Saudi Arabia Milk Powder Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowSaudi Arabia Milk Powder Market Trends & Summary

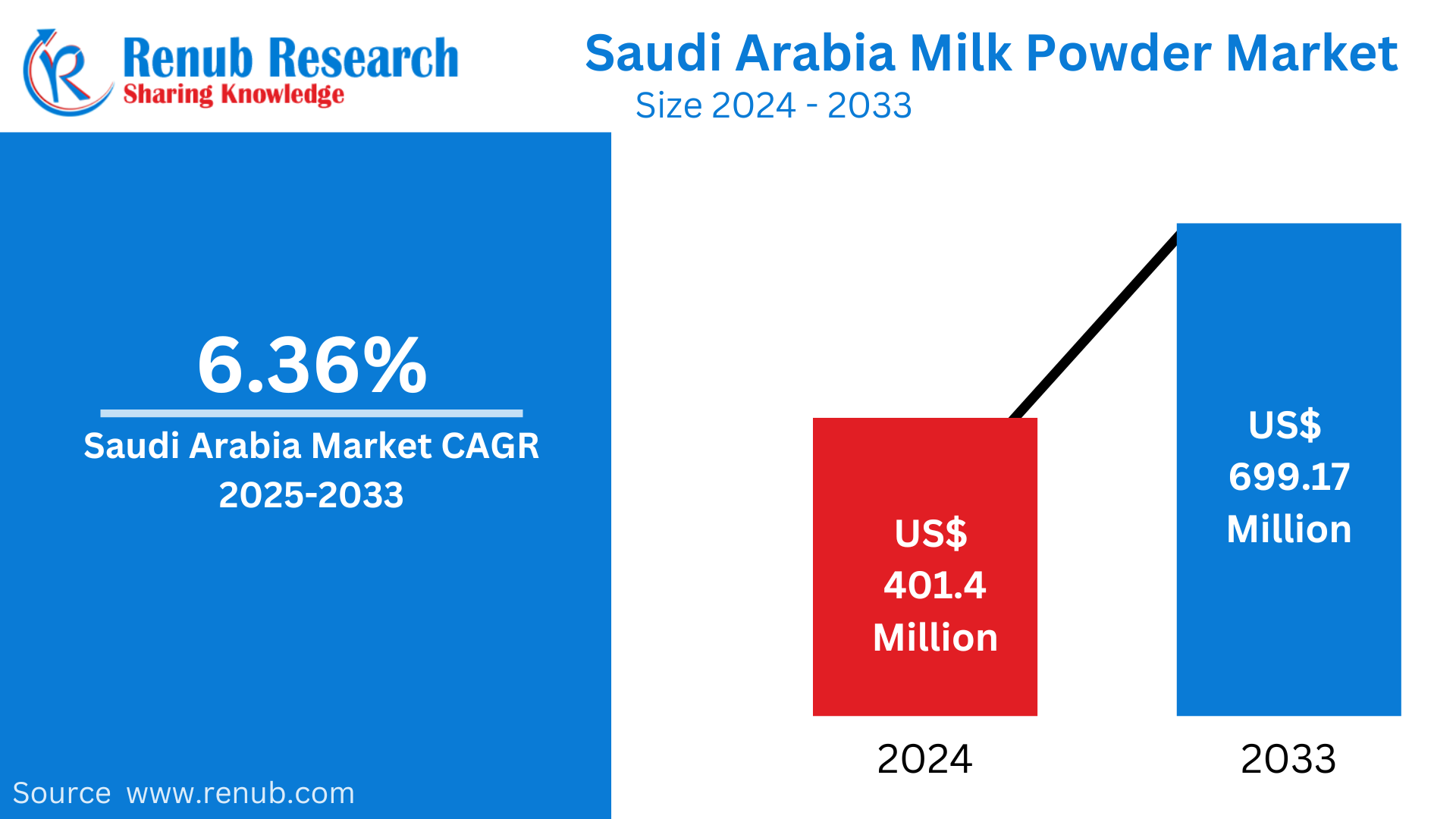

Saudi Arabia Milk Powder market is expected to reach US$ 699.17 million by 2033 from US$ 401.4 million in 2024, with a CAGR of 6.36% from 2025 to 2033. The demand for infant formula, growing retail networks, government assistance for food security, increased health consciousness, changing consumer tastes, and population growth are the main factors propelling the milk powder market in Saudi Arabia.

The report Saudi Arabia Milk Powder Market & Forecast covers by Type (Whole, Skimmed, Dairy Whitener, Buttermilk, Fat-Filled, Other), Application (Nutritional Food, Infant Formulas, Confectionaries, Baked Sweets, Savories) and Company Analysis 2025-2033.

Saudi Arabia Milk Powder Industry Overview

A growing population, growing health consciousness, and developing retail networks are all contributing to the notable rise of the Saudi dried milk market. Due to cultural preferences and the significant number of expatriates, there is a high need for milk powder, particularly infant formula. Food security is being promoted by government measures, especially those under Vision 2030, which stimulate domestic dairy production while ensuring a consistent supply of imported high-quality milk powder. Additionally, the use of milk powder has expanded due to the trend for convenient and long-lasting products. Although there is competition from plant-based substitutes, milk powder is still a common home staple. Milk powder is now more widely accessible to Saudi Arabian consumers thanks to the growth of supermarkets, hypermarkets, and e-commerce platforms.

| Report Features | Details |

|

Base Year |

2024 |

|

Forecast Years |

2025 - 2033 |

|

Historical Years |

2020 - 2024 |

|

Market Size in 2024 |

US$ 401.4 Million |

|

Market Forecast in 2033 |

US$ 699.17 Million |

|

Market Growth Rate (2025-2033) |

6.36% |

Saudi Arabia was the world's 29th largest exporter of dried milk in 2022, with $32.6 million in exports. In the same year, Saudi Arabia's top export was milk powder, which came in at number 212th. Kuwait ($11.5M), Oman ($7.64M), the United Arab Emirates ($7.34M), Bahrain ($3.61M), and Mauritania ($1.3M) are Saudi Arabia's top export destinations for milk powder.

Saudi Arabia's milk powder exports to Kuwait ($7.59M), Oman ($5.5M), and Mauritania ($1.29M) grew at the fastest rates between 2021 and 2022. Bringing in Saudi Arabia became the 17th largest milk powder importer in the world in 2022, bringing in $156 million. In the same year, milk powder ranked as Saudi Arabia's 201st most imported good. The main suppliers of milk powder to Saudi Arabia are the United States ($16.3M), Belgium ($25.6M), Poland ($22.8M), Germany ($21M), and New Zealand ($20.2M).

Growth Drivers for the Saudi Arabia Milk Powder Market

Expansion of Retail Networks

One major factor propelling the growth of the Saudi Arabian milk powder market is the expansion of retail networks, which include supermarkets, hypermarkets, and e-commerce platforms. Milk powder products are becoming more widely available to a wider range of consumers, including those in both urban and rural areas, as contemporary retail outlets multiply. To accommodate a range of consumer preferences, supermarkets and hypermarkets provide more shelf space for different milk powder brands and formats. By offering customers the ease of online ordering, home delivery, and a greater selection of products, e-commerce platforms further improve accessibility. In a nation where the public is becoming more tech-savvy, this accessibility is essential. Furthermore, by increasing brand visibility, these enlarged retail networks enable businesses to reach a wider audience and increase sales across a range of demographic groups.

Growing Infant Formula Demand

A major factor driving the Saudi Arabian milk powder market's expansion is the strong demand for baby formula, which is mostly driven by both domestic births and the country's sizable expat population. Due to cultural choices, medical advice, and a growing tendency toward convenience in childrearing, infant formula is commonly used in Saudi Arabia. This demand is further increased by the large number of expatriates, especially from nations with high birth rates. Because infant formula contains vital vitamins, minerals, and proteins for a baby's development, many parents—both domestic and foreign—rely on it. The milk powder segment is a vital market category in Saudi Arabia due to the country's rising reliance on formula and growing awareness of its significance for newborn health.

Increasing Government Initiatives

Initiatives for food security and Saudi Arabia's Vision 2030 are key factors propelling the market for milk powder. Vision 2030 places a strong emphasis on diversifying the economy, lowering the nation's dependency on food imports, and promoting the growth of indigenous dairy and agricultural output. As a result, more money is being invested in regional dairy farms, infrastructure, and technology to improve the quantity and quality of milk produced. In order to meet consumer demand and guarantee a steady supply, the government also keeps encouraging the importation of premium milk powder. Enhancing food security, maintaining price stability, and guaranteeing the supply of necessary dairy goods, such as milk powder, are the goals of these programs. This supports market expansion and consumer access by strengthening both domestic production and imports of milk powder.

Challenges in the Saudi Arabia Dried Milk Market

Competition from Local and International Brands:

Both domestic and foreign brands are fighting for market share in the Saudi Arabian milk powder industry, which is highly competitive. Local dairy producers can provide goods that are suited to local tastes and needs since they have earned consumer trust and an awareness of regional preferences. International brands, on the other hand, frequently benefit from worldwide experience, cutting-edge technology, and more robust financial resources, which allow them to provide premium, inventive goods at affordable costs. Producers are always innovating and differentiating their offers through marketing techniques, packaging, and product quality as a result of this rivalry. To keep a competitive edge in the congested market, businesses are responding by launching value-added items like organic alternatives, fortified milk powders, and customized formulations for babies and health-conscious consumers.

Health and Dietary Shifts

The market for traditional milk powder is facing a major challenge as plant-based diets are becoming increasingly popular in Saudi Arabia due to rising health and wellness consciousness. Concerns about lactose intolerance, cholesterol, and environmental sustainability are driving consumers to look for alternatives including almond, soy, oat, and coconut milk. A rising number of health-conscious people are drawn to these plant-based products since they are frequently promoted as healthier, lower-calorie alternatives. The market for traditional dairy-based powders is therefore declining, which is bad news for milk powder manufacturers. Many businesses are engaging in marketing techniques to highlight the nutritional advantages of dairy products and are looking into ways to expand their offers, such as releasing lactose-free or fortified milk powders, in order to stay competitive.

Whole milk powder remains popular due to versatility and consumer preference

Whole milk powder could remain considerable in the Saudi Arabia milk powder market. This is because of its versatility and dietary value. It is a handy dairy alternative for numerous culinary applications, including baking, cooking, and making drinks. Further, whole milk powder's longer shelf life and ease of storage make it an attractive choice for clients seeking convenient dairy solutions. Its wealthy flavor and creamy texture contribute to its reputation, solidifying its function as a central section of the milk powder market.

The market for milk powder in Saudi Arabia may see infant formula take the lead

Infant formula might hold a dominant position in the Saudi Arabia milk powder market. This is due to its essential role in infant nutrients. With a developing population and increasing urbanization, more moms are joining the workforce, leading to a higher demand for convenient infant feeding solutions. Infant formulation presents a reliable source of vital nutrients for toddlers, ensuring proper increase and development. Moreover, stringent guidelines and amicable standards instill acceptance among consumers, bolstering infant formula's popularity as a dependent preference for infant nutrition in the Saudi Arabian market.

Type – Milk Powder Market breakup in 6 viewpoints:

1. Whole

2. Skimmed

3. Dairy Whitener

4. Buttermilk

5. Fat-Filled

6. Other

Application – Market breakup in 6 viewpoints:

1. Nutritional Food

2. Infant Formulas

3. Confectionaries

4. Baked Sweets

5. Savories

6. Others

All the Key players have been covered from 3 Viewpoints:

• Overview

• Recent Development

• Revenue Analysis

Company Analysis:

1. Almarai Company

2. Rabouh Al Hofuf Est.

3. M.M.Siddique Abdullah Trading Est.

4. Gulf Dimensions Trading Est.

5. AL-Juffaily for Trading

6. Shatha Abeer Ltd.

7. Riyadh Dairy Products Factory

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Million |

| Segment Covered |

Type and Application |

| Type Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Milk Powder Market

6. Market Share

6.1 By Types

6.2 By Application

7. Types

7.1 Whole Milk Powder

7.2 Skimmed Milk Powder

7.3 Dairy Whitener Powder

7.4 Buttermilk Powder

7.5 Fat-Filled Milk Powder

7.6 Other Milk Powder

8. Application

8.1 Nutritional Food

8.2 Infant Formulas

8.3 Confectionaries

8.4 Baked Sweets

8.5 Savories

8.6 Others

9. Value Chain Analysis

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Almarai Company

12.1.1 Overview

12.1.2 Recent Development

12.2 Rabouh Al Hofuf Est.

12.2.1 Overview

12.2.2 Recent Development

12.3 M.M.Siddique Abdullah Trading Est.

12.3.1 Overview

12.3.2 Recent Development

12.4 Gulf Dimensions Trading Est

12.4.1 Overview

12.4.2 Recent Development

12.5 AL-Juffaily for Trading

12.5.1 Overview

12.5.2 Recent Development

12.6 Shatha Abeer Ltd

12.6.1 Overview

12.6.2 Recent Development

12.7 Riyadh Dairy Products Factory

12.7.1 Overview

12.7.2 Recent Development

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com