Saudi Arabia Poultry Meat Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowSaudi Arabia Poultry Meat Market Trends & Summary

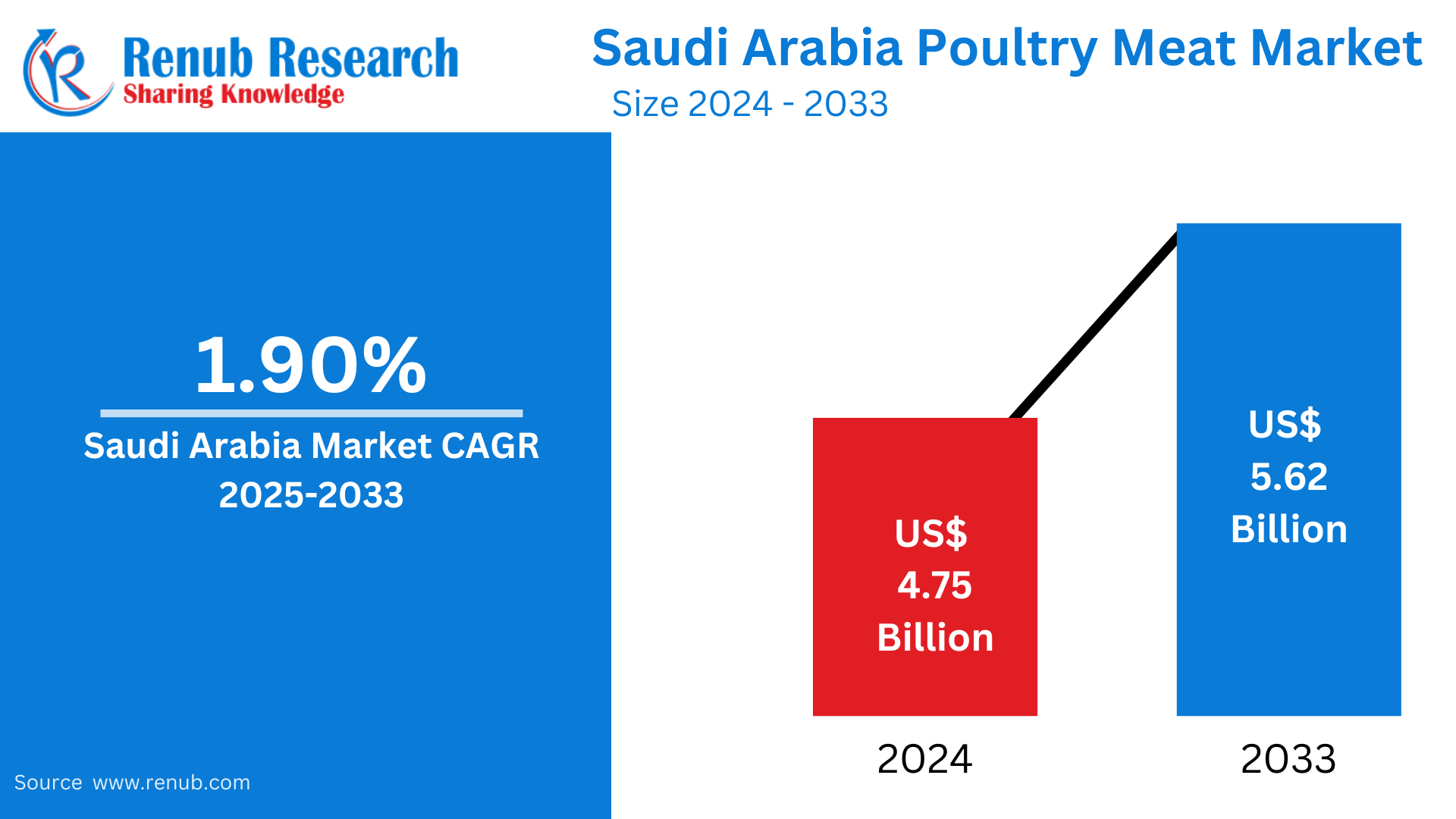

Saudi Arabia Poultry Meat market is expected to reach US$ 5.62 billion by 2033 from US$ 4.75 billion in 2024, with a CAGR of 1.90% from 2025 to 2033. Urbanization, rising disposable incomes, changing consumer preferences toward convenience, improved food processing capabilities, government programs for food security, and rising demand for reasonably priced, high-quality, halal-certified poultry products are all factors driving the Saudi poultry meat industry.

Saudi Arabia Poultry Meat Market Report by Type (Chicken, Turkey, Duck, Other), Form (Canned, Fresh / Chilled, Frozen, Processed- Deli Meats, Marinated/ Tenders, Meatballs, Nuggets, Sausages, Other Processed Poultry), Distribution Channel (Convenience Stores, Online Channel, Supermarkets and Hypermarkets, Others) and Company Analysis 2025-2033

Saudi Arabia Poultry Meat Industry Overview

A growing population and rising demand for easy and reasonably priced protein sources have made Saudi Arabia's chicken meat business a key component of the nation's food economy. Saudi Arabia is the Gulf Cooperation Council's (GCC) biggest buyer of poultry, and its market is growing quickly. Because poultry meat is less expensive than red meat, people are choosing it more frequently as a result of urbanization and growing discretionary incomes. In addition, urban populations' hectic lives and the expanding retail and restaurant industries have increased demand for processed and ready-to-eat poultry products. Recent years have seen a sharp rise in domestic output, which has improved food security and decreased the nation's dependency on imports.

Through programs designed to increase local output and enhance the sector's overall sustainability, the Saudi government has been instrumental in assisting the chicken meat business. Local producers are now able to meet the growing demand thanks to investments in cutting-edge technology, processing facilities, and contemporary poultry farms. Furthermore, the prevalence of halal-certified goods guarantees that the chicken meat sector stays in line with the cultural and religious inclinations of the vast majority of Muslims. The sector is anticipated to keep growing as consumer awareness of food safety and quality rises, with advancements in production methods, packaging, and distribution networks further improving accessibility and product selection nationwide.

Approximately 71% of the Middle East's poultry production in 2022 came from Saudi Arabia, making it the region's leading producer of poultry meat. Between 2017 and 2022, the production of poultry meat increased by 73.85%. In 2022, 68% of Saudi Arabia's chicken meat was produced domestically, up from 45% in 2016.Over the last five years, the mortality rate of chicken meat has decreased by about 8%, which has increased the production rate in Saudi Arabian poultry farms. There are now more chicken farms nationwide as a result of government assistance for production, interest-free loans, and equipment refunds that have lowered overall production costs. Many foreign manufacturers are investing in the nation as a result of these causes. Many foreign manufacturers are investing in the nation as a result of these causes.

For example, a new memorandum of agreement between MHP SE of Ukraine and the local poultry enterprise Tanmiah Food enterprise in 2022 presented the possibility of increasing the share of domestic chicken production in the Kingdom's total consumption. In a similar vein, BRF, a Brazilian company, established a new joint venture in Saudi Arabia in 2023 through one of its subsidiaries in order to fulfill the country's goal of producing halal chicken. The efforts of the Saudi Food and Drug Authority (SFDA) and the Saudi Ministry of Environment, Water, and Agriculture (MEWA) are expected to boost the production of poultry meat. The ministry wants to offer up to USD 187 million in incentives per year.

The government encourages foreign businesses to participate in poultry farms with 100% local farm ownership under Vision 2030. Production is predicted to rise by 80% in 2025 and 100% in 2030 as a result of this action. To encourage domestic production, the Saudi Food and Drug Authority limits the import and export of poultry meat.

Growth Drivers for the Saudi Arabia Poultry Meat Market

Government Support and Food Security

The Saudi government has made a concerted effort to improve food security and lessen the reliance on imported poultry meat. As a result, substantial investments have been made in domestic chicken farming, with programs aimed at increasing production capacity and enhancing infrastructure. Through funding, research, and the adoption of contemporary technologies in chicken farming, the government has supported sustainable agricultural methods. Modernized processing facilities guarantee that the sector can satisfy rising demand while upholding high standards of quality. In addition to increasing local production, these initiatives have stabilized pricing, guaranteeing a steady supply of poultry products that promote economic growth and food security.

Halal Certification and Cultural Alignment

Halal certification is necessary in Saudi Arabia to satisfy the dietary needs of the country's predominately Muslim populace. Therefore, when it comes to slaughter and processing, the chicken meat sector must follow stringent Islamic requirements. Customers now consider halal-certified poultry to be essential, which fuels demand and guarantees steady market expansion. Long-term prosperity depends on producers meeting these standards because they gain the trust of consumers. The poultry market's conformity to cultural and religious customs supports both domestic and export prospects by fostering strong customer loyalty and enabling producers to capitalize on the rising demand for halal goods in both home and foreign markets.

Expanding Retail and Foodservice Sectors

Poultry products are now more widely available and accessible in Saudi Arabia thanks in large part to the country's fast-food chains, supermarkets, and hypermarkets' explosive growth. From fresh cuts to processed and ready-to-eat products, these retail locations give customers easy access to a variety of chicken products. The demand for chicken keeps growing as the foodservice industry expands as well, with more cafes, restaurants, and food delivery services opening up. In addition to increasing the market for poultry meat, these advancements in the retail and foodservice sectors give producers additional chances to broaden their customer base and vary their product lines.

Challenges in the Saudi Arabia Poultry Meat Market

Competition and Market Saturation

As more manufacturers enter the market to satisfy the growing demand for chicken products, the market is becoming more competitive as a result of Saudi Arabia's local poultry industry expanding quickly. Price wars among producers result from this overstock, which pushes profit margins lower even while it helps guarantee product availability. To stand out in a crowded market, producers must compete on quality, price, and innovation—all of which can be difficult for smaller firms. Competition is further heightened by the surge of foreign poultry imports, especially from nations with cheaper production costs. Because cheaper imported goods may appeal to price-conscious consumers, these imports have the potential to reduce the market share of domestic producers and make it more difficult for local companies to compete.

Consumer Preferences for Healthier Options

Food tastes are shifting toward healthier options as Saudi Arabian consumers become more aware of their nutritional choices due to the country's growing health consciousness. In an attempt to enhance their health, many customers are switching to plant-based substitutes or leaner meats, which includes consuming less red meat and poultry. The poultry business faces a difficulty as a result of this shift in consumer behavior since it may restrict long-term growth if traditional poultry products become less popular. fowl producers must adjust to the changing dietary demands of health-conscious consumers by providing healthier product options, such as organic or lower-fat fowl, or even looking into diversifying into other protein sources in order to stay competitive.

In order to offset the increase in production costs, poultry prices increased.

In Saudi Arabia, the cost of poultry meat rose 7.84% between 2017 and 2022. In Saudi Arabia, one of the most popular animal proteins is poultry meat. Prices rose to USD 3,426 per ton in 2022, mostly as a result of a greater reliance on poultry feed imported from France and Brazil. Three large companies and seven medium-sized companies currently generate over 80% of the poultry meat. A third of local production comes from National Company, the largest meat producer in the area, which is followed by Fakeeh and Almarai.

A 1,000-gram chicken now costs about USD 4 instead of USD 3.8 after national poultry companies raised the price of their products by USD 0.1 per chicken in January 2022. Along with the increase in gasoline prices after Saudi Aramco decided to raise the price of diesel by 21%, making a liter cost about USD 16.7 instead of USD 13.80, the high cost of manufacturing is listed as one of the primary reasons for the decision to hike prices.

Saudi Arabia Poultry Meat Industry Segments

Type

• Chicken

• Turkey

• Duck

• Other

Form

• Canned

• Fresh / Chilled

• Frozen

• Processed

1. Deli Meats

2. Marinated/ Tenders

3. Meatballs

4. Nuggets

5. Sausages

6. Other Processed Poultry

Distribution Channel

• Convenience Stores

• Online Channel

• Supermarkets and Hypermarkets

• Others

All the Key players have been covered from 4 Viewpoints

• Overview

• Key Persons

• Recent Development

• Revenue

Key Players Analysis

1. Al-Watania Poultry

2. Almarai Food Company

3. Almunajem Foods

4. Americana Group

5. BRF S.A.

6. Golden Chicken Farm Factory Company CJSC

7. Sunbulah Group

8. Tanmiah Food Company

9. The Savola Group

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Type, By Form and By Distribution Channel |

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the projected size of the Saudi Arabia Poultry Meat market by 2033?

-

What is the compound annual growth rate (CAGR) for the Saudi Poultry Meat market from 2025 to 2033?

-

Which segment of poultry meat is most prominent in Saudi Arabia: chicken, turkey, or duck?

-

What are the main factors driving the growth of the Saudi Poultry Meat market?

-

How does the Saudi government support the poultry meat industry?

-

What is the significance of halal certification in the Saudi Poultry Meat market?

-

How much of Saudi Arabia's poultry production was domestic in 2022?

-

Which foreign companies have invested in the Saudi poultry meat industry recently?

-

What challenges does the Saudi poultry industry face in terms of competition?

-

Which distribution channels are most prominent for poultry meat in Saudi Arabia?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Poultry Meat Market

6. Market Share Analysis

6.1 By Type

6.2 By Form

6.3 By Distribution Channel

7. Type

7.1 Chicken

7.2 Turkey

7.3 Duck

7.4 Other

8. Form

8.1 Canned

8.2 Fresh / Chilled

8.3 Frozen

8.4 Processed

8.4.1 Deli Meats

8.4.2 Marinated/ Tenders

8.4.3 Meatballs

8.4.4 Nuggets

8.4.5 Sausages

8.4.6 Other Processed Poultry

9. Distribution Channel

9.1 Convenience Stores

9.2 Online Channel

9.3 Supermarkets and Hypermarkets

9.4 Others

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Al-Watania Poultry

12.1.1 Overviews

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 Almarai Food Company

12.2.1 Overviews

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Almunajem Foods

12.3.1 Overviews

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Americana Group

12.4.1 Overviews

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 BRF S.A.

12.5.1 Overviews

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Golden Chicken Farm Factory Company CJSC

12.6.1 Overviews

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Sunbulah Group

12.7.1 Overviews

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Tanmiah Food Company

12.8.1 Overviews

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 The Savola Group

12.9.1 Overviews

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com