Saudi Arabia IVD Market by Test Types (ELISA & CLIA, PCR, Rapid Test, Fluorescence Immunoassays (FIA), In Situ Hybridization, Transcription Mediated Amplification, Sequencing, Colorimetric Immunoassay, Radioimmunoassay (RIA), Isothermal Nucleic Acid Amplification Technology, and Others), Products (Reagents, Instruments, and Services), Application (Immunochemistry, Clinical Chemistry, Hematology, Coagulation, Molecular Diagnostics, Microbiology, and Others), Company Analysis 2025-2033

Buy NowSaudi Arabia IVD market size

This Saudi Arabian in vitro diagnostics market size will be US$ 1.68 billion by 2033. Meanwhile, its share in 2024 stood at US$ 1.15 billion and is poised to grow at a compound annual growth rate of 4.30% from 2025 to 2033. The rise in this market is caused by enhanced investment in healthcare, technological innovations in diagnostic equipment, as well as the demand for earlier disease diagnosis. Expanding infrastructure in healthcare and a shift in more personalized medicine enhance the overall growth of this market within the region.

Saudi Arabia IVD Market Outlook

In vitro diagnostics, also known as IVD, is a medical test carried out on samples obtained from the human body, including blood, urine, or tissue, to diagnose diseases, monitor health conditions, and guide treatment decisions. The tests are performed outside the human body in a laboratory or diagnostic setting. IVD includes a wide range of products, such as reagents, instruments, and consumables, used in testing for infectious diseases, chronic conditions, genetic disorders, and more.

| Report Features | Details |

|

Base Year |

2024 |

|

Forecast Years |

2025 - 2033 |

|

Historical Years |

2020 - 2024 |

|

Market Size in 2024 |

US$ 1.15 Billion |

|

Market Forecast in 2033 |

US$ 1.68 Billion |

|

Market Growth Rate (2025-2033) |

4.30% |

The IVD market in Saudi Arabia is growing rapidly due to increasing healthcare needs and advancements in medical technology. IVD is critical in disease prevention, early detection, and personalized treatment. For example, diagnostic tests for diabetes, cancer, and cardiovascular diseases are commonly used in healthcare facilities nationwide. The Saudi government's investment in healthcare infrastructure and its Vision 2030 plan, which aims to improve healthcare services, is driving the adoption of advanced IVD technologies, ensuring more efficient and accurate diagnostics.

Growth Driver in the Saudi Arabia IVD Market

Increasing Healthcare Investments and Infrastructure Development

Saudi Arabia's ongoing healthcare reforms, driven by its Vision 2030 plan, are a key factor fueling the growth of the in vitro diagnostics (IVD) market. The government has made huge investments in healthcare infrastructure, with new hospitals, diagnostic centers, and research facilities. These expansions have increased the demand for advanced diagnostic technologies, such as IVD devices. As the number of healthcare institutions focused on modern diagnostic solutions grows, the demand for accurate, reliable, and timely IVD testing has increased, which has led to an expansion of the market in the region. Saudi Arabia accounts for 60 percent of the Gulf Cooperation Council (GCC) countries' healthcare expenditure and ranks as a priority in spending for the Saudi Arabian Government. In 2023, it will commit an amount of $50.4 billion to health care and social development - that represents 16.96 percent of its 2023 budget and is the second most-expensive line item in budget after education.

Growing incidence of Chronic Diseases

The rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, and cancer in Saudi Arabia is a strong growth driver for the IVD market. These conditions are constantly monitored and diagnosed at an early stage, which in vitro diagnostics enables. With an aging population and lifestyle-related diseases on the rise, there will be a corresponding increase in the demand for diagnostic tests to manage these conditions. This increase in chronic diseases promotes the use of IVD technologies for screening, early diagnosis, and disease management.

Technological Advancements and Innovation in IVD Products

Advancements in IVD products, including molecular diagnostics, point-of-care testing, and automation, are significantly changing the Saudi Arabian market. The development of more precise, faster, and economical diagnostic tools is expanding the scope of IVD applications. Introduction next generation of sequencing and digital health equipment allows for more accurate as well as personalized diagnostics resulting in better patient care outcome. This further encourages implementation across healthcare settings, boosting this market. In January 2024, Scientific & Medical Equipment House Co. entered the distribution agreement with Haier Germany to market and sell Operating Room equipment in Saudi Arabia. This partnership will enable the company to expand its customer base, as well as the scope of its portfolio of regional medical equipment agencies.

Challenge in Saudi Arabia IVD Market

Regulatory and compliance challenges

A very important hurdle in Saudi Arabia IVD market is regulatory issues. According to this regulatory body in Saudi Arabia, all medical device products are to be pre-approved and registered. However, delays in approvals, stringent regulatory requirements, and the need for compliance with international standards can hinder market growth. Manufacturers must adhere to local and global certifications, which may require additional testing and documentation. These regulatory hurdles can slow the introduction of new products and increase operational costs for IVD companies.

High Cost of Advanced IVD Technologies

The high cost of advanced IVD technologies is a challenge in Saudi Arabia, especially in the public healthcare sector. Private healthcare facilities may have the financial resources to invest in cutting-edge diagnostic tools, but many public hospitals need help with budget constraints. This limits the accessibility of advanced IVD solutions to a broader population. Moreover, the high costs of importing specialized IVD equipment and consumables add to the financial burden. Due to this, there is a requirement for more affordable, locally manufactured IVD products in order to increase market reach and accessibility.

Saudi Arabia ELISA and CLIA Tests Market

ELISA and CLIA tests are well-positioned for growth in the Saudi Arabia IVD market. Due to the increased prevalence of chronic and infectious diseases, there is a growing need for novel diagnostic solutions. Because of their high sensitivity and specificity, these tests are essential for disease detection and monitoring. In addition, the Saudi Arabia IVD market is driven by increased healthcare expenditure, technological advancements, and the development of healthcare infrastructure, which are factors that lead to the adoption of ELISA and CLIA tests.

Saudi Arabia Instrument Offerings IVD Market

The Saudi Arabia IVD market saw an increase in instrument products. Increasing healthcare spending, the rising incidence of chronic diseases, and the growing elderly population drive demand for advanced diagnostic solutions. Instruments, which include immunoassay analyzers, molecular diagnostic units, and point-of-care testing devices, are prominent for their accuracy and performance in ailment detection. Also, government projects to improve healthcare infrastructure and provide early illness analysis contribute to expanding instruments in the Saudi Arabia IVD market.

Saudi Arabia Clinical Chemistry Market

The market is anticipated to enjoy a surge in clinical chemistry. With a developing burden of chronic illnesses like diabetes and cardiovascular issues, demand rises for diagnostic checks to display the patient's health. Clinical chemistry analyzers are pivotal in assessing diverse biomarkers, aiding disorder diagnosis and treatment tracking. Moreover, technological advancements enhance the accuracy and performance of those analyzers, further fueling their adoption in the Saudi Arabia IVD market.

Key Players

Roche Diagnostics, Danaher Corporation, Abbott Laboratories, Thermo Fischer Scientific, Bio–Rad Laboratories, Inc., Sysmex Corporation, Becton, and Biomerieux are active in the Saudi Arabia IVD Market.

April 2023 - Oxford Nanopore Technologies and bioMerieux partner to bring nanopore sequencing to infectious disease diagnostics to help improve global health outcomes.

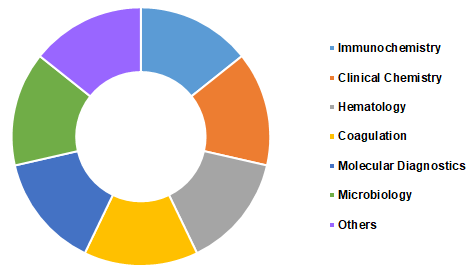

Saudi Arabia In-Vitro Diagnostics (IVD) Market Share, By Application (Percentage)

Note: The chart above shows dummy data and is only for illustration purposes. Please get in touch with us for the actual market size and trends.

Test Types – Market breakup in 11 viewpoints:

1. ELISA & CLIA

2. PCR

3. Rapid Test

4. Fluorescence Immunoassays (FIA)

5. In Situ Hybridization

6. Transcription Mediated Amplification

7. Sequencing

8. Colorimetric Immunoassay

9. Radioimmunoassay (RIA)

10. Isothermal Nucleic Acid Amplification Technology

11. Others

Products – Market breakup in 3 viewpoints:

1. Reagents

2. Instruments

3. Services

Application – Market breakup in 7 viewpoints:

1. Immunochemistry

2. Clinical Chemistry

3. Hematology

4. Coagulation

5. Molecular Diagnostics

6. Microbiology

7. Others

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Roche Diagnostics

2. Danaher Corporation

3. Abbott Laboratories

4. Thermo Fischer Scientific

5. Bio–Rad Laboratories, Inc.

6. Sysmex Corporation

7. Becton

8. Biomerieux

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Test Types, Products, and Application |

| Test Types Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia In-Vitro Diagnostics (IVD) Market

6. Market Share

6.1 By Test Types

6.2 By Products

6.3 By Application

7. Test Types

7.1 ELISA & CLIA

7.2 PCR

7.3 Rapid Test

7.4 Fluorescence Immunoassays (FIA)

7.5 In Situ Hybridization

7.6 Transcription Mediated Amplification

7.7 Sequencing

7.8 Colorimetric Immunoassay

7.9 Radioimmunoassay (RIA)

7.10 Isothermal Nucleic Acid Amplification Technology

7.11 Others

8. Products

8.1 Reagents

8.2 Instruments

8.3 Services

9. Application

9.1 Immunochemistry

9.2 Clinical Chemistry

9.3 Hematology

9.4 Coagulation

9.5 Molecular Diagnostics

9.6 Microbiology

9.7 Others

10. Porter's Five Forces Analysis

10.1 Threat of New Entry

10.2 The Bargaining Power of Buyer

10.3 Threat of Substitution

10.4 The Bargaining Power of Supplier

10.5 Competitive Rivalry

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threat

12. Key Players Analysis

12.1 Roche Diagnostics

12.1.1 Overview

12.1.2 Recent Development

12.1.3 Revenue

12.2 Danaher Corporation

12.2.1 Overview

12.2.2 Recent Development

12.2.3 Revenue

12.3 Abbott Laboratories

12.3.1 Overview

12.3.2 Recent Development

12.3.3 Revenue

12.4 Thermo Fischer Scientific

12.4.1 Overview

12.4.2 Recent Development

12.4.3 Revenue

12.5 Bio–Rad Laboratories, Inc

12.5.1 Overview

12.5.2 Recent Development

12.5.3 Revenue

12.6 Sysmex Corporation

12.6.1 Overview

12.6.2 Recent Development

12.6.3 Revenue

12.7 Becton

12.7.1 Overview

12.7.2 Recent Development

12.7.3 Revenue

12.8 Biomerieux

12.8.1 Overview

12.8.2 Recent Development

12.8.3 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com