Saudi Arabia Cinema Market Report Forecast By Revenue (Box Office, Cinema Advertising, Cinema food and drinks), Cinema Format (2D, 3D, 4D, IMAX), Seating Format (VIP/Premium, Standard), End-User (Alone, Spouse (Couple), Family, Friends), Region and Company Analysis (2025-2033)

Buy NowSaudi Arabia Cinema Market Analysis

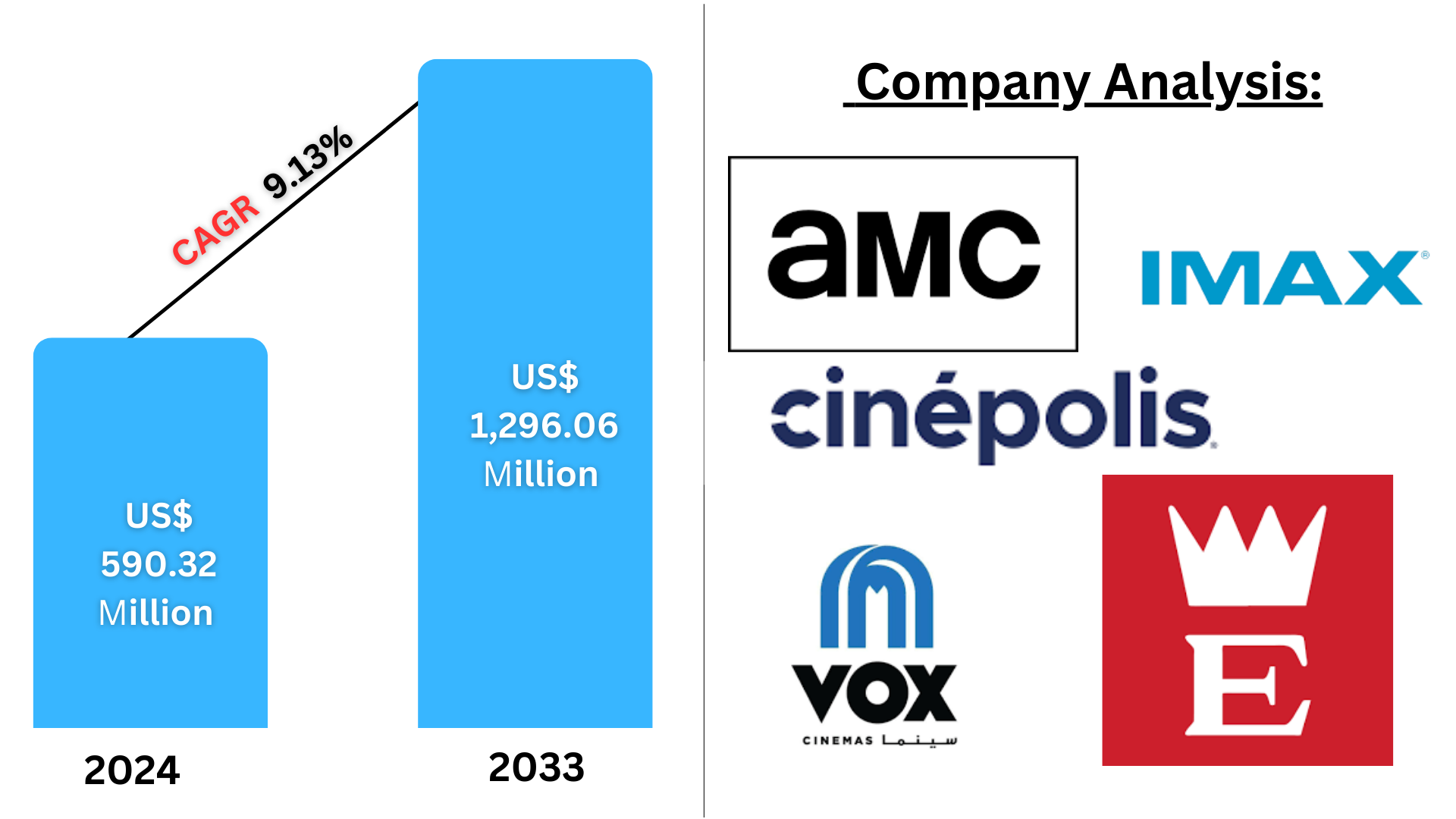

Saudi Arabia Cinema Market will reach US$ 1,296.06 million by 2033, up from US$ 590.32 million in 2024, with a CAGR of 9.13% between 2025 and 2033. A youthful and tech-savvy populace, growing disposable incomes, more government funding for entertainment projects, and solid international alliances are major growth factors for Saudi Arabia's film industry. The market is expanding because to the increased desire for immersive experiences and diversified content, which in turn is creating a thriving local film industry.

Saudi Arabia Cinema Industry Outlooks

In Saudi Arabia, the film industry is booming and has ingrained itself into the national identity. With Vision 2030, the nation is entering a revolutionary stage of social and economic growth with the goal of improving the general well-being of its citizens and diversifying its non-oil sectors. In addition to offering entertainment, the film industry is vital to this effort because it protects and nurtures talent and the nation's legacy. Support is given to regional producers and filmmakers, and their films are screened, which promotes the industry's expansion and opens up new markets for the international sale of Saudi content. This forward-thinking strategy shows Saudi Arabia's dedication to preserving its cultural identity and interacting with the global cinema industry.

The cinema market in Saudi Arabia is expanding due to a number of important causes. When a 35-year ban on movie theaters was lifted in 2017, the area saw tremendous growth and attracted large investments from both domestic and foreign businesses. Demand is higher due to a growing number of young people, wealthier consumers, and the growing appeal of local content. The watching experience is further enhanced by new movie theater complexes and cutting-edge technology, which further solidifies the cinema's place in the Kingdom's social and cultural life.

Growth Driver in the Saudi Arabia Cinema Market

Increasing Entertainment Demand Due to Vision 2030

Saudi Arabia's Vision 2030 reform strategy focuses on diversifying the economy and developing culture, with resulting entertainment infrastructure growth. With cinema bans lifted and government investment in the leisure market, consumer demand for film experiences has grown quickly. Large international cinema groups set up operations, and local developers open high-end cinemas in urban areas. This strategic momentum is turning the experience of watching movies into a mainstream pursuit, particularly among young people and families, making it a critical column of Saudi Arabia's entertainment ecosystem. More than $64 billion has been poured into entertainment in Riyadh since a record-breaking rave was held in November 2022 at an outdoor desert location outside the city. Much of this investment will be in the direction of developing the live music industry.

Rapid Urbanization and Retail Development

Rapid urbanization in cities such as Riyadh, Jeddah, and Dammam is driving demand for mixed entertainment complexes, including cinemas. With the emergence of malls and mixed-use developments across the region, cinema operators are placing theaters strategically within these centers to capture foot traffic. This urbanization, combined with increased disposable incomes, has caused growing demand for new-style cinema experiences, stimulating both the size and number of cinema sites nationwide. By 2030, more than 80% of the Saudi population will be resident in urban communities. By 2040, the Kingdom of Saudi Arabia (KSA) population is predicted to increase by 2.3%, reaching a total of 42 million individuals. This expansion will add further pressure to the already dwindling and limited natural resources. More Partnerships and Investments Foreign cinema chains and domestic investors are entering into joint ventures to develop Saudi Arabia's untapped film market.

Increased Partnerships and Investments

Companies such as AMC, VOX, and MUVI are growing aggressively, introducing cutting-edge technology like IMAX and 4DX into cinemas. Government assistance in facilitating licensing and rewarding investment further supports this momentum. These alliances are speeding up infrastructure growth, increasing service levels, and improving overall cinema-going experiences, assisting the market to expand at a remarkable rate. July 2024- Saudi Arabia's largest cinema exhibitor, Muvi Cinemas, has joined forces with IMAX Corporation to install four new IMAX with Laser systems in key commercial districts. The initial IMAX theatre will be located in Dhahran, and the rest of the systems will be found at Jeddah's Mall of Arabia and two in Riyadh. Three of the facilities are expected to be up and running by the end of 2024, while the fourth facility is to be launched in 2025.

Challenges in the Saudi Arabia Cinema Market

Content Restrictions and Censorship

Content Restrictions and Censorship Even after liberalization, Saudi Arabia maintains strict content rules, restricting the volume of films eligible for screening. Most global releases are held back or modified to fit cultural sensitivities, influencing audience satisfaction and box office returns. The content control poses difficulties for cinema operators in managing varied programming and luring broader audiences. Finding a balance between cultural values and commercial appeal is an ongoing concern for industry stakeholders.

High Operating Expenses and Profitability Issues

Setting up and running cutting-edge cinemas involves high capital investment in a market that is yet to mature. High operating expenses—such as leasing, personnel, and technology—present financial challenges, especially for smaller operators. With growing competition and volatile attendance levels, profitability can be challenging to maintain. Operators need to innovate through pricing, loyalty schemes, and differentiated experiences to maintain their business models in the long term.

Saudi Arabia Box Office Cinema Market

Saudi Arabia's box office market is experiencing explosive growth, fueled by increasing attendance and the growing supply of international blockbusters. After cinema bans were removed in 2018, the market rapidly transformed, reaching significant annual revenue milestones. Young people in cities, families, and expats comprise the bulk of customers, thronging cinemas for holiday and weekend viewing. The most popular film genres are action, animation, and family movies, followed by local content, which is also gaining popularity. Improved marketing, improved seating quality, and food are all contributing to increased ticket sales and retention of audience.

Saudi IMAX Cinema Market

IMAX is emerging as a high-end offering in the Saudi cinema market, with consumers looking for immersive and high-quality visual experiences. VOX Cinemas and AMC, among major players, are increasing IMAX screens in key cities. These cinemas tend to show blockbuster action and science fiction releases that take advantage of the format's higher sound and picture quality. High demand for technological innovation, particularly from younger consumers, is driving growth in this segment. Occupancy rates remain high despite higher ticket prices due to the prestige appeal of the format.

Saudi Arabia VIP/Premium Cinema Market

The Saudi VIP or luxury cinema market is growing fast as customers increasingly look for unique, bespoke entertainment experiences. Premium cinemas have luxurious seating, gourmet restaurants, private lounges, and concierge services. These theaters are located in upscale urban areas and target high-income consumers, corporate clients, and event-hosting markets. The trend is part of a larger luxury lifestyle change observed throughout the Kingdom, particularly in Riyadh and Jeddah. Operators are also combining loyalty programs and membership models to boost customer engagement in this high-margin sector.

Saudi Arabia Standard Cinema Market

The standard cinema market represents the core of the Saudi film exhibition sector, providing budget-priced ticketing and extensive film selection. These cinemas are mainly focused on middle-income households, university students, and general audiences. Situated in malls and residential neighborhoods, mainstream cinemas offer convenience and accessibility, which contribute to building a robust film-going culture. Operators emphasize optimizing operations, upgrading audio-visual quality, and enhancing food and beverage offerings to encourage repeat visits. This segment continues to be crucial in maintaining nationwide box office performance and driving cinema penetration outside of major cities.

Riyadh Cinema Industry

Growing disposable earnings and a youthful, tech-savvy populace are driving Riyadh's cinema sector. The rise of regional film festivals and programs aimed at assisting young people have encouraged innovation and teamwork in the business. Global investments and collaborations with major studios are augmenting the caliber and variety of productions. Future developments will likely emphasize immersive experiences, streaming platforms, and more localized cinema tales. Furthermore, technological developments like virtual reality and improved visual effects are anticipated to influence the film industry and draw viewers from both domestic and foreign markets to Riyadh's developing film scene.

Jeddah Cinema Industry

With an increase in contemporary theaters and a rising demand for a wide selection of films, Jeddah's film industry is changing quickly. Nowadays, a wide range of people are drawn to both local and foreign films, which are becoming more and more popular. A major trend is the emphasis on premium watching experiences, which include plush chairs and cutting-edge technology. In the future, more government funding is anticipated to help the sector by promoting regional film festivals and the production of original material. Future watching possibilities could be shaped by the merging of digital and streaming platforms, providing hybrid experiences to go along with traditional moviegoing.

Saudi Arabia Cinema Company Analysis

The key players in Saudi Arabia cinema industry are AMC, IMAX, Cinépolis, VOX Cinemas and Empire Cinemas.

Saudi Arabia Cinema Company News

July 2024- The largest exhibitor in Saudi Arabia, muvi Cinemas, and IMAX Corporation (NYSE: IMAX) announced their first-ever partnership today. The agreement calls for the installation of four brand-new, cutting-edge IMAX® with Laser systems in some of the nation's most prominent commercial districts. According to the agreement, muvi Cinemas will introduce the first IMAX system to Dhahran, one system to Jeddah's Mall of Arabia, and two to Riyadh, the capital and most populated city of Saudi Arabia. By the end of 2024, three of the four locations should be operational, while another one will follow in 2025.

November 2023- Expanding its footprint in the Kingdom of Saudi Arabia, Empire Cinemas established its first theater in the Madina district. This is the tenth Empire Cinema site in Saudi Arabia, including 10 screens and a 764-seat capacity. It can be found within the Al Rashid Mall.

Revenue– Market breakup in 3 viewpoints:

- Box Office

- Cinema Advertising

- Cinema food and drinks

Cinema Format– Market breakup in 4 viewpoints:

- 2D

- 3D

- 4D

- IMAX

Seating Format– Market breakup in 2 viewpoints:

- VIP/Premium

- Standard

Region– Market breakup in 3 viewpoints:

- Riyadh

- Jeddah

- Others

End-User– Market breakup in 4 viewpoints:

- Alone

- Spouse (Couple)

- Family

- Friends

All the key players have been covered from 3 viewpoints:

- Business Overview

- Key Persons

- Recent Development & Strategies

Key Players Analysis:

- AMC

- IMAX

- Cinépolis

- VOX Cinemas

- Empire Cinemas

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2019 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered | Revenue, Cinema Format, Seating Format, Region and End User |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenge

5. Saudi Arabia Cinema Market

6. Market Share Analysis

6.1 By Revenue

6.2 By Cinema Format

6.3 By Seating Format

6.4 By Region

6.5 By End-User

7. Revenue

7.1 Box Office

7.2 Cinema Advertising

7.3 Cinema food and drinks

8. Cinema Format

8.1 2D

8.2 3D

8.3 4D

8.4 IMAX

9. Seating Format

9.1 VIP/Premium

9.2 Standard

10. Region

10.1 Riyadh

10.2 Jeddah

10.3 Others

11. End-User

11.1 Alone

11.2 Spouse (Couple)

11.3 Family

11.4 Friends

12. Porter’s Five Forces Analysis

12.1 Bargaining Power of Buyers

12.2 Bargaining Power of Suppliers

12.3 Degree of Rivalry

12.4 Threat of New Entrants

12.5 Threat of Substitutes

13. SWOT Analysis

13.1.1 Strength

13.1.2 Weakness

13.1.3 Opportunity

13.1.4 Threat

14. Key Players Analysis

14.1 AMC

14.1.1 Business overview

14.1.2 Key Persons

14.1.3 Recent Development & Strategies

14.2 IMAX

14.2.1 Business overview

14.2.2 Key Persons

14.2.3 Recent Development& Strategies

14.3 Cinépolis

14.3.1 Business overview

14.3.2 Key Persons

14.3.3 Recent Development & Strategies

14.4 VOX Cinemas

14.4.1 Business overview

14.4.2 Key Persons

14.4.3 Recent Development & Strategies

14.5 Empire Cinemas

14.5.1 Business overview

14.5.2 Key Persons

14.5.3 Recent Development & Strategies

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com