Saudi Arabia Contact Lenses Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowSaudi Arabia Contact Lenses Market Trends & Summary

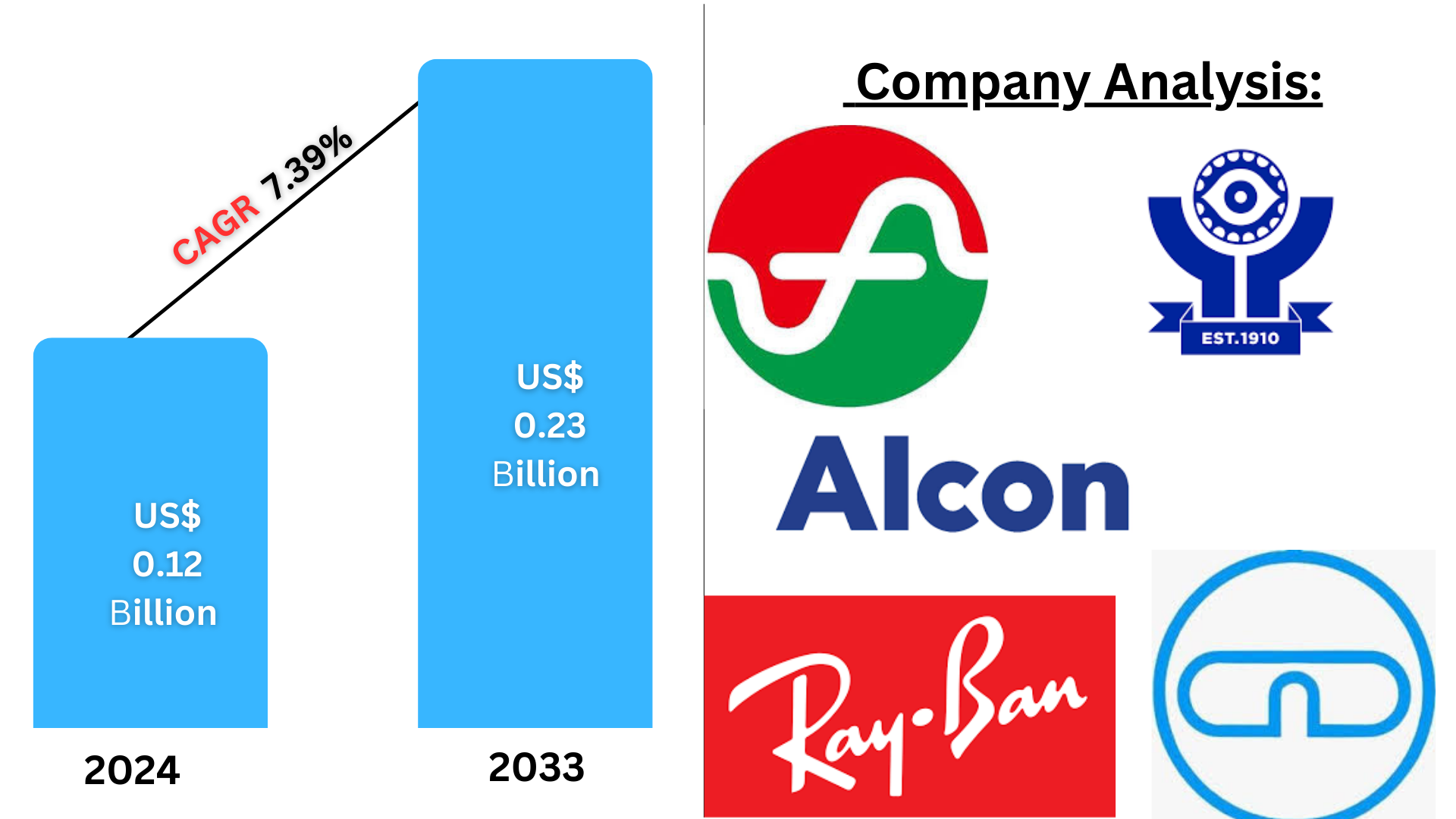

The Saudi Arabia contact lenses market was valued at US$ 0.12 billion in 2024 and reached US$ 0.23 billion by 2032, with a CAGR of 7.39% from 2025 to 2033. This growth is driven by increasing demand for vision correction solutions, rising awareness about eye health, and the popularity of contact lenses over traditional eyewear.

The report Saudi Arabia Contact Lenses Market & Forecast covers by Material (Gas Permeable, Silicone Hydrogel, and Hybrid), Usage (Daily Disposable, Disposable, Frequently Disposable, and Traditional (Reusable) Lenses), Design (Spherical, Toric, and Multifocal), Application (Vision Correction and Cosmetic), Distribution Channel (Online Pharmacy, Retail Pharmacy, and Hospital Pharmacy), Regions and Company Analysis 2025-2033.

Saudi Arabia Contact Lenses Market Outlooks

Contact lenses are thin, curved lenses worn directly on the eye's surface to correct vision or for cosmetic purposes. They are made from soft or rigid gas-permeable materials and are an alternative to eyeglasses, offering benefits such as improved peripheral vision and greater comfort during physical activities. In Saudi Arabia, contact lenses are used primarily to correct refractive errors, including myopia (nearsightedness), hyperopia (farsightedness), astigmatism, and presbyopia (age-related vision issues).

Contact lenses are also used in Saudi Arabia for cosmetic purposes, and colored lenses are commonly used to change the appearance of the eyes. There are also specific lenses, like toric lenses for astigmatism and scleral lenses for irregular corneas. The growing popularity of contact lenses in Saudi Arabia is supported by consumer awareness of eye health rising, higher disposable incomes, and a shift toward more convenient and comfortable vision correction solutions. As technology improves, the contact lens market continues to gain momentum, with both correctable and cosmetic options being ever more accessible.

Saudi Arabia Contact Lenses Market Trends

Growing Awareness of Ophthalmic Care

A study conducted by NCBI indicates that the prevalence of dry eye disease in Saudi Arabia is 17.5%. The contact lens market in the country is gaining a lot of growth due to increased awareness of eye health among the population. This rise in awareness results from several public health initiatives that encourage eye care and provide regular eye examinations. The Saudi authorities' healthcare initiatives, such as Vision 2030, focus on enhancing the health infrastructure and services. With an increasing focus on health awareness, especially in the case of eye health, the contact lens market is likely to be positively affected.

Increased Exposure to Digital Screens and Changing Lifestyle

The contact lens market in Saudi Arabia is experiencing a high growth rate due to increased exposure to digital screens and changing lifestyles. As the GMI editorial stated, digital eye strain is increasingly common, with 99% of the population accessing the internet and spending 7 hours and 9 minutes per day online, including 3 hours and 6 minutes on social media. Thus, the need for an efficient vision correction solution has grown as people rely more on digital devices for work, education, and entertainment. Contact lenses are a flexible and convenient solution, considering the needs of a modern lifestyle. Mobility, fashion, convenience, and aesthetic appeals are some of the major factors driving this trend. Cosmetically, colored contact lenses have become popular in Saudi Arabia, driven by the demands of aesthetics and the ongoing cultural trends. The survey of the Saudi Cosmetic Product Usage Survey in 2024 reported that 40% of women aged 18-35 have used cosmetic lenses at least once. This upward trend, as well as the increasing influence of social media influencers on aesthetic products, opens up considerable market opportunities for companies offering variants of cosmetic lenses.

Technological Advances in Contact Lenses

Advancements in contact lens technology are critical to the expansion of the Saudi Arabian market. For instance, clear hospital-grade contact lenses by MAGRABi, as well as silicone hydrogel lenses, offer considerable comfort and can be worn for an extended period. Their AquaGen™ technology ensures hydration, rounded edges minimize eyelid interaction, and UV protection ensures eye safety. Their development of lens designs, such as multifocal and toric lenses, helps address various vision needs. Augmented reality and health monitoring features will be integrated into the future. This innovation is driving demand and shaping the future of the market.

Growth in the usage of e-commerce

E-commerce drives the contact lens market in Saudi Arabia due to unmatched convenience, accessibility, and variety. The International Trade Administration estimates that the number of internet users in Saudi Arabia who will shop online will increase to 33.6 million by 2024, up 42% from 2019. Online platforms offer a wide range of brands, types, and designs, which is particularly advantageous for those in remote areas. Detailed product descriptions and comparisons allow consumers to make informed choices, while doorstep delivery saves time. Competitive pricing also allows for cost savings through easy price comparisons.

Growing Cosmetic Use of Contact Lenses

The growing demand for cosmetic contact lenses drives the market in Saudi Arabia. Colored lenses allow users to change or enhance eye shade, fitting any style. Contact lenses function in myriad designs, from patterns to cat-eye results, enabling character expression. This variety aligns with fashion tendencies, catering to special occasions or social media influences. The choice of contact lenses over conventional glasses is increasing, driven by convenience and aesthetic enchantment. Contact lenses are easy to pair with sunglasses, contributing to the market boom.

Challenges in the Saudi Arabia Contact Lenses Market

High Costs and Affordability

One of the major challenges in the Saudi Arabia contact lens market is the high cost of contact lenses, especially specialty lenses such as astigmatism or presbyopia. Although basic contact lenses are relatively affordable, the constant need for replacement, eye exams, and specialty lenses can add up. This makes contact lenses an expensive option for some consumers, especially when compared to eyeglasses. Although the market is increasing, cost can be a barrier for it to reach broader audiences, most especially those in the poorer classes or those in the villages where access to cheaper healthcare options is scarce.

Limited Public Awareness and Education

Lack of public awareness of appropriate use and care for the contact lenses is also considered a challenge in Saudi Arabia. Many users are not fully educated on the importance of hygiene, the risk of infections, or the need for periodic replacement. Inappropriate use can include wearing lenses for extended periods or failing to clean them properly, which can result in eye health problems such as infections or discomfort. Education of consumers on the proper use of contact lenses without health risks is still crucial for market growth. Saudi Arabia Contact Lenses Analysis

The north region of Saudi Arabia becomes a potential market for contact lenses

World Data Atlas reveals that the area has a relatively higher population density than other regions, with about 288,921 people. Urbanization is tremendous, with 86.7% of the Northern Borders being urbanized, according to UN-Habitat. The urbanization enables the accessibility of ophthalmologists and retail outlets selling contact lenses, enhancing the access of patrons. Monetary development of the location ensures a large consumer base with increased disposable income, thus increasing affordability. But the new entrants face opposition in the market, which should be kept in mind and highlight the need to understand the competitive landscape for success. Contact lens manufacturers have tremendous potential in these areas, considering only 30% of rural populations have access to proper vision care services. The Saudi government is investing in rural healthcare infrastructure. So far, in 2023, $5 billion has been allocated to improve the medical services in underdeveloped regions. This provides companies with an opportunity to build distribution networks and offer affordable contact lenses to meet the demand.

Saudi Arabia Multifocal Contact Lenses Market

The Saudi Arabia multifocal contact lenses market is growing, driven by the increasing demand for vision correction among the aging population. Multifocal contact lenses are designed to correct presbyopia and provide clear vision at multiple distances without the need for reading glasses. With the aging of the Saudi population, there is a growing demand for these lenses, especially among people above 40 years. Moreover, improvements in lens technology, such as comfort and better visual acuity, are increasing adoption. The market is also experiencing a growing interest in eye health and a preference for contact lenses over eyeglasses.

Saudi Arabia Vision Correction Market Overview

The Saudi Arabia vision correction market is growing significantly, stimulated by the growing incidence of myopia, hyperopia, astigmatism, and presbyopia. This market presents a wide array of choices, ranging from eyeglasses to contact lenses and also refractive surgery like LASIK. Though eyeglasses are more commonly and economically available, contact lens usage is on the rise due to their ease, comfortability, and beauty. The aging population, the growing middle class, and increased awareness of eye health are driving a demand for more sophisticated correction of vision. Specialized contact lenses, including multifocal, toric, and colored lenses, have also created new choices for consumers. Increasingly, refractive surgery, especially LASIK, is being used as an alternative for permanent correction. As of 2024, over 1.5 million people have engaged in government-sponsored vision health programs, which has increased contact lens usage as a substitute for eyeglasses. This demand is further enhanced through partnerships with local clinics to promote vision health and lens care among consumers.

Saudi Arabia Contact Lenses Company Analysis

The Saudi Arabia contact lenses market comprises Alcon, Menicon Co. Ltd, Al-Jamil Optical Co., Yateem Opticians, and Ray-Ban.

In December 2023 - Menicon Co., Ltd. releases two new monthly replacement contact lenses under its exclusive brand: MelsME. The variants, "1MONTH MeniconMelsME" and "1MONTH MeniconMelsMEtoric" are designed to offer additional moisturization and wearing comfort to the users.

Oct 2023 - Alcon launched TOTAL30 for Astigmatism, the first reusable contact lens with Water Gradient material for astigmatic contact lens wearers.

May 2023: EssilorLuxottica and Chalhoub Group formed a joint venture to develop its retail eyewear presence across the GCC region.

Saudi Arabia Contact Lenses Market Segments

Material – Market breakup in 3 viewpoints:

1. Gas Permeable

2. Silicone Hydrogel

3. Hybrid

Usage – Market breakup in 4 viewpoints:

1. Daily Disposable

2. Disposable

3. Frequently Disposable

4. Traditional(Reusable) Lenses

Design – Market breakup in 3 viewpoints:

1. Spherical

2. Toric

3. Multifocal

Application – Market breakup in 2 viewpoints:

1. Vision Correction

2. Cosmetic

Distribution Channel – Market breakup in 3 viewpoints:

1. Online Pharmacy

2. Retail Pharmacy

3. Hospital Pharmacy

Region – Market breakup in 4 viewpoints:

1. Eastern

2. Western

3. Northern & Central

4. Southern

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Alcon

2. Menicon Co. Ltd

3. Al-Jamil Optical Co.

4. Yateem Opticians

5. Ray-Ban

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Material, Usage, Design, Application, Distribution Channel and Region |

| Region Covered | 1. Eastern 2. Western 3. Northern & Central 4. Southern |

| Companies Covered | 1. Alcon 2. Menicon Co. Ltd 3. Al-Jamil Optical Co. 4. Yateem Opticians 5. Ray-Ban |

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Contact Lenses Market

6. Market Share

6.1 By Material

6.2 By Usage

6.3 By Design

6.4 By Application

6.5 By Distribution Channel

6.6 By Region

7. Material

7.1 Gas Permeable

7.2 Silicone Hydrogel

7.3 Hybrid

8. Usage

8.1 Daily Disposable

8.2 Disposable

8.3 Frequently Disposable

8.4 Traditional(Reusable) Lenses

9. Design

9.1 Spherical

9.2 Toric

9.3 Multifocal

10. Application

10.1 Vision Correction

10.2 Cosmetic

11. Distribution Channel

11.1 Online Pharmacy

11.2 Retail Pharmacy

11.3 Hospital Pharmacy

12. Region

12.1 Eastern

12.2 Western

12.3 Northern & Central

12.4 Southern

13. Porter’s Five Forces Analysis

13.1 Bargaining Power of Buyers

13.2 Bargaining Power of Suppliers

13.3 Degree of Rivalry

13.4 Threat of New Entrants

13.5 Threat of Substitutes

14. SWOT Analysis

14.1 Strength

14.2 Weakness

14.3 Opportunity

14.4 Threat

15. Key Players Analysis

15.1 Alcon

15.1.1 Overview

15.1.2 Recent Development

15.1.3 Revenue

15.2 Menicon Co. ltd

15.2.1 Overview

15.2.2 Recent Development

15.2.3 Revenue

15.3 Al-Jamil Optical Co.

15.3.1 Overview

15.3.2 Recent Development

15.4 Yateem Opticians

15.4.1 Overview

15.4.2 Recent Development

15.5 Ray Ban

15.5.1 Overview

15.5.2 Recent Development

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com