Saudi Arabia Seafood Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowSaudi Arabia Seafood Market Trends & Summary

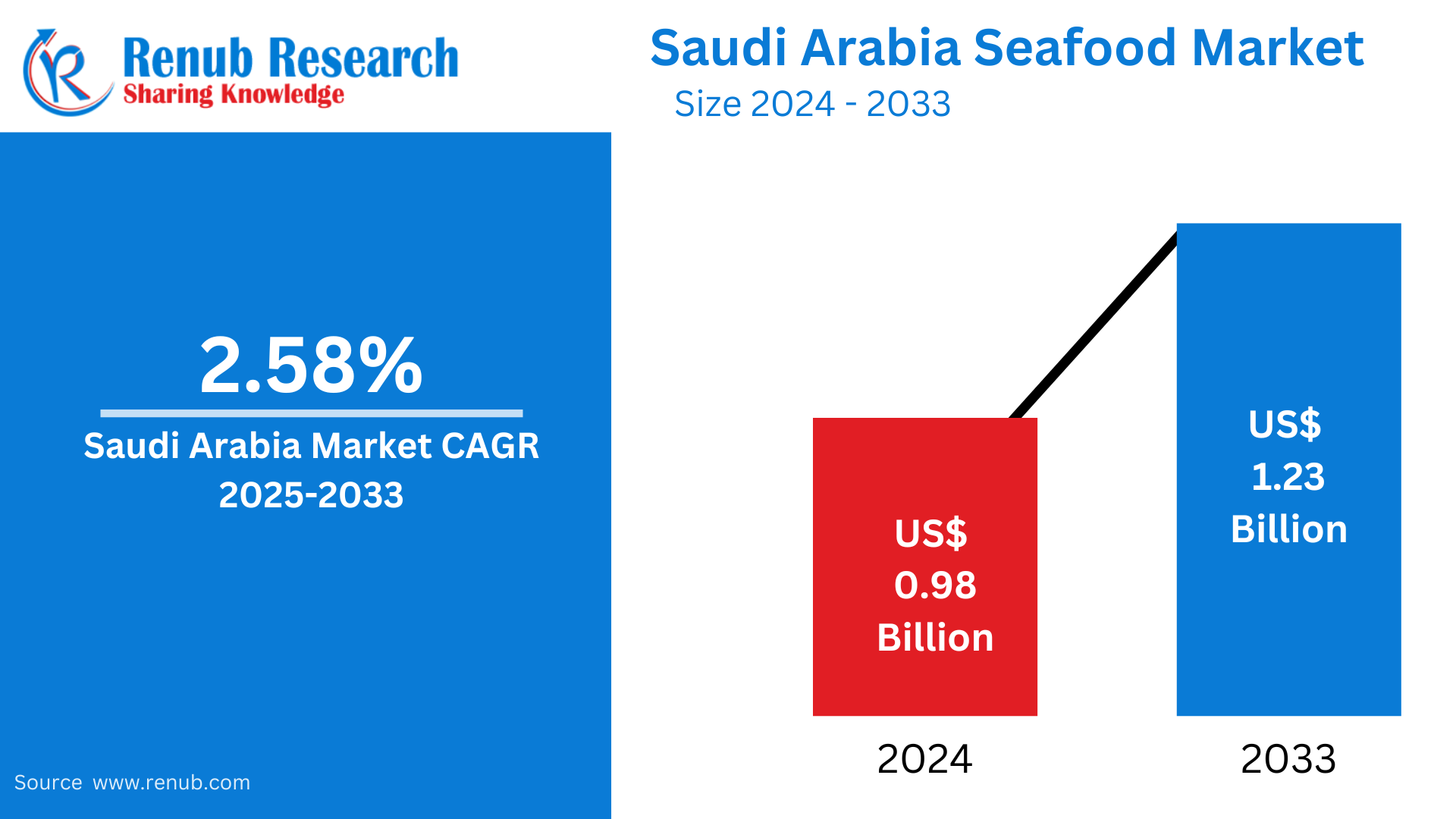

Saudi Arabia Seafood market is expected to reach US$ 1.23 billion by 2033 from US$ 0.98 billion in 2024, with a CAGR of 2.58% from 2025 to 2033. Some of the major reasons propelling the market's growth include growing consumer health consciousness, government programs encouraging seafood consumption, expanded retention channels, and notable technological advancements in aquaculture.

Saudi Arabia Seafood Market Report by Type (Fish, Shrimp, Crab, Lobster, Others), Form (Canned, Fresh / Chilled, Frozen, Processed), Distribution Channel (Supermarket/Hypermarket, Departmental Stores, Specialized Stores, Institution Sales, Food Service, Online, Others), Region (Western Region, Northern & Central Region, Eastern Region, Southern Region) and Company Analysis 2025-2033

Saudi Arabia Seafood Industry Overview

Saudi Arabia's seafood market is expanding significantly due to growing customer demand for sustainable and healthful protein sources. More people are looking for meat substitutes and turning to seafood because of its nutritional advantages as the population rises and health consciousness rises. Consumption of fish and shellfish has increased because of their high omega-3 fatty acid, vitamin, and mineral content. The seafood industry has also grown more quickly as a result of government efforts to diversify the economy away from oil and to encourage sustainable fishing methods. The advancement of aquaculture technologies has supplemented this, increasing the sustainability and economic viability of local seafood production.

To establish itself as a significant player in the world fish market, the nation is also concentrating on growing its seafood exports. Saudi Arabia may satisfy demand from both domestic and foreign markets by growing its infrastructure for seafood processing and distribution. In order to ensure the long-term sustainability of seafood production, the Kingdom is looking into ways to expand the aquaculture industry as part of its Vision 2030 project. Furthermore, as tourists from abroad look for genuine regional cuisine, the expanding tourism industry is increasing demand for premium seafood items. Saudi Arabia is well-positioned to meet the changing preferences and demands of its citizens while emerging as a major exporter in the global seafood market because to investments made in the sector and the infrastructure that surrounds it.

Government initiatives and growing domestic production capabilities are driving a dramatic transition in the Saudi seafood market. In 2022, the nation produced 399.5 million metric tons of seafood domestically, a significant increase of 15 million metric tons over 2018. With the goal of producing 600,000 tons by 2030, the government's Vision 2030 plan has set high goals for the Saudi Arabian aquaculture industry. Modern aquaculture technologies and sustainable fishing methods have seen large investments as a result of this strategic focus. To modernize the industry and improve production capacity, the National Fisheries Development Program (NFDP) is actively seeking USD 4 billion in investments.

With a per capita intake of 7.34 kg of fish in 2022, Saudi Arabian consumer tastes and consumption patterns are changing. Fresh seafood is becoming more and more popular; in 2022, fresh and chilled seafood will account for 57.5% of the market share by value. Consumption patterns are greatly influenced by price dynamics. In 2022, shrimp costs were relatively stable at USD 3.02 per kg, which led to its growing popularity among consumers. Saudi Arabia's inclusion in the top 15 nations globally with ASC certification for shrimp farming in 2022 is only one example of the industry's shift towards sustainable and certified seafood products.

Growth Drivers for the Saudi Arabia Seafood Market

Government Initiatives and Vision 2030

The main drivers of the growth of the seafood business are the Saudi Arabian government's initiatives and the strategic goals outlined in Vision 2030. The government has been growing the aquaculture industry as part of its economic diversification plan in an effort to reduce dependency on oil and enhance food production. To accommodate the rising domestic demand, significant capital expenditures, subsidies, and incentives are provided to promote local fish production. This government assistance includes effective legal frameworks, aquaculture technology advancement, and infrastructural development. As a result, these programs are crucial in broadening the market and creating space for regional seafood producers to flourish.

The Ministry of Environment, Water, and Agriculture (MEWA) announced a new program under Vision 2030 to increase aquaculture production to 600,000 tons by 2030, which includes significant investments in infrastructure and technology to support sustainable aquaculture practices, according to an August 2021 article on King Abdullah University of Science and Technology.

Innovation in Aquaculture and Technological Developments

Technological developments and aquaculture breakthroughs are responsible for the expansion of the Saudi Arabian seafood sector. Seafood production yields are increased by the application of innovative technology in aquaculture, such as RAS, automated feeding, and species genetic enhancement. By enabling ethical and environmentally favorable activities, these technologies aid in preventing overfishing and damage to the marine environment. Additionally, better cold chain logistics and processing technologies increase fish items' quality and freshness, extending their shelf life and market availability. Market expansion is also fueled by ongoing innovation in improving aquaculture methods and creating more resilient seafood species to meet the rising demand for seafood products from consumers. As part of the Kingdom's Vision 2030 ambition to diversify the Saudi economy, the National Fisheries Development Programme (NFDP) of Saudi Arabia, headed by Dr. Ali Al-Shaikhi, intends to draw $4 billion in investments to the aquaculture industry.

Awareness of Nutrition and Health

One of the main factors driving the expansion of the seafood sector in Saudi Arabia is the growing consumer awareness of nutritional qualities and healthy eating. Demand for seafood intake is rising as people become more aware of its health benefits, which include high protein, omega-3 fatty acids, and other vitamins and minerals. The consumption of different marine products is rising quickly as a result of these dietary changes. Additionally, this trend is influenced by the growing awareness of the advantages of seafood brought about by health organizations' educational programs and efforts. The industry is growing because more people are choosing seafood as a healthier alternative due to the rise in lifestyle disorders including obesity and heart disease.

For example, the Saudi Food and Drug Authority (SFDA) started a campaign to highlight the advantages of eating seafood for a balanced diet, stressing its role in reducing chronic diseases and enhancing general health, according to a 2021 report published in the Saudi Gazette.

Challenges in the Saudi Arabia Seafood Market

Overfishing and Sustainability Concerns

Fish populations are at risk, and the natural equilibrium of marine ecosystems is being upset by overfishing, which has emerged as a significant problem in Saudi Arabia's seafood sector. Even though the government has passed a number of laws to encourage sustainable fishing methods, illicit fishing is still a problem and is making the loss of important marine resources worse. Fish stocks are depleted as a result of overfishing, which impacts seafood availability and quality. Furthermore, the long-term sustainability of the fishing sector may be threatened by the environmental effects of unsustainable practices. Stricter enforcement of sustainable fishing laws, such as quotas and protected marine zones, is being pushed in an effort to counteract this. For the seafood market to stay sustainable in the future, it will still be difficult to strike a balance between environmental preservation and economic growth.

Dependency on Imports

Despite initiatives to increase domestic seafood production, Saudi Arabia is still mostly dependent on imports to meet the rising domestic demand. The market is vulnerable to a number of risks as a result of its reliance on overseas suppliers, such as changes in global prices, interruptions in the supply chain, and possible problems with quality control. Due to shipping issues, tariffs, and geopolitical considerations, imported fish may also experience delays or higher prices. Furthermore, dependence on imports lessens the motivation to develop domestic fisheries and aquaculture, which could otherwise assist alleviate supply threats. Saudi Arabia has been making investments in aquaculture to increase domestic seafood output in order to address this problem, but it will take some time for domestic production to completely satisfy demand and lessen dependency on imports.

Saudi Arabia Seafood Market Overview by Regions

By Region, the Saudi Arabia Seafood market is divided into Western Region, Northern & Central Region, Eastern Region, Southern Region.

Eastern Saudi Arabia Seafood Market

Eastern Saudi Arabia's vast coastline along the Arabian Gulf makes it a major center for the nation's seafood production and consumption. Due to its wealth of marine resources, this area is a major supplier of both farmed and wild seafood. Local tastes for fresh fish and shellfish, which are essential components of traditional cuisines, are the main drivers of the demand for seafood in Eastern Saudi Arabia. The area also gains from being close to important ports, which make it simple to reach both local and foreign markets. However, issues like overfishing and the requirement for sustainable fishing methods present difficulties for the region. For the Eastern Saudi Arabian seafood market to continue growing and being sustainable, efforts must be made to advance aquaculture and encourage ethical fishing.

Western Saudi Arabia Seafood Market

The region's coastline along the Red Sea drives the Western Saudi Arabia seafood market, which is a significant part of the country's seafood sector. A vast array of fish, shellfish, and other seafood products may be found in this region, which is rich in marine biodiversity. Western Saudi Arabians consume a lot of seafood, with a penchant for fresh catches that are frequently employed in regional specialties such stews and grilled fish. Major cities like Jeddah and Mecca, where seafood is highly sought after by both the local population and a significant stream of tourists, also benefit the region. The market is supported by continuous efforts in aquaculture growth and more sustainable fishing methods, which attempt to balance supply with environmental preservation, despite obstacles including overfishing and sustainability concerns.

Saudi Arabia Seafood Market Segments

Type

• Fish

• Shrimp

• Crab

• Lobster

• Others

Form

• Canned

• Fresh / Chilled

• Frozen

• Processed

Distribution Channel

• Supermarket/Hypermarket

• Departmental Stores

• Specialized Stores

• Institution Sales

• Food Service

• Online

• Others

Region

• Western Region

• Northern & Central Region

• Eastern Region

• Southern Region

All the Key players have been covered from 4 Viewpoints

• Overview

• Key Persons

• Recent Development

• Revenue

Key Players Analysis

1. Almunajem Foods

2. Arab Fisheries Co.

3. IZAFCO Fish Packing Company

4. National Aquaculture Group

5. Saudi Fisheries Company

6. Shell Fisheries Company W.L.L.

7. Tabuk Fisheries Co.

8. The Savola Group.

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

By Type, By Form, By Distribution Channel and By Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the expected market size of the Saudi Arabia Seafood Market by 2033?

-

What is the projected growth rate (CAGR) of the Saudi Arabia Seafood Market from 2025 to 2033?

-

What are the major drivers of growth in the Saudi Arabia Seafood Market?

-

How is the Saudi Arabian government supporting the growth of the seafood sector under Vision 2030?

-

What technological innovations are driving the growth of the seafood industry in Saudi Arabia?

-

How is consumer awareness of nutrition and health impacting the demand for seafood in Saudi Arabia?

-

What challenges does the Saudi Arabia Seafood Market face regarding sustainability and overfishing?

-

What is the current dependency of Saudi Arabia on seafood imports, and how is it being addressed?

-

What are the main types of seafood products in the Saudi Arabian market?

-

Which regions in Saudi Arabia are most influential in the seafood market, and why?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

aNeed More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive

4. Market Dynamic

4.1 Growth Drivers

4.2 Challenges

5. Saudi Arabia Seafood Market

6. Market Share Analysis

6.1 By Type

6.2 By Form

6.3 By Distribution Channel

6.4 By Region

7. Type

7.1 Fish

7.2 Shrimp

7.3 Crab

7.4 Lobster

7.5 Others

8. Form

8.1 Canned

8.2 Fresh / Chilled

8.3 Frozen

8.4 Processed

9. Distribution Channel

9.1 Supermarket/Hypermarket

9.2 Departmental Stores

9.3 Specialized Stores

9.4 Institution Sales

9.5 Food Service

9.6 Online

9.7 Others

10. Region

10.1 Western Region

10.2 Northern & Central Region

10.3 Eastern Region

10.4 Southern Region

11. Porter's Five Forces Analysis

11.1 Bargaining Power of Buyers

11.2 Bargaining Power of Suppliers

11.3 Degree of Competition

11.4 Threat of New Entrants

11.5 Threat of Substitutes

12. SWOT Analysis

12.1 Strength

12.2 Weakness

12.3 Opportunity

12.4 Threats

13. Key Players Analysis

13.1 Almunajem Foods

13.1.1 Overviews

13.1.2 Key Person

13.1.3 Recent Developments

13.1.4 Revenue

13.2 Arab Fisheries Co.

13.2.1 Overviews

13.2.2 Key Person

13.2.3 Recent Developments

13.2.4 Revenue

13.3 IZAFCO Fish Packing Company

13.3.1 Overviews

13.3.2 Key Person

13.3.3 Recent Developments

13.3.4 Revenue

13.4 National Aquaculture Group

13.4.1 Overviews

13.4.2 Key Person

13.4.3 Recent Developments

13.4.4 Revenue

13.5 Saudi Fisheries Company

13.5.1 Overviews

13.5.2 Key Person

13.5.3 Recent Developments

13.5.4 Revenue

13.6 Shell Fisheries Company W.L.L.

13.6.1 Overviews

13.6.2 Key Person

13.6.3 Recent Developments

13.6.4 Revenue

13.7 Tabuk Fisheries Co.

13.7.1 Overviews

13.7.2 Key Person

13.7.3 Recent Developments

13.7.4 Revenue

13.8 The Savola Group

13.8.1 Overviews

13.8.2 Key Person

13.8.3 Recent Developments

13.8.4 Revenue

Reach out to us

Call us on

USA: +1-478-202-3244

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com