South Africa Ecommerce Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowSouth Africa E-commerce Market Trends & Summary

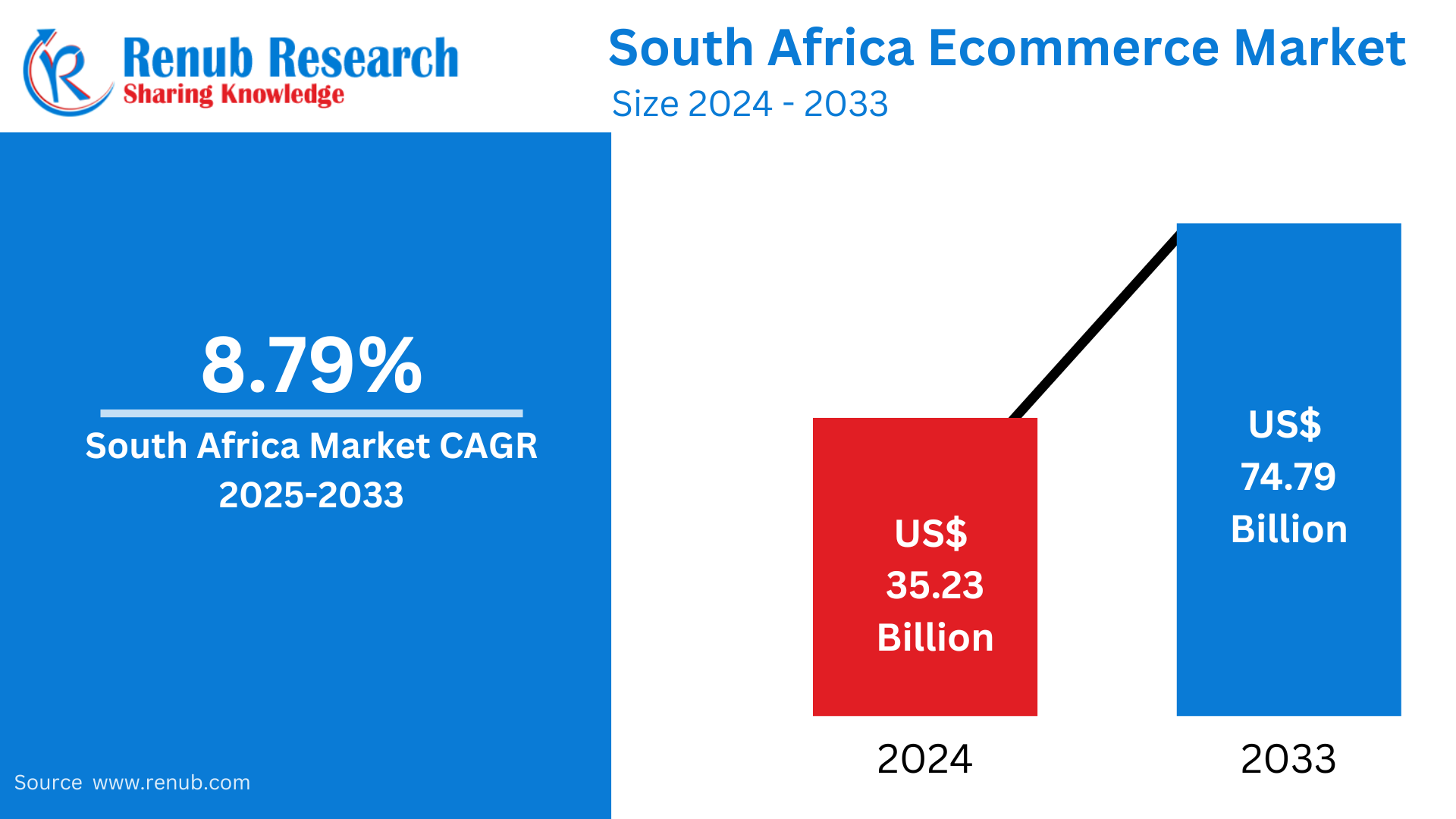

The South African e-commerce market is going to experience tremendous growth. It is expected to reach US$ 74.79 billion by 2033, compared to US$ 35.23 billion in 2024. This growth is at a compound annual growth rate of 8.79% from 2025 to 2033. Factors driving this growth include increased internet penetration, rising mobile commerce, and greater consumer acceptance of online shopping. E-commerce platforms also benefit from enhanced payment solutions, improved logistics, and changing shopping behaviors nationwide.

The report South Africa Ecommerce Market & Forecast covers by Product Categories (Apparel and Accessories, Health and Personal Care and Beauty, Computer and Consumer Electronics, Office Equipment and Supplies, Toys and Hobby, Furniture and Home Furnishing, Books/Music/Video, Other), Payment Mode (Digital Wallet, Credit Card, Debit Card, Account-to-Account (A2A), Buy Now Pay Later, Cash on Delivery, Prepay, Other - Incl. Cryptocurrency), and Company Analysis 2025-2033.

South Africa E-commerce Industry Overview

E-commerce, or electronic commerce, refers to the buying and selling of goods and services over the Internet. It involves transactions through online platforms, where consumers can browse products, make payments, and have items delivered to their location. E-commerce includes various business models such as Business-to-Consumer (B2C), Business-to-Business (B2B), and Consumer-to-Consumer (C2C). Internet penetration, digital payment systems, and technological advancements in logistics and communication power the rise of e-commerce.

South African e-commerce has been growing because more people have been getting online with a smartphone, thus increasing their connection to the internet. Most retail has changed because most consumers are able to purchase products online ranging from apparels to electronics and even groceries. The e-commerce platforms like Takealot and Zando have made online shopping popular, targeting different consumers' needs. E-commerce has also enabled small and medium-sized enterprises to access larger markets. Online banking and mobile payment systems have improved online shopping experiences, while the businesses have fewer overheads compared to a physical brick-and-mortar store. E-commerce has also facilitated the easy access of international brands, giving South African consumers more variety of products.

Drivers of the South Africa E-commerce Market

High Internet Penetration and Mobile Usage

South Africa has experienced a very rapid expansion of internet connectivity. This, coupled with the increasing use of smartphones to access the Internet, means that consumers can shop at any time, anywhere. The growth in mobile internet usage has been quite impressive, especially with data plans being made more affordable and with increased smartphone adoption. This connectivity brings more people, including rural residents, to online shopping platforms, expanding the consumer base and making e-commerce more inclusive. With the improvement of internet accessibility, a larger market for e-commerce businesses is fostered. As of January 2024, 74.7% of South Africans had internet access, with 118.6 million active internet users.

Growth of Digital Payment Solutions

The rise of digital payment methods, such as mobile wallets, credit cards, and other secure online payment systems, has fueled e-commerce in South Africa. Consumers are becoming more comfortable with cashless transactions, and the platforms such as PayFast and SnapScan provide safe and convenient payment options. This move towards digital payments makes online transactions easy and smooth, thereby increasing consumer confidence and driving more people to engage in e-commerce. Increased security of digital payments along with the ease of usage contributes to the overall growth of online shopping in the country. The custodian of the national payment system, South African Reserve Bank, released the Digital Payments Roadmap today. The Roadmap has been developed to achieve the high-level objectives and strategies of the National Payment System Framework and Strategy: Vision 2025. Among other things, these are to promote competition and innovation, cost-effectiveness, interoperability, and financial inclusion.

Change in Consumer Shopping Behavior

South African consumers increasingly opt for online shopping as it is convenient, especially after the pandemic. With a wider portfolio of products online, shoppers can check prices, read reviews and make purchasing decisions from the comfort of their own homes. Changing lifestyles also facilitate this shift in shopping behavior, for instance, more consumers prefer to have the convenience of receiving goods at home and other time-saving benefits. Since more South Africans are increasingly embracing online shopping, more businesses have to change their strategies, by offering custom-made promotions and improving user experiences to fulfill the rising demand.

Problems facing the South African E-commerce market

Delivery and Logistics Problems

One of the main challenges in the South African e-commerce market is logistics and delivery infrastructure. Though the cities of Johannesburg, Cape Town, and Durban are reliable, it has not been the case with many other places and remote or rural areas face a lot of delays and a lot of costs due to lack of infrastructure. The last-mile delivery is still complex, with road condition and limited rural access affecting delivery time and customer satisfaction. As this e-commerce grows, these companies must invest in proper logistics solutions to ensure fast delivery and reduce consumer's cost.

Online Payment Security Concerns

Despite online payment methods growing, online payment security concerns are a major restraint to the adoption of this e-commerce in South Africa. Fraudulent activities such as data breaches and phishing scams have made the consumers wary of entering their personal and financial information online. Although it introduced secure payment gateways, most consumers have to become a full convert to e-commerce. The concerns about the same have to be addressed by having robust cybersecurity, educating consumers about safe online shopping, and providing more trusted payment solutions.

South Africa E-Commerce Apparel and Accessories Market

The South African e-commerce apparel and accessories market is witnessing high growth due to increased internet penetration, rising disposable incomes, and changes in consumer shopping behavior. The market leaders are online platforms such as Zando, Superbalist, and Takealot, which offer a wide range of clothing, footwear, and accessories. Consumers increasingly seek the convenience of online shopping, which benefits them with home delivery, easy returns, and access to various brands and styles. In addition, mobile commerce is experiencing increased popularity since more South Africans use their smartphones to browse and make purchases of fashion items. Moreover, the market is boosted by targeted marketing, recommendation of items based on specific preferences, and convenient payment systems. Challenges such as high delivery costs, logistical issues, and lack of trust in online payment security persist. In May 2024, Amazon launched its online shopping service in South Africa, directly competing with several online retailers, primarily dominated by Naspers' Takealot.com.

South Africa Digital Wallet Market

The digital wallet market in South Africa is expanding rapidly due to growing adoption of mobile payment and digital financial services. As the smartphone-penetrated population grows along with better internet connectivity, digital wallets such as Apple Pay and Google Pay along with local solutions like SnapScan and Zapper, have become increasingly popular. The convenience, speed, and safety of digital wallets boost its adoption for online and physical transactions. Increased e-commerce with a shift toward cashless transactions, especially after the pandemic, have contributed to the expansion of the market. As financial inclusion continues growing, digital wallets are going to be very vital in the shaping of payment landscapes in South Africa.

South Africa Ecommerce Market Segments

Product Categories - Industry is divided into 8 viewpoints:

- Apparel and Accessories

- Health and Personal Care and Beauty

- Computer and Consumer Electronics

- Office Equipment and Supplies

- Toys and Hobby

- Furniture and Home Furnishing

- Books/Music/Video

- Other

Payment Mode - Industry is divided into 8 viewpoints:

- Digital Wallet

- Credit Card

- Debit Card

- Account-to-Account (A2A)

- Buy Now, Pay Later (BNPL)

- Cash on Delivery

- Prepay

- Other - Incl. Cryptocurrency

All companies have been covered with 5 Viewpoints

- Overviews

- Key Persons

- Recent Developments

- Product Portfolio

- Revenue

Company Analysis

- Takealot online Pty Ltd

- Evetech Pty. Ltd

- Jumia

- Walmart Inc.

- Zando

- SoFresh

- Decathlon

- UCook

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Categories and Payment Mode |

| Product Categories Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Key Questions Answered in This Report:

-

What is the expected market size of the South African e-commerce industry in 2033?

-

What is the projected compound annual growth rate (CAGR) of the South African e-commerce market from 2025 to 2033?

-

What factors are driving the growth of e-commerce in South Africa?

-

How has mobile commerce contributed to the expansion of South African e-commerce?

-

What are the challenges related to logistics and delivery in the South African e-commerce market?

-

How do digital payment solutions like mobile wallets and credit cards impact e-commerce in South Africa?

-

What are the key product categories in the South African e-commerce market?

-

How has consumer shopping behavior changed in South Africa, particularly after the pandemic?

-

Who are some of the leading companies in the South African e-commerce industry?

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamic

4.1 Growth Driver

4.2 Challenges

5. South Africa Ecommerce Market

6. Market Share Analysis

6.1 Product Categories

6.2 Payment Mode

7. Product Categories

7.1 Apparel and Accessories

7.2 Health and Personal Care and Beauty

7.3 Computer and Consumer Electronics

7.4 Office Equipment and Supplies

7.5 Toys and Hobby

7.6 Furniture and Home Furnishing

7.7 Books/Music/Video

7.8 Other

8. Payment Mode

8.1 Digital Wallet

8.2 Credit Card

8.3 Debit Card

8.4 Account-to-Account (A2A)

8.5 Buy Now, Pay Later (BNPL)

8.6 Cash on Delivery

8.7 Prepay

8.8 Other - Incl. Cryptocurrency

9. Porter’s Five Forces Analysis

9.1 Bargaining Power of Buyers

9.2 Bargaining Power of Suppliers

9.3 Degree of Rivalry

9.4 Threat of New Entrants

9.5 Threat of Substitutes

10. SWOT Analysis

10.1 Strength

10.2 Weakness

10.3 Opportunity

10.4 Threat

11. Company Analysis

11.1 Takealot online Pty Ltd

11.1.1 Overview

11.1.2 Key Person

11.1.3 Recent Development

11.1.4 Product Portfolio

11.1.5 Revenue

11.2 Evetech Pty. Ltd

11.2.1 Overview

11.2.2 Key Person

11.2.3 Recent Development

11.2.4 Product Portfolio

11.2.5 Revenue

11.3 Jumia

11.3.1 Overview

11.3.2 Key Person

11.3.3 Recent Development

11.3.4 Product Portfolio

11.3.5 Revenue

11.4 Walmart Inc.

11.4.1 Overview

11.4.2 Key Person

11.4.3 Recent Development

11.4.4 Product Portfolio

11.4.5 Revenue

11.5 Zando

11.5.1 Overview

11.5.2 Key Person

11.5.3 Recent Development

11.5.4 Product Portfolio

11.5.5 Revenue

11.6 SoFresh

11.6.1 Overview

11.6.2 Key Person

11.6.3 Recent Development

11.6.4 Product Portfolio

11.6.5 Revenue

11.7 Decathlon

11.7.1 Overview

11.7.2 Key Person

11.7.3 Recent Development

11.7.4 Product Portfolio

11.7.5 Revenue

11.8 UCook

11.8.1 Overview

11.8.2 Key Person

11.8.3 Recent Development

11.8.4 Product Portfolio

11.8.5 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com