inc. – Global Revenue (Million US$), 2016 – 2021

Figure-44: AtriCure, Inc. – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-45: Medtronic plc – Global Revenue (Million US$), 2016 – 2021

Figure-46: Medtronic plc – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-47: Stryker – Global Revenue (Million US$), 2016 – 2021

Figure-48: Stryker – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-49: Conmed Corporation – Global Revenue (Million US$), 2016 – 2021

Figure-50: Conmed Corporation – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-51: Smith & Nephew plc – Global Revenue (Million US$), 2016 – 2021

Figure-52: Smith & Nephew plc – Forecast for Global Revenue (Million US$), 2022 – 2027

Figure-53: Boston Scientific Corporation, Inc. – Global Revenue (Million US$), 2016 – 2021

Figure-54: Boston Scientific Corporation, Inc. – Forecast for Global Revenue (Million US$), 2022 – 2027

List Of Tables:

Table-01: Global – Radiofrequency-based Devices Market Share by Product (Percent), 2016 – 2021

Table-02: Global – Forecast for Radiofrequency-based Devices Market Share by Product (Percent), 2022 – 2027

Table-03: Global – Radiofrequency-based Devices Market Share by Application (Percent), 2016 – 2021

Table-04: Global – Forecast for Radiofrequency-based Devices Market Share by Application (Percent), 2022 – 2027

Table-05: Global – Radiofrequency-based Devices Market Share by End User (Percent), 2016 – 2021

Table-06: Global – Forecast for Radiofrequency-based Devices Market Share by End User (Percent), 2022 – 2027

Table-07: Global – Radiofrequency-based Devices Market Share by Region (Percent), 2016 – 2021

Table-08: Global – Forecast for Radiofrequency-based Devices Market Share by Region (Percent), 2022 – 2027

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com