Russia Tequila Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowRussia Tequila Market Trends & Summary

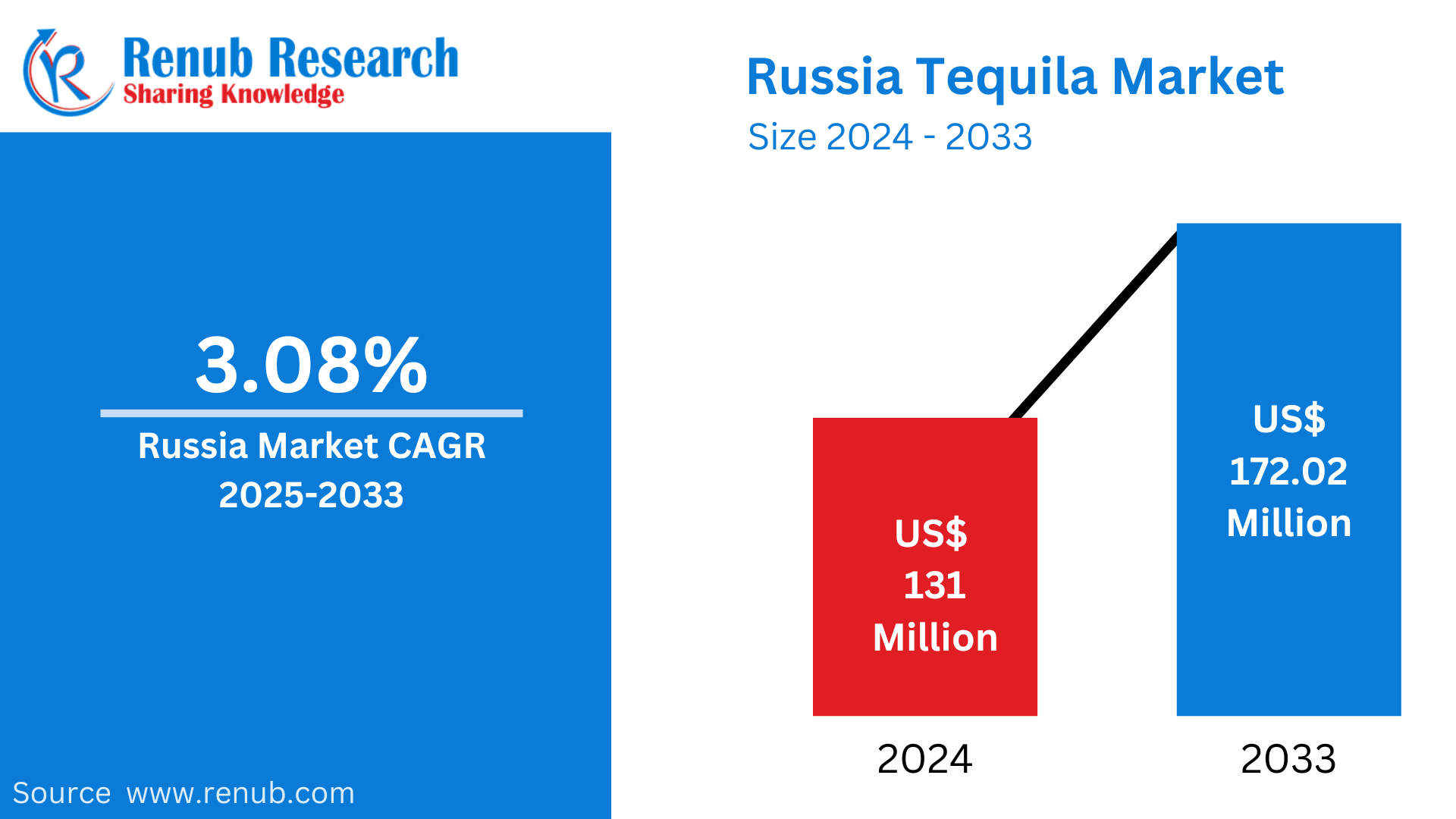

Russia Tequila market is expected to reach US$ 172.02 million by 2033 from US$ 131 million in 2024, with a CAGR of 3.08% from 2025 to 2033. The market is driven by a number of factors, including the growing number of bars, pubs, and restaurants, the popularity of Mexican food and festivals, the legislative and regulatory environment, and a notable move toward premium and ultra-premium alcoholic beverages.

The report Russia Tequila Market Forecast covers by Product Type (Blanco, Joven, Reposado, Anejo, Others), Purity (100% Tequila, 60% Tequila, Other), Price Range (Premium Tequila, Value Tequila, Premium and Super-Premium Tequila, Ultra-Premium Tequila, Other), Distribution Channel (Off-Trade- Supermarkets and Hypermarkets, Discount Stores, Online Stores, Others), (On-Trade- Restaurants and Bars, Liquor Stores, Others), Region (Central District, Volga District, Urals District, Northwestern District, Siberian District, Others) and Company Analysis 2025-2033.

Russia Tequila Industry Overview

Due to rising consumer demand for high-end and foreign spirits, the Russian tequila market has grown steadily in recent years. Although vodka is still the most popular alcoholic beverage in Russia, tequila has made a name for itself, especially among younger, more daring consumers looking for novel experiences. The importation of tequila from Mexico, the spirit's birthplace, is the main source of energy for the industry, with Don Julio, Sauza, and Jose Cuervo dominating the market. The increasing availability of tequila in bars and restaurants, particularly in big cities like Moscow and St. Petersburg, has contributed to its rising appeal.

Russian manufacturers have also started looking into producing tequila-like spirits locally in response to growing demand, but this is made more difficult by legal and regulatory obstacles pertaining to tequila's Denomination of Origin. Despite these obstacles, tequila has been able to acquire traction, particularly in the premium market, thanks to Russian customers' predilection for expensive, well-branded spirits. It is anticipated that the business will keep growing thanks to marketing initiatives that inform consumers about tequila's many uses in cocktails and as an upscale beverage for special events. Tequila appears to have a bright future in Russia's alcoholic beverage business given the country's steadily increasing disposable income and growing inclination for international drinking customs.

The growing desire for quality over quantity has caused a notable change in the Russian market toward premium and ultra-premium alcoholic beverages. Growing disposable earnings and customers' desire for a more upscale lifestyle are major factors driving this trend. The average net-adjusted disposable income per capita for households in the Russian Federation is USD 19,546 annually. The increasing number of working professionals who place a high value on quality and brand reputation supports this trend. In the Russian Federation, around 70% of those between the ages of 15 and 64 work for a living. Once regarded as a specialty item, tequila is currently becoming more and more well-liked as a high-end spirit. Expensive tequila companies are marketing themselves as luxury goods, attracting wealthy customers and connoisseurs looking for exceptional and distinctive drinking experiences. The market for tequila in Russia is being driven by the country's increasing taste for luxury spirits, which is also promoting the importation and distribution of upscale tequila brands.

Growth Drivers for the Russia Tequila Market

Rising Preference for Premium Spirits

Russia's growing inclination for luxury spirits is fueled by expanding disposable income, which enables people to experiment with more expensive alcoholic drinks. Premium drinks like tequila are becoming more popular as Russian consumers become wealthier and prioritize quality over quantity. Those looking for a more upscale drinking experience have been drawn to tequila because of its legacy, workmanship, and distinctive flavors. Younger, more discriminating drinkers who value exclusivity and authenticity in their beverage selections are especially affected by the trend. In Russia's changing alcoholic beverage market, the demand for tequila is further fueled by consumers' increasing willingness to invest in higher-quality drinks, which supports this move toward premium products.

Growing Cocktail Culture

Tequila sales in Russia have increased dramatically as a result of the country's developing cocktail culture, especially thanks to well-liked tequila-based drinks like Tequila Sunrises and Margaritas. To meet the desire for fresh, exciting experiences, bars and restaurants are increasingly including tequila in their cocktail menus as customers get more daring with their drink selections. Because of its many uses in cocktails, tequila is more popular in social settings and appeals to a broad range of consumers, from casual drinkers to cocktail connoisseurs. As cocktail culture has grown in places like Moscow and St. Petersburg, tequila has become popular in upscale dining establishments and lounges in addition to bars. Due to this trend toward inventive and tasty beverages, tequila has become a crucial component of Russia's changing alcoholic beverage landscape.

Expansion of the Hospitality Industry

More options for tequila consumption have been made possible by the growth of the Russian hospitality sector, especially in large cities like Moscow and St. Petersburg. The demand for a wide variety of high-end spirits, including tequila, is rising in tandem with the expansion of bars, eateries, and entertainment facilities. Tequila's growing appeal as a high-end beverage and in cocktails fits in with the hospitality industry's growing selection, which increasingly appeals to customers looking for novel and distinctive drinking experiences. Tequila brands may now more easily reach a larger audience because to the industry's growth, which enables the spirit to flourish in metropolitan areas where social and cultural trends are changing. Tequila's growing popularity in Russia's alcoholic beverage sector is directly a result of this expansion.

Challenges in the Russia Tequila Market

High Import Taxes and Regulations

Russia's tequila business faces major obstacles due to high import fees and stringent laws governing alcoholic beverages. The price of imported tequila may increase as a result of these duties, making it more expensive for customers, especially those in the mid-range and luxury markets. Because of this, a lot of prospective customers might choose less expensive local spirits or well-liked substitutes like vodka, which is frequently less expensive because of fewer taxes and laxer rules. Additionally, these exorbitant expenses restrict the market's capacity to reach a wider audience, particularly among lower-income groups. In Russia's cutthroat alcoholic beverage market, the legislative obstacles pertaining to the importation and sale of alcohol make matters more difficult, impeding market penetration and delaying tequila's growth.

Limited Local Production

One major obstacle to domestic tequila production in Russia is the Denomination of Origin (DO) regulations. Tequila cannot be produced domestically since it needs to be produced in certain areas of Mexico. Because of this, Russia's tequila market is totally dependent on imports, which may cause problems with the supply chain. Potential delays, availability variations, and higher expenses as a result of foreign shipping, customs, and taxes are some of these difficulties. Furthermore, the ability to scale output to meet rising demand or react swiftly to changes in the market is restricted by the reliance on imports. These elements can hamper attempts to expand market penetration in Russia and impact pricing, making tequila less competitive when compared to locally made spirits.

Russia Tequila Market Overview by Regions

By Region, the Russia Tequila market is divided into Central District, Volga District, Urals District, Northwestern District, Siberian District, Others.

Central District Tequila Market

One of the most important regions for the tequila market in Russia is the Central District, which includes Moscow and the surrounding territories. Moscow, the nation's center of culture and commerce, fuels the demand for tequila and other high-end, imported drinks. With a large number of bars, eateries, and nightclubs serving a variety of alcoholic beverages, including cocktails made with tequila, the area has a flourishing hospitality industry. Tequila consumption has increased as a result of this expanding cocktail culture, especially among younger, urban customers. But the Central District also has to contend with issues like high import duties and competition from vodka, which continues to be the most popular alcoholic beverage. Notwithstanding these challenges, the region's tequila market is still expected to grow because to changing customer tastes and a growing food and beverage industry.

Volga District Tequila Market

In Russia, the Volga District, which includes the towns of Kazan and Nizhny Novgorod, has a nascent but expanding tequila market. Although vodka has historically dominated the market, as customer preferences change, there is a growing interest in premium and international spirits, such as tequila. Tequila's gradual rise in popularity is attributed to the growing trend of cocktail culture and foreign drinking customs in urban areas. High import taxes, fierce competition from regional spirits, and restricted distribution in smaller areas are some of the market's obstacles. The Volga District's hospitality sector is expanding, and tequila is progressively finding its way into eateries, particularly in bigger cities. Tequila's prospects for expansion in this area are still bright, despite changing consumer tastes.

Urals District Tequila Market

Russia's tequila market is growing in the Urals District, which includes cities like Yekaterinburg and Chelyabinsk. Although vodka is still the most popular spirit, consumers' tastes are clearly shifting toward high-end, foreign drinks like tequila as a result of shifting drinking patterns and the rise in popularity of cocktail culture. Cocktails made with tequila are increasingly popular in taverns and restaurants in cities. But there are still issues, such limited supply and increased prices because of import taxes, which make tequila harder to get in rural and small communities. Notwithstanding these obstacles, the region's growing number of international restaurants and nightclubs presents tequila with significant prospects. The market for tequila in the Urals has room to grow as the demand for a variety of spirits increases.

Key Questions Answered in Report:

1. How big is the Russia Tequila industry?

The Russia Tequila market size was valued at US$ 131 million in 2024 and is expected to reach US$ 172.02 million in 2033.

2. What is the Russia Tequila growth rate?

The Russia Tequila market is expected to expand at a compound annual growth rate (CAGR) of 3.08% from 2025 to 2033.

3. Who are the key players in Russia Tequila industry?

Some key players operating in the Russia Tequila market includes Jose Cuervo, Patron Spirits Company, Sauza Tequila, Don Julio, EI Jimador, Herradura, 1800 Tequila, Casamigos, Milagro Tequila, Avion Tequila).

4. What are the factors driving the Russia Tequila industry?

The desire for premium spirits, burgeoning cocktail culture, rising disposable income, the growing hospitality sector, and growing consumer awareness of tequila's adaptability are some of the factors propelling the Russian tequila market.

5. What segments are covered in the Russia Tequila Market report?

Product Type, Purity, Price Range, Distribution Channel, and Region segment are covered in this report.

Russia Tequila Market Segments

Product Type

- Blanco

- Joven

- Reposado

- Anejo

- Others

Purity

- 100% Tequila

- 60% Tequila

- Other

Price Range

- Premium Tequila

- Value Tequila

- Premium and Super-Premium Tequila

- Ultra-Premium Tequila

- Other

Distribution Channel

1 Off-Trade

1.1 Supermarkets and Hypermarkets

1.2 Discount Stores

1.3 Online Stores

1.4 Others

2 On-Trade

2.1 Restaurants and Bars

2.2 Liquor Stores

2.3 Others

Region

- Central District

- Volga District

- Urals District

- Northwestern District

- Siberian District

- Others

Key Players Analysis

- Jose Cuervo

- Patron Spirits Company

- Sauza Tequila

- Don Julio

- EI Jimador

- Herradura

- 1800 Tequila

- Casamigos

- Milagro Tequila

- Avion Tequila

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Purity, Price Range, Distribution Channel and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Russia Tequila Market

6. Market Share Analysis

6.1 By Product Type

6.2 By Purity

6.3 By Price Range

6.4 By Distribution Channel

6.5 By Region

7. Product Type

7.1 Blanco

7.2 Joven

7.3 Reposado

7.4 Anejo

7.5 Others

8. Purity

8.1 100% Tequila

8.2 60% Tequila

8.3 Other

9. Price Range

9.1 Premium Tequila

9.2 Value Tequila

9.3 Premium and Super-Premium Tequila

9.4 Ultra-Premium Tequila

9.5 Other

10. Distribution Channel

10.1 Off-Trade

10.1.1 Supermarkets and Hypermarkets

10.1.2 Discount Stores

10.1.3 Online Stores

10.1.4 Others

10.2 On-Trade

10.2.1 Restaurants and Bars

10.2.2 Liquor Stores

10.2.3 Others

11. Region

11.1 Central District

11.2 Volga District

11.3 Urals District

11.4 Northwestern District

11.5 Siberian District

11.6 Others

12. Porter's Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Competition

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1 Strength

13.2 Weakness

13.3 Opportunity

13.4 Threats

14. Key Players Analysis

14.1 Jose Cuervo

14.1.1 Overviews

14.1.2 Key Person

14.1.3 Recent Developments

14.1.4 Revenue

14.2 Patron Spirits Company

14.2.1 Overviews

14.2.2 Key Person

14.2.3 Recent Developments

14.2.4 Revenue

14.3 Sauza Tequila

14.3.1 Overviews

14.3.2 Key Person

14.3.3 Recent Developments

14.3.4 Revenue

14.4 Don Julio

14.4.1 Overviews

14.4.2 Key Person

14.4.3 Recent Developments

14.4.4 Revenue

14.5 EI Jimador

14.5.1 Overviews

14.5.2 Key Person

14.5.3 Recent Developments

14.5.4 Revenue

14.6 Herradura

14.6.1 Overviews

14.6.2 Key Person

14.6.3 Recent Developments

14.6.4 Revenue

14.7 1800 Tequila

14.7.1 Overviews

14.7.2 Key Person

14.7.3 Recent Developments

14.7.4 Revenue

14.8 Casamigos

14.8.1 Overviews

14.8.2 Key Person

14.8.3 Recent Developments

14.8.4 Revenue

14.9 Milagro Tequila

14.9.1 Overviews

14.9.2 Key Person

14.9.3 Recent Developments

14.9.4 Revenue

14.10 Avion Tequila

14.10.1 Overviews

14.10.2 Key Person

14.10.3 Recent Developments

14.10.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com