United Arab Emirates Dairy Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Buy NowUnited Arab Emirates Dairy Market Trends & Summary

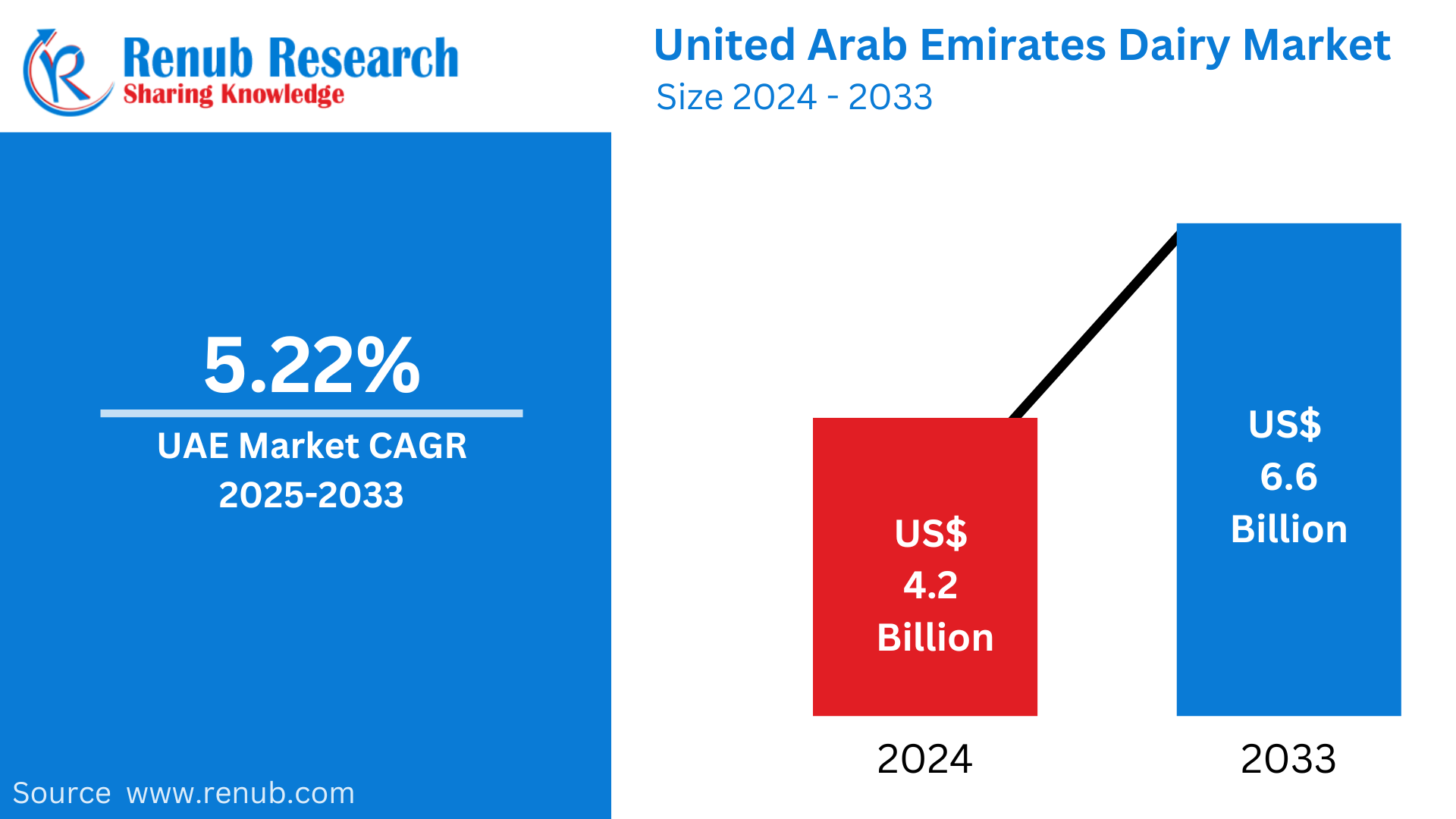

United Arab Emirates Dairy market is expected to reach US$ 6.60 billion by 2033 from US$ 4.20 billion in 2024, with a CAGR of 5.22% from 2025 to 2033. Some of the drivers driving the market ahead include the country's growing population and urbanization, changing dietary preferences of consumers, increased health consciousness, continuous product innovation in the dairy industry, and the adoption of supporting government regulations.

The report United Arab Emirates Dairy Market Forecast covers by Product Type (Liquid Milk, Flavored Milk, Cream, Butter, Cheese, Yoghurt, Ice Cream, Anhydrous Milk Fat (AMF), Skimmed Milk Powder (SMP), Whole Milk Powder (WMP), Whey Protein, Lactose Powder, Curd, Others), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail Stores, Other), Region (Dubai, Abu Dhabi, Sharjah, Others) and Company Analysis 2025-2033.

United Arab Emirates Dairy Industry Overview

The country's growing population, increasing disposable incomes, and shifting dietary habits have all contributed to the United Arab Emirates' (UAE) dairy industry's recent strong growth. For people of the United Arab Emirates, dairy products such as milk, yogurt, and cheese are vital parts of their daily meals. Even though the nation produces a sizable number of dairy products domestically, the market remains mostly depends on imports to meet demand, especially for high-end and specialized goods. Leading domestic companies like Almarai and Al Ain Dairy are essential to the industry because they provide a variety of dairy products, including flavored, functional, and conventional dairy items, to meet the needs of a wide range of consumers.

The demand for plant-based, low-fat, and lactose-free dairy products is rising in the United Arab Emirates due to health-conscious customers. Growing knowledge of wellness and nutrition is the cause of this move toward healthier options. The UAE's severe climate and scarcity of arable land have an additional impact on the sector, making it more dependent on cutting-edge technology like vertical farming and imported feed to maintain domestic dairy output. The rising demand for fortified dairy products among customers who are health-conscious is another factor driving the market's expansion. The UAE dairy industry is expected to grow as a result of innovation and the launch of high-end dairy products, drawing in both domestic producers and foreign dairy companies hoping to take advantage of this profitable market.

The UAE's population has grown quickly in recent years, which has led to a notable increase in demand across a number of industries, including dairy. There are 10.17 million people living in the nation as of 2023, and 88.5% of them are foreigners. Due to lifestyle choices, dairy consumption is more common in urban areas like Dubai and Abu Dhabi, where urbanization trends have resulted in an increase in families and people. The UAE is producing more milk as a result of an increase in the number of homes and a growing demand for convenience foods. The demand for a variety of dairy products, such as bottled milk, cheeses, and yogurt, that satisfy various nutritional requirements is growing as cities get denser. Furthermore, convenience and health consciousness are common among urban customers, increasing the demand for dairy products with added nutrients, including fortified milk. With the UAE positioned as a regional hub, this demographic transition not only affects local consumption but also stimulates a developing dairy export industry.

The UAE has seen a change in consumer behavior in recent years, with a stronger emphasis on nutrition and healthy eating practices. Since dairy is a major source of vitamins, calcium, and protein, it is being included in regular diets more and more. Promoting nutritional awareness is also greatly aided by the government's attention on public health through programs like the UAE Food Security Strategy, which was introduced in 2020. Low-fat, lactose-free, and plant-based dairy products have become more popular as a result of health and wellness trends. The increasing demand from customers with dietary restrictions, such as lactose intolerance or vegan preferences, is met by these items. Additionally, customers are choosing healthier dairy substitutes as a result of growing awareness of obesity, especially among young people. A recent study found that over 39% of UAE adults are obese, underscoring the significance of low-calorie and functional dairy products in preventing health problems. This change in eating patterns is reflected in the rise in popularity of products like probiotic yogurt, vitamin D-fortified milk, and other value-added dairy products.

Growth Drivers for the United Arab Emirates Dairy Market

Innovation in Products

The UAE's market has grown significantly due in large part to innovation in the dairy sector. Due to competition, both domestic and foreign dairy firms are now developing novel products to satisfy shifting consumer demands. Plant-based dairy substitutes including oat milk, almond milk, and soy-based yogurt have seen some promising developments in 2023 and 2024. Vegans and people with lactose intolerance are among the health-conscious consumers that these items are aimed at. Although the demand for plant-based dairy products has increased by roughly 36% in most other nations due to younger, health-conscious, and lifestyle-focused customers, the UAE's numbers are much more average. Additionally, the dairy products were modified to meet consumer dietary needs and taste preferences. These include low-fat cheeses, probiotic beverages, and protein-enhanced yogurts in addition to flavored dairy and functional items. However, the government has promoted greater innovation in the dairy industry with regard to regional goods that are both sustainable and organic.

Assistance and Investment from the Government

The government has begun to aggressively support the local dairy business in order to improve productivity and support food security, according to the most recent news on the UAE dairy market. Efforts would be made to promote self-sufficiency in all key areas, particularly dairy, and decrease reliance on food imports under the 2020 UAE National Food Security Strategy. As a result, dairy farms and industrial facilities have seen a rise in investment.

For example, the Ministry of Climate Change and Environment in the United Arab Emirates has implemented programs designed to increase the sustainability of dairy farms by utilizing the most recent developments in agricultural technologies and innovations. Along with improving milk yield and quality, modern irrigation systems, feed optimization, and animal health management systems are also included. In addition to the carbon footprint of environmental goals, the government has concentrated on sustainability in the food production chain. This helps local dairy producers, which leads to an increase in the supply of high-quality dairy products in the country.

Health & Wellness Trends

The demand for more nutrient-dense and useful goods, like those in the dairy industry, has increased due to UAE consumers' health consciousness. This factor is mostly caused by growing worries about lifestyle disorders, such as diabetes, heart disease, and osteoporosis, for which dairy products are crucial to good health. Dairy products including milk, yoghurt, and cheese are being promoted to people today due to their potential benefits for bone health, as calcium is the main preventive measure against osteoporosis. The UAE Ministry of Health and Prevention's 2023 report stated that calcium deficiency was still a serious health issue, particularly for women and children, which raised awareness of and demand for fortified dairy products. When consumers need goods that offer more health advantages than just nutritional value, functional dairy products enhanced with probiotics, omega-3, and other vitamins gain popularity. Demand for high-protein dairy products is also rising as a result of sports and fitness culture. Dairy is a preferred source of high-quality proteins and microminerals in this expanding health trend.

Challenges in the United Arab Emirates Dairy Market

Climate and Limited Local Production:

Due to its severe climate and scarcity of arable land, the UAE is heavily dependent on imports to supply consumer demand for dairy products. Large-scale dairy farming operations are difficult to operate due to extreme temperatures and a shortage of fertile soil, which restricts local farmers' ability to supply the market. Because of this, a significant amount of the dairy products and raw materials eaten in the United Arab Emirates are imported. Costs are raised by this reliance on imports since dairy products are more expensive due to transportation and customs. Furthermore, it exposes the market to global supply chain vulnerabilities, which can result in price volatility and supply shortages. These vulnerabilities include disruptions in international trade or variations in foreign production.

High Import Dependency

To meet the rising demand for dairy products, the UAE's dairy market is heavily reliant on imports. The nation depends on foreign suppliers for both raw materials and completed dairy products because of its limited capacity for domestic production. Due to this reliance, the market is subject to changes in the price of dairy products globally, which may raise expenses for both producers and consumers. Furthermore, delays, shortages, or price increases in imported dairy products can result from interruptions in the global supply chain, whether brought on by natural catastrophes, transportation problems, or geopolitical tensions. Due to growing import prices and uncertain supply, the UAE is especially sensitive to the volatility of the global dairy markets, making it difficult for businesses to maintain stable pricing and availability of dairy products.

United Arab Emirates Dairy Market Overview by Regions

By Region, the United Arab Emirates Dairy market is divided into Dubai, Abu Dhabi, Sharjah, Others.

Dubai Dairy Market

Due to the city's diversified population, growing convenience demand, and growing emphasis on health and wellbeing, Dubai's dairy business is expanding. Milk, yogurt, and cheese are examples of dairy products that are essential to Dubai residents' everyday diets. Due to the city's limited capacity for domestic dairy production, the market is heavily dependent on imports, with foreign brands controlling the market. However, as consumer preferences evolve toward more nutrient-dense options, there is an increasing desire for healthy substitutes, such as lactose-free, low-fat, and plant-based dairy solutions. While newcomers serve specialized health-conscious markets, established companies like Almarai and Al Ain Dairy are diversifying their product lines. The market is nevertheless vibrant and offers chances for innovation and expansion in spite of the difficulties caused by a strong reliance on imports.

Abu Dhabi Dairy Market

Abu Dhabi's dairy market is growing as a result of the region's growing population, rising disposable incomes, and shifting customer tastes. A cornerstone of the everyday diet, dairy products including milk, yogurt, and cheese are in high demand in both urban and rural locations. Due to limited local production capabilities, the market, like the rest of the United Arab Emirates, is primarily dependent on imports, leaving it susceptible to supply chain disruptions and worldwide price swings. Increased health consciousness has also led to a rise in the demand for plant-based, low-fat, and lactose-free dairy substitutes. In response to these changes, well-known companies like Almarai and Al Ain Dairy are expanding their product lines to appeal to Abu Dhabi's increasingly health-conscious consumer base.

Sharjah Dairy Market

The region's growing population and rising customer demand for quick and wholesome food items are driving Sharjah's dairy market's steady expansion. Dairy products including milk, yogurt, and cheese are consumed in large quantities, and both domestic and foreign brands satisfy a range of tastes. Due to a lack of local manufacturing capability, the market is mostly dependent on imported dairy products, just as the rest of the United Arab Emirates. As customers grow more health conscious, there is an increasing trend towards healthier alternatives, such as plant-based, low-fat, and lactose-free products. To satisfy these demands, industry leaders like Almarai and Al Ain Dairy are diversifying their product lines. The dairy market in Sharjah still presents chances for innovation and expansion, despite issues brought on by a heavy reliance on imports.

United Arab Emirates Dairy Market Segments

Product Type

- Liquid Milk

- Flavored Milk

- Cream

- Butter

- Cheese

- Yoghurt

- Ice Cream

- Anhydrous Milk Fat (AMF)

- Skimmed Milk Powder (SMP)

- Whole Milk Powder (WMP)

- Whey Protein

- Lactose Powder

- Curd

- Others

Distribution Channel

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Retail Stores

- Other

Region

- Dubai

- Abu Dhabi

- Sharjah

- Others

All companies have been covered from 4 viewpoints:

- Overview

- Key Persons

- Recent Development

- Revenue

Company Analysis

- Danone SA

- The Kraft Heinz Company

- Fonterra Co-Operative Group

- Nestle SA

- General Mills Inc.

- Royal Frieslandcampina NV

- Groupe Lactalis

- Arla Foods amba

- Al Rawabi Dairy Company

- National Food Products Company

Report Details:

| Report Features | Details |

| Base Year |

2024 |

| Historical Period |

2020 - 2024 |

| Forecast Period |

2025 - 2033 |

| Market |

US$ Billion |

| Segment Covered |

Product Type, Distribution Channel and Region |

| Region Covered |

|

| Companies Covered |

|

| Customization Scope |

20% Free Customization |

| Post-Sale Analyst Support |

1 Year (52 Weeks) |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on request) |

Customization Services available

- Analysis of Market Size and Its Segments

- More Company Profiles (Upto 10 without any additional cost):

- Additional Countries (Other than mentioned Countries):

- Region/Country Specific Reports:

- Market Entry Strategy:

- Region-Specific Market Dynamics:

- Regional Market Share Analysis:

- Trade Analysis:

- Production Insights:

- Others Customized Requests:

For more information contact our analysts.

Need More Assistance?

- Talk to our analysts to get more precious information on the current market trends.

- Include more countries and segments and customize the report based on the final requirement.

- Get a competitive advantage in your industry by knowing the report findings and making a positive impact on your revenues and operations.

- Our analysts are always ready to provide more help and pertinent information if you need any additional assistance.

1. Introduction

2. Research & Methodology

3. Executive Summary

4. Market Dynamics

4.1 Growth Drivers

4.2 Challenges

5. United Arab Emirates Dairy Market

6. Market Share Analysis

6.1 By Product Type

6.2 By Distribution Channel

6.3 By Region

7. Product Type

7.1 Liquid Milk

7.2 Flavored Milk

7.3 Cream

7.4 Butter

7.5 Cheese

7.6 Yoghurt

7.7 Ice Cream

7.8 Anhydrous Milk Fat (AMF)

7.9 Skimmed Milk Powder (SMP)

7.10 Whole Milk Powder (WMP)

7.11 Whey Protein

7.12 Lactose Powder

7.13 Curd

7.14 Others

8. Distribution Channel

8.1 Supermarkets/Hypermarkets

8.2 Convenience/Grocery Stores

8.3 Online Retail Stores

8.4 Other

9. Region

9.1 Dubai

9.2 Abu Dhabi

9.3 Sharjah

9.4 Others

10. Porter's Five Forces Analysis

10.1 Bargaining Power of Buyers

10.2 Bargaining Power of Suppliers

10.3 Degree of Competition

10.4 Threat of New Entrants

10.5 Threat of Substitutes

11. SWOT Analysis

11.1 Strength

11.2 Weakness

11.3 Opportunity

11.4 Threats

12. Key Players Analysis

12.1 Danone SA

12.1.1 Overview

12.1.2 Key Person

12.1.3 Recent Developments

12.1.4 Revenue

12.2 The Kraft Heinz Company

12.2.1 Overview

12.2.2 Key Person

12.2.3 Recent Developments

12.2.4 Revenue

12.3 Fonterra Co-Operative Group

12.3.1 Overview

12.3.2 Key Person

12.3.3 Recent Developments

12.3.4 Revenue

12.4 Nestle SA

12.4.1 Overview

12.4.2 Key Person

12.4.3 Recent Developments

12.4.4 Revenue

12.5 General Mills Inc.

12.5.1 Overview

12.5.2 Key Person

12.5.3 Recent Developments

12.5.4 Revenue

12.6 Royal Frieslandcampina NV

12.6.1 Overview

12.6.2 Key Person

12.6.3 Recent Developments

12.6.4 Revenue

12.7 Groupe Lactalis

12.7.1 Overview

12.7.2 Key Person

12.7.3 Recent Developments

12.7.4 Revenue

12.8 Arla Foods amba

12.8.1 Overview

12.8.2 Key Person

12.8.3 Recent Developments

12.8.4 Revenue

12.9 Al Rawabi Dairy Company

12.9.1 Overview

12.9.2 Key Person

12.9.3 Recent Developments

12.9.4 Revenue

12.10 National Food Products Company

12.10.1 Overview

12.10.2 Key Person

12.10.3 Recent Developments

12.10.4 Revenue

Reach out to us

Call us on

USA: +1-678-302-0700

INDIA: +91-120-421-9822

Drop us an email at

info@renub.com